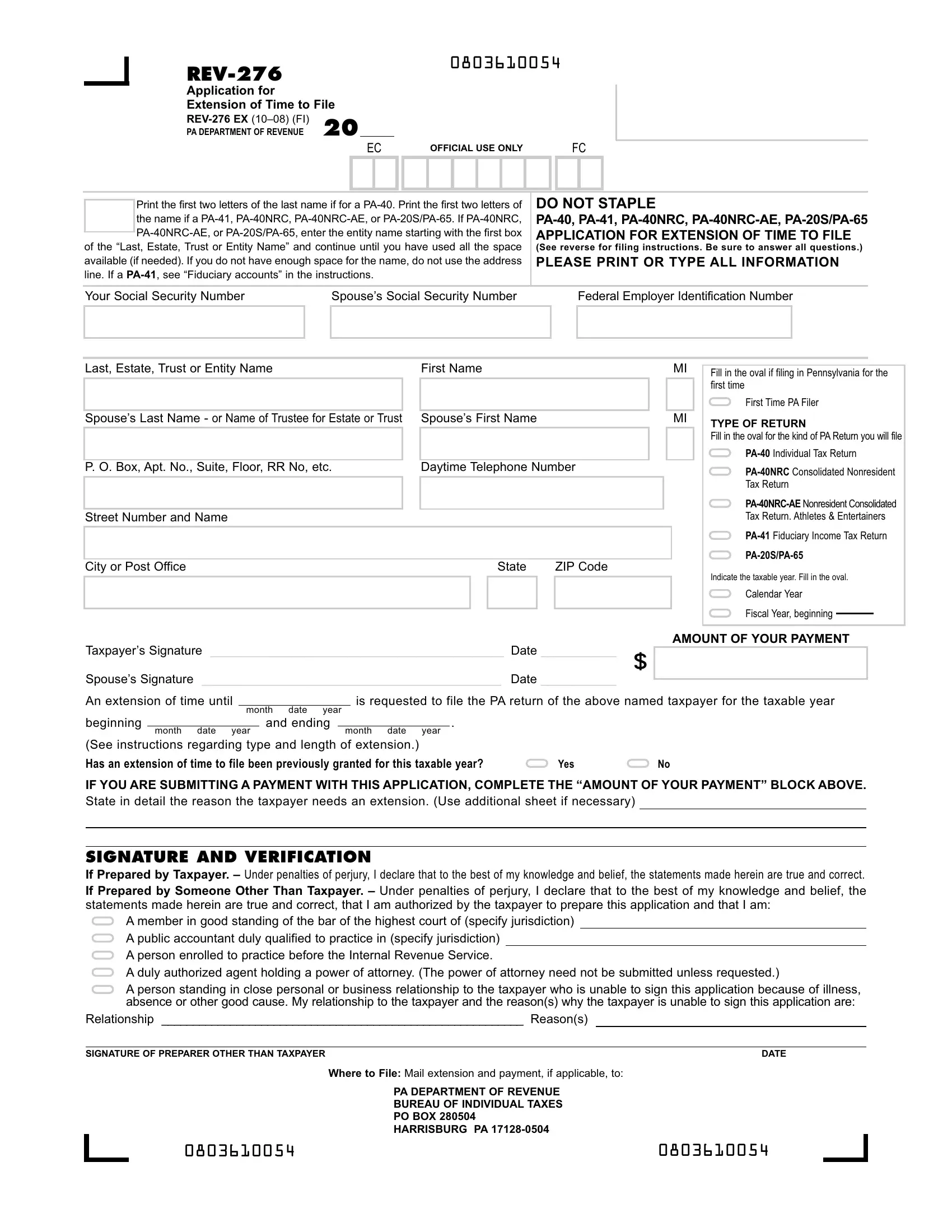

1. HOW TO FILE

UsethisformforanextensionoftimetofileaPA-40,PA-41,PA-40NRC, PA-40NRC-AE, or a PA-20S/PA-65 if you do not apply for a federal extension of time. If you owe tax on your PAreturn, you must submit this extension form along with your payment. Use this form if your extension request to the federal government was denied. You will only receive notification from the Department in the event of denial of the extension request.

If you have an extension for filing your Federal IncomeTax return, you still may request an extension of time for filing your PAtax return. xrrNRCNRC

xx(xrxyrwu Uxrr xv(xrxyrwu

UApplications must be submitted in sufficient time for the Department to consider and act upon them prior to the regular due date of the return.

When submitting this application, clearly describe in detail the circum- stances beyond your control that will cause an unavoidable delay in filing the return. Applications that give incomplete reasons, such as “illness” or “practitioner too busy” without adequate explanations, will not be approved.

Fiduciary accounts: Enter the name of the estate or trust, starting with the “Last, Estate or Trust, or Entity Name“ area and continuing through the “First Name” area. Enter the name of the trustee in the designated area continuing through the area designated for the spouse’s first name. Do not use the first address line designated for PO BOX, apartment number, etc. for fiduciary accounts.

If you pay by credit card or ACH debit on or before April 15, you can get an automatic four-month extension without mailing a REV-276. On the Internet, go to www.revenue.state.pa.us and link to the e-Services Center. By telephone, call toll-free

1-888-PATAXES (1-888-728-2937).

2. WHEN TO FILE

Submit this application in sufficient time for the PA Department of Revenue to consider and act upon it before the PAreturn due date, usuallyApril 15 for calendar year filers, and the 15th day of the fourth month following the close of the fiscal year for fiscal year filers.

3. REASONS FOR EXTENSION

The PA Department of Revenue will grant a taxpayer an automatic extension of time for filing a PA tax return if an extension has been

granted by the rRvurv (IRS) for filing the federal tax return. The extension period granted by Pennsylvania will be

equivalent to the extension period granted by the Rxr |

|

rrxrr |

|

rurrrwv( |

.Acopy |

oftheformgrantingthefederalextensionmustaccompanyyourreturn.

A reasonable extension of time will be granted if the taxpayer is unable to file the return by the regular due date because of circum- stances beyond his or her control. An application will be considered

based on the efforts made by the taxpayer to fulfill his or her own filing responsibility, rather than the convenience of someone who provides assistance. Circumstances in which the taxpayer’s practitioner is unable to complete the return for filing by the due date, due to reasons beyond his or her control, will be taken into consideration. Other circumstances, such as when a taxpayer is unable to get essential professional assistance in spite of timely efforts to obtain it, will be considered also.

Combat Zone and Hazardous Duty Service

If serving in an area so designated by the President of the United States, Pennsylvania allows the same automatic extensions of time to file and pay your PA tax return that the IRS provides for your Federal Income Tax return. When you file your PA income tax return, please print “COMBAT ZONE” at the top of your PA-40 or computer-generated PA tax return, if using software or paying a preparer. Copies of your orders and discharge papers must accom- pany your return. If filing an electronic return through Federal/State e-file, if filing by telephone using PA TeleFile, or if filing over the Internet using pa.direct.file, you must still fax or mail copies of your orders and discharge papers. Print “COMBAT ZONE” at the top of each page.

4. PERIOD OF EXTENSION

xgrrxyrʼrrur |

|

xrgryvrNR |

C |

NRCwquvxr |

gr |

yRrgryxyxyrv |

g |

uUy x |

rgrr |

x( |

|

rxrururg |

|

rryg |

|

xwwqu |

v |

wR xrv(rrw |

|

wv(xrrv |

|

urvugR rurx |

r |

v( |

wxgrrr |

v(r xyrw |

U |

5. BLANKET REQUESTS

Blanket requests for extensions of time for filing Pennsylvania tax returns will not be granted.Aseparate application must be submitted for each return.

6. FORMS ORDERING

Forms can be obtained by writing to the PADepartment of Revenue, Tax Forms Service Unit, 711 Gibson Boulevard, Harrisburg, PA 17104-3200 or by calling: 1-888-PATAXES (1-888-728-2937), or

1-800-362-2050 if you do not have touch-tone phone service. Toll-free for taxpayers with special hearing and/or speaking needs:

1-800-447-3020 (TT only). The Department’s Web site also has this form available at: www.revenue.state.pa.us