The RCT-124 form, crucial for reporting domestic and foreign marine insurance tax, serves as a comprehensive document required by the Bureau of Corporation Taxes in Pennsylvania. Specifically designed for entities engaged in marine insurance within both domestic and foreign realms, this form collects detailed financial information for the tax year, including net premiums written, unearned premiums, marine losses incurred, and specific marine expenses. It facilitates the calculation of underwriting profit on marine business transacted within the U.S. and, by extension, the assessment of taxes due. Entities must indicate if the form represents a first report, an amended report, or the last report, providing an avenue for adjustments or corrections to previously submitted data. Additionally, the form accommodates overpayment instructions, allowing for automatic transfer to other underpaid taxes or refunds of overpayments. Crucial schedules attached to the form highlight premiums written, losses incurred, and expenses specific to the marine insurance business, outlining the operational financial landscape within the given tax year. Filing this form accurately is essential for compliance with Pennsylvania's tax laws regarding marine insurance, underscoring its importance to businesses operating in this sector.

| Question | Answer |

|---|---|

| Form Name | Rct 124 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | CHARGEABLE, 2009, rct 124, prepayments |

1240011101 |

MARINE INSURANCE TAX REPORT

DOMESTIC AND FOREIGN MARINE INSURANCE

Bureau of Corporation Taxes |

|

|

|

|

2011 REPORT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

PO BOX 280407 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Harrisburg PA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORP TAX ACCOUNT ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(DepartmentUseOnly) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DateReceived |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEDERAL ID (EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

CITY |

|

|

|

STATE |

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

o Check to send all correspondence to preparer. |

|

|

|

|

|

|

|

|

o Check to indicate a change of address |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o First Report |

o Amended Report (See instructions.) |

|

|

|

|

|

|

|

|

|

|

|

o LastReport (See instructions.) |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL PAYMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

TAX YEAR ENDING |

|

|

|

|

|

|

|

|

|

|

DUE DATE |

06/01/12 |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

12/31/11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUEUSEONLY |

A.TaxLiability |

|

B.Estimated |

|

|

|

C.Restricted |

|

|

|

|

Remittance |

||||||||||||||||||||||||||||||

TAX TYPE |

|

|

|

|

|

Payments&Credits |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

TYPE |

|

BUDGET |

fromTaxReport |

|

|

|

|

|

Credit |

|

|

AminusBminusC |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

onDeposit |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

CODE |

|

CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOMESTICMARINE |

|

70 |

|

125161 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOREIGNMARINE |

|

70 |

|

125164 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GRAND TOTALS

oPLEASE CHECK THIS BLOCK ONLY IF THE TOTAL PAYMENT SHOWN ABOVE HAS BEEN OR WILL BE PAID ELECTRONICALLY.

OVERPAYMENT INSTRUCTIONS (Choose only Option A or Option B and write the appropriate letter in the box provided.)

oA = Automatically transfer overpayments to other underpaid taxesfor the current tax period, then to the next tax period. B = Refund overpayment(s) of the current tax period after paying any other underpaid taxes for the current tax period.

Bycheckingthe“AmendedReport”boxonthisform,thetaxpayerconsentstotheextensionoftheassessmentperiodforthistaxyeartooneyearfromthedateoffilingofthisamendedreport orthreeyearsfromthefilingoftheoriginalreport,whicheverperiodlastexpires.Forpurposesofthisextension,anoriginalreportfiledbeforetheduedateisdeemedfiledontheduedate.

Iaffirmunderpenaltiesprescribedbylawthatthisreport(includinganyaccompanyingschedulesandstatements)wasexaminedbyme,tothebestofmyknowledgeandbeliefisatrue,cor- rectandcompletereportandIamauthorizedtoexecutethisconsenttotheextensionoftheassessmentperiod.ThisdeclarationisbasedonallinformationofwhichIhaveanyknowledge.

Signature of Officer |

|

|

Title |

Date |

Telephone Number |

|

|

|

|

|

|

( |

) |

|

|

|

|

|||

Iaffirmunderpenaltiesprescribedbylaw,thisreport(includinganyaccompanyingschedulesandstatements)hasbeenpreparedbymeandtothebestofmyknowledgeandbeliefisa |

||||||

true,correctandcompletereport. |

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINTIndividual Preparer or Firm’s Name |

|

|

Signatureof Preparer |

|

Fax Number |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

PRINTIndividual or Firm’s Street Address |

|

|

Title |

|

Telephone Number |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

City |

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

1240011101 |

1240011101 |

1240011201

SCHEDULE A

MARINE PREMIUMS WRITTEN WITHIN THE U.S.

Page 2

(Excludingpremiumsonbusinessfallingwithintheprovisionsof72P.S.§2281(c)imposingastatetaxonmarineinsuranceunderwritingprofits.)

ITEMS |

1 |

2 |

3 |

4 |

5 |

6 |

|

NETPREMIUMSLESS |

|||||||

LAST THREE |

GROSS |

RETURN |

NET |

NET |

|||

|

|||||||

|

NETREINSURANCE |

||||||

|

CALENDAR YEARS |

PREMIUMS |

PREMIUMS |

PREMIUMS |

REINSURANCE |

||

|

PREMIUMS |

||||||

|

|

|

|

|

|

aYear 2009 b Year 2010 c Year 2011 d Totals

SCHEDULE B

MARINE PREMIUMS WRITTEN WITHIN THE COMMONWEALTH OF PENNSYLVANIA

ITEMS |

1 |

2 |

3 |

4 |

5 |

6 |

|

NETPREMIUMSLESS |

|||||||

LAST THREE |

GROSS |

RETURN |

NET |

NET |

|||

|

|||||||

|

NETREINSURANCE |

||||||

|

CALENDAR YEARS |

PREMIUMS |

PREMIUMS |

PREMIUMS |

REINSURANCE |

||

|

PREMIUMS |

||||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

a |

Year 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

Year 2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Year 2011 |

|

|

|

|

|

dTotals

SCHEDULE C

PREMIUMS WRITTEN – ALL CLASSES OF BUSINESS – FOR THE LAST THREE CALENDAR YEARS

WITHIN THE U.S.

ITEMS |

1 |

2 |

3 |

4 |

5 |

6 |

|

NETPREMIUMSLESS |

|||||||

LAST THREE |

GROSS |

RETURN |

NET |

NET |

|||

NETREINSURANCE |

|||||||

CALENDAR YEARS |

PREMIUMS |

PREMIUMS |

PREMIUMS |

REINSURANCE |

|||

PREMIUMS |

|||||||

|

|||||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

a |

Year 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

Year 2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Year 2011 |

|

|

|

|

|

dTotals

SCHEDULE D

UNEARNED PREMIUMS ON OUTSTANDING MARINE INSURANCE CONTRACTS (WRITTEN WITHIN THE U.S.)

AT CLOSE OF BUSINESS DEC. 31 FOR LAST FOUR CALENDAR YEARS.

|

|

TRIP(OrVoyage)CONTRACTS |

TERMCONTRACTS |

ADVANCE |

|

||

|

1 |

PREMIUMS |

7 |

||||

|

|

|

|

|

|||

ITEMS |

LAST FOUR |

2 |

3 |

4 |

5 |

6 |

TOTAL NET |

CALENDAR YEARS |

PREMIUMS IN |

NET UNEARNED |

PREMIUMS IN |

NET UNEARNED |

NET UNEARNED |

UNEARNED |

|

|

FORCE LESS |

PREMIUMS |

FORCE LESS |

PREMIUMS 50% |

PREMIUMS |

PREMIUMS |

|

|

|

||||||

|

|

REINSURANCE |

100% |

REINSURANCE |

|

100% |

|

|

|

|

|

|

|

|

|

a |

Year 2008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

Year 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Year 2010 |

|

|

|

|

|

|

dYear 2011

1240011201

|

|

1240011301 |

Page 3 |

|

SCHEDULE E

MARINE LOSSES INCURRED ON BUSINESS WRITTEN WITHIN THE U.S.

FOR LAST THREE CALENDAR YEARS

ITEMS |

1 |

2 |

3 |

4 |

5 |

6 |

|

LAST THREE |

GROSS |

REINSURANCE |

SALVAGE |

TOTAL |

NET |

||

(Column 2 minus |

|||||||

CALENDAR YEARS |

LOSSES |

(Columns 3 and 4) |

|||||

|

|

|

|

|

|

Column 5) |

|

a |

Year 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

Year 2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Year 2011 |

|

|

|

|

|

dTotals

SCHEDULE F

SPECIFIC MARINE EXPENSES INCURRED ON BUSINESS TRANSACTED WITHIN THE U.S.

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

ITEMS |

LAST THREE |

AGENCY |

AGENCY |

FEDERAL |

STATE & CITY |

LOSS |

ALLOTHER |

TOTAL |

CALENDAR |

COMMISSIONS |

EXPENSES |

TAXES |

TAXES & FEES |

ADJUSTMENT |

EXPENSES |

||

|

YEARS |

INCLUDING |

|

|

|

EXPENSE |

|

|

|

BROKERAGE |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

a |

Year 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

Year 2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Year 2011 |

|

|

|

|

|

|

|

dTotals

SCHEDULE G

GENERAL EXPENSES NOT CHARGEABLE SPECIFICALLY TO ANY PARTICULAR CLASS OF BUSINESS

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

ITEMS |

LAST THREE |

SALARIES OF |

ADVERTISING |

FEDERAL |

RENTS |

PRINTING & |

ALLOTHER |

TOTAL |

CALENDAR |

OFFICERS & |

& |

TAXES |

STATIONERY |

EXPENSES |

|||

|

YEARS |

EMPLOYEES |

SUBSCRIP- |

|

|

|

|

|

|

TIONS |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

a |

Year 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

Year 2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Year 2011 |

|

|

|

|

|

|

|

dTotals

e. |

|

|

|||

of business within the U.S. (Schedule C, Column 4, Item d) |

|

% |

|

||

f. |

|

|

|||

to total net marine premiums written within the U.S. (Schedule A, Column 4, Item d) |

|

% |

|

||

|

Attach Copy of Pennsylvania Business Page of the Annual Report filed with the Pennsylvania Insurance Department. |

|

|

||

|

NOTE: If the company is licensed to write ocean marine premiums in Pennsylvania, this report must be filed whether or not ocean |

|

|

||

|

marine premiums were written. |

|

|

||

1240011301

|

|

1240011401 |

Page 4 |

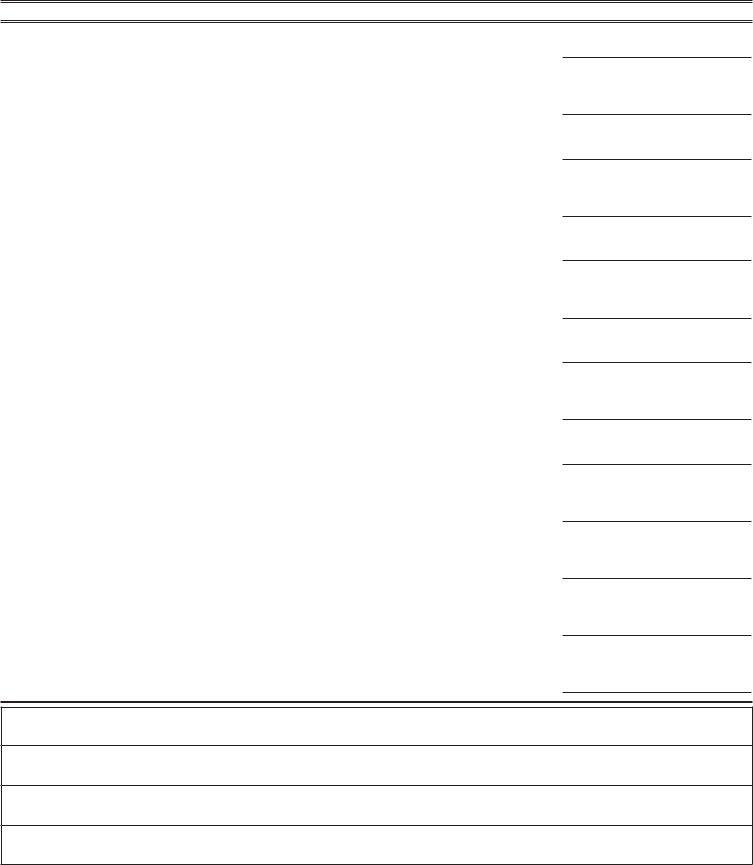

TOTAL UNDERWRITING PROFIT ON MARINE BUSINESS TRANSACTED WITHIN THE U.S.

1. |

Net Premiums, less Net Reinsurance Premiums, written within the U.S. |

|

|

(Schedule A, Column 6, Item d) |

.$ |

2. |

Plus: Net Unearned Marine Premiums on U.S. business at beginning of |

|

|

.$ |

|

3. |

Total (Line 1 plus Line 2) |

.$ |

4. |

Less: Net Unearned Marine Premiums on U.S. business at end offour- |

|

|

year period (Schedule D, Column 7, Item d) |

.$ |

5. |

Net Marine Premiums Earned (Line 3 minus Line 4) |

.$ |

6. |

Net Marine Losses incurred on business written within the U.S. |

|

|

(Schedule E, Column 6, Item d) |

.$ |

7. |

Specific Marine Expenses incurred (Schedule F, Column 8, Item d) |

.$ |

8. |

Proportion of general expenses chargeable to U.S. Marine Premiums |

|

|

(Schedule G, Item e multiplied by Schedule G, Column 8, Item d) |

.$ |

9. |

Total Deductions (Line 6 plus Line 7 plus Line 8) |

.$ |

10. |

Net Marine Underwriting Profit on business written within the U.S. |

|

|

(Line 5 minus Line 9) |

.$ |

11. |

Net Marine Underwriting Profit on business written within Pennsylvania |

|

|

for three years (Line 10 multiplied by Schedule G, Item f) |

.$ |

12. |

Average Net Marine Underwriting Profit on business within Pennsylvania |

|

|

for one year (0.33 x Line 11) |

.$ |

13. |

Tax at 5 percent on Average Net Marine Underwriting Profit on business within Pennsylvania for one |

|

|

year (0.05 x Line 12) Enter this amount on Page 1, ColumnA (whole dollars only) |

.$ |

IF ALIEN, GIVE NAME OF STATE IN WHICH PRINCIPAL U.S. OFFICE IS LOCATED

DATE BUSINESS COMMENCED IN PENNSYLVANIA

INCORPORATED OR ORGANIZED UNDER THE LAWS OF:

THIS REPORT IS MADE BY A STOCK COMPANY, ASSOCIATION, EXCHANGE, ETC. (PLEASE SPECIFY)

Á

1240011401