Schedule G Form can be filled out with ease. Simply open FormsPal PDF editor to accomplish the job quickly. To make our editor better and more convenient to use, we continuously implement new features, taking into consideration feedback coming from our users. This is what you would want to do to begin:

Step 1: First of all, access the pdf editor by clicking the "Get Form Button" in the top section of this webpage.

Step 2: When you open the file editor, you will see the form all set to be completed. Besides filling in various blank fields, it's also possible to perform other sorts of actions with the file, specifically adding any text, editing the initial textual content, inserting graphics, signing the form, and a lot more.

Concentrate when filling out this form. Ensure every field is filled in accurately.

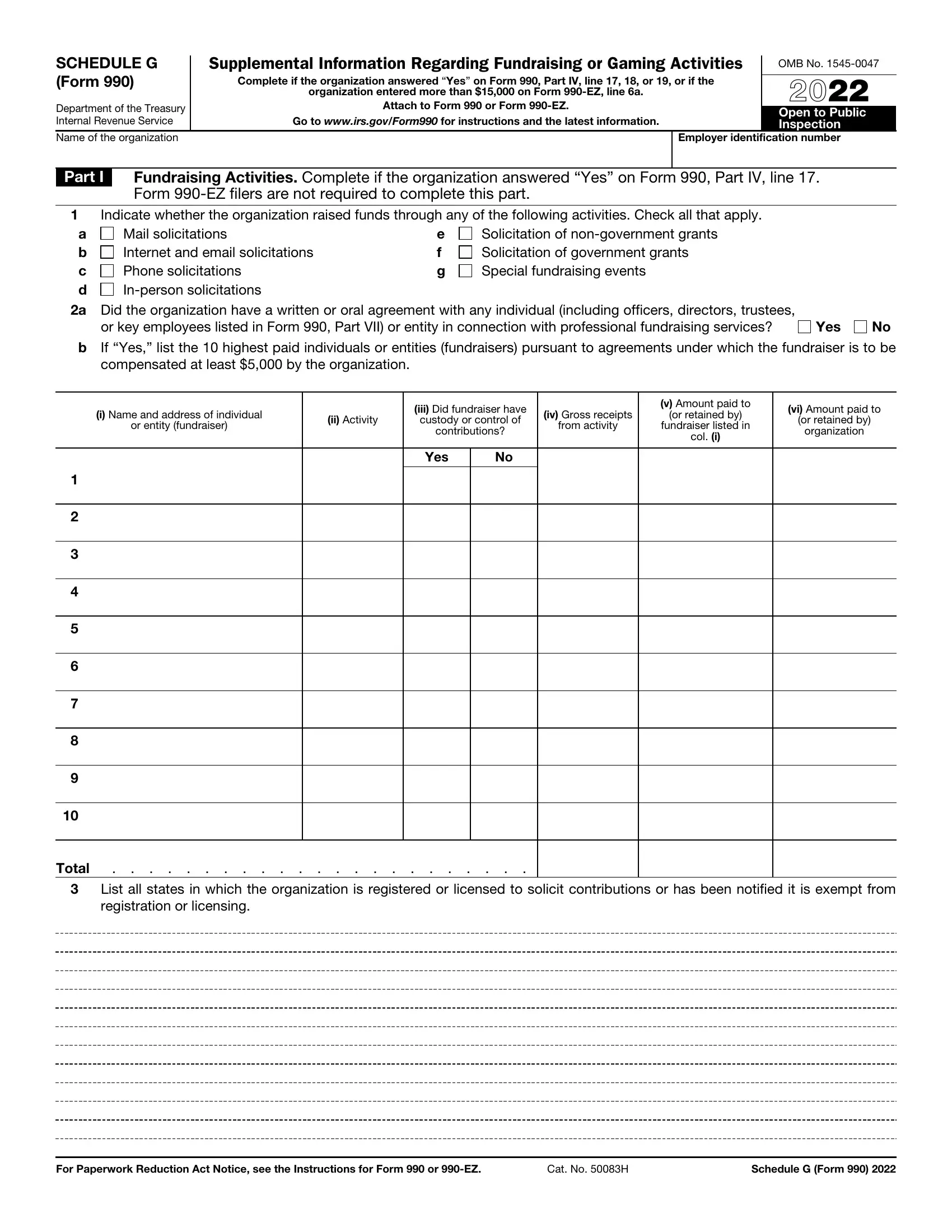

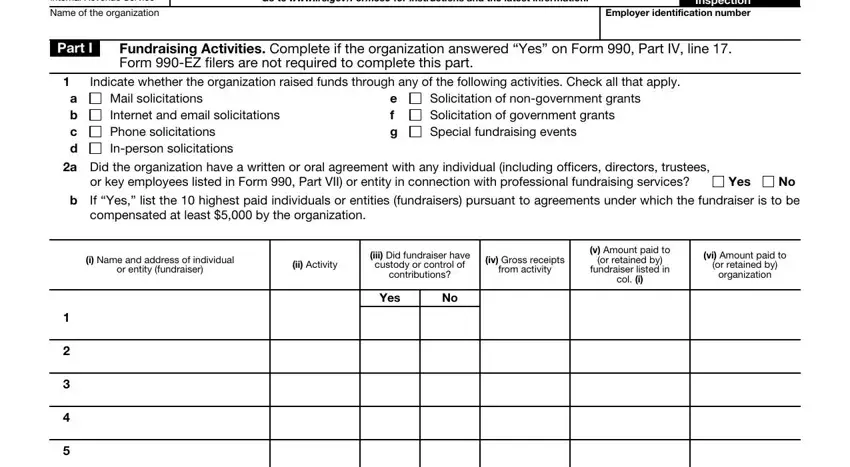

1. To start off, while completing the Schedule G Form, start in the form section that features the following blanks:

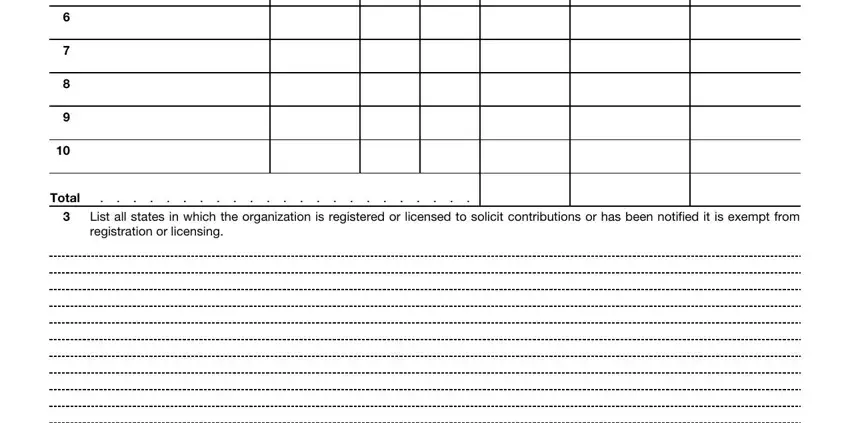

2. Immediately after the last section is done, proceed to type in the applicable information in these: Total, and List all states in which the.

You can potentially make errors when completing your Total, hence make sure you reread it before you'll finalize the form.

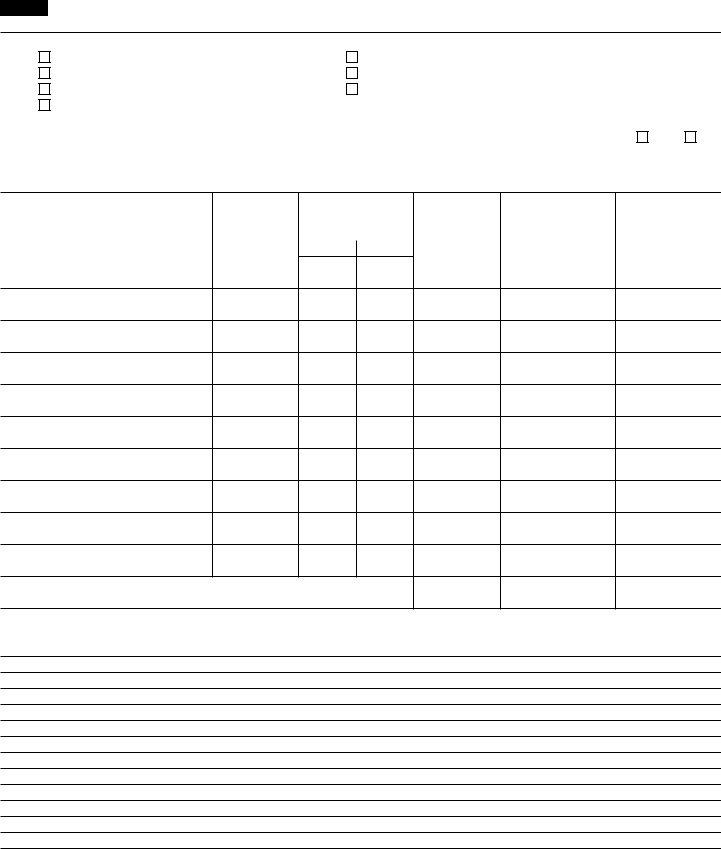

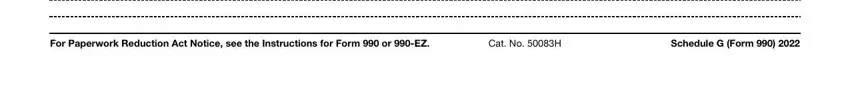

3. Within this stage, examine For Paperwork Reduction Act Notice, Cat No H, and Schedule G Form. Each of these need to be filled out with greatest accuracy.

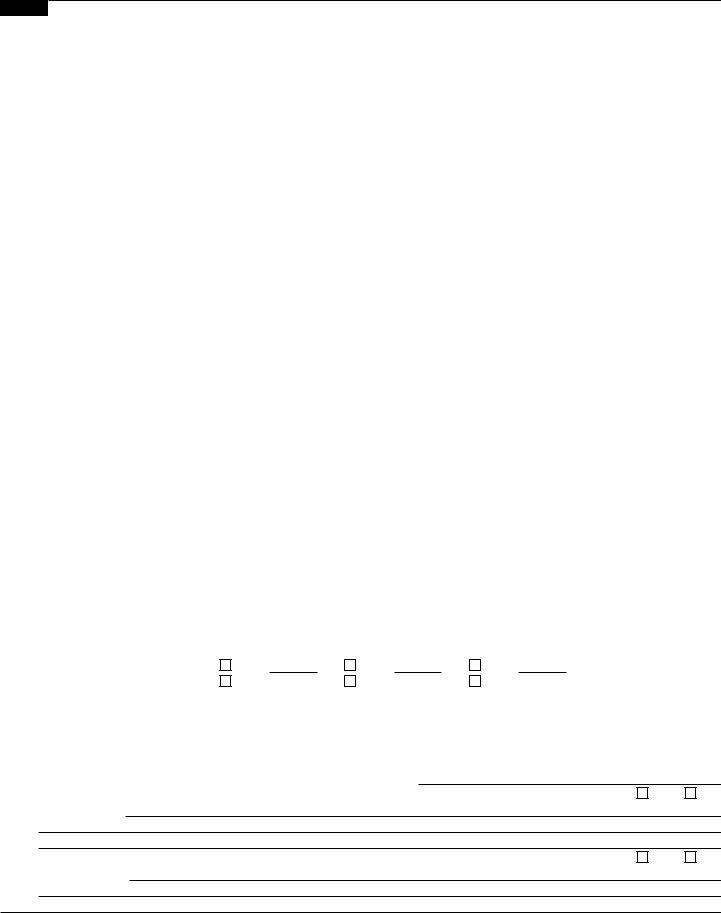

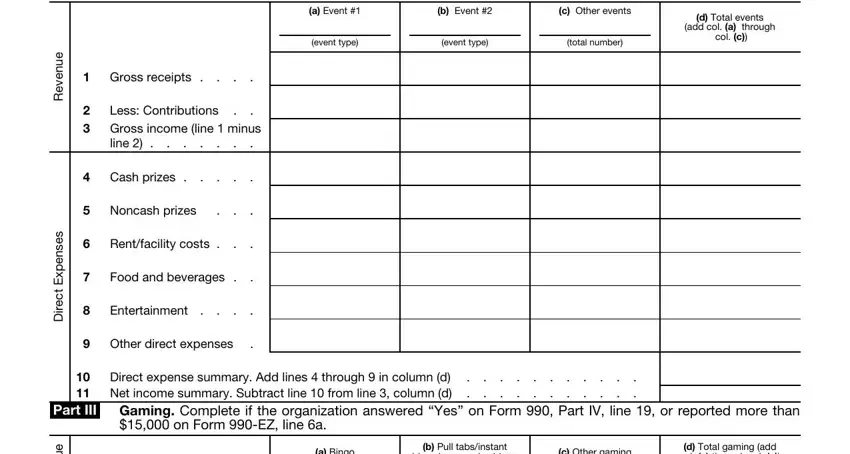

4. Filling out a Event, b Event, c Other events, event type, event type, total number, d Total events, add col a through, col c, Gross receipts, Less Contributions Gross income, Cash prizes, Noncash prizes, Rentfacility costs, and Food and beverages is paramount in this section - ensure to invest some time and fill out each and every blank!

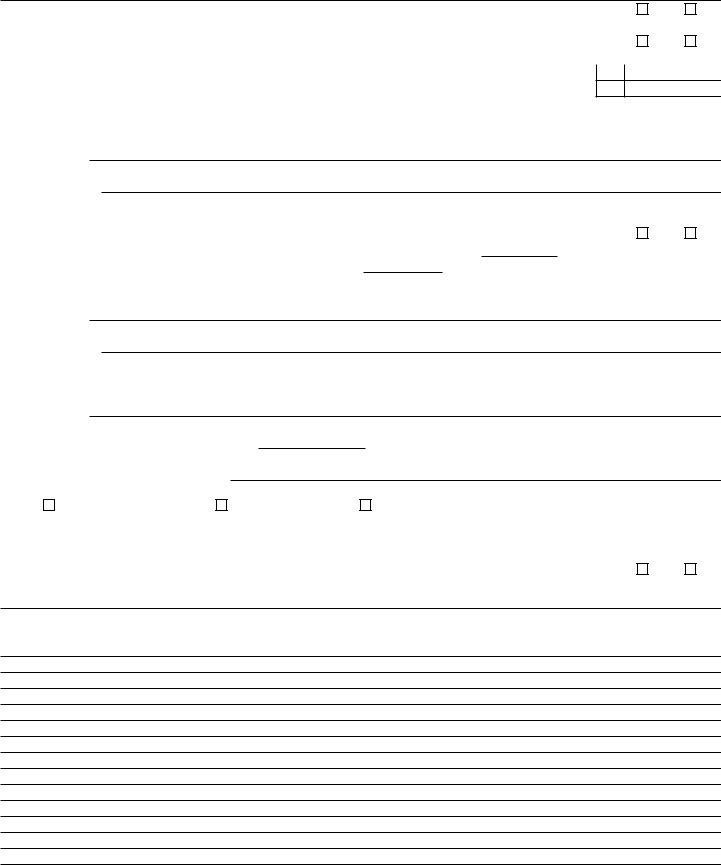

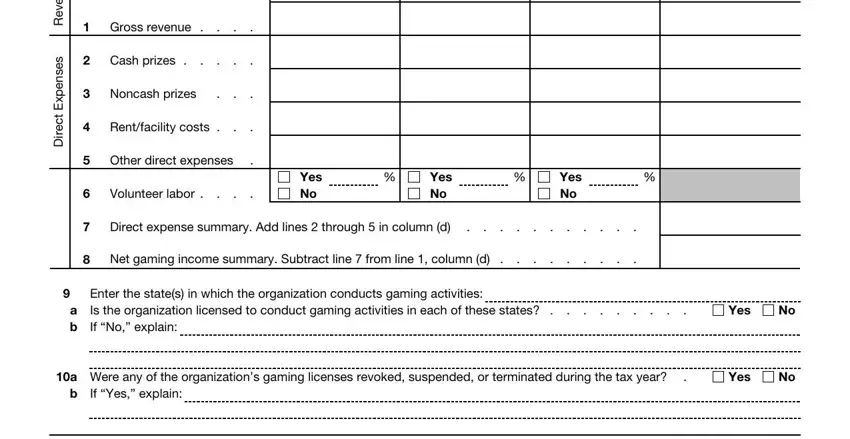

5. The final section to finalize this document is crucial. Make certain you fill in the displayed fields, like Gross revenue, Cash prizes, Noncash prizes, Rentfacility costs, Other direct expenses, Volunteer labor, Yes No, Yes No, Yes No, Direct expense summary Add lines, Net gaming income summary Subtract, Enter the states in which the, a Is the organization licensed to, e u n e v e R, and s e s n e p x E t c e r i, before finalizing. Neglecting to do this can give you an incomplete and possibly unacceptable paper!

Step 3: Just after rereading the entries, click "Done" and you are done and dusted! Sign up with us today and easily obtain Schedule G Form, available for download. All alterations you make are saved , meaning you can edit the document further if needed. FormsPal is committed to the confidentiality of our users; we make sure that all personal information going through our system is secure.