Dealing with PDF documents online is always super easy with our PDF editor. You can fill in wisconsin transfer by affidavit form here painlessly. FormsPal is dedicated to making sure you have the best possible experience with our tool by constantly adding new capabilities and enhancements. With these improvements, working with our editor becomes better than ever! Starting is simple! What you need to do is adhere to these basic steps down below:

Step 1: Hit the "Get Form" button above. It is going to open up our tool so that you could start completing your form.

Step 2: As soon as you open the tool, you will get the document made ready to be filled out. Aside from filling in various blanks, it's also possible to perform various other actions with the form, particularly adding custom words, changing the original textual content, inserting images, placing your signature to the form, and a lot more.

Be mindful when filling in this document. Make sure that all mandatory blank fields are filled out properly.

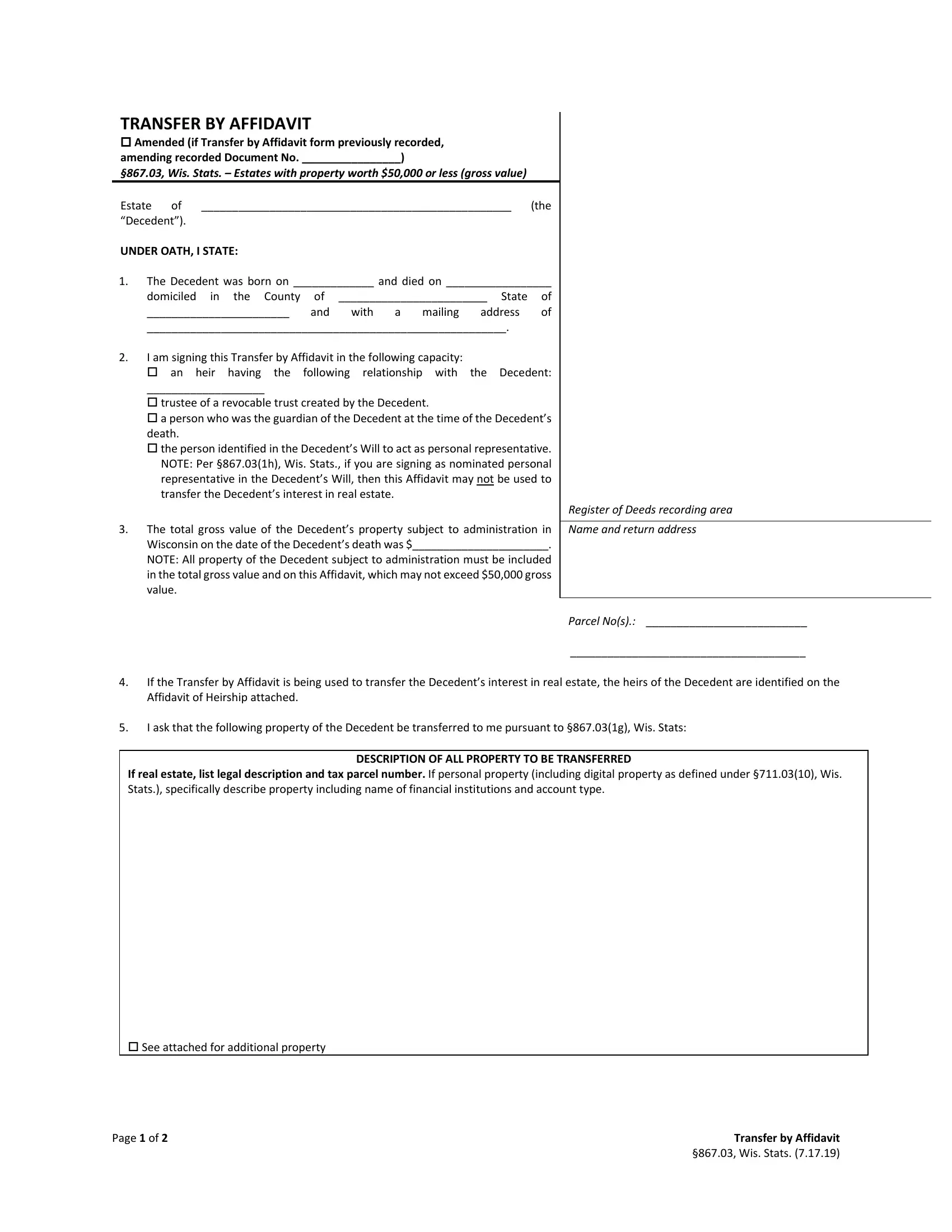

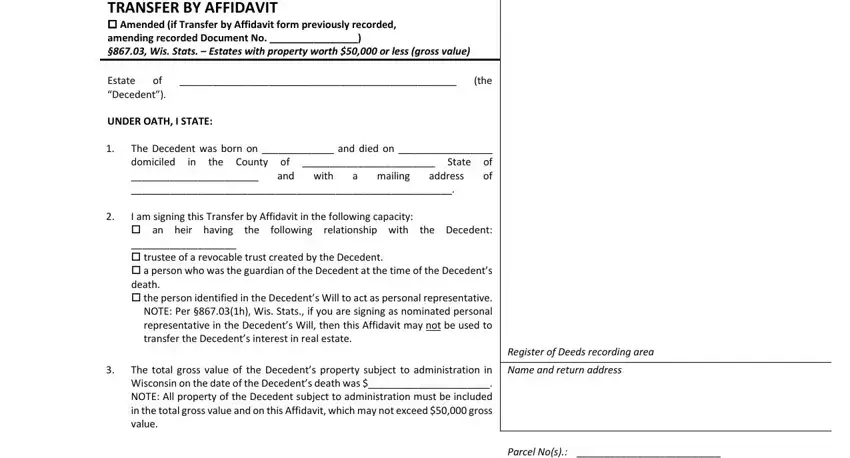

1. The wisconsin transfer by affidavit form usually requires particular information to be entered. Be sure the following fields are filled out:

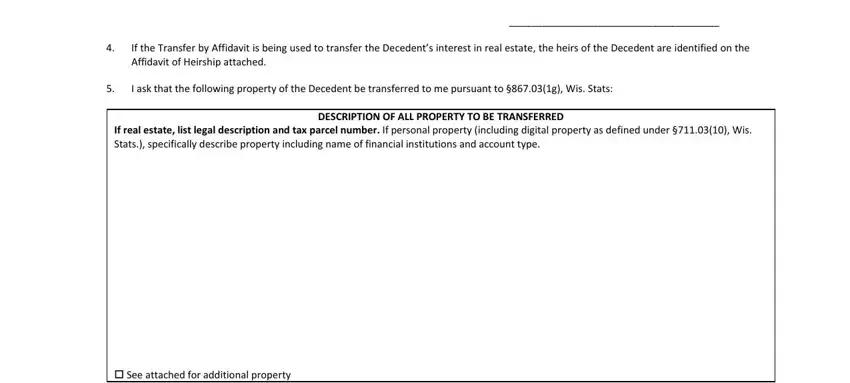

2. Your next part is to fill in these particular blank fields: Parcel Nos, If the Transfer by Affidavit is, I ask that the following property, If real estate list legal, DESCRIPTION OF ALL PROPERTY TO BE, and See attached for additional.

Be really careful while filling out If the Transfer by Affidavit is and Parcel Nos, as this is the section where a lot of people make some mistakes.

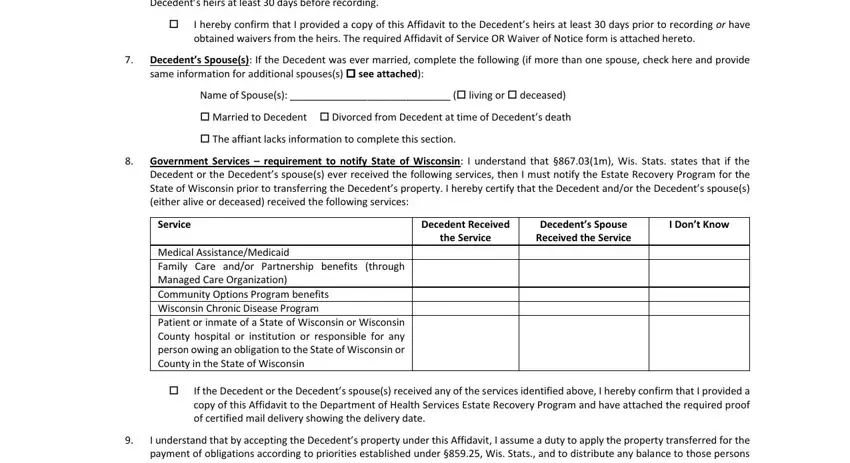

3. Completing Real Estate Requirement to notify, I hereby confirm that I provided, obtained waivers from the heirs, Decedents Spouses If the Decedent, Name of Spouses living or, Married to Decedent Divorced, The affiant lacks information to, Government Services requirement, Service, Decedent Received, the Service, Decedents Spouse Received the, I Dont Know, Medical AssistanceMedicaid Family, and If the Decedent or the Decedents is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

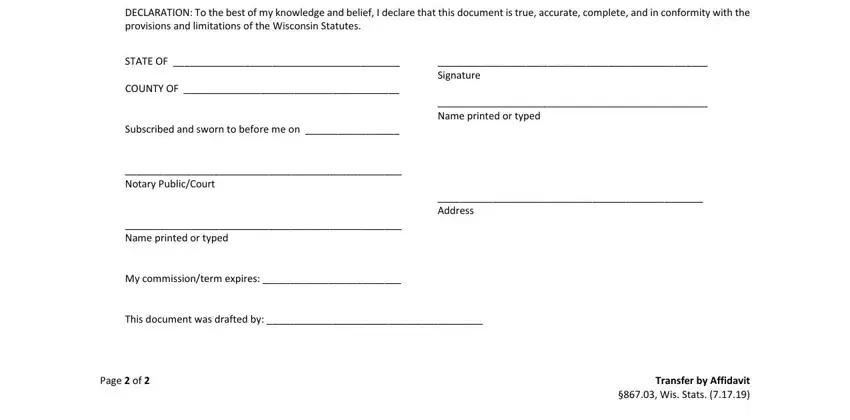

4. The fourth part comes next with the following empty form fields to type in your information in: DECLARATION To the best of my, STATE OF, COUNTY OF, Subscribed and sworn to before me, Signature, Name printed or typed, Notary PublicCourt, Name printed or typed, My commissionterm expires, Address, This document was drafted by, Page of, and Transfer by Affidavit Wis Stats.

Step 3: Spell-check all the details you have entered into the blank fields and then press the "Done" button. Make a free trial option with us and obtain immediate access to wisconsin transfer by affidavit form - downloadable, emailable, and editable inside your personal account page. With FormsPal, you can easily fill out documents without stressing about data incidents or data entries being distributed. Our protected platform ensures that your personal information is kept safely.