county real estate transfer can be completed online very easily. Just make use of FormsPal PDF tool to complete the task without delay. FormsPal team is committed to making sure you have the absolute best experience with our editor by regularly introducing new features and improvements. With all of these updates, working with our tool becomes easier than ever before! Here is what you'd want to do to begin:

Step 1: Click on the "Get Form" button at the top of this page to access our editor.

Step 2: With the help of this advanced PDF file editor, you may do more than just complete blanks. Try each of the features and make your documents seem high-quality with customized textual content incorporated, or tweak the original input to perfection - all comes along with an ability to incorporate almost any graphics and sign the document off.

This document will require some specific information; in order to ensure accuracy, please take heed of the suggestions down below:

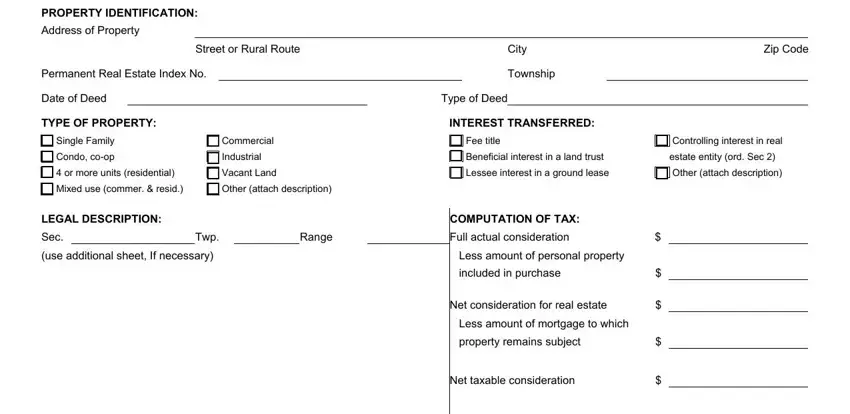

1. Before anything else, while completing the county real estate transfer, beging with the part with the next fields:

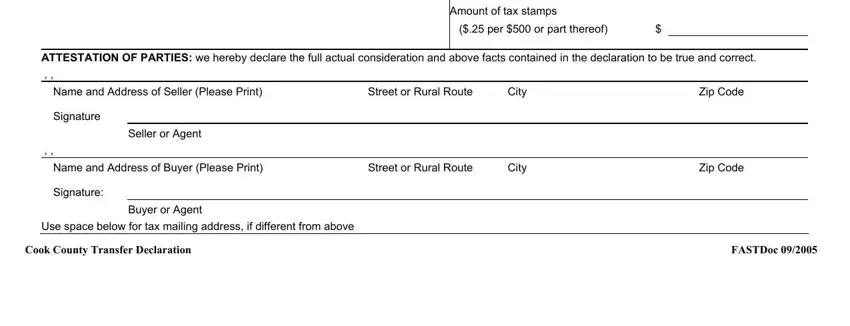

2. Given that this segment is finished, you're ready put in the required details in Net taxable consideration, Amount of tax stamps, per or part thereof, ATTESTATION OF PARTIES we hereby, Name and Address of Seller Please, Street or Rural Route, City, Zip Code, Signature, Seller or Agent, Name and Address of Buyer Please, Street or Rural Route, City, Zip Code, and Signature so you're able to go to the 3rd part.

A lot of people often make mistakes while completing City in this part. Make sure you re-examine whatever you enter here.

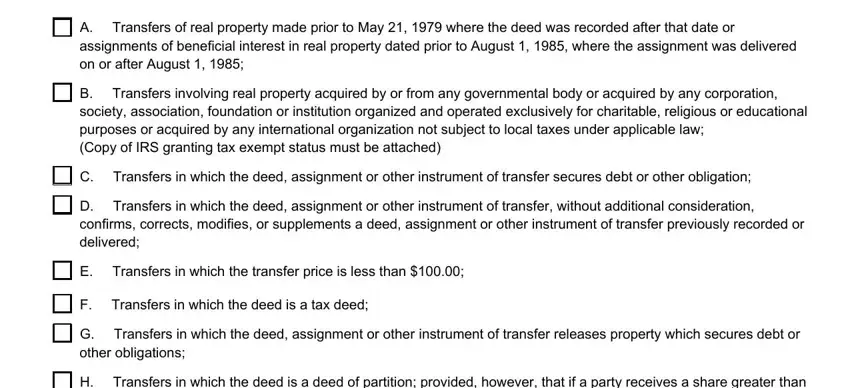

3. The third step is normally simple - fill out all of the form fields in A Transfers of real property made, B Transfers involving real, C Transfers in which the deed, D Transfers in which the deed, E Transfers in which the transfer, F Transfers in which the deed is a, G Transfers in which the deed, and H Transfers in which the deed is a in order to finish the current step.

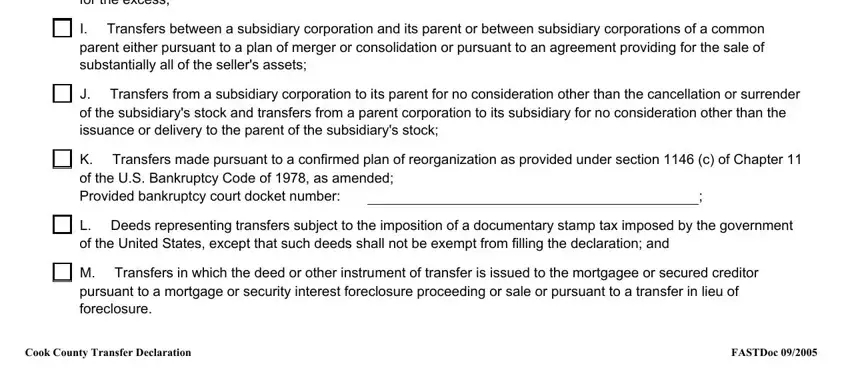

4. To go onward, the following section involves typing in a handful of blank fields. Examples of these are H Transfers in which the deed is a, I Transfers between a subsidiary, J Transfers from a subsidiary, K Transfers made pursuant to a, L Deeds representing transfers, M Transfers in which the deed or, Cook County Transfer Declaration, and FASTDoc, which are key to going forward with this PDF.

Step 3: Always make sure that your details are correct and click "Done" to continue further. Obtain your county real estate transfer after you register here for a 7-day free trial. Quickly use the form inside your FormsPal cabinet, together with any modifications and adjustments being automatically synced! FormsPal guarantees safe form tools devoid of personal data record-keeping or distributing. Rest assured that your details are secure with us!