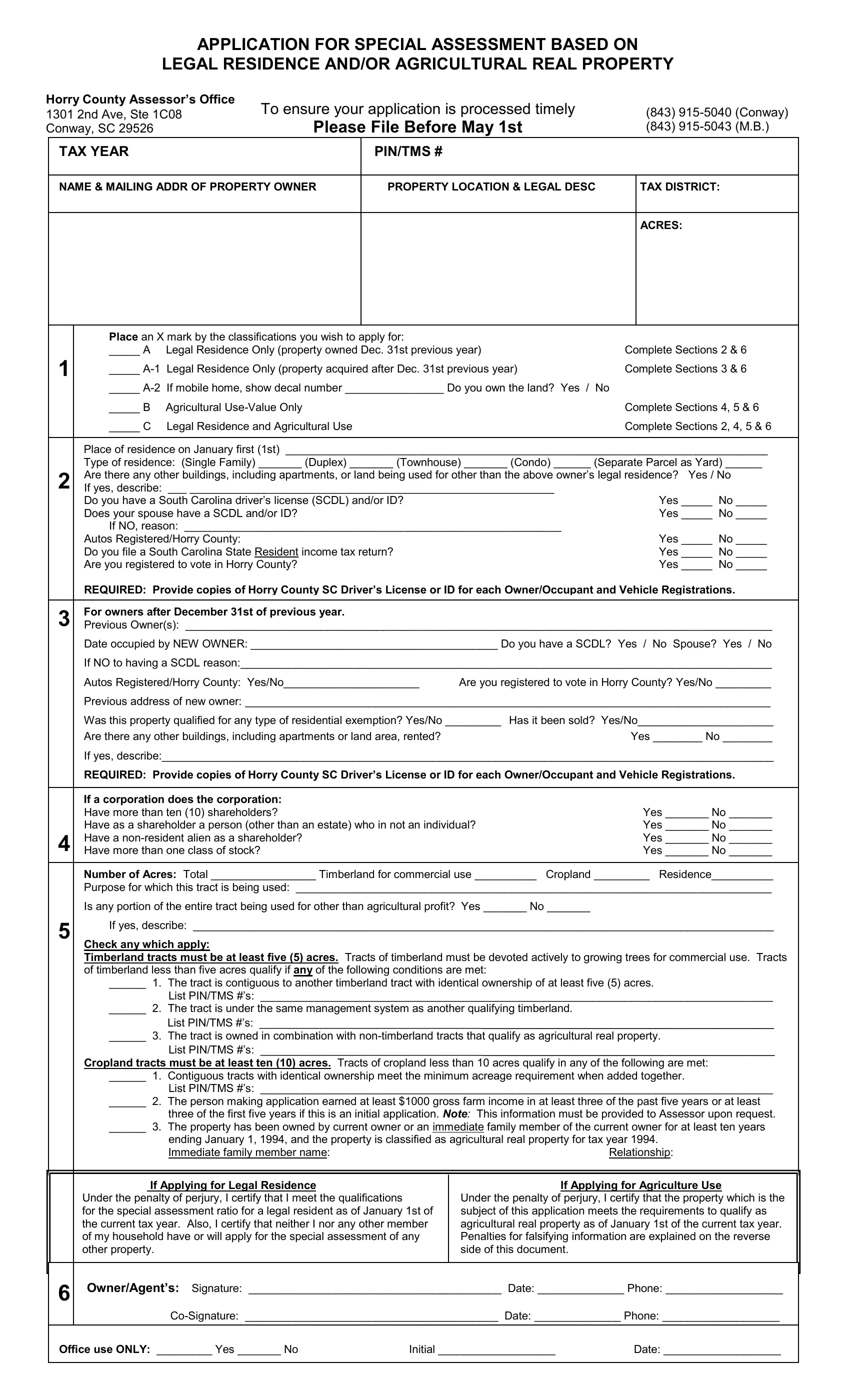

APPLICATION FOR SPECIAL ASSESSMENT AS

LEGAL RESIDENCE

DEFINITION OF LEGAL RESIDENCE

For property tax purposes the term “Legal Residence” shall mean the permanent home or dwelling place owned by a person and occupied by the owner thereof. If it shall be the place where he/she intends to remain permanently for an indefinite time even though he/she may temporarily be living at another location, however, the same shall not be made a residence maintained principally for vacation or recreational purposes.

QUALIFICATION REQUIREMENTS

The property must be occupied by the owner prior to December 31st of the tax year and prior to date of application. To include not more than five (5) acres contiguous thereto and be owned totally or in part in fee or by life estate, but shall not include the portion which is not owned and occupied for residential purposes.

S.C. Code of Laws, Section 12-43-220 (c)

“Under penalty of perjury I certify that: (A) the residence which is the subject of this application is my legal residence and where I am domiciled at the time of this application and that I do not claim to be a legal resident of a jurisdiction other than South Carolina for any purpose; and (B) that neither I nor any other member of my

household is residing in or occupying any other residence which I or any member of my immediate family has qualified for the special assessment ratio allowed by this section.”

(iii)For purpose of sub item (ii)(B) of this item, “a member of my household” means:

(A)the owner-occupant’s spouse, except when that spouse is legally separated from the owner-occupant; and

(B)any child of the owner-occupant claimed or eligible to be claimed as a dependant on the owner- occupant’s federal income tax return.

(iv)In addition to the certification, the burden of proof for eligibility for the four percent assessment ratio is on

the owner-occupant and the applicant must provide proof the assessor requires including, but not limited to:

(A)a copy of the owner-occupant’s most recently filed South Carolina individual income tax return;

(B)copies of South Carolina motor vehicle registrations for all motor vehicles registered in the name of the owner-occupant;

(C)other proof required by the assessor necessary to determine eligibility for the assessment ratio allowed by this item.

If the assessor determines the owner-occupant ineligible, the six percent property tax assessment ratio applies and the owner-occupant may appeal the classification as provided in Chapter 60 of this title.

PENALTIES FOR FALSE STATEMENTS

SECTION 12-37-1130. Penalties for false statements.

If any person shall willfully deliver any statement to the South Carolina Department of Revenue concerning "no situs" property containing a false statement of a material fact, whether it be an owner, shipper, his agent or a storage or warehouseman or his agent, he shall be guilty of a misdemeanor and upon conviction shall be punished by a fine of not less than one hundred dollars nor more than five hundred dollars, or by imprisonment of not less than ten days nor more than six months.

APPLICATION FOR SPECIAL ASSESSMENT AS

AGRICULTURAL REAL PROPERTY

DEFINITION OF AGRICULTURAL REAL VALUE

Agricultural real property shall mean any tract of real property which is used to raise, harvest, or store crops raised to breed or

manage livestock, or to produce plants, trees, fowl, or animals to man, including the preparation of products raised thereon for man’s use and disposed of by marketing or other means. It includes but is not limited to such real property used for the

agriculture, grazing, horticulture, forestry, dairying, and mariculture. In the event, at least 50% of a real property tract shall qualify as “agricultural real property,” the entire tract shall be also classified, provided no other business for profit is being operated there. The term “agricultural real property” shall not include any presently used as the residence of the owner or

others in that the taxation of such property is specifically provided for in Section 1 (C) and (E) of Act 208.

QUALIFICATION REQUIREMENTS

Agricultural real property which is actually used for such agricultural purposes and meets certain size and income restrictions shall be taxed on an assessment equal to (A) four percent of its fair market value for such agricultural purpose customarily for owners or lessees who are individuals or partnerships and certain corporations which do not:

Have more than ten (10) shareholders.

Have as a shareholder a person (other than an estate) who is not an individual. Have a non-resident alien as a shareholder, and

Have more than one (1) class of stock.

six (6) percent of its fair market value for such agricultural purposes (use value) for owners or lessees who are corporations, except for certain corporations specified in (A) above.

ROLLBACK TAXES

It is understood by the property owner that when real property which is in agricultural use and is being valued, assessed and taxed as agricultural real property and is applied to a use other than agricultural, it shall be subject to additional taxes referred to as rollback taxes. Rollback taxes effect the year of change and the previous five (5) years. A rollback tax is a lien against the property.

RIGHT TO APPEAL

If the assessor determines a property to be ineligible for classification as special assessment property, the property owner may appeal the classification as provided in Chapter 60, Title 12 of the South Carolina Code of Laws.

KEEP THE YELLOW COPY

Return top (white) copy only, keep second (yellow) copy for your records. Make any necessary corrections such as mailing address, zip code, etc., directly on the front of this application. An inspection of your property may be necessary for qualification. Mail top (white) copy to:

HORRY COUNTY ASSESSOR’S OFFICE

1301 Second Avenue, Ste 1C08

Conway, SC 29526

If you have any questions concerning this application call: Conway: 843-915-5040; Myrtle Beach: 843-915-5043 Visit our website at www.horrycounty.org or email assessor@horrycounty.org