It's very easy to fill in the rp 5217 pdf fill in gaps. Our software can make it almost effortless to complete any type of PDF. Listed below are the primary four steps you should consider:

Step 1: You should click the orange "Get Form Now" button at the top of the page.

Step 2: Now you are going to be on your file edit page. You can add, update, highlight, check, cross, add or erase areas or text.

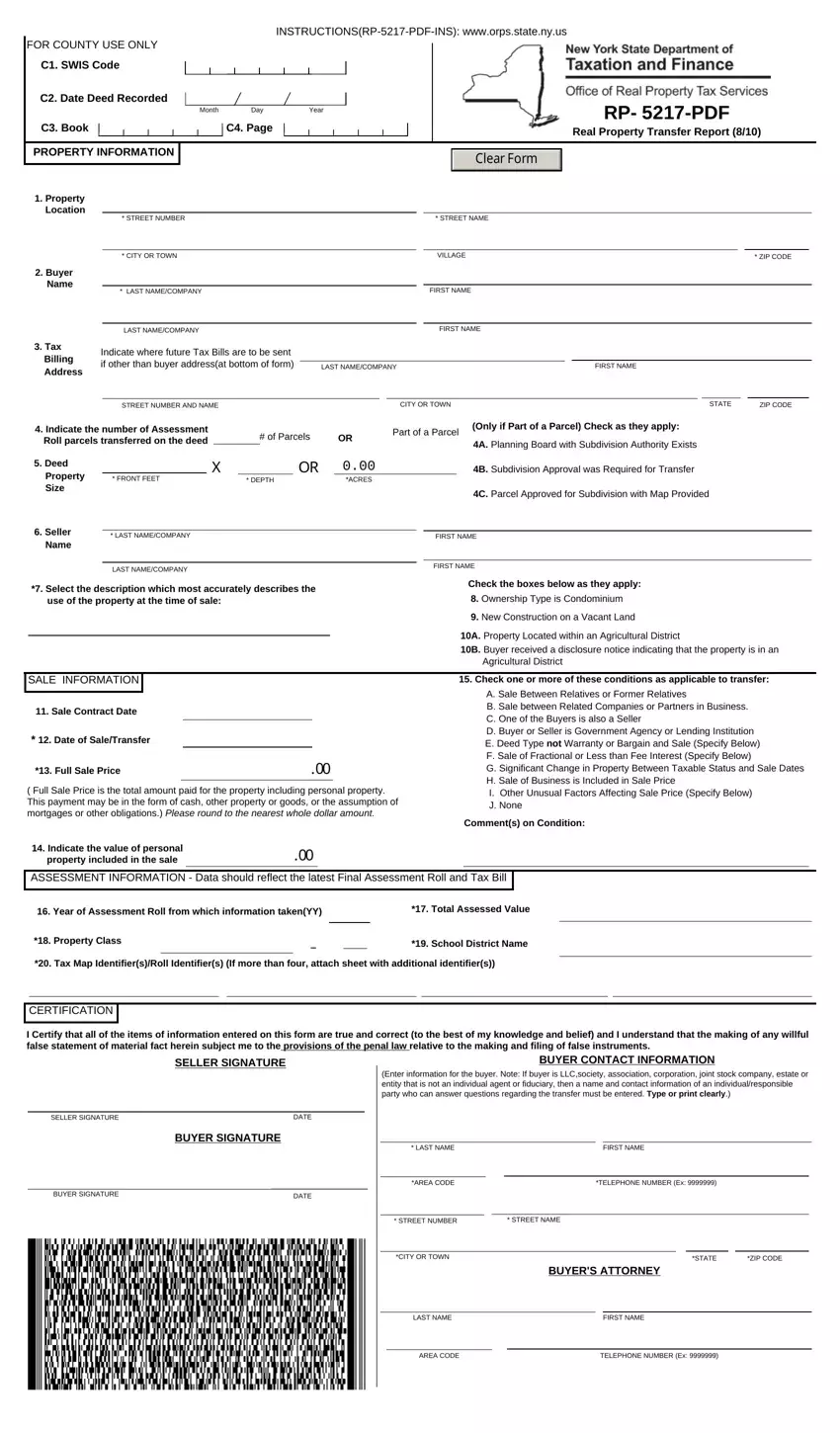

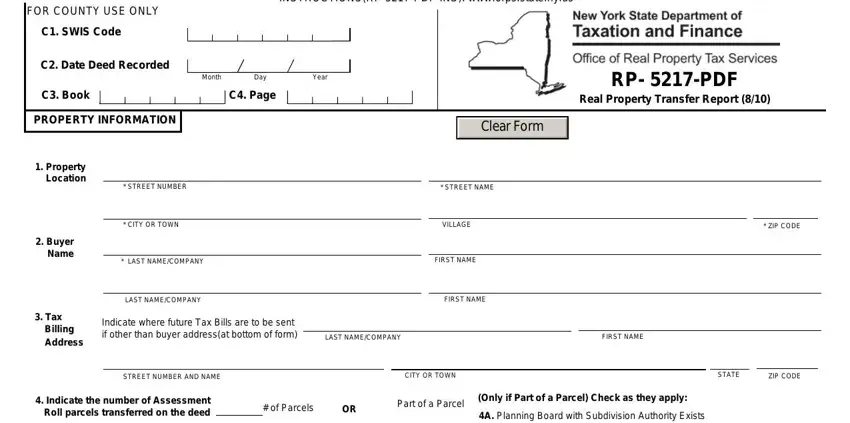

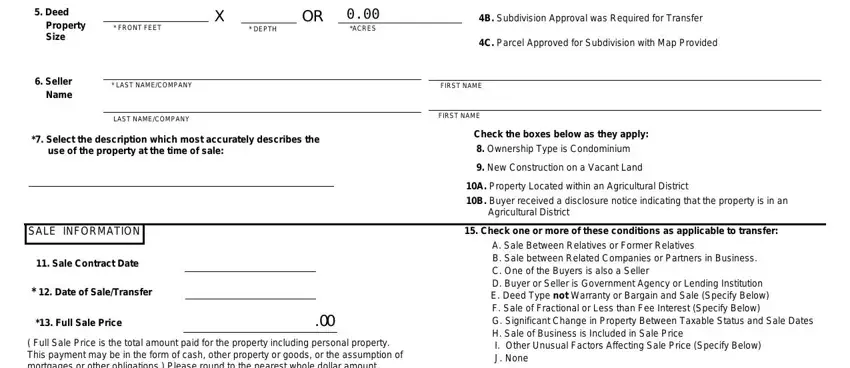

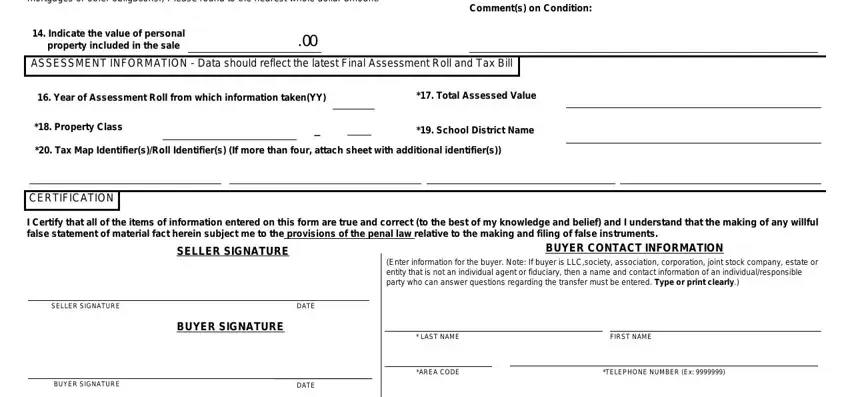

The next areas will make up the PDF file that you'll be filling in:

Write the asked data in the field.

Note down the essential details while you're on the segment.

Please be sure to describe the rights and responsibilities of the sides within the field.

Step 3: As you click the Done button, the finished document is readily transferable to all of your gadgets. Alternatively, you can easily deliver it via email.

Step 4: You could make duplicates of the document toremain away from all forthcoming challenges. Don't get worried, we do not reveal or record your details.