sba supplemental loan agreement can be filled out online with ease. Just make use of FormsPal PDF editor to get it done in a timely fashion. Our tool is continually developing to grant the very best user experience possible, and that's thanks to our resolve for continual enhancement and listening closely to comments from customers. Getting underway is effortless! All you should do is stick to the following basic steps below:

Step 1: Just click the "Get Form Button" in the top section of this site to see our pdf form editing tool. There you'll find everything that is required to fill out your file.

Step 2: With our advanced PDF editor, you can do more than merely complete blank fields. Express yourself and make your docs look great with custom text incorporated, or modify the original content to excellence - all that accompanied by the capability to incorporate your personal graphics and sign it off.

This document will need specific details; in order to ensure consistency, please make sure to bear in mind the following recommendations:

1. The sba supplemental loan agreement usually requires particular information to be entered. Be sure the next blanks are completed:

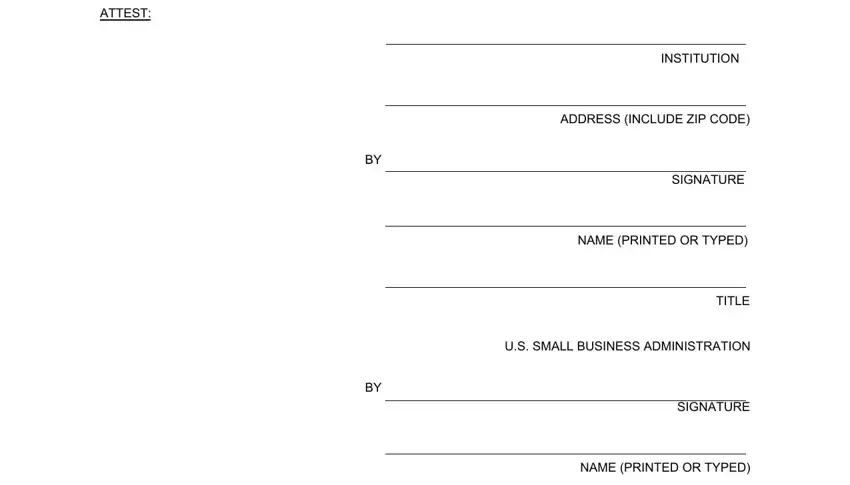

2. The subsequent step would be to fill out these particular fields: ATTEST, INSTITUTION, ADDRESS INCLUDE ZIP CODE, SIGNATURE, NAME PRINTED OR TYPED, TITLE, US SMALL BUSINESS ADMINISTRATION, SIGNATURE, and NAME PRINTED OR TYPED.

As for US SMALL BUSINESS ADMINISTRATION and NAME PRINTED OR TYPED, make sure you get them right in this section. These are definitely the most important fields in this PDF.

Step 3: Make certain the details are accurate and click on "Done" to proceed further. Download the sba supplemental loan agreement the instant you join for a free trial. Conveniently access the pdf document within your FormsPal cabinet, with any modifications and changes conveniently kept! At FormsPal, we do our utmost to guarantee that all your information is maintained private.