form 5500 ez instructions can be filled in with ease. Just try FormsPal PDF tool to perform the job quickly. To keep our editor on the forefront of convenience, we strive to implement user-oriented capabilities and improvements regularly. We are routinely thankful for any suggestions - play a pivotal part in revampimg how we work with PDF documents. To start your journey, consider these easy steps:

Step 1: Press the "Get Form" button at the top of this webpage to access our PDF tool.

Step 2: With this handy PDF file editor, it is possible to accomplish more than simply fill out forms. Edit away and make your docs look professional with custom text incorporated, or tweak the file's original input to perfection - all comes with an ability to incorporate almost any pictures and sign it off.

This form will require some specific information; to ensure accuracy, please be sure to consider the suggestions further down:

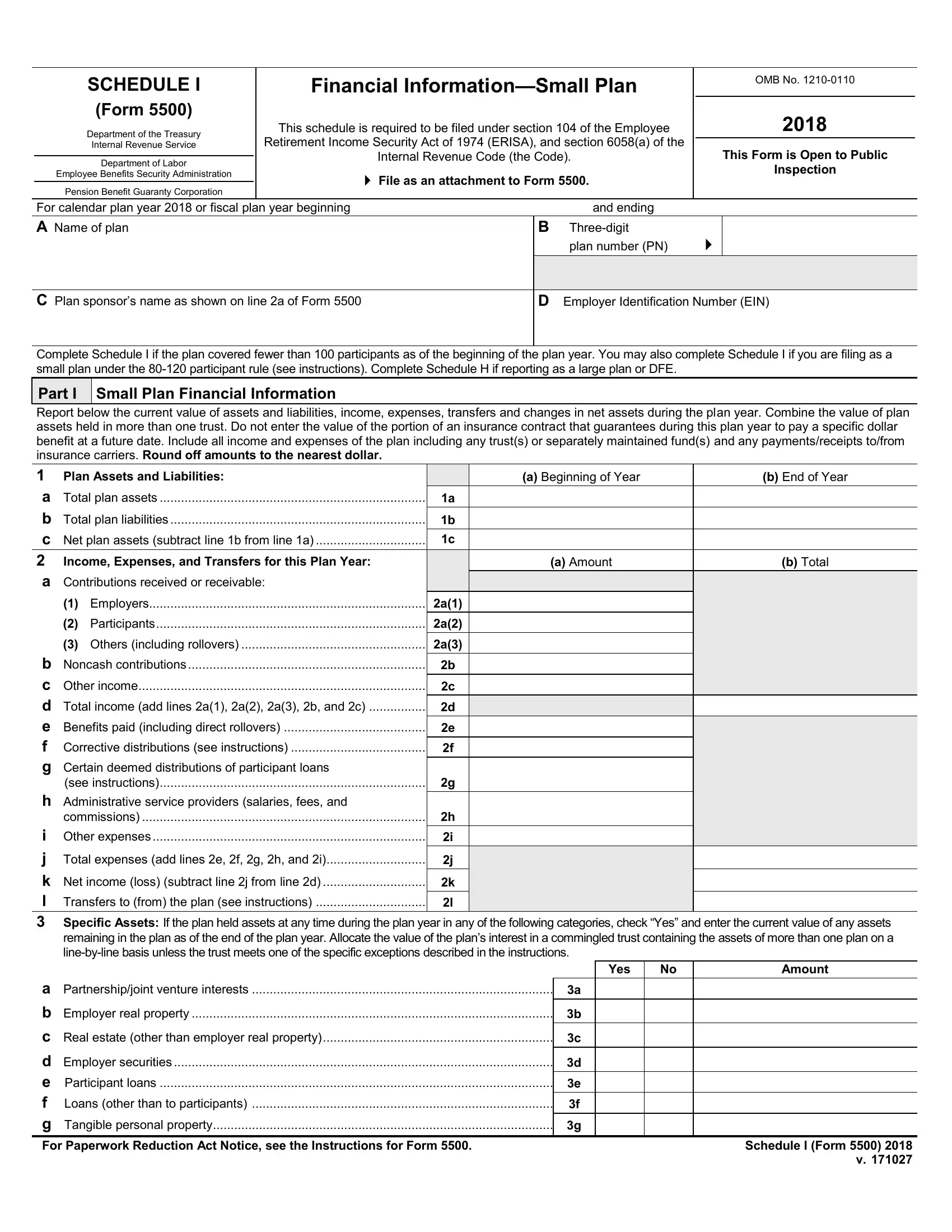

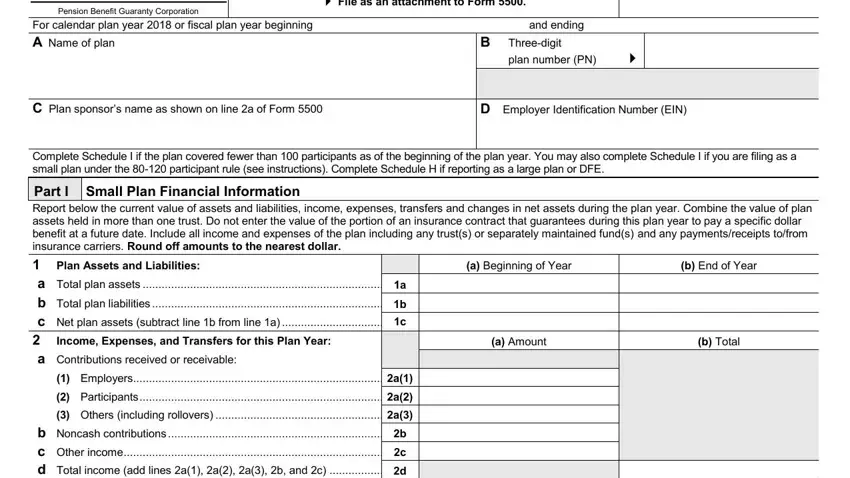

1. When completing the form 5500 ez instructions, make certain to include all of the necessary blank fields in their relevant form section. It will help hasten the process, allowing your details to be processed efficiently and correctly.

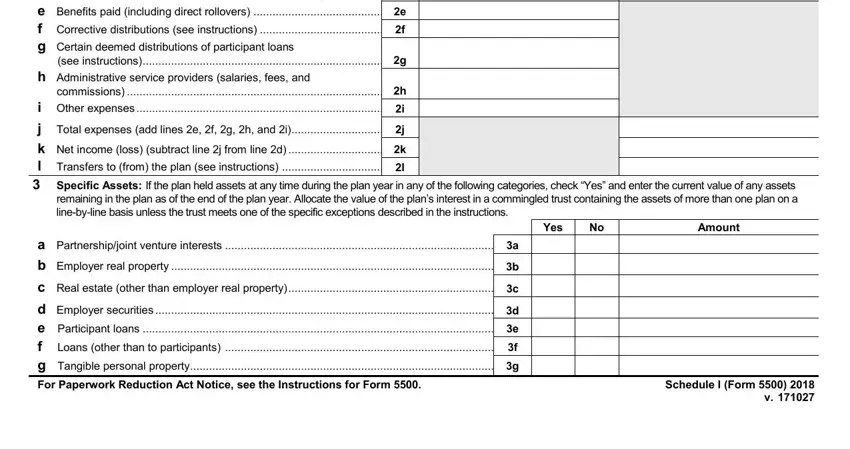

2. The subsequent part would be to submit these particular blank fields: Others including rollovers b, see instructions, h Administrative service providers, j Total expenses add lines e f g h, k Net income loss subtract line j, a Partnershipjoint venture, Yes, b Employer real property, c Real estate other than employer, d Employer securities e, Amount, and Schedule I Form v.

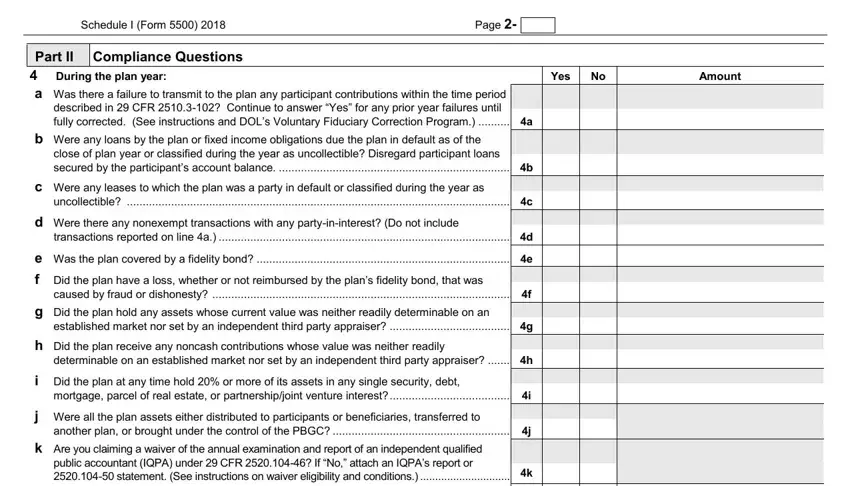

3. Completing Schedule I Form, Page x, Part II Compliance Questions, b Were any loans by the plan or, close of plan year or classified, c Were any leases to which the, uncollectible c, d Were there any nonexempt, transactions reported on line a, e Was the plan covered by a, caused by fraud or dishonesty, g Did the plan hold any assets, established market nor set by an, h Did the plan receive any noncash, and determinable on an established is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

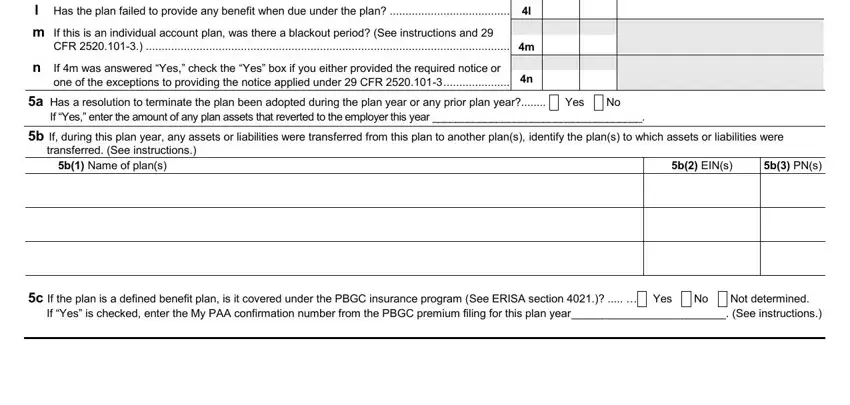

4. This specific subsection arrives with all of the following empty form fields to complete: public accountant IQPA under CFR, CFR m, n If m was answered Yes check the, one of the exceptions to providing, a Has a resolution to terminate, If Yes enter the amount of any, transferred See instructions, b Name of plans, b EINs, b PNs, ABCDEFGHI ABCDEFGHI ABCDEFGHI, ABCDEFGHI ABCDEFGHI ABCDEFGHI, ABCDEFGHI ABCDEFGHI ABCDEFGHI, ABCDEFGHI ABCDEFGHI ABCDEFGHI, and ABCDEFGHI ABCDEFGHI ABCDEFGHI.

People who use this form often make errors while completing public accountant IQPA under CFR in this part. Be certain to read twice whatever you type in right here.

Step 3: Before moving forward, check that all blank fields have been filled out as intended. When you verify that it is fine, press “Done." Download the form 5500 ez instructions as soon as you join for a 7-day free trial. Readily get access to the pdf form inside your personal account page, along with any edits and changes conveniently kept! When you work with FormsPal, you can certainly fill out documents without needing to get worried about information leaks or data entries being shared. Our secure software ensures that your personal details are maintained safe.