Navigating the complexities of travel expense reporting within the U.S. Postal Service (USPS) can be a daunting task, but understanding the PS Form 1012-E is a critical first step in ensuring a smooth and compliant process for claiming reimbursements. This form, dedicated to documenting and reporting expenses incurred during overnight travel, serves as a comprehensive tool for postal employees to detail the various expenses such as lodging, meals, and transportation. The form is organized into several sections, starting with a report header that includes essential traveler information, trip details, and a checklist of the nature of expenses. Following this, the form meticulously breaks down expenses into categories, guiding the employee through per diem rates, hotel stays, vehicle usage, and more, while emphasizing the necessity of attaching corresponding receipts for expenses over $50 not charged to a travel card. Beyond the mere filing of expenses, the form delves into instances of airfare, rental services, and even includes a segment for other reimbursable expenses, ensuring that nothing is overlooked. The detailed instructions highlight the importance of honesty and accuracy in reporting, reminding employees of their responsibility towards compliance and the potential legal ramifications of falsification. As such, the PS Form 1012-E not only facilitates the reimbursement process but also embodies the thoroughness and accountability required in managing public funds effectively and ethically.

| Question | Answer |

|---|---|

| Form Name | Ps Form 1012 E |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | ps form 1011, expense expenses etravel, travel b etravel, postal form 1012 |

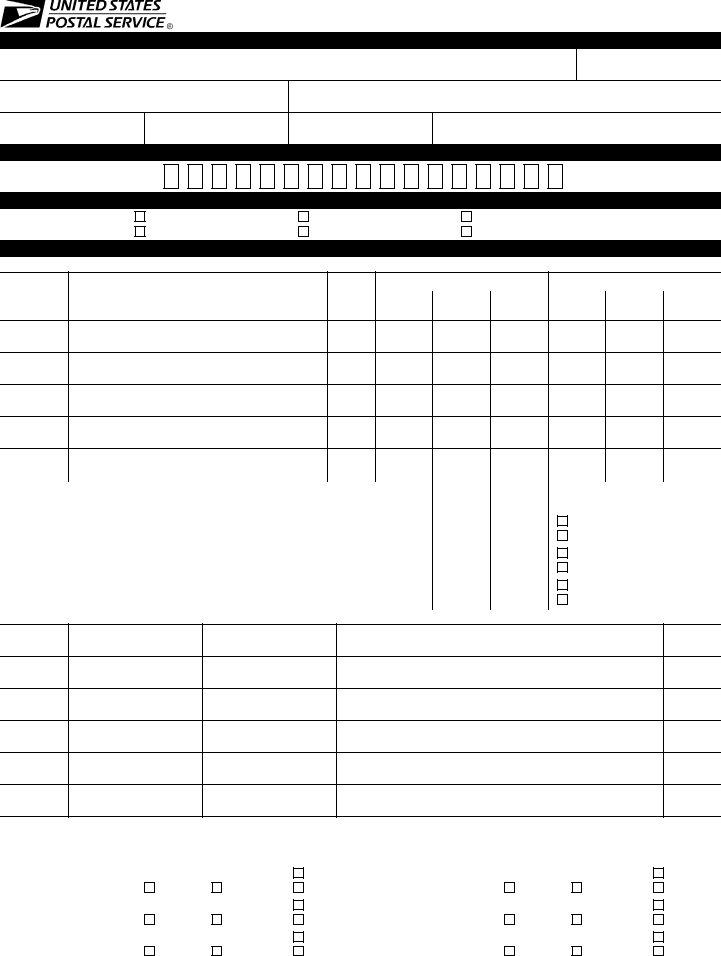

eTravel Expense Report — Overnight Travel

A.Report Header (Submit this report with hotel receipt(s) and all other receipts over $50 that were not charged to your travel card)

1.Traveler’s Name (First, MI, Last)

2. Employee ID (SSN)

3. Employee’s Office

4. Reason for Trip

5. Charge to Finance No.

6. Trip Start Date

7. Trip End Date

8. Trip Interuption

B. GTA

GTA Ticket No. (17 Characters)

C. Nature of Expense

(Check one)

General Meetings

Detail

Speaking Engagement Project Team

Other Expense

Training Course

D.Expenses

1.Per Diem

Start/Return |

|

|

Check Box with Total Trip Length |

Number of Meals Provided |

|||||

Destination/Temporary Duty Station |

No. of |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

Dates |

24 Hrs. |

|

|

|

|||||

State/City/County |

Days |

Breakfasts |

Lunches |

Dinners |

|||||

(MM/DD/YYYY) |

|||||||||

w/o Hotel |

with Hotel |

or Longer |

|||||||

|

|

||||||||

|

|

|

|

|

|||||

|

|

|

|

|

|

||||

2. Hotel |

|

|

|

No. of Nights |

$ Total of |

Paid by |

Circle on the hotel |

|

|

|

|

|

|||||

Name of Hotel |

City |

This Hotel |

Hotel Bill |

Travel Card? |

||||

bill any expenses |

||||||||

|

|

|

||||||

|

|

|

|

|

|

Yes |

||

|

|

|

|

|

|

that are personal |

||

|

|

|

|

|

|

No |

||

|

|

|

|

|

|

|

expenses (examples: |

|

|

|

|

|

|

|

Yes |

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

No |

room service, in- |

|

|

|

|

|

|

|

room movies, |

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Yes |

||

|

|

|

|

|

|

laundry services). |

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

No |

|

|

3. Personal Car |

|

|

|

|

|

|

|

Depart Date

(MM/DD/YYYY)

Trip Originated at

Destination City

Purpose of Trip/Comments

Round Trip

Miles

4. Telephone Calls

Date |

Cost |

|

Type of Call |

Is Call Listed |

Date |

Cost |

|

Type of Call |

Is Call Listed |

|

(MM/DD/YYYY) |

(B)usiness or |

on Hotel Bill? |

(MM/DD/YYYY) |

(B)usiness or |

on Hotel Bill? |

|||||

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

Yes |

|

|

|

B |

P |

No |

|

|

B |

P |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

Yes |

|

|

|

B |

P |

No |

|

|

B |

P |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

Yes |

|

|

|

B |

P |

No |

|

|

B |

P |

No |

|

PS Form

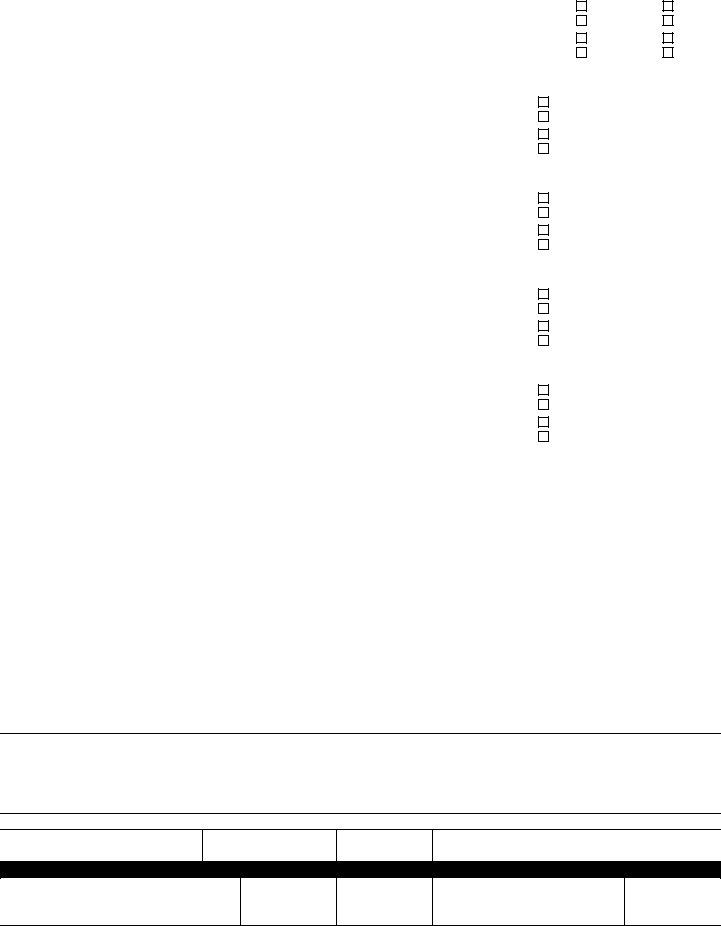

5. Airfare/Train |

|

|

|

|

|

|

|

|

|

|

Paid by |

|

|

"Master Billed" |

||

|

|

|

|

|

|

|

|

|

|

|

|

or |

||||

Depart Date |

|

Airline or Train Name |

|

Origin |

|

Destination |

|

|

Cost |

|

Travel Card? |

GTA Ticket? |

||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

No |

|

6. Taxi/Limo |

|

|

|

|

|

|

|

|

Paid by |

|

Comments |

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Date |

|

City |

|

Origin |

|

|

Destination |

Cost |

|

Travel Card? |

|

|||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Car Rental |

|

|

|

|

|

|

|

|

Paid by |

|

Comments |

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Date |

|

Rental Agency |

|

City |

|

Cost |

|

Travel Card? |

|

|||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

8. Other Reimbursable Expenses (Tolls, Gas, ATM Fees, Parking Fees, Public Transit) |

|

|

Paid by |

|

Comments |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Date |

|

City |

|

Expense/Purpose |

|

Cost |

|

Travel Card? |

|

|||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Training Course (GL Account 52363) |

|

|

|

|

|

|

|

Paid by |

|

Comments |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Date |

|

Place |

|

Course Description |

|

Cost |

|

Travel Card? |

|

|||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comments or Additional Travel Expenses

The collection of this information is authorized by 39 U.S.C. 1001 and 2008. This information will be used to account for your official duty travel expenses. As a routine use, the information may be disclosed to a congressional office at your request; to OMB for review of private relief legislation; to a labor organization as required by NLRB; where pertinent in a legal proceeding to which the USPS is a party; to an appropriate law enforcement agency for investigative or prosecutorial purposes; to a government agency where relevant to a hiring, contracting, or licensing decision by the requesting agency; or by the USPS; to an expert or consultant under contract with the USPS to fulfill an agency function; to the Federal Records Center for storage; to the Equal Employment Opportunity Commission for investigating a formal EEO complaint filed against USPS under 29 CFR 1613; to an independent Certified Public Accountant during an official audit of USPS finances; and to the Merit System Protection Board or Office of Special Counsel for proceedings involving possible prohibited personnel practices. The completion of this form is voluntary; however, if this information is not provided, you may not be reimbursed for your travel expenses.

I certify these expenses are valid; I understand any falsification may result in forfeiture of this claim (28 U.S.C. 2514) and criminal prosecution.

Traveler’s Signature

Phone No.

Date Report Submitted Approving Manager’s Name

OFFICE USE ONLY

Input by

Date Input

Date Updated

Date Receipt Report |

Date Submitted to |

Sent to Back Office |

Approving Mgr. |

|

|

Date Detail Report Sent to Traveler

PS Form

Instructions for Completing PS Form

A.Report Header

1.Traveler’s Name: Print First Name, Middle Initial, and Last Name (to be used in naming convention for expense report).

2.Employee ID: Enter the traveler’s Social Security Number.

3.Employee’s Office: Enter the Traveler’s Duty Station.

4.Reason for Trip: Briefly describe the reason(s) you traveled, e.g., POS One training, OIC assignment, MPOO meeting.

5.Charge to Finance No.: Enter the finance number to be charged.

6.Trip Start Date: Date the trip started (MM/DD/YYYY).

7.Trip End Date: Date you returned from the trip (MM/DD/YYYY).

8.Trip Interuption: If an interuption in per diem days occurred for the convenience of the traveler, enter the date(s) to be omitted from the per diem calculation. Note: Only used for

B.GTA

The GTA Ticket Number (17 characters) will be used when transportation is charged to the corporate travel card, rather than the individual traveler’s card.

C.Nature of Expense

Check one of the boxes listed. Note: Form

D.Expenses

1.Per Diem

a.Start/Return Dates: Enter the start date of the trip and the return date

b.Destination/Temporary Duty Station State/City/County: Used to determine per diem rate at each location.

c.No. of Days: Enter the total number of days at same per diem location.

d.Check Box with Trip Length (Note: Trip length refers to the total time traveled, not the time spent at a specific per diem location):

(1)

(2)

(3)24 Hrs. or Longer: For trips longer than 24 hours, Traveler is paid 75% of the daily per diem rate on the first and last days of travel, and 100% of the daily per diem rate is paid for all other days of the trip, minus meals provided.

e.Number of Meals Provided: Enter the number of breakfasts, lunches, and dinners provided at Postal Service expense at each per diem location.

2.Hotel

a.Name of Hotel: Enter the name of the hotel.

b.City: Location of hotel.

c.

d.

e.No. of Nights This Hotel: Indicate the number of nights you spent in the hotel.

f.$ Total of Hotel Bill: Enter the total of your hotel bill, including all

The employee who enters the expense report will separate the tax from the room rate in eTravel’s hotel itemization function.

g.Paid by Travel Card? Indicate whether or not you paid for the hotel expense with your government travel card by checking "Yes" or "No".

Note: USPS policy requires that travelers use the government travel card for all transportation, lodging, and travel advances. For stays at Norman, Oklahoma or Potomac, Maryland, hotel charges should not be entered into eTravel unless the cost is being charged to the government travel card. Generally, these charges are directly billed to the employee’s home office.

3.Personal Car

a.Depart Date: Enter the first date your personal vehicle was used for official business travel.

b.Trip Originated at: Enter the location where the trip in your personal vehicle originated, e.g., residence or name of office.

c.Destination City: Enter the location where the trip in your personal vehicle ended.

d.Purpose of the Trip/Comments: Enter the reason for travel in your personal vehicle. Also include information to notify the approving manager of any special circumstances involved in driving your personal vehicle.

e.Round Trip Miles: Enter the total miles driven in your personal vehicle on this date.

4.Telephone Calls

a.Date: Enter the date of the call.

b.Cost: Enter the cost of the call. (Personal phone call reimbursement is limited to 5 minutes per

c.Type of Call: Identify the telephone call by checking "B" for Business or "P" for Personal Call.

d.Is Call Listed on Hotel Bill? Indicate by checking "Yes" or "No" whether or not the call appears on the hotel bill.

Note: When possible, the traveler must use the least expensive means of placing the phone call. Whenever feasible, business and reimbursable phone calls made by the traveler are charged to the traveler’s

5.Airfare/Train

a.Depart Date: Enter the date you departed by airplane or train.

b.Airline or Train Name: Enter the company name of the airline or train.

c.Origin: Enter the city name where your flight/train trip began.

PS Form

d.Destination: Enter the city name of the final

destination of your flight/train trip. Note:

e.Cost: Enter the cost of your airfare or train ticket.

f.Paid by Travel Card or "Master Billed" GTA Ticket? Indicate if your government travel card was used to pay for the ticket by checking "Yes" or "No". If airfare or train expense was

Note: The traveler must include an explanation if they do not use the Government Travel Card to pay for the airfare or train.

6.Taxi/Limo

a.Date: Enter the date of your taxi/limo ride.

b.City: Enter the city where you rode the taxi/limo.

c.Origin: Enter the location where you were picked up, e.g., hotel, airport, residence, etc.

d.Destination: Enter the location where you were dropped off.

e.Cost: Enter the cost of the ride (may include a tip up to 15%).

f.Paid by Travel Card? Indicate if you paid for the taxi/limo with your government travel card by checking either "Yes" or "No".

g.Comments: List any comments about your taxi/limo expense, if necessary, such as sharing with other USPS employees, etc.

7.Car Rental

a.Date: Enter the date car rental began.

b.Rental Agency: Enter the car rental agency name.

c.City: Enter the city where the car was rented.

d.Cost: Enter the cost of the car rental.

e.Paid by Travel Card? Indicate if you paid for the taxi/limo with your government travel card by checking either "Yes" or "No".

f.Comments: List any comments about your car rental, when appropriate, such as sharing with other USPS employees, etc. Provide an explanation if your Government Travel Card was not used to pay for the car rental.

8.Other Reimbursable Expenses (Tolls, Gas, ATM Fees, Parking Fees, Public Transit)

a.Date: Enter the date the other expense occurred.

b.City: Enter the city where the expense occurred.

c.Expense/Purpose: Describe the expense you incurred. Some examples of expenses that should be entered here include tolls, cash advance fees (fees only, not the amount of the cash advance), gas, or parking.

d.Cost: Enter the cost of the expense.

e.Paid by Travel Card? Indicate if you paid for the other expense with your government travel card by checking either "Yes" or "No".

f.Comments: Enter any comments about the expense.

9.Training Course (GL Account 52363) — Tuition Only

a.Date: Enter start date of the course.

b.Place: Enter type of institution where training course was taken, e.g., Facility, University, Other).

c.Course Description: Enter the type of course taken.

d.Cost: Enter tuition paid.

e.Paid by Travel Card? Indicate if you paid for the training expense with your government travel card by checking either "Yes" or "No".

f.Comments: Enter any comments about the expense.

Note: The employee who enters the expense report must change the general ledger account in the GL Account field of eTravel to training expenses.

Traveler’s Signature: The traveler’s signature certifies factual presentation of all expense entries and compliance with USPS expense policy.

Phone No.: A phone number where the traveler can be reached if there are questions about your travel expenses.

Date Report Submitted: Enter the date the traveler sent the eTravel Expense Report to the employee for entry into eTravel.

Approving Manager’s Name: Enter the name of the manager

to whom the travel report should be submitted. Note: This field must contain a manager’s name, not a supervisor’s name. Managers who can approve a travel report are defined in Handbook

Office Use Only

To be completed by the employee who enters the expense report data into the eTravel system on behalf of the traveler. Once the data is entered into the eTravel system, the original form and backup are maintained in the office of the web alias. A copy of the eTravel Detail Report is sent to the traveler. Any questions from the approving manager will be addressed to the traveler.

Additional Comments

Any questions concerning completion of this form or about travel, should be addressed through the district eTravel coordinator or the employee designated to enter PS Form

After completing this form, forward the form and all receipts for expenses $50 and over that were not charged to your government travel card to the employee designated to enter your PS Form

Resubmit

If the approving manager has any questions regarding the expense report, he or she will contact the traveler directly and resubmit the report to the web alias if necessary. The traveler is responsible for notifying the web alias in writing of any necessary corrections, and authorizing the person entering the expense report to edit the report in the eTravel system.The expense report will then be resubmitted to the approving manager.

PS Form