Are you a business owner looking for information on S 110L form? You’re not alone: tax season can be confusing for so many. Don’t worry, tackling this particular document doesn’t have to be complicated. This blog post will answer all of your questions – from what an S 110L form is and why it exists, to whether or not you need one, and how to submit the paperwork correctly and on time! So get comfortable, sharpen those pencils (or open up that laptop!), and let's dive deep into understanding South Carolina's specific S110L Form requirements today.

| Question | Answer |

|---|---|

| Form Name | S 110L Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | s 110l application for certificate of manufactured home ownership, sos form s 110l, form s 110l, secretary of state s 110l |

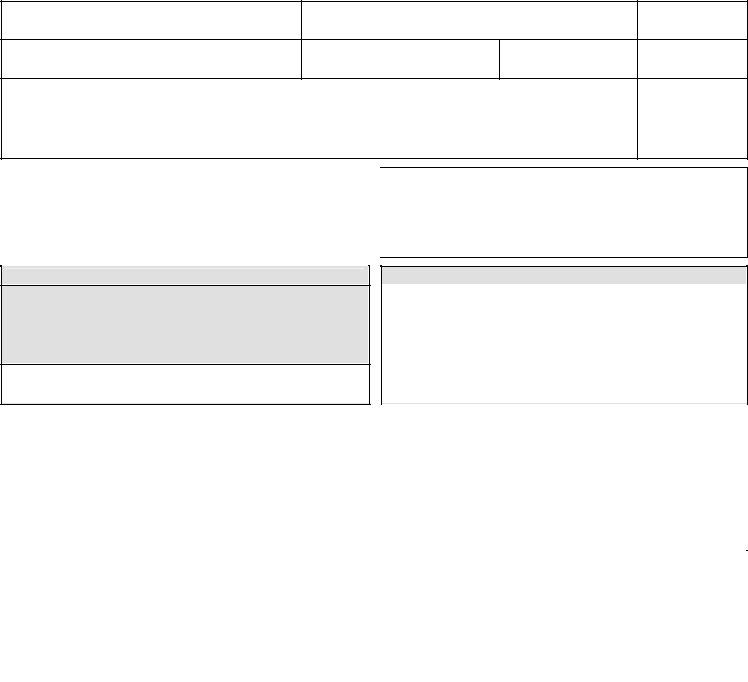

Michigan Department of Licensing and Regulatory Affairs Application for Certificate of Manufactured Home Ownership

TRANSACTION TYPE

SERIAL NUMBER

BRAND NAME |

|

CERTIFICATE FEE |

YEAR OF MANUFACTURE |

FULL RIGHTS TO SURVIVOR |

TAX |

$0.00

OWNER’S NAME(S) AND ADDRESS

FIRST SECURED PARTY |

FILING DATE |

|

SECOND SECURED PARTY |

|

|

|

|

TOTAL

$0.00

FILING DATE

APPLICANT IDENTIFICATION

Owner Other Name: ___________________________________

I.D. Presented: ___________________________________

Reason for Duplicate Title: Lost |

Stolen |

Mutilated |

|

|

|

LEGAL PAPERS

TYPE OF DOCUMENT |

COUNTY |

STATE |

|

|

|

COURT |

FILE OR DOCKET NUMBE |

DATE EXAMINED |

|

|

|

BRANCH OFFICE |

EXAMINER (Print) |

|

|

|

|

CLAIM FOR TAX EXEMPTION |

|

USE TAX RETURN |

|

|||

|

|

|

|

|

|

PURCHASE DATE: |

REASON: |

1. |

Purchase price or retail value, |

|

|||

|

|

|

|

|||

|

|

|

whichever is greater. |

|

|

|

|

|

|

|

|

|

|

|

|

2. |

6% Tax |

$0.00 |

SELLER'S NAME: |

|

|

|

|

|

|

|

|

|

|

3. |

Credit for tax paid to a |

|

|

|

|

|

|

reciprocal state (proof attached) |

|

||

|

|

|

|

|

|

|

I certify I own this manufactured home and all |

|

|

|

$0.00 |

|

|

information on this application is correct to the |

4. |

Tax Being Paid |

|

|||

best of my knowledge. |

|

|

|

|

|

|

|

|

|

|

|

|

|

New Owner’s/Applicant’s Signature |

|

|

|

|

|

|

X |

|

|

|

If your certificate of manufactured home ownership is not |

||

|

|

|

|

|

received within 60 days from the date of filing, contact a |

|

|

|

|

|

|

||

X |

|

|

|

|

Secretary of State branch office. |

|

|

|

|

|

|

||

If the manufactured home you are purchasing is located in a manufactured home community or being placed in a manufactured home community, be sure you and the home are approved for residency by the community before purchasing the home.

Final determination of the correct tax liability will be made by the Michigan Department of Treasury. You may be required to document your tax return or prove you are entitled to the exemption claimed. If you cannot support your claim, minimum penalties include the added tax, a negligence penalty, plus interest from the date of filing this application. Additional penalties can be imposed including criminal prosecution or assessing up to 175% of the tax due.

EXEMPTION ─ TRANSFERS BETWEEN RELATIVES: An exemption from use tax is allowed when the new owner is the spouse, father, mother, brother, sister, child, stepparent, stepchild, stepbrother, stepsister, half brother, half sister, grandparent, grandchild, legal ward, or legally appointed guardian of the previous owner. Documentation proving the relationship may be requested by the Michigan Department of Treasury.

VALIDATION:

|

Ruth Johnson, Secretary of State |

Authority granted under Public Act 300 of 1949 as amended. |