You may prepare Rct 101 Form effortlessly in our online PDF tool. The tool is continually improved by us, receiving powerful functions and turning out to be more versatile. In case you are seeking to get going, here's what it will take:

Step 1: Click on the orange "Get Form" button above. It's going to open up our pdf tool so that you can start filling in your form.

Step 2: The tool will allow you to work with PDF documents in many different ways. Modify it by writing your own text, adjust what's already in the PDF, and include a signature - all when it's needed!

It is easy to finish the pdf with our practical tutorial! Here's what you need to do:

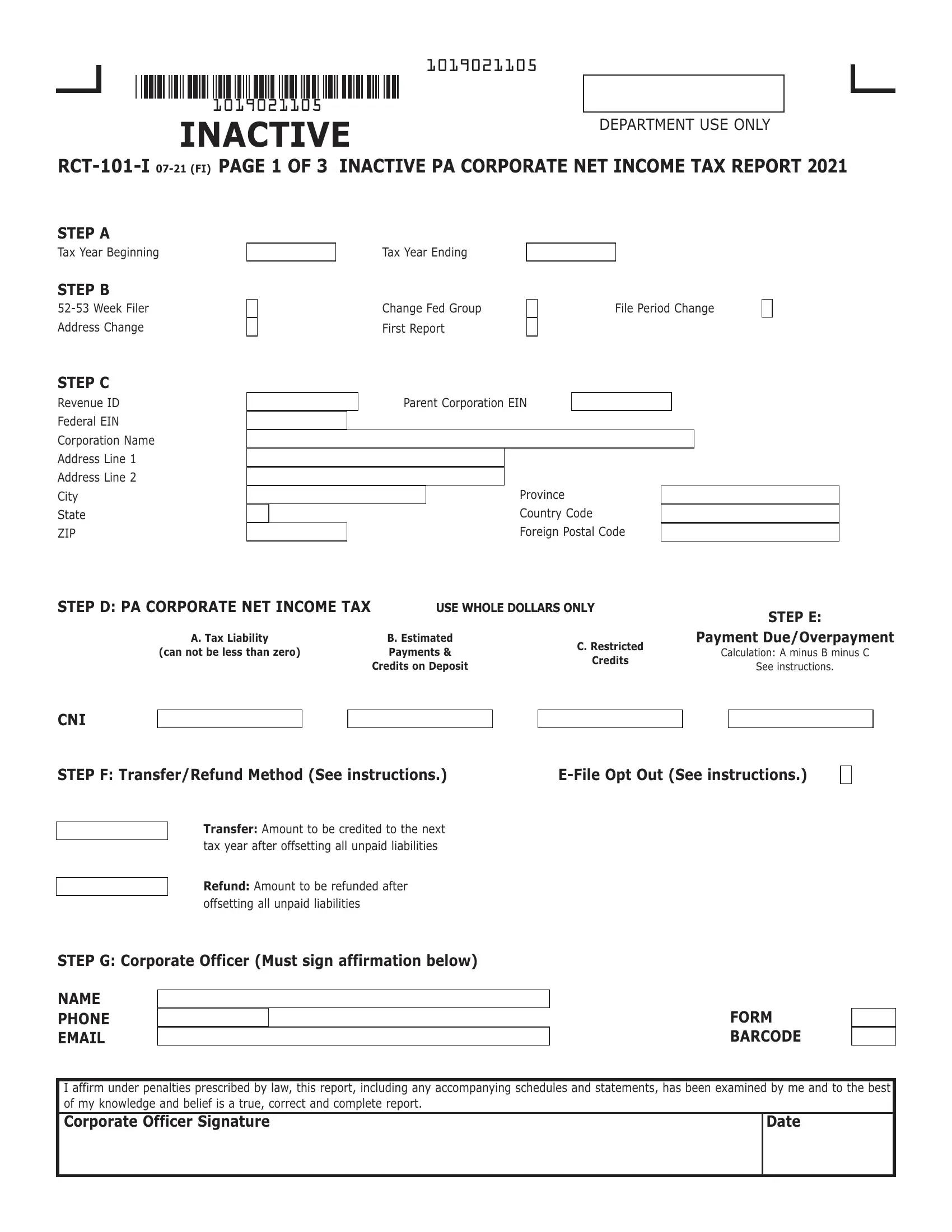

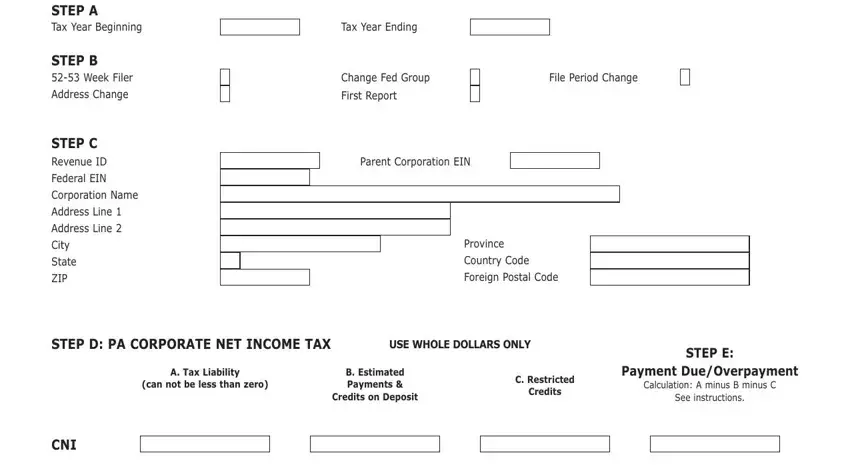

1. While filling out the Rct 101 Form, be certain to include all of the necessary blanks within the relevant part. This will help expedite the work, allowing for your details to be handled fast and appropriately.

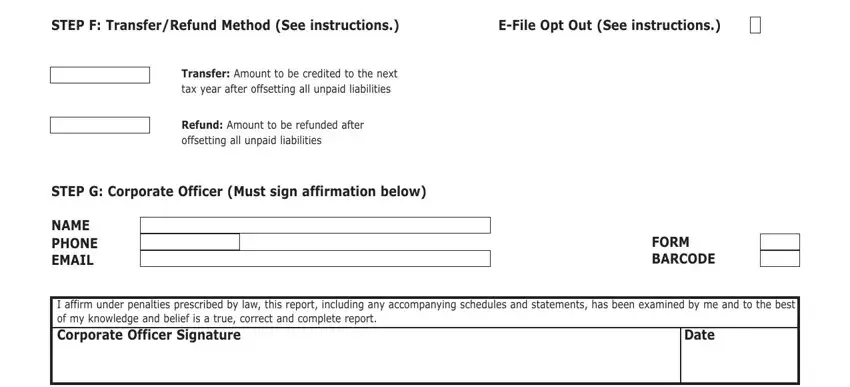

2. The next stage is usually to submit these particular fields: STep F TransferRefund method See, eFile opt out See instructions, Transfer Amount to be credited to, Refund Amount to be refunded after, STep g Corporate officer must sign, name phone email, FoRm BaRCoDe, and I affirm under penalties.

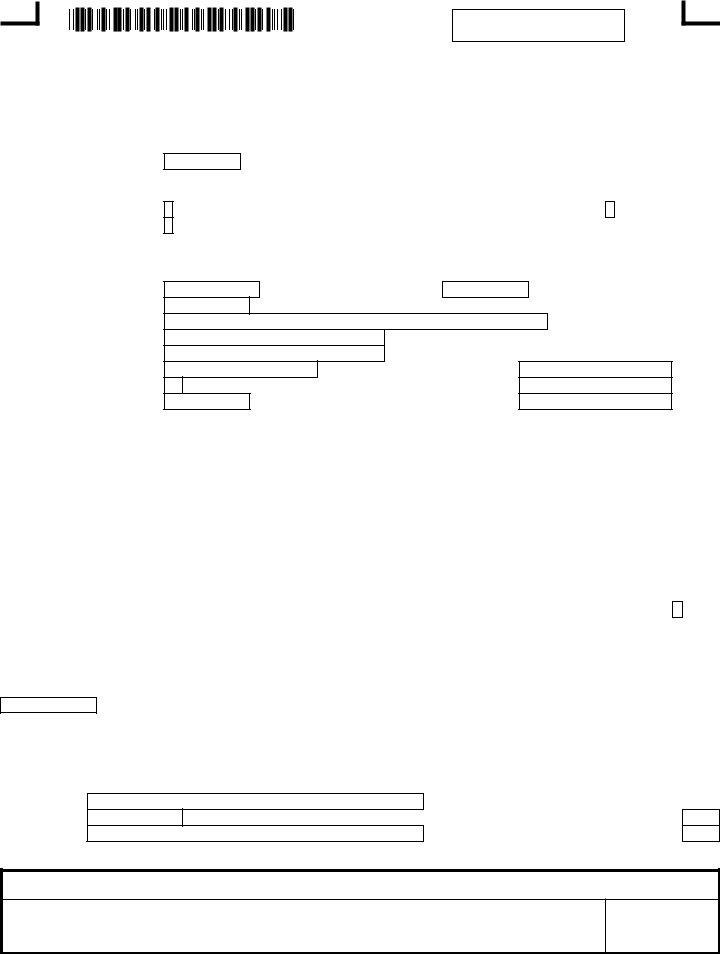

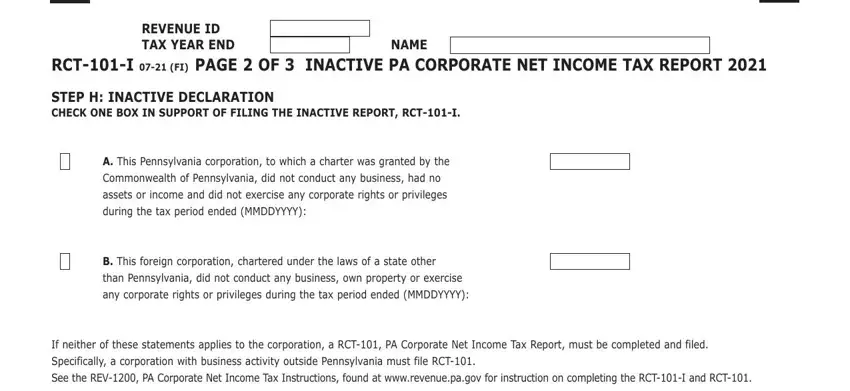

3. Completing Revenue iD Tax yeaR enD, name, RCTi Fi page oF inaCTive pa, STep h inaCTive DeClaRaTion CheCk, a This Pennsylvania corporation to, Commonwealth of Pennsylvania did, assets or income and did not, during the tax period ended, B This foreign corporation, than Pennsylvania did not conduct, any corporate rights or privileges, If neither of these statements, Specifically a corporation with, and See the REV PA Corporate Net is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

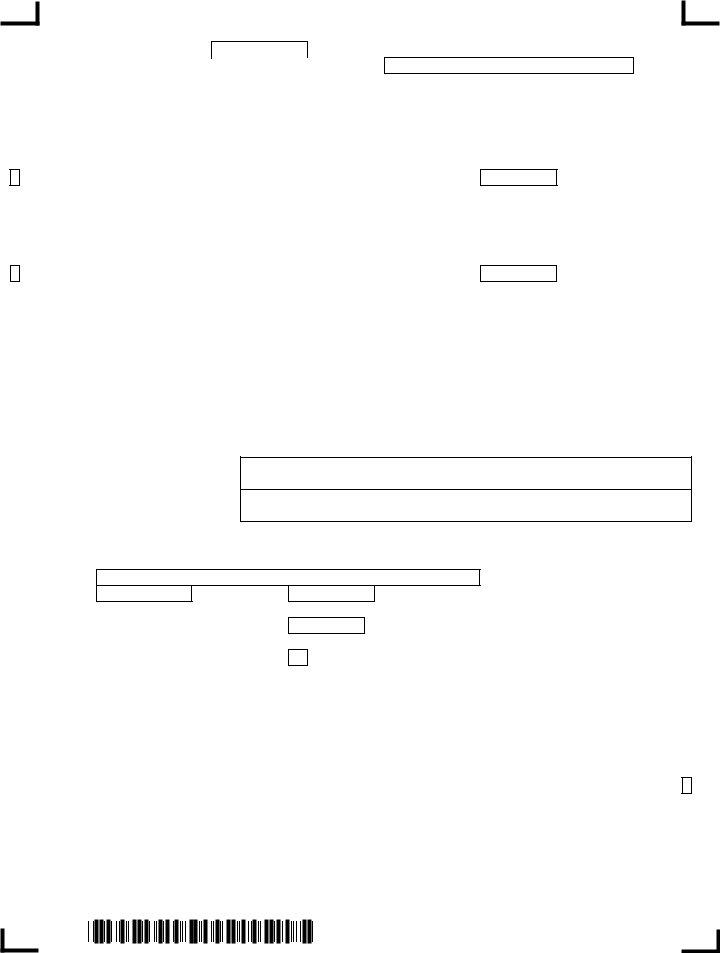

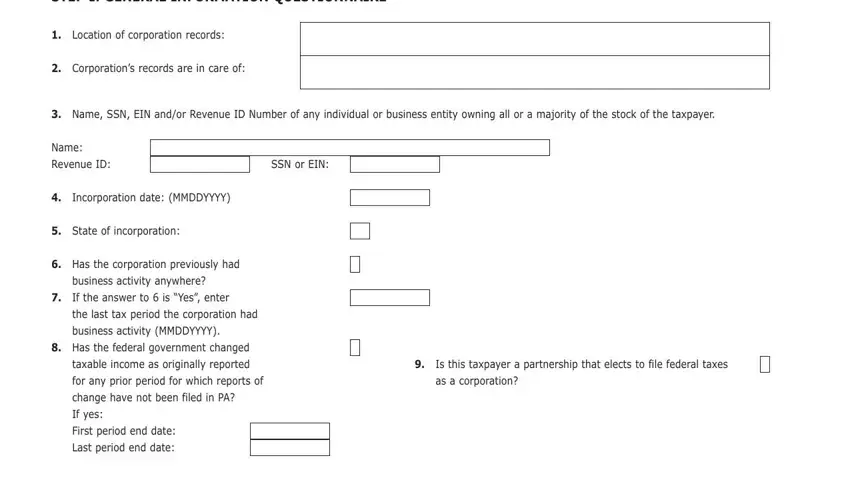

4. You're ready to fill in this fourth section! Here you'll have these STep i geneRal inFoRmaTion, Location of corporation records, Corporations records are in care, Name SSN EIN andor Revenue ID, Name, Revenue ID, SSN or EIN, Incorporation date MMDDYYYY, State of incorporation, Has the corporation previously had, business activity anywhere, If the answer to is Yes enter, the last tax period the, business activity MMDDYYYY, and Has the federal government changed fields to fill out.

Regarding Name and business activity MMDDYYYY, ensure that you review things in this current part. The two of these are surely the most significant fields in this form.

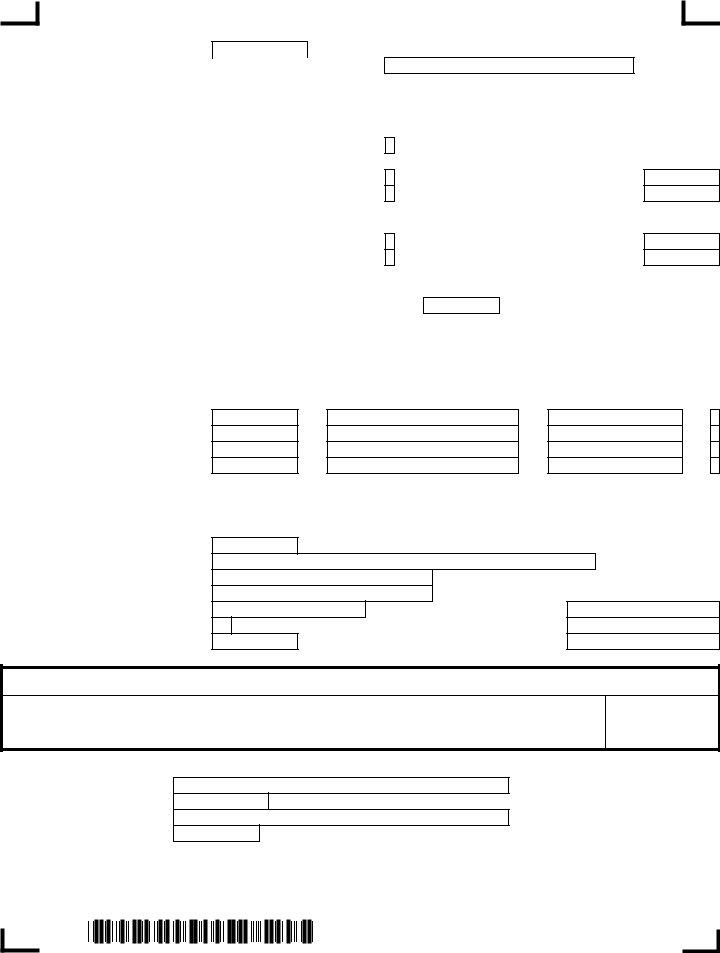

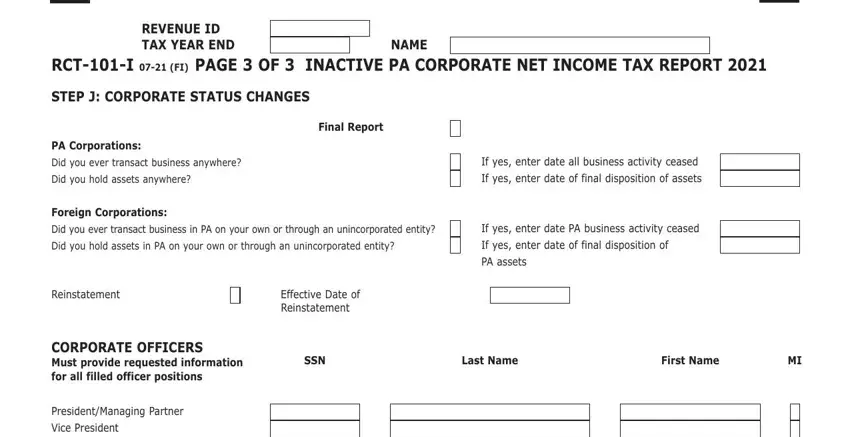

5. Finally, the following final part is what you will have to complete prior to closing the document. The blanks under consideration are the following: Revenue iD Tax yeaR enD, name, RCTi Fi page oF inaCTive pa, STep j CoRpoRaTe STaTuS ChangeS, Final Report, pa Corporations, Did you ever transact business, Did you hold assets anywhere, Foreign Corporations, If yes enter date all business, If yes enter date of final, Did you ever transact business in, If yes enter date PA business, Did you hold assets in PA on your, and If yes enter date of final.

Step 3: Just after looking through your entries, click "Done" and you're done and dusted! Join FormsPal now and easily obtain Rct 101 Form, prepared for download. Every change made is conveniently saved , helping you to edit the pdf further if necessary. FormsPal guarantees your information confidentiality via a protected system that in no way records or distributes any kind of sensitive information used in the file. Be confident knowing your files are kept confidential any time you use our tools!