Making use of the online PDF editor by FormsPal, you're able to fill in or alter pa form 488 here and now. Our editor is constantly evolving to provide the best user experience achievable, and that is because of our resolve for continuous development and listening closely to comments from customers. This is what you'd want to do to begin:

Step 1: Just hit the "Get Form Button" above on this page to get into our pdf editor. This way, you will find all that is necessary to work with your document.

Step 2: With this state-of-the-art PDF editing tool, it is possible to accomplish more than simply complete blank fields. Express yourself and make your docs seem faultless with custom text added, or modify the original input to excellence - all that comes along with an ability to add any photos and sign it off.

This document will require specific information; in order to ensure accuracy, be sure to heed the next guidelines:

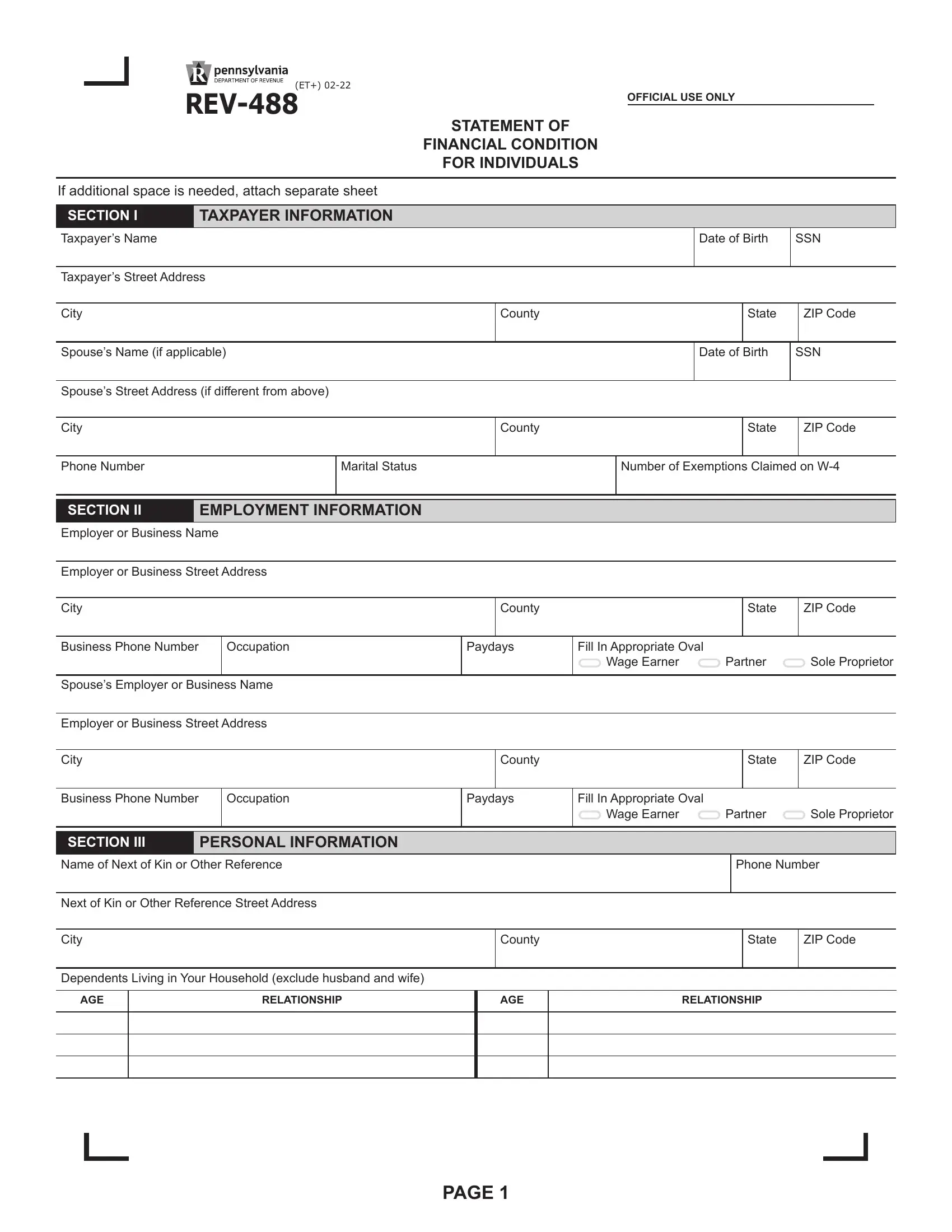

1. The pa form 488 necessitates particular details to be typed in. Ensure that the following blank fields are complete:

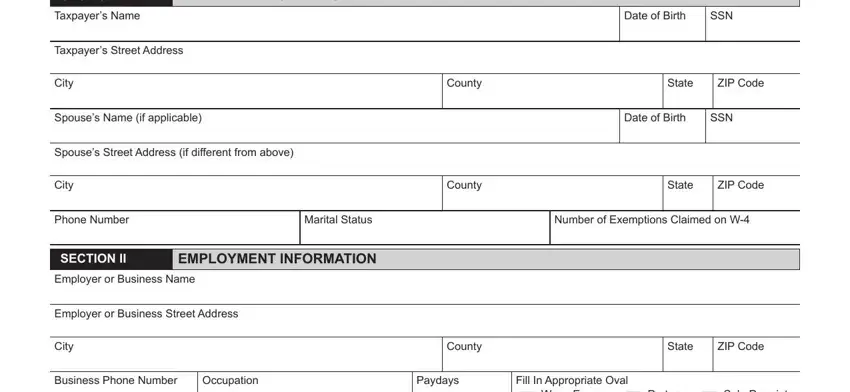

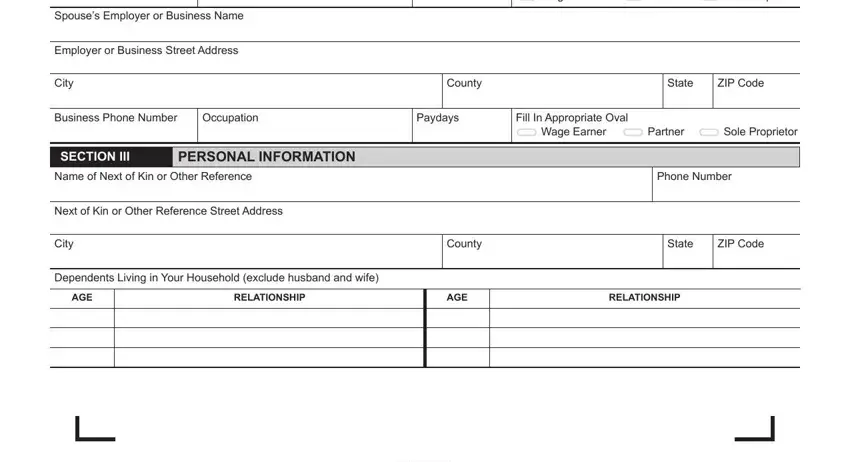

2. Once your current task is complete, take the next step – fill out all of these fields - Wage Earner, Partner, Sole Proprietor, Spouses Employer or Business Name, Employer or Business Street Address, City, County, State, ZIP Code, Business Phone Number, Occupation, Paydays, Fill In Appropriate Oval, Wage Earner, and Partner with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

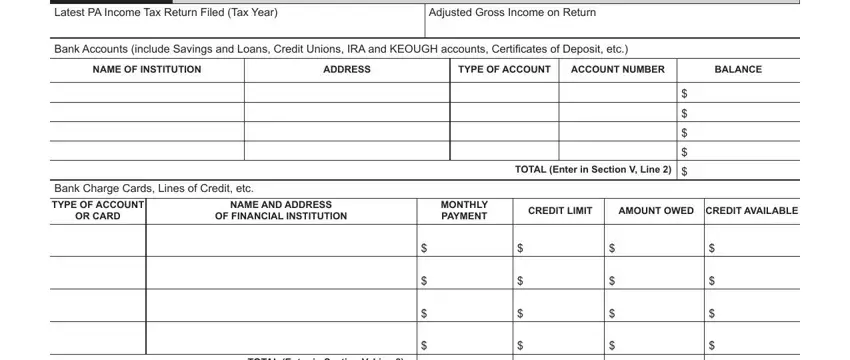

3. This next step is related to SECTION IV, GENERAL FINANCIAL INFORMATION, Latest PA Income Tax Return Filed, Adjusted Gross Income on Return, Bank Accounts include Savings and, NAME OF INSTITUTION, ADDRESS, TYPE OF ACCOUNT, ACCOUNT NUMBER, BALANCE, TOTAL Enter in Section V Line, Bank Charge Cards Lines of Credit, TYPE OF ACCOUNT, OR CARD, and NAME AND ADDRESS - fill in each of these fields.

Those who work with this document often make errors while filling out TYPE OF ACCOUNT in this part. Be certain to revise what you type in here.

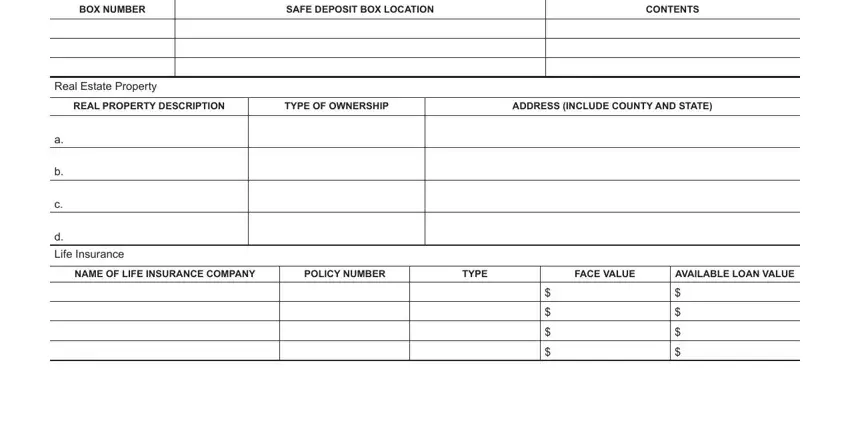

4. The next paragraph will require your information in the following areas: BOX NUMBER, SAFE DEPOSIT BOX LOCATION, CONTENTS, Real Estate Property, REAL PROPERTY DESCRIPTION, TYPE OF OWNERSHIP, ADDRESS INCLUDE COUNTY AND STATE, Life Insurance, NAME OF LIFE INSURANCE COMPANY, POLICY NUMBER, TYPE, FACE VALUE, and AVAILABLE LOAN VALUE. Make sure you type in all needed info to go onward.

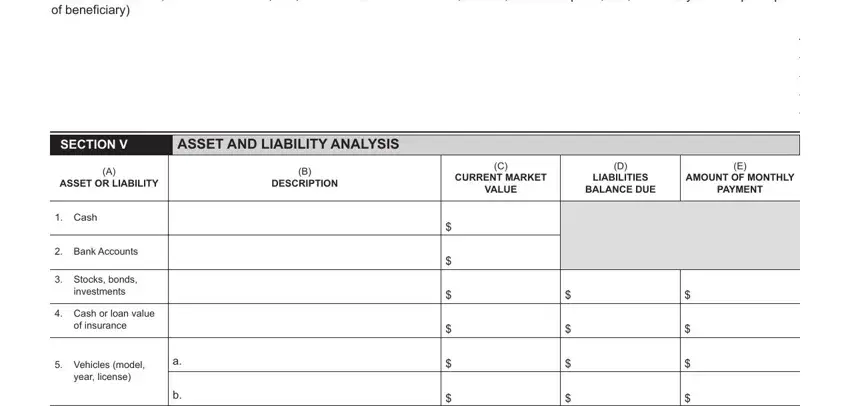

5. This last stage to finish this form is crucial. Ensure you fill in the mandatory blank fields, and this includes Additional Information court, SECTION V, ASSET AND LIABILITY ANALYSIS, ASSET OR LIABILITY, DESCRIPTION, CURRENT MARKET, VALUE, LIABILITIES BALANCE DUE, AMOUNT OF MONTHLY, PAYMENT, Cash, Bank Accounts, Stocks bonds, investments, and Cash or loan value, prior to finalizing. In any other case, it can contribute to an incomplete and potentially invalid form!

Step 3: When you've looked again at the information entered, just click "Done" to conclude your form at FormsPal. Create a 7-day free trial account with us and acquire immediate access to pa form 488 - with all changes preserved and accessible inside your personal account. At FormsPal.com, we endeavor to ensure that your information is kept private.