Once you open the online editor for PDFs by FormsPal, it is possible to fill in or alter 2020 wisconsin rent certificate form right here. In order to make our editor better and easier to utilize, we constantly come up with new features, considering feedback coming from our users. By taking some simple steps, it is possible to begin your PDF journey:

Step 1: Click the "Get Form" button above. It's going to open our editor so that you could begin filling in your form.

Step 2: With this state-of-the-art PDF file editor, you'll be able to do more than just fill in blanks. Express yourself and make your docs seem perfect with customized textual content added in, or fine-tune the original content to excellence - all backed up by the capability to add just about any pictures and sign it off.

It really is simple to complete the pdf using this practical tutorial! Here is what you must do:

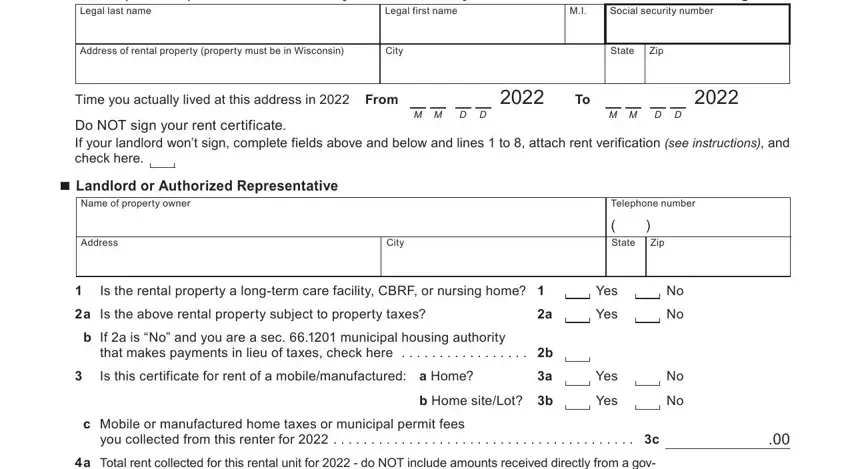

1. The 2020 wisconsin rent certificate form will require certain information to be inserted. Ensure that the next blanks are completed:

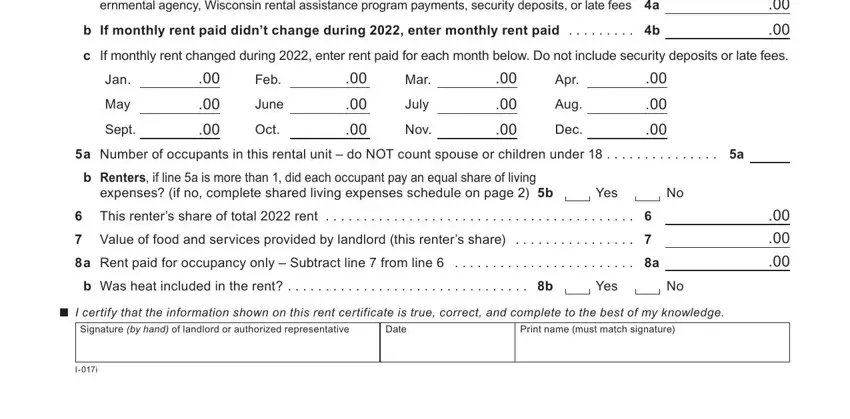

2. Just after finishing the last part, head on to the subsequent part and complete the essential particulars in all these blank fields - a Total rent collected for this, b If monthly rent paid didnt, c If monthly rent changed during, Jan, May, Sept, Feb, June, Oct, Mar, July, Nov, Apr, Aug, and Dec.

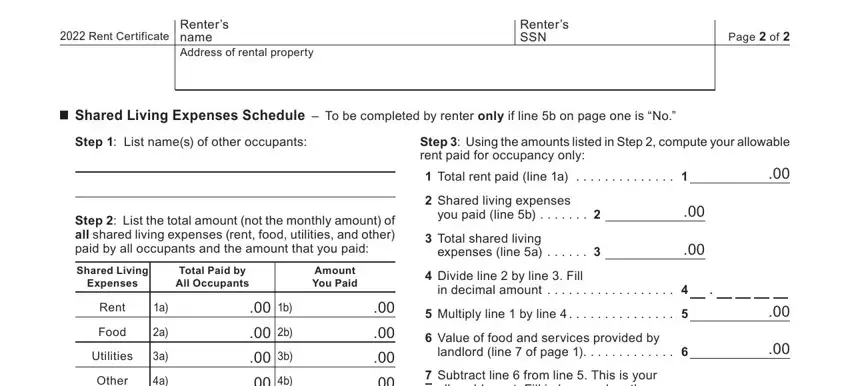

3. The following step is focused on Rent Certificate, Renters name Address of rental, Renters SSN, Page of, Shared Living Expenses Schedule, Step List names of other occupants, Step Using the amounts listed in, Total rent paid line a, Step List the total amount not, Shared Living, Expenses, Total Paid by All Occupants, Amount You Paid, Shared living expenses you paid, and Total shared living expenses line - type in each one of these fields.

Regarding Total Paid by All Occupants and Expenses, be sure that you double-check them in this current part. These are surely the most important ones in the document.

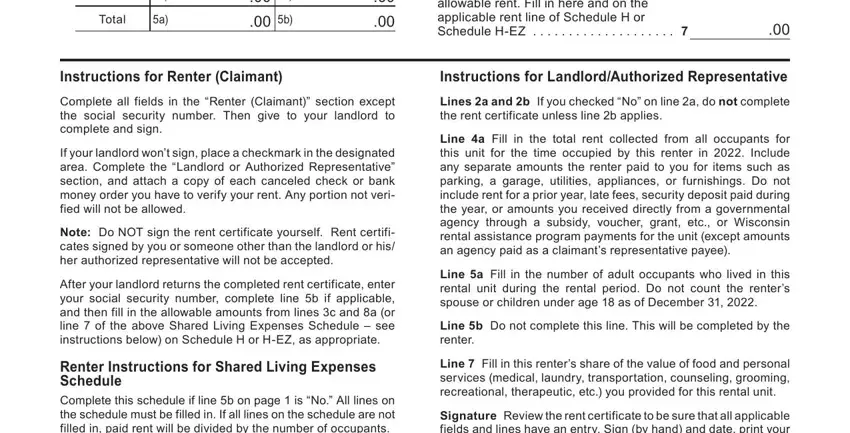

4. The subsequent section needs your input in the subsequent areas: Other, Total, Subtract line from line This is, Instructions for Renter Claimant, Instructions for, Complete all fields in the Renter, If your landlord wont sign place a, Note Do NOT sign the rent, After your landlord returns the, Renter Instructions for Shared, Complete this schedule if line b, Lines a and b If you checked No on, Line a Fill in the total rent, Line a Fill in the number of adult, and Line b Do not complete this line. Make sure that you fill out all of the required info to move further.

Step 3: Before submitting this document, it's a good idea to ensure that blank fields are filled out right. Once you’re satisfied with it, click on “Done." Right after registering a7-day free trial account with us, you will be able to download 2020 wisconsin rent certificate form or send it through email directly. The PDF file will also be readily accessible in your personal account with your each and every modification. When using FormsPal, you can complete forms without needing to worry about data incidents or entries getting shared. Our protected platform helps to ensure that your private details are stored safely.