When using the online editor for PDFs by FormsPal, you'll be able to complete or modify 50 285 form here and now. FormsPal expert team is relentlessly endeavoring to enhance the tool and make it much easier for people with its cutting-edge functions. Bring your experience one stage further with continuously developing and interesting opportunities we provide! If you are seeking to get started, here's what it requires:

Step 1: Press the "Get Form" button at the top of this page to open our PDF editor.

Step 2: Using this handy PDF file editor, you can actually do more than merely fill out blank fields. Try each of the features and make your forms look faultless with customized textual content put in, or fine-tune the file's original input to perfection - all that supported by an ability to incorporate your personal photos and sign the file off.

This form will involve specific details; in order to ensure accuracy and reliability, please pay attention to the next recommendations:

1. Whenever filling in the 50 285 form, ensure to incorporate all important blank fields in their relevant area. This will help speed up the process, allowing your details to be processed swiftly and properly.

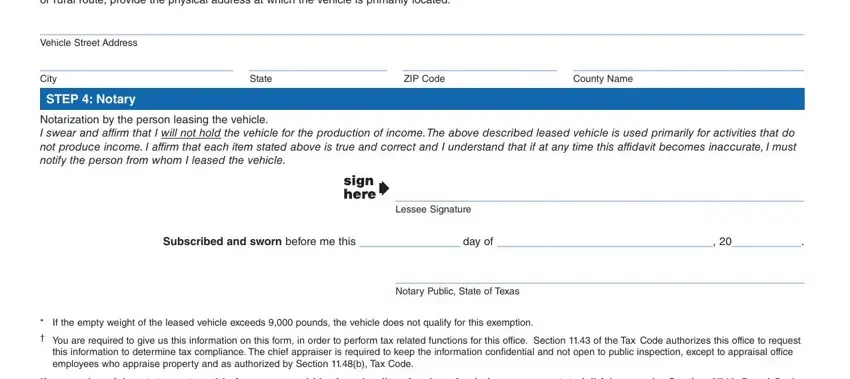

2. Once your current task is complete, take the next step – fill out all of these fields - If the vehicle is usually located, Vehicle Street Address, City, County Name, ZIP Code, State, STEP Notary, Notarization by the person leasing, Lessee Signature, Subscribed and sworn before me, Notary Public State of Texas, If the empty weight of the leased, You are required to give us this, and this information to determine tax with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

People often make some mistakes while filling out Lessee Signature in this part. You should reread whatever you type in right here.

Step 3: Once you have looked once more at the information in the blanks, just click "Done" to conclude your document creation. Go for a 7-day free trial plan at FormsPal and acquire immediate access to 50 285 form - which you may then make use of as you wish from your FormsPal cabinet. Here at FormsPal, we do everything we can to be certain that your information is stored secure.