Navigating the ownership process of a manufactured home in Michigan requires completing specific paperwork, prominently featuring the S 110L form, a crucial document facilitated by the Michigan Department of Licensing and Regulatory Affairs. This form serves a variety of purposes, including the application for a Certificate of Manufactured Home Ownership, detailing the transaction type, serial number, brand name, certificate fee, year of manufacture, and the essential taxation and ownership details. It’s designed for current or prospective owners who need to establish clear legal ownership, address issues related to lost, stolen, or mutilated titles, or update ownership details due to changes like transfers between relatives. The form takes into account the full rights to survivorship, underscores the importance of tax obligations, and outlines the procedures for claiming tax exemptions. Additionally, it emphasizes the significance of proper filing, including identifying the first and second secured parties, and underscores the consequences of failing to properly document or support claims for tax exemptions. The S 110L form not only streamlines the process but also acts as a safeguard ensuring that all parties are aware of their rights and responsibilities, including understanding the implications of purchasing a home within a manufactured home community. With final tax liability determinations resting with the Michigan Department of Treasury, it is imperative for applicants to accurately fulfill the form’s requirements and heed its guidelines to prevent potential legal and financial repercussions.

| Question | Answer |

|---|---|

| Form Name | S 110L Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | s 110l application for certificate of manufactured home ownership, sos form s 110l, form s 110l, secretary of state s 110l |

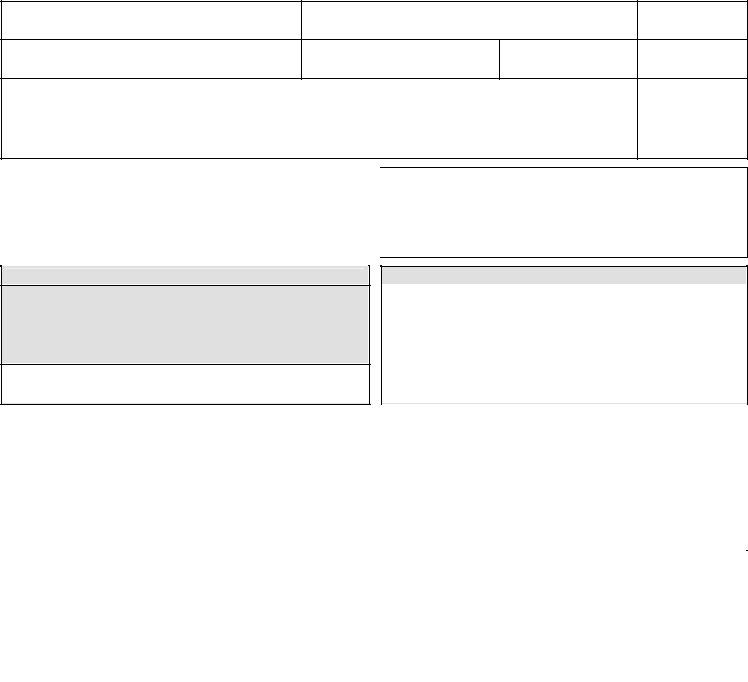

Michigan Department of Licensing and Regulatory Affairs Application for Certificate of Manufactured Home Ownership

TRANSACTION TYPE

SERIAL NUMBER

BRAND NAME |

|

CERTIFICATE FEE |

YEAR OF MANUFACTURE |

FULL RIGHTS TO SURVIVOR |

TAX |

$0.00

OWNER’S NAME(S) AND ADDRESS

FIRST SECURED PARTY |

FILING DATE |

|

SECOND SECURED PARTY |

|

|

|

|

TOTAL

$0.00

FILING DATE

APPLICANT IDENTIFICATION

Owner Other Name: ___________________________________

I.D. Presented: ___________________________________

Reason for Duplicate Title: Lost |

Stolen |

Mutilated |

|

|

|

LEGAL PAPERS

TYPE OF DOCUMENT |

COUNTY |

STATE |

|

|

|

COURT |

FILE OR DOCKET NUMBE |

DATE EXAMINED |

|

|

|

BRANCH OFFICE |

EXAMINER (Print) |

|

|

|

|

CLAIM FOR TAX EXEMPTION |

|

USE TAX RETURN |

|

|||

|

|

|

|

|

|

PURCHASE DATE: |

REASON: |

1. |

Purchase price or retail value, |

|

|||

|

|

|

|

|||

|

|

|

whichever is greater. |

|

|

|

|

|

|

|

|

|

|

|

|

2. |

6% Tax |

$0.00 |

SELLER'S NAME: |

|

|

|

|

|

|

|

|

|

|

3. |

Credit for tax paid to a |

|

|

|

|

|

|

reciprocal state (proof attached) |

|

||

|

|

|

|

|

|

|

I certify I own this manufactured home and all |

|

|

|

$0.00 |

|

|

information on this application is correct to the |

4. |

Tax Being Paid |

|

|||

best of my knowledge. |

|

|

|

|

|

|

|

|

|

|

|

|

|

New Owner’s/Applicant’s Signature |

|

|

|

|

|

|

X |

|

|

|

If your certificate of manufactured home ownership is not |

||

|

|

|

|

|

received within 60 days from the date of filing, contact a |

|

|

|

|

|

|

||

X |

|

|

|

|

Secretary of State branch office. |

|

|

|

|

|

|

||

If the manufactured home you are purchasing is located in a manufactured home community or being placed in a manufactured home community, be sure you and the home are approved for residency by the community before purchasing the home.

Final determination of the correct tax liability will be made by the Michigan Department of Treasury. You may be required to document your tax return or prove you are entitled to the exemption claimed. If you cannot support your claim, minimum penalties include the added tax, a negligence penalty, plus interest from the date of filing this application. Additional penalties can be imposed including criminal prosecution or assessing up to 175% of the tax due.

EXEMPTION ─ TRANSFERS BETWEEN RELATIVES: An exemption from use tax is allowed when the new owner is the spouse, father, mother, brother, sister, child, stepparent, stepchild, stepbrother, stepsister, half brother, half sister, grandparent, grandchild, legal ward, or legally appointed guardian of the previous owner. Documentation proving the relationship may be requested by the Michigan Department of Treasury.

VALIDATION:

|

Ruth Johnson, Secretary of State |

Authority granted under Public Act 300 of 1949 as amended. |