supplement can be filled out in no time. Just open FormsPal PDF tool to perform the job fast. To maintain our editor on the forefront of practicality, we strive to integrate user-oriented features and improvements on a regular basis. We are routinely glad to receive suggestions - join us in revampimg the way you work with PDF documents. To begin your journey, take these simple steps:

Step 1: Click on the orange "Get Form" button above. It is going to open our tool so you can start filling in your form.

Step 2: When you start the PDF editor, you will get the document prepared to be filled out. Aside from filling out different fields, you can also perform many other actions with the file, specifically adding custom textual content, modifying the initial text, adding illustrations or photos, placing your signature to the PDF, and more.

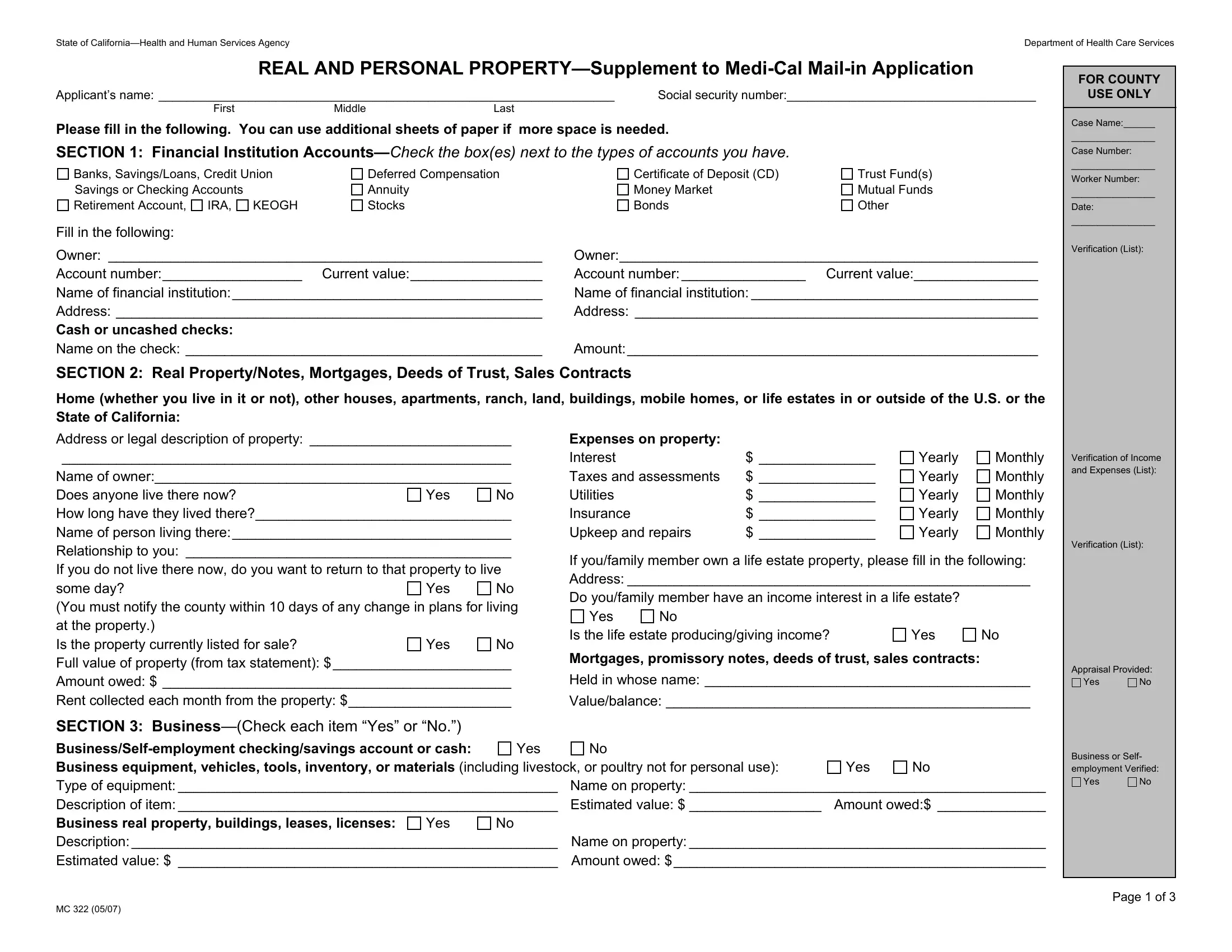

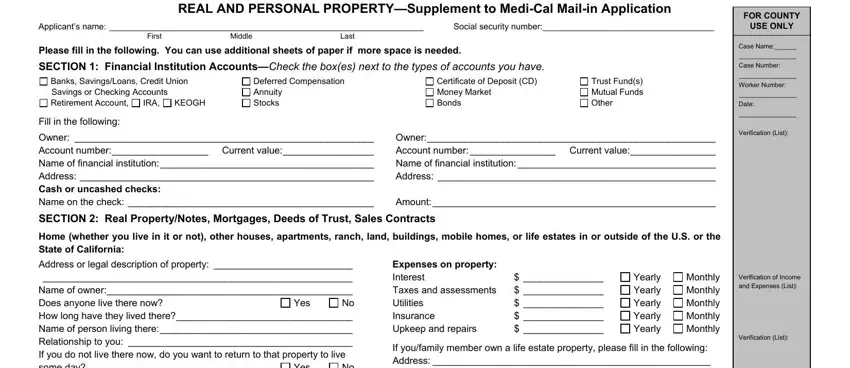

If you want to fill out this PDF document, be certain to type in the right information in every area:

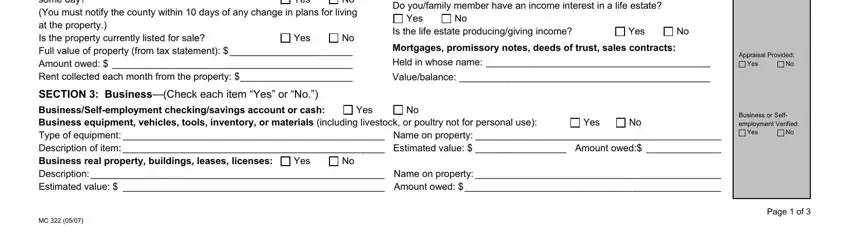

1. Whenever filling out the supplement, be certain to incorporate all of the needed fields within the corresponding area. This will help speed up the process, making it possible for your details to be handled without delay and accurately.

2. The subsequent stage would be to fill out these blank fields: Address or legal description of, Yes, Yes, If youfamily member own a life, Yes, Is the life estate producinggiving, Yes, Mortgages promissory notes deeds, Held in whose name, Valuebalance, SECTION BusinessCheck each item, Yes, Yes, Yes, and Appraisal Provided No.

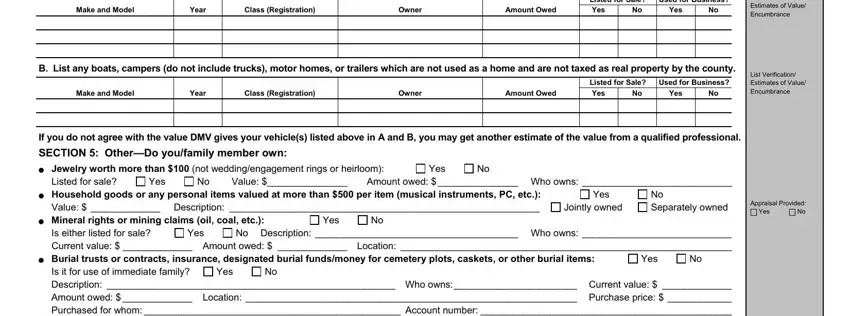

3. The next section is normally pretty uncomplicated, SECTION VehiclesRecreational, Class Registration, Make and Model, Amount Owed, Owner, Year, Yes, B List any boats campers do not, Make and Model, Year, Class Registration, Owner, Amount Owed, Listed for Sale Used for Business, and Yes - these empty fields must be filled out here.

It's easy to get it wrong while completing the Amount Owed, and so make sure to look again prior to when you finalize the form.

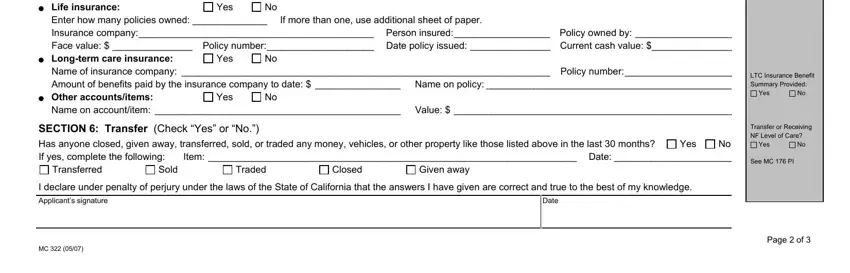

4. Completing cid Life insurance, Yes, Enter how many policies owned, If more than one use additional, cid Longterm care insurance, Yes, Name of insurance company Policy, cid Other accountsitems, Yes, Name on accountitem Value, SECTION Transfer Check Yes or No, No Item Date, Yes, Transferred, and Sold is vital in the fourth stage - don't forget to be patient and take a close look at each empty field!

Step 3: Reread the information you have typed into the blanks and then click the "Done" button. Sign up with FormsPal right now and easily access supplement, available for downloading. Every single modification made is handily saved , helping you to edit the file at a later stage if necessary. At FormsPal.com, we endeavor to be sure that all of your information is stored protected.