It is really simple to fill in the investments distribution 401k empty lines. Our tool makes it practically effortless to edit any sort of PDF. Down the page are the primary four steps you should consider:

Step 1: Choose the "Get Form Here" button.

Step 2: At the moment, it is possible to update the investments distribution 401k. Our multifunctional toolbar permits you to add, eliminate, alter, highlight, as well as do several other commands to the content and fields within the form.

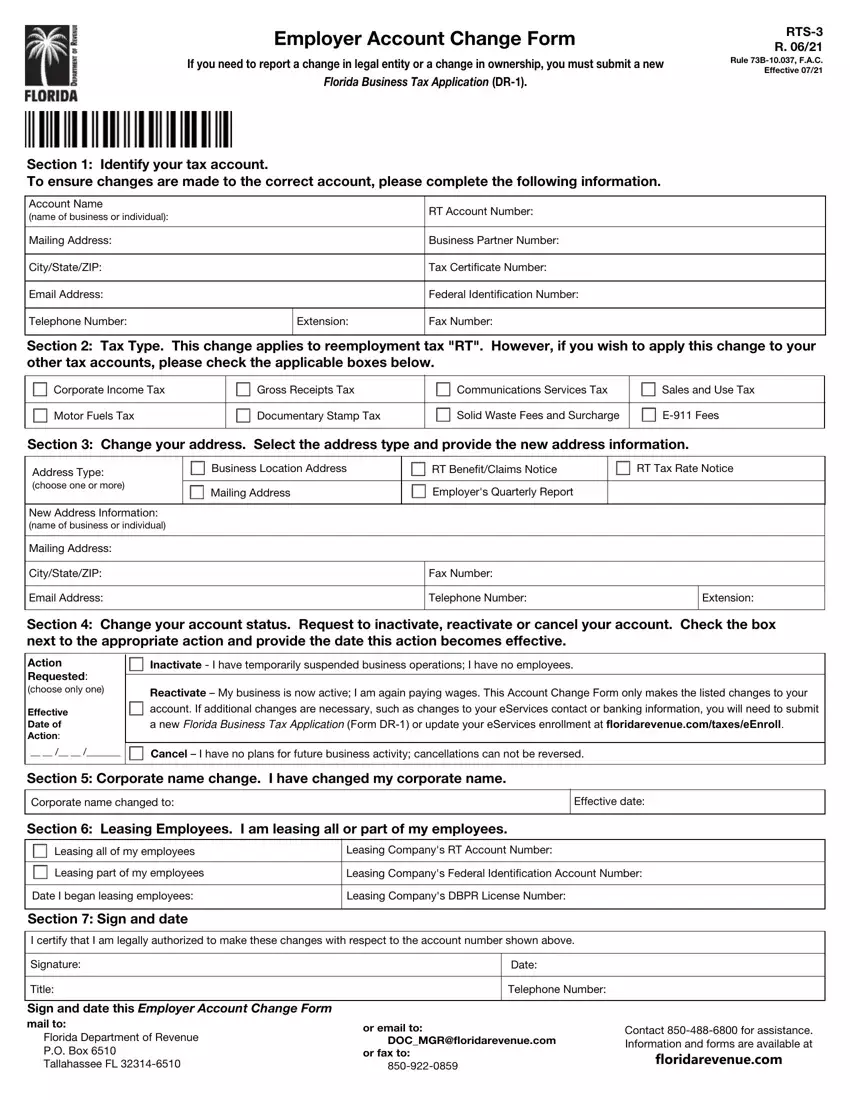

Get the investments distribution 401, k PDF and enter the material for every single segment:

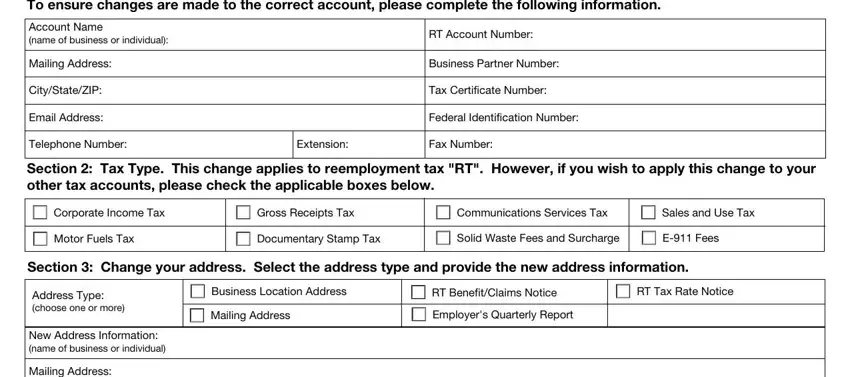

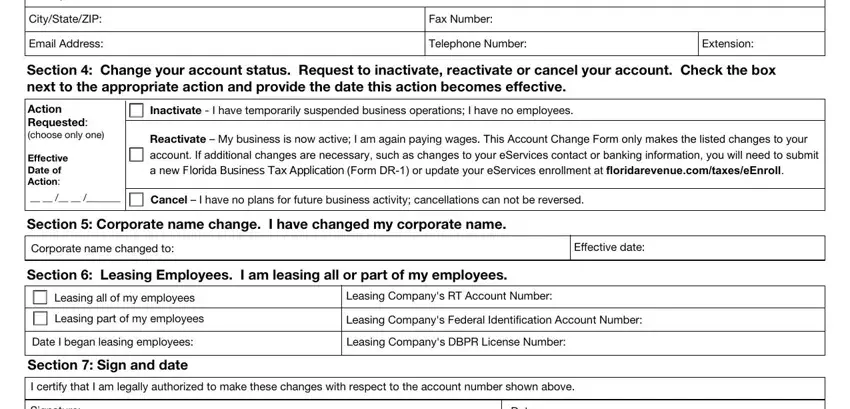

Enter the appropriate data in the space Mailing, Address City, State, ZIP Email, Address Fax, Number Telephone, Number Extension, Corporate, name, changed, to Effective, date Leasing, all, of, my, employees Leasing, part, of, my, employees Leasing, Company, s, RT, Account, Number Leasing, Company, s, DB, PR, License, Number Signature, and Date.

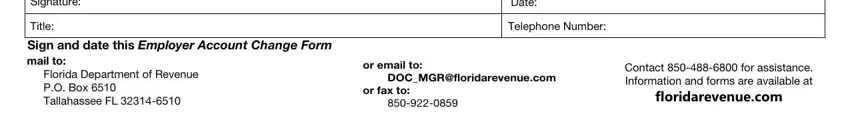

It is necessary to write down certain data in the segment Signature, Date, Telephone, Number and florida, revenue, com

Step 3: Press the button "Done". Your PDF file may be exported. You may upload it to your device or send it by email.

Step 4: Create copies of your template. This would prevent potential misunderstandings. We cannot check or disclose your information, hence be assured it's going to be secure.