Should you need to fill out alberta corproation annual return form alberta for reg3062, you don't need to download any kind of programs - simply make use of our online PDF editor. The tool is continually upgraded by our staff, receiving handy features and growing to be greater. Starting is effortless! Everything you need to do is adhere to the next easy steps down below:

Step 1: Firstly, access the editor by pressing the "Get Form Button" at the top of this page.

Step 2: Once you start the tool, you will notice the document ready to be filled out. Aside from filling in various blanks, you may as well perform other actions with the file, that is writing any text, changing the original textual content, inserting images, putting your signature on the form, and much more.

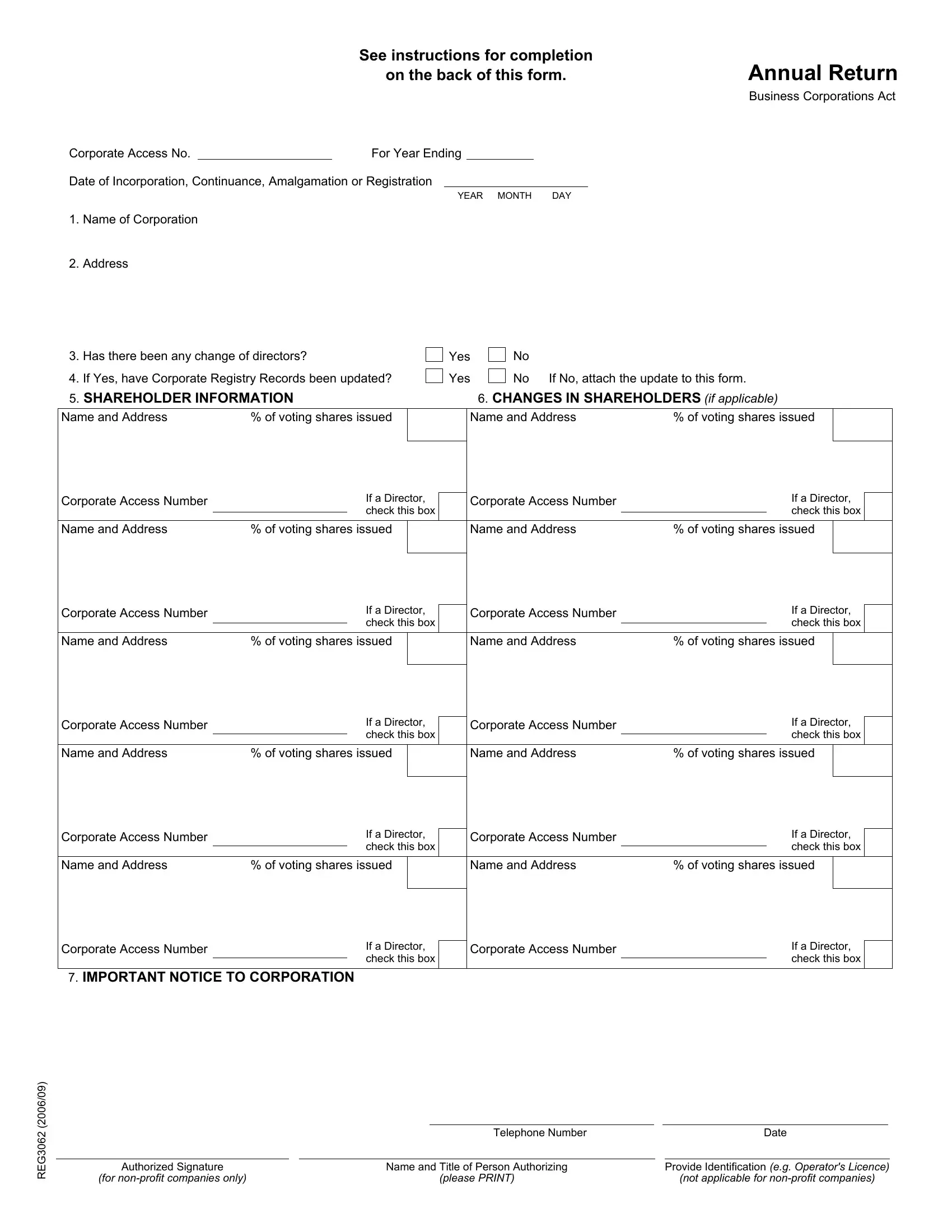

So as to complete this form, be sure to provide the necessary information in each and every area:

1. While filling in the alberta corproation annual return form alberta for reg3062, ensure to complete all of the important fields in its corresponding form section. It will help facilitate the process, enabling your details to be processed swiftly and appropriately.

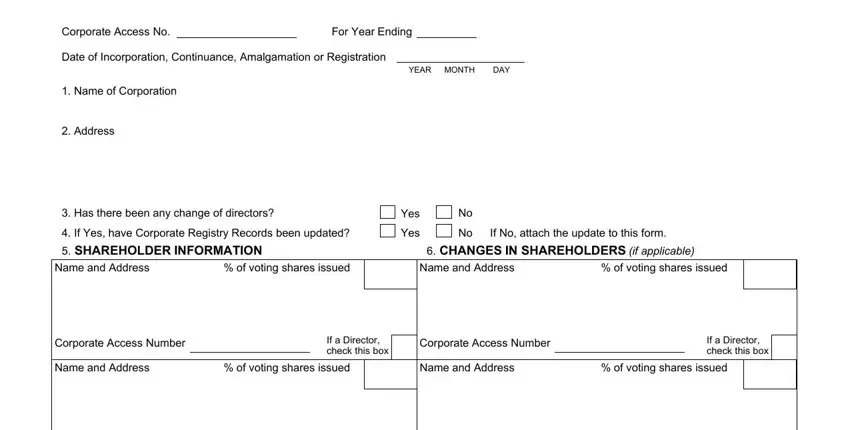

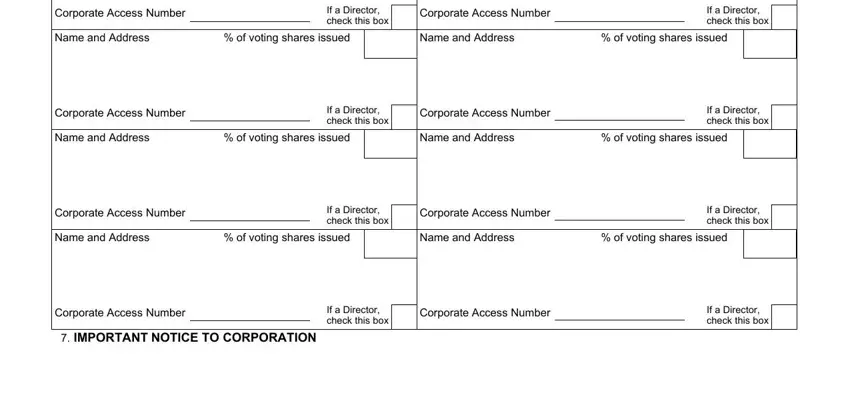

2. Your next part is to submit these fields: Corporate Access Number, If a Director check this box, Corporate Access Number, If a Director check this box, Name and Address of voting shares, Name and Address of voting shares, Corporate Access Number, If a Director check this box, Corporate Access Number, If a Director check this box, Name and Address of voting shares, Name and Address of voting shares, Corporate Access Number, If a Director check this box, and Corporate Access Number.

People often get some points wrong when filling in If a Director check this box in this area. You should read again everything you type in right here.

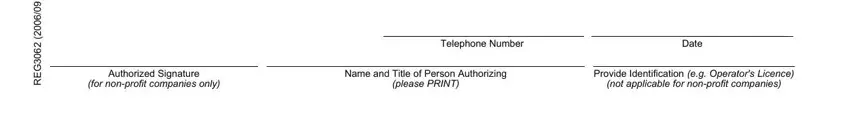

3. In this specific stage, have a look at G E R, Authorized Signature, for nonprofit companies only, Name and Title of Person, please PRINT, Provide Identification eg, not applicable for nonprofit, Telephone Number, and Date. All these will have to be taken care of with utmost precision.

Step 3: Right after you've reread the details in the file's blank fields, simply click "Done" to conclude your FormsPal process. Join us right now and easily access alberta corproation annual return form alberta for reg3062, ready for downloading. Every edit made is handily kept , enabling you to edit the form at a later point when required. We don't share or sell any details you provide when completing documents at FormsPal.