When you wish to fill out Rev 545 Form, it's not necessary to download any applications - simply try using our online PDF editor. The editor is consistently upgraded by us, getting additional functions and growing to be greater. If you are seeking to get going, this is what it takes:

Step 1: Access the form inside our editor by clicking the "Get Form Button" at the top of this page.

Step 2: After you access the tool, you'll see the form prepared to be completed. Besides filling out different fields, you may as well perform several other actions with the form, such as adding any textual content, modifying the original text, inserting illustrations or photos, placing your signature to the form, and much more.

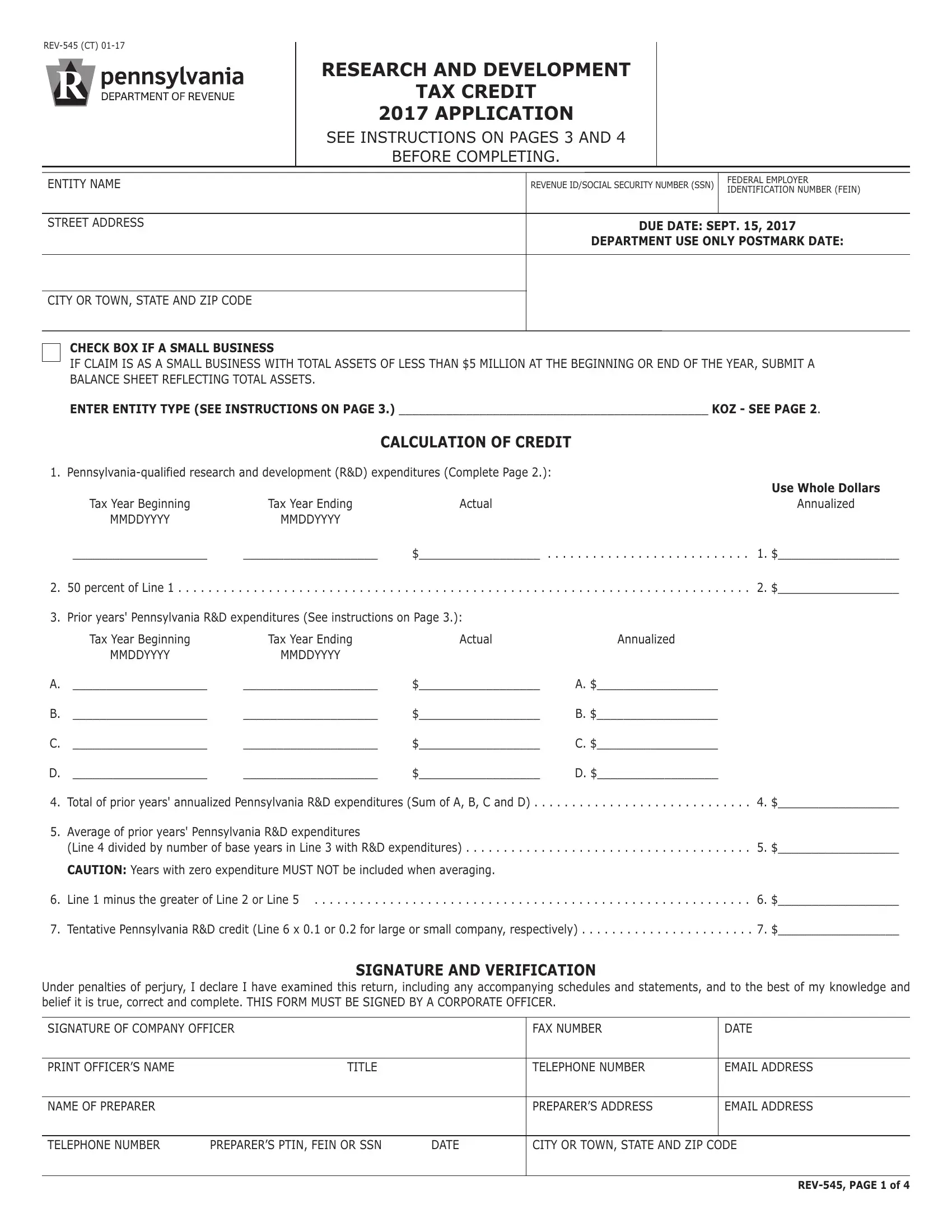

To be able to finalize this PDF form, make certain you provide the required information in each field:

1. Begin completing the Rev 545 Form with a number of essential blank fields. Note all the information you need and make certain nothing is neglected!

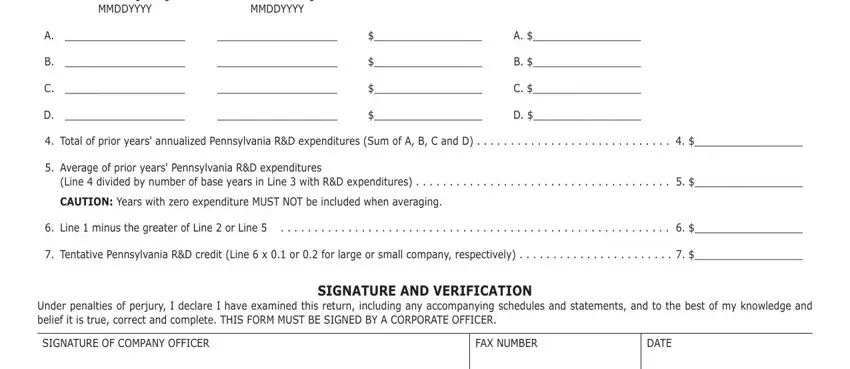

2. When the last segment is finished, it is time to insert the required specifics in Tax Year Beginning, MMDDYYYY, Tax Year Ending, MMDDYYYY, Actual, Annualized, Total of prior years annualized, Average of prior years, Line divided by number of base, Line minus the greater of Line, Tentative Pennsylvania RD credit, Under penalties of perjury I, SIGNATURE AND VERIFICATION, SIGNATURE OF COMPANY OFFICER, and FAX NUMBER in order to go further.

Always be really mindful while filling in Line minus the greater of Line and Tentative Pennsylvania RD credit, because this is the section in which most people make errors.

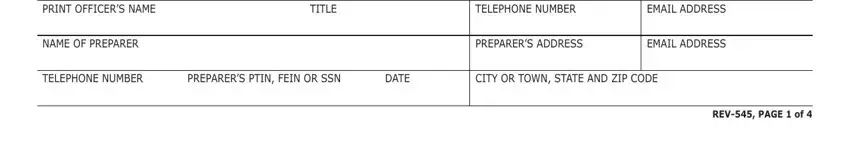

3. Completing PRINT OFFICERS NAME, TITLE, TELEPHONE NUMBER, EMAIL ADDRESS, NAME OF PREPARER, PREPARERS ADDRESS, EMAIL ADDRESS, TELEPHONE NUMBER, PREPARERS PTIN FEIN OR SSN, DATE, CITY OR TOWN STATE AND ZIP CODE, and REV PAGE of is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

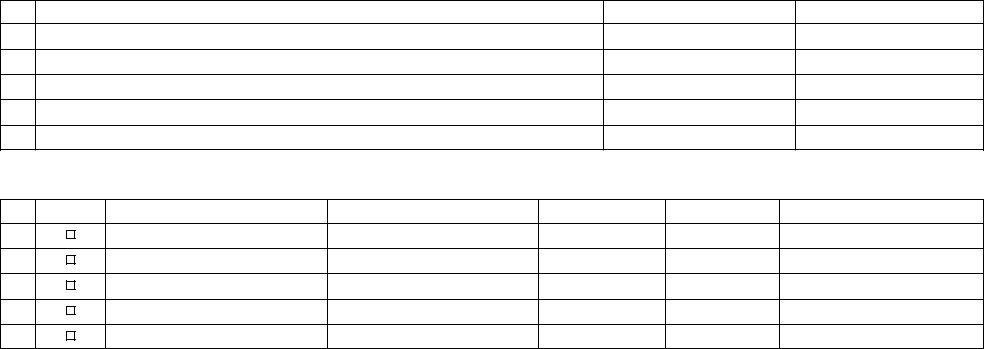

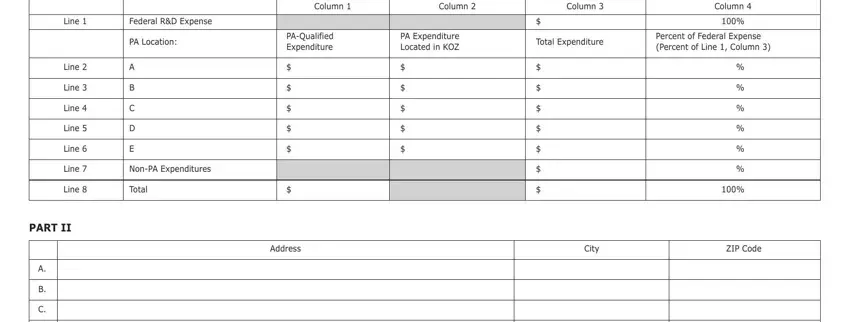

4. To move onward, the following step requires filling out a few form blanks. These comprise of Line, Federal RD Expense, PA Location, Column, Column, Column, PAQualified Expenditure, PA Expenditure Located in KOZ, Total Expenditure, Column, Percent of Federal Expense Percent, Line, Line, Line, and Line, which you'll find integral to moving forward with this particular form.

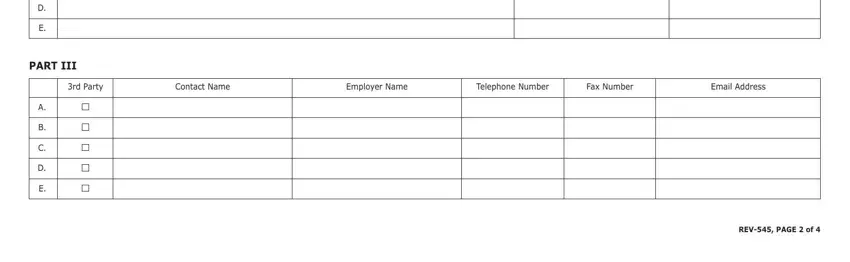

5. This pdf has to be completed by filling in this segment. Further you will notice a detailed listing of form fields that need appropriate information in order for your form usage to be faultless: PART III, rd Party, Contact Name, Employer Name, Telephone Number, Fax Number, Email Address, and REV PAGE of.

Step 3: Make sure your details are accurate and press "Done" to proceed further. Join us now and immediately gain access to Rev 545 Form, prepared for download. All changes you make are kept , helping you to customize the form later when necessary. Here at FormsPal, we aim to make sure that all of your information is kept secure.