Should you would like to fill out revenue canada rc145, it's not necessary to install any sort of applications - just try our PDF tool. To retain our tool on the leading edge of convenience, we strive to put into operation user-driven capabilities and enhancements regularly. We are always looking for suggestions - assist us with revampimg PDF editing. Here is what you would want to do to get going:

Step 1: Click the "Get Form" button above. It will open up our tool so that you can start filling out your form.

Step 2: With our advanced PDF editor, it is possible to accomplish more than simply fill out forms. Edit away and make your docs seem great with custom text added, or optimize the original content to perfection - all accompanied by an ability to insert any kind of photos and sign the file off.

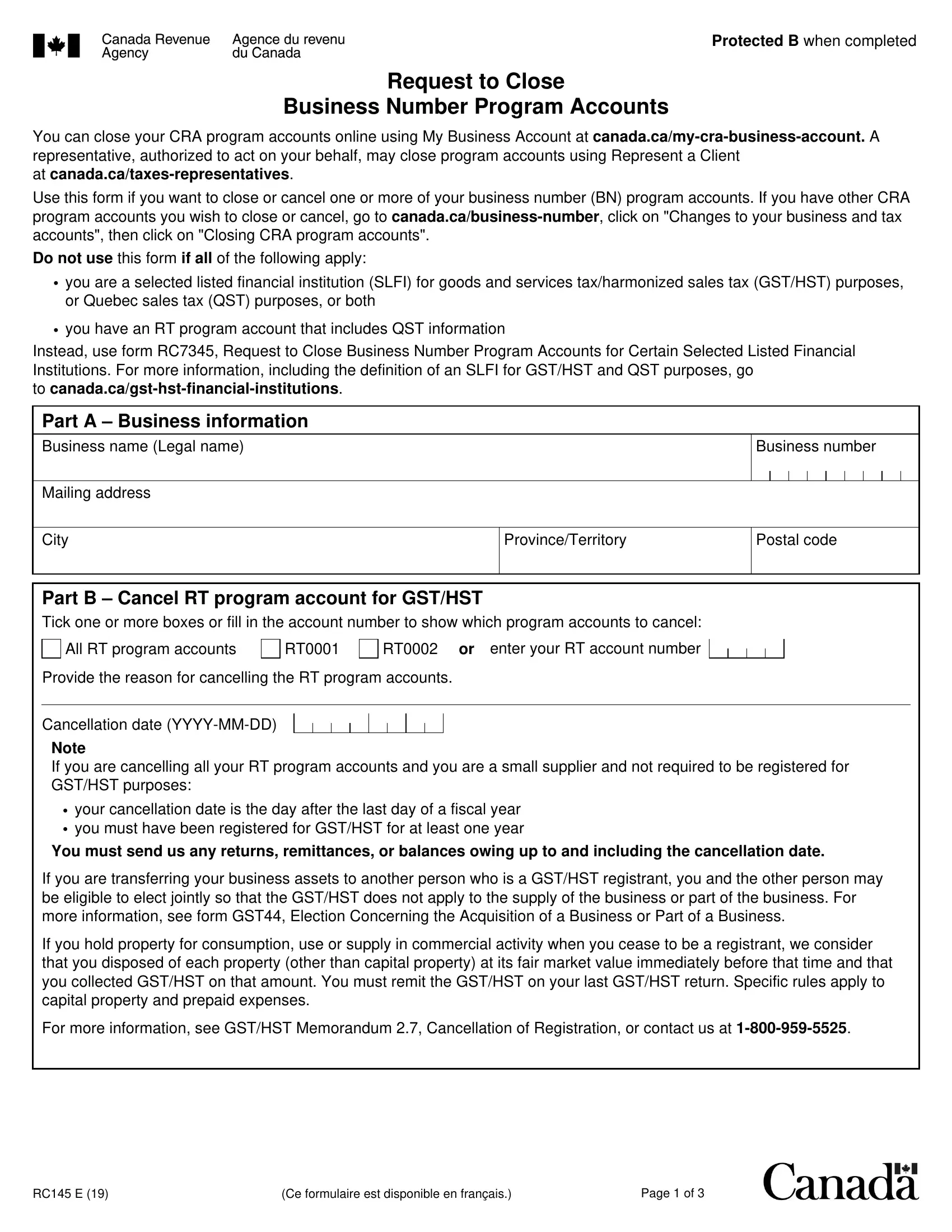

This PDF doc will require specific information; to ensure accuracy and reliability, please make sure to consider the next guidelines:

1. It is crucial to fill out the revenue canada rc145 correctly, so take care when working with the sections comprising these blanks:

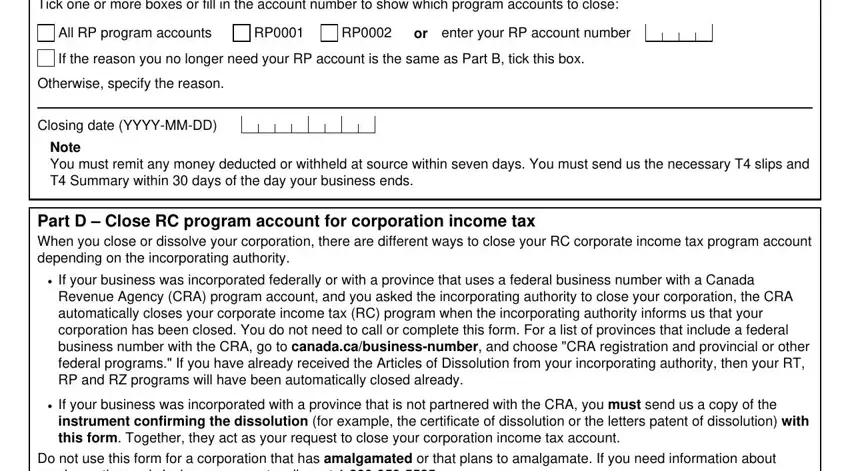

2. Once the last selection of blanks is done, proceed to enter the suitable details in all these: Part C Close RP program account, All RP program accounts, or enter your RP account number, If the reason you no longer need, Otherwise specify the reason, Closing date YYYYMMDD, Note You must remit any money, Part D Close RC program account, cid If your business was, Revenue Agency CRA program account, cid If your business was, instrument confirming the, and Do not use this form for a.

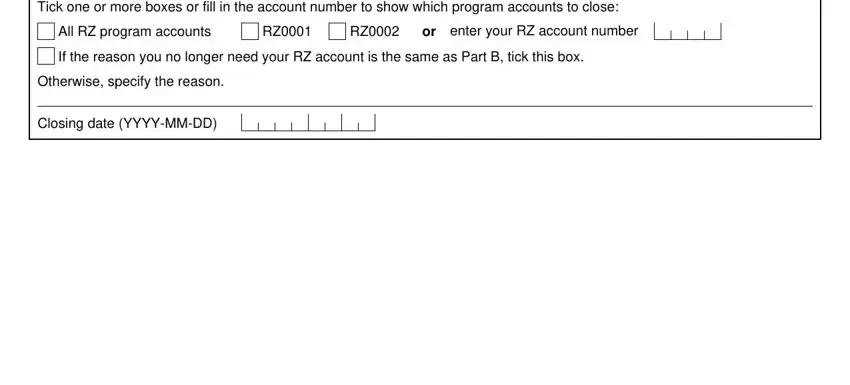

3. This third step is generally hassle-free - fill in all of the empty fields in Tick one or more boxes or fill in, All RZ program accounts, or enter your RZ account number, If the reason you no longer need, Otherwise specify the reason, and Closing date YYYYMMDD in order to complete this process.

As for All RZ program accounts and or enter your RZ account number, be certain you review things here. Both these are considered the key fields in the PDF.

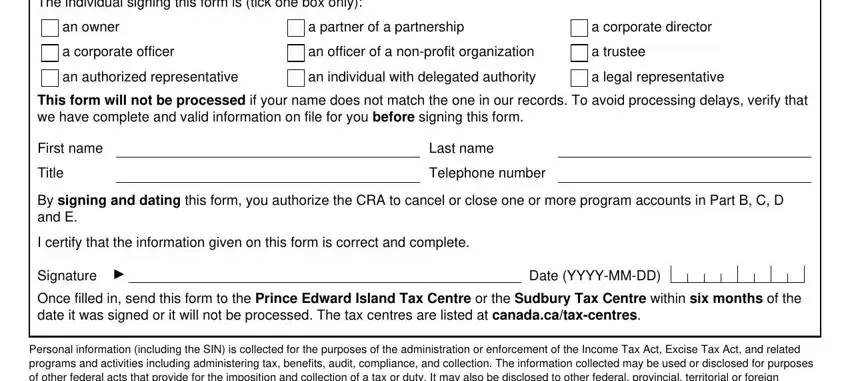

4. This fourth paragraph arrives with these blanks to enter your particulars in: The individual signing this form, an owner, a partner of a partnership, a corporate director, a corporate officer, an officer of a nonprofit, a trustee, an authorized representative, an individual with delegated, a legal representative, This form will not be processed if, First name, Title, Last name, and Telephone number.

Step 3: As soon as you've reviewed the details in the file's blanks, click on "Done" to complete your document creation. Try a 7-day free trial account at FormsPal and obtain instant access to revenue canada rc145 - downloadable, emailable, and editable in your FormsPal cabinet. We don't sell or share the details you enter when dealing with documents at our site.