You can fill in sa109 instantly using our PDFinity® PDF editor. Our tool is constantly evolving to present the best user experience attainable, and that is due to our resolve for continual enhancement and listening closely to customer feedback. With a few simple steps, you may start your PDF journey:

Step 1: Just press the "Get Form Button" above on this webpage to open our form editing tool. Here you'll find everything that is necessary to fill out your file.

Step 2: When you open the file editor, you will see the form made ready to be filled in. Aside from filling out different fields, you could also perform other things with the form, particularly adding your own text, modifying the original text, adding graphics, placing your signature to the PDF, and a lot more.

This PDF doc requires some specific details; in order to ensure consistency, you should pay attention to the suggestions directly below:

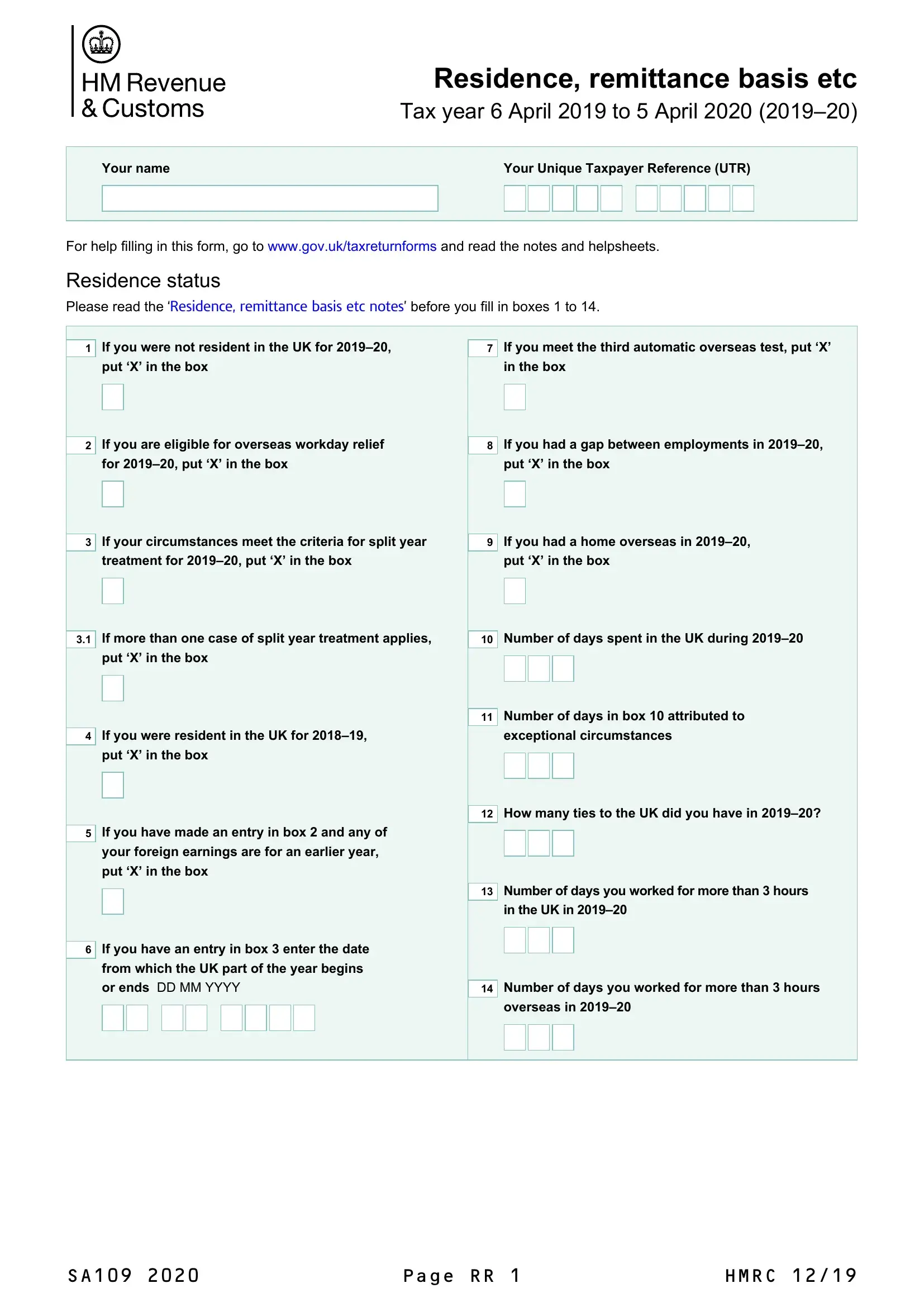

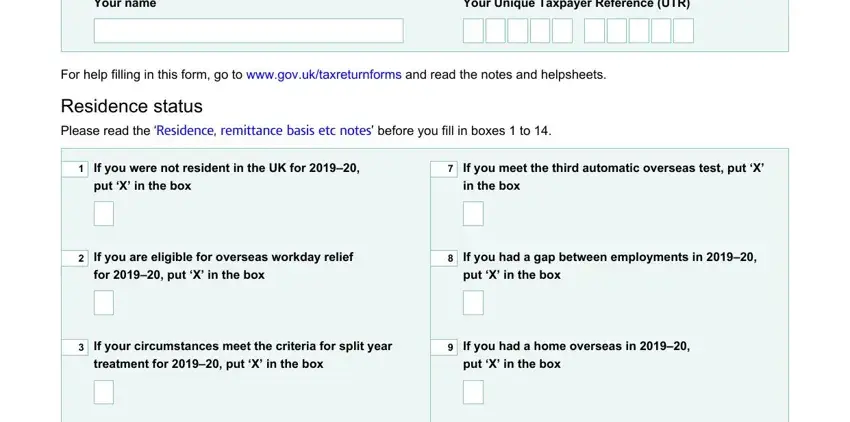

1. First of all, while filling out the sa109, beging with the part that contains the subsequent fields:

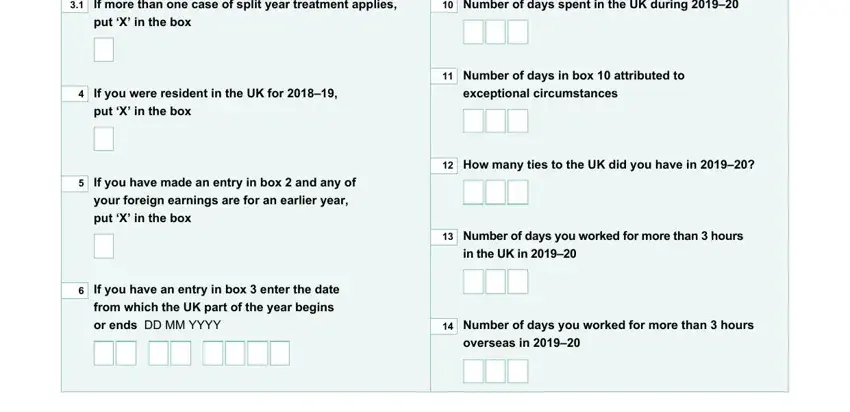

2. Once your current task is complete, take the next step – fill out all of these fields - If more than one case of split, Number of days spent in the UK, put X in the box, If you were resident in the UK, put X in the box, Number of days in box attributed, exceptional circumstances, If you have made an entry in box, If you have an entry in box, How many ties to the UK did you, Number of days you worked for, in the UK in, Number of days you worked for, and overseas in with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

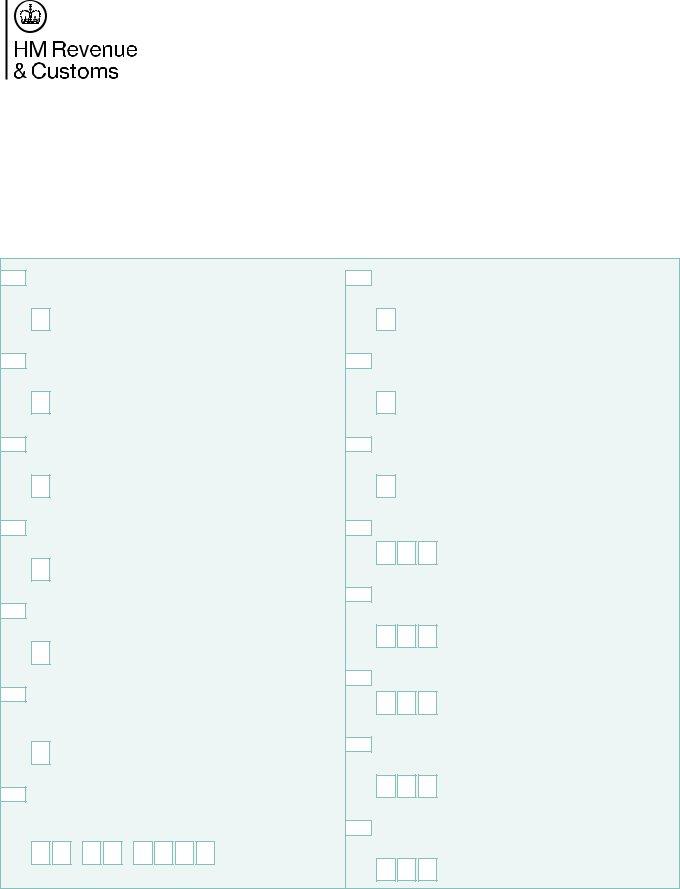

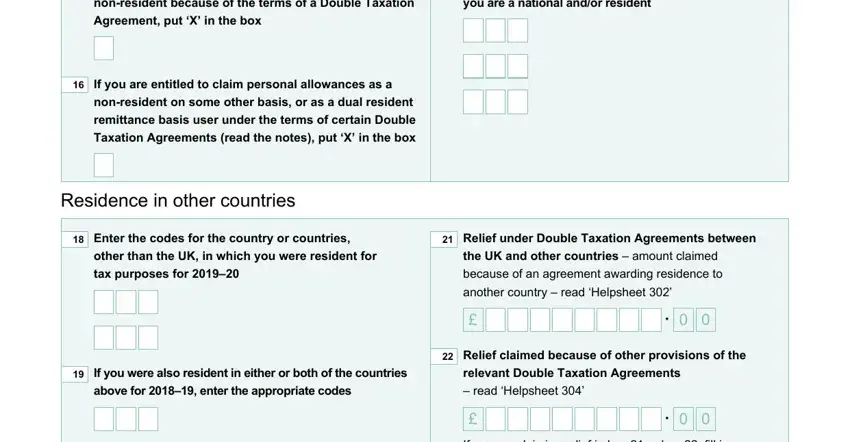

3. The following step is mostly about nonresident because of the terms, you are a national andor resident, If you are entitled to claim, nonresident on some other basis or, Residence in other countries, Enter the codes for the country, Relief under Double Taxation, other than the UK in which you, If you were also resident in, above for enter the appropriate, the UK and other countries amount, Relief claimed because of other, and relevant Double Taxation - fill in all of these empty form fields.

Always be really attentive when filling in Relief under Double Taxation and Enter the codes for the country, as this is where many people make a few mistakes.

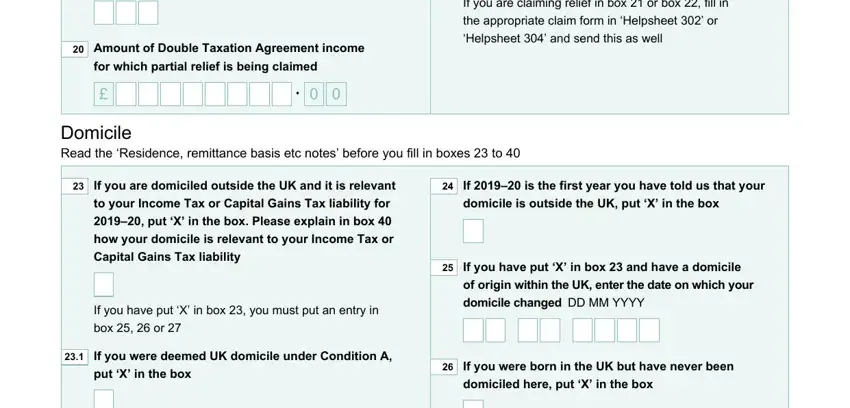

4. To go ahead, this fourth stage requires typing in a handful of empty form fields. These include Amount of Double Taxation, relevant Double Taxation, for which partial relief is being, Domicile Read the Residence, If you are domiciled outside the, If you have put X in box you must, If you were deemed UK domicile, put X in the box, If is the first year you have, domicile is outside the UK put X, If you have put X in box and, of origin within the UK enter the, If you were born in the UK but, and domiciled here put X in the box, which you'll find fundamental to continuing with this process.

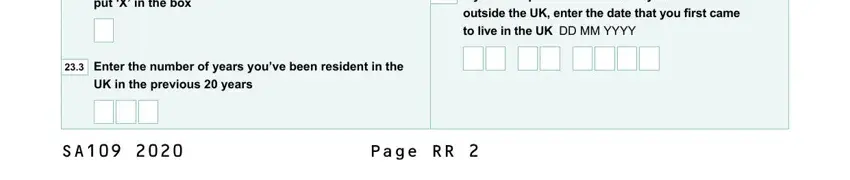

5. This pdf has to be finalized by going through this section. Below there can be found a detailed set of form fields that require specific details to allow your form submission to be faultless: put X in the box, Enter the number of years youve, UK in the previous years, If you have put X in box and you, outside the UK enter the date that, and Page RR.

Step 3: Revise all the information you have typed into the blank fields and then click the "Done" button. Right after registering afree trial account here, it will be possible to download sa109 or email it right away. The document will also be available from your personal account menu with your edits. We don't sell or share the information you type in whenever completing documents at FormsPal.