Are you tired of wasting time manually entering customer data into your spreadsheet? Automating this tedious task can be a game changer for your business, and Selene Form is here to help. No more back-and-forth emails or copy/pasting from databases. With Selene Form automated forms, collecting customer information becomes an easy and organized process. Our innovative technology simplifies form creation and streamlines the way firms collect data on any device without programming knowledge - leaving you with more time to keep up with the rest of your daily operations! Keep reading to learn how Selene Form can help save you time and money.

| Question | Answer |

|---|---|

| Form Name | Selene Form |

| Form Length | 13 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min 15 sec |

| Other names | selene form, seq, Servicer, selene financials com loss mitigation form pdf printable |

UNIFORM BORROWER ASSISTANCE FORM

If you are experiencing a temporary or

documentation to be considered for available solutions. On this page, you must disclose information about (1) you and your intentions to either keep

o t a sitio out of ou ho e; the p ope t ’s status; eal estate ta es; ho eo e ’s i su a e p e iu s; 5) bankruptcy; (6) your credit counseling agency, and (7) other liens, if any, on your property.

On Page 2 you must disclose information about all of your income, expenses and assets. Page 2 also lists the required income documentation that you must submit in support of your request for assistance. The on Page 3, you must complete the Hardship Affidavit in which you disclose the nature of your hardship. The Hardship Affidavit informs you of the required documentation that you must submit in support of your hardship claim.

NOTICE: In addition, when you sign and date this form, you will make important certifications, representations and agreements, including certifying that all of the information in this Borrower Assistance Form is accurate and truthful and any identified hardship has contributed to your submission of this request for mortgage relief.

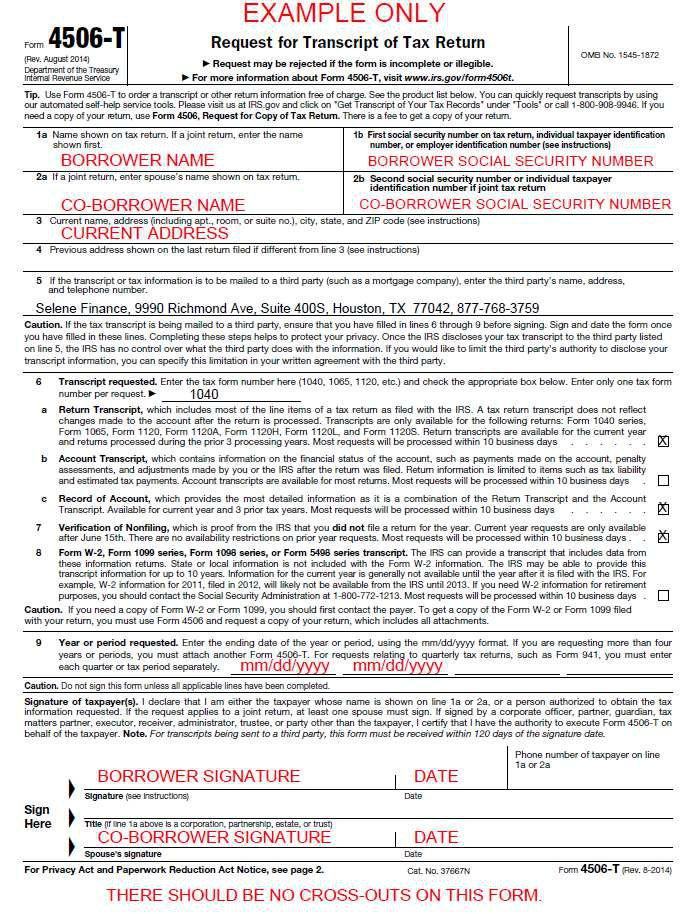

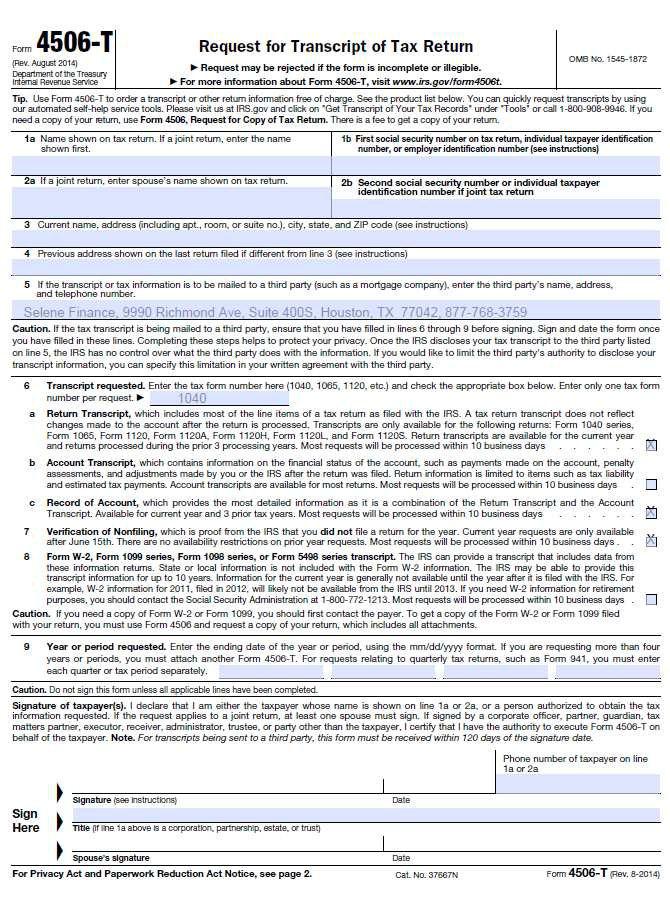

REMINDER: The Borrower Response Package you need to return consists of: (1) this completed, signed and dated Borrower Assistance Form; (2) completed and signed IRS Form

Loan I.D. Number |

|

(usually found on your monthly mortgage statement) |

|

|

|

|

|

I want to: |

Keep the property Sell the property Deed the property to lienholder |

||

|

|

|

|

The property is currently: My Primary Residence |

A Second Home An Investment Property |

||

Provide verification of occupancy (i.e. cable/cell phone bill)

The property is currently: Owner Occupied |

Renter Occupied |

Vacant |

|

|

|||

|

|

Borrower |

|

|

|

||

BORROWER’“ NAME |

|

|

|

|

|

||

|

|

|

|

|

|

||

SOCIAL SECURITY NUMBER |

DATE OF BIRTH |

|

SOCIAL SECURITY NUMBER |

DATE OF BIRTH |

|

||

|

|

|

|

|

|

||

HOME PHONE NUMBER WITH AREA CODE |

|

HOME PHONE NUMBER WITH AREA CODE |

|

|

|||

|

|

|

|

|

|||

CELL OR WORK NUMBER WITH AREA CODE |

|

CELL OR WORK NUMBER WITH AREA CODE |

|

|

|||

|

|

|

|||||

Selene is authorized to call and text this cell phone number for loss |

Selene is authorized to call and text this cell phone number for loss mitigation |

|

|||||

mitigation efforts |

Yes No |

|

efforts |

Yes No |

|

|

|

|

|

|

|

|

|

|

|

BEST TIME TO CALL |

|

|

|

BEST PHONE NUMBER TO CALL |

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS

PROPERTY ADDRESS (IF SAME AS MAILING ADDRESS, JUST WRITE SAME)

EMAIL ADDRESS

Estimated value: $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have you contacted a |

||||||||||||||||

Is the property listed for sale? Yes |

No |

|

|

|

|

|

If yes, please complete the counselor contact information below: |

||||||||||||||||||||||||

If yes, what was the listing date? |

|

|

|

Listing Price? $ |

|

|

|

Cou |

selo ’s Na |

e: |

|||||||||||||||||||||

|

|

|

|

|

|

Age |

’s Na |

e: |

|

|

|

|

|

|

|

|

|||||||||||||||

If property has been listed for sale, have you received an offer on the |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

property? Yes |

No |

|

|

|

|

|

|

|

|

|

Cou |

selo ’s Pho |

e Nu e : |

||||||||||||||||||

Date of offer: |

|

|

|

|

Amount of Offer: $ |

|

|

|

Cou |

selo ’s E |

ail Add ess: |

|

|

||||||||||||||||||

Age |

t’s Na |

e: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age |

t’s Pho |

e Nu |

e : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

For Sale by Owner? |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Do you have condominium or homeowner association (HOA) fees? Yes No |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Total monthly amount: $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Name and address that fees are paid to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Have you filed for bankruptcy? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

If yes: |

|

|

|

|

|

|

|

|

Chapter 7 Chapter 13 |

Filing Date: |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Has your bankruptcy been discharged? Yes |

No |

Bankruptcy case number: |

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Selene Loss Mitigation Application |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 13 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNIFORM BORROWER ASSISTANCE FORM |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Monthly Household |

|

|

|

Monthly Household Debt |

|

|

Household Assets (associated with |

|

|

Monthly Household |

|

|||||||||||||||

|

|

Income |

|

|

|

|

|

|

|

the property and/or borrower(s) |

|

|

Expenses |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Monthly Gross |

|

$ |

|

|

|

First Mortgage |

|

$ |

|

|

|

Checking Account (s) |

$ |

|

|

|

Food |

$ |

|

|||||||

|

wages |

|

|

|

|

Payment |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Overtime |

|

$ |

|

|

|

Second Mortgage |

|

$ |

|

|

|

Checking Account (s) |

$ |

|

|

|

Water / Gas / |

$ |

|

|||||||

|

|

|

|

|

Payment |

|

|

|

|

|

|

|

|

Electric |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Child |

|

|

|

|

|

Ho eo |

e ’s |

|

|

|

|

|

Savings or |

|

|

|

|

|

|

|

||||||

|

|

$ |

|

|

|

|

$ |

|

|

|

Money Market |

$ |

|

|

|

Transportation |

$ |

|

|||||||||

|

Support/Alimony* |

|

|

|

|

Insurance |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Acct(s) |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

$ |

|

|

|

Property Taxes |

|

$ |

|

|

|

CDs |

$ |

|

|

|

Child Care |

$ |

|

||||||||

|

security/SSDI |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Taxable SS |

|

|

|

|

|

Credit Cards / |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

Installment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

benefits or other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Loan(s) (total |

|

|

|

|

|

|

|

|

|

|

|

|

Life / Auto |

|

|

||||||

|

monthly income |

|

$ |

|

|

|

|

$ |

|

|

|

Stocks / Bonds |

$ |

|

|

|

$ |

|

|||||||||

|

|

|

|

|

minimum |

|

|

|

|

|

|

|

Insurance |

|

|||||||||||||

|

from annuities or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

payment per |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

retirement plans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

month) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Tips, commissions, |

|

|

|

|

|

HOA/Condo |

|

|

|

|

|

|

|

|

|

|

|

|

Cable / |

|

|

|||||

|

bonus and self- |

|

$ |

|

|

|

Fees/Property |

|

$ |

|

|

|

Other Cash on Hand |

$ |

|

|

|

$ |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Satellite |

|

||||||||||||||

|

employed income |

|

|

|

|

|

Maintenance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Rents Received |

|

$ |

|

|

|

Car Lease |

|

$ |

|

|

|

Other Real Estate |

$ |

|

|

|

Religious / |

$ |

|

|||||||

|

|

|

|

|

Payments |

|

|

|

|

(estimated value) |

|

|

|

Charity |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Unemployment |

|

$ |

|

|

|

Alimony, Child |

|

$ |

|

|

|

401K / 403B / IRA |

$ |

|

|

|

MISC |

$ |

|

|||||||

|

Income |

|

|

|

|

Support Payments |

|

|

|

|

|

|

|

Expenses |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Food |

|

|

|

|

|

Mortgage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

$ |

|

|

|

Payments on |

|

$ |

|

|

|

Other |

$ |

|

|

|

|

$ |

|

||||||||

|

Stamps/Welfare |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

other properties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Other |

|

$ |

|

|

|

Other |

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (Gross |

|

$ |

|

|

|

Total Debt |

|

$ |

|

|

|

Total Assets |

$ |

|

|

|

Total |

$ |

|

|||||||

|

income) |

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

*Notice: Alimony, child support, or separate maintenance income need not be revealed if you do not choose to have it considered for repaying this loan. |

||||||||||||||||||||||||||

|

Additional Properties Owned: |

|

Address/Mortgage Company |

|

|

|

|

|

|

Rents |

|

|

|

Mortgage |

|||||||||||||

|

(Rental, 2nd Home, Primary) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

Required Income Documentation – For All Household Members and Mortgagors |

|

|

||||||||||||||||||

|

Do you earn a wage? |

|

|

|

|

|

|

|

|

|

Are you |

|

|

|

|

|

|||||||||||

|

For each borrower who is a salaried employee or hourly wage |

|

|

For each borrower who receives |

|||||||||||||||||||||||

|

earner, include the most recent pay stub that reflects at least |

|

|

completed, signed individual federal income tax returns and, as applicable, the |

|||||||||||||||||||||||

|

30 days of |

|

|

business tax return; AND either the most recent signed and dated quarterly or |

|||||||||||||||||||||||

|

s, 2 ba k state |

e ts (all pages, all |

|

|

|||||||||||||||||||||||

|

accounts)) |

|

|

|

|

|

|

|

|

|

|

|

|

three months; OR copies of bank statements for all accounts for the last six |

|||||||||||||

|

Employer: ______________________ |

|

|

|

|

|

months evidencing continuation of business activity. |

|

|

||||||||||||||||||

|

Date of Hire: ___________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Seasonal Worker/Teacher? |

Annual Start Date :________________ Annual End Date: _________________ Average Months worked per yr: ____________ |

|||||||||||||||||||||||||

|

Do you have any additional sources of income? Provide for each borrower as applicable: |

|

|

|

|

|

|||||||||||||||||||||

|

Other Ear ed I |

o e su h as o |

uses, |

o issio |

s, housi g allo a |

e, tips, or o erti e: |

|

|

|

|

|

|

|

||||||||||||||

|

Reliable |

||||||||||||||||||||||||||

|

Social Security, disability or death benefits, pension, public assistance, or adoption assistance: |

|

|

|

|

|

|

|

|||||||||||||||||||

|

Documentation showing the amount and frequency of the benefits, such as letters, exhibits, disability policy or benefits statement from the provider, and |

||||||||||||||||||||||||||

|

Documentation showing the receipt of payment, such as copies of the two most recent bank statements showing deposit amounts. |

|

|

||||||||||||||||||||||||

|

Rental income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Copy of the most recent filed federal tax return with all schedules, including Schedule E – Supplement Income and Loss. Rental income for qualifying purposes will |

||||||||||||||||||||||||||

|

|

be 75% of the gross rent reduced by the monthly debt service on the property, if applicable; or |

|

|

|

|

|

|

|

||||||||||||||||||

|

If rental income is not reported on Schedule E – Supplemental Income and Loss, provide a copy of the current lease agreement with either bank statements or |

||||||||||||||||||||||||||

|

|

cancelled rent checks demonstrating receipt of rent. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Investment income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Copies of the two most recent investment statements or bank statements supporting receipt of this income. |

|

|

|

|

|

|||||||||||||||||||||

Selene Loss Mitigation Application |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 of 13 |

|

|

||||||||

Alimony, child support, or separation maintenance payments as qualifying income:*

Copy of divorce decree, separation agreement, or other written legal agreement filed with a court, or court decree that states the amount of the alimony, child support, or separation maintenance payments and the period of time over which the payments will be received, and

Copies of your two most recent bank statements or other

*Notice: Alimony, child support, or separate maintenance income need not be revealed if you do not choose to have it considered for repaying this loan.

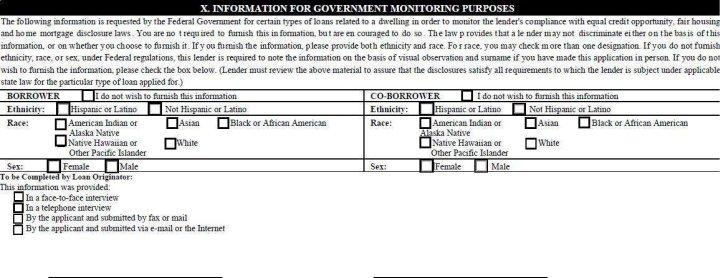

UNIFORM BORROWER ASSISTANCE FORM

HARDSHIP AFFIDAVIT

(provide a written explanation with this request describing the specific nature of your hardship)

I am requesting review of my current financial situation to determine whether I quality for temporary or permanent mortgage relief options.

Date Hardship Began is:

I believe that my situation is:

I am having difficulty making my monthly payment because of reasons set forth below:

(Please check all that apply and submit required documentation demonstrating your hardship)

If Your Hardship is: |

Then the Required Hardship Documentation is: |

|

|

Unemployment |

State Unemployment Letter, Unemployment Compensation Form 1099 G for the |

Start Date: _________ End Date: _______ |

time frames listed or tax returns for those year(s). |

|

|

Underemployment |

Pa stu s, W ’s, a d Tax Returns for the time frames during which you were |

|

underemployed. |

Income reduction (e.g., elimination of Pa stu s, W ’s, a d tax returns for the time frames during which your income was

overtime, reduction in regular working |

reduced. Income Before: __________Income After: _____________________ |

hours, or a reduction in base pay) |

|

Increase in Household Expenses |

Tax returns to support increase in number of dependents |

Divorce or legal separation; Separation Divorce decree signed by the court; OR

of Borrowers unrelated by marriage, |

Separation agreement signed by the court; OR |

civil union or similar domestic |

Recorded quitclaim deed evidencing that the |

partnership under applicable law |

Borrower has relinquished all rights to the property |

|

|

Death of a borrower or death of either |

Original Death certificate; OR |

the primary or secondary wage earner |

Obituary or newspaper article reporting the death |

in the household |

Probated Will |

Serious illness of a borrower/co- |

Medical bills; OR |

borrower or dependent family |

Proof of monthly insurance benefits or government assistance (if applicable) |

member |

|

Disaster (natural or |

Insurance claim; OR |

adversely impacting the property or |

Federal Emergency Management Agency grant or Small Business Administration loan; |

Bo o e ’s pla e of e plo e t |

OR |

|

Borrower or Employer property located in a federally declared disaster area |

|

|

Distant employment transfer |

For active duty service members: Notice of Permanent Change of Station (PCS) or |

|

actual PCS orders. |

|

For employment transfers/new employment: |

Copy of signed offer letter or notice from employer showing transfer to a new employment location,

Paystub from new employer, or

Written explanation (if neither item listed above is applicable).

In addition, documentation that reflects the amount of any relocation assistance provided, if applicable (not required for those with PCS orders).

Selene Loss Mitigation Application |

Page 3 of 13 |

Business Failure

Tax return from the previous year (including all schedules) AND

Proof of business failure supported by one of the following:

∙Bankruptcy filing for the business; or

∙Two months recent bank statements for the business account evidencing cessation of business activity; or

∙Most recent signed and dated quarterly or

UNIFORM BORROWER ASSISTANCE FORM

1.I certify that all of the information in this Borrower Assistance Form is truthful and the hardship(s) identified above has contributed to submission of this request for mortgage relief.

2.I understand and acknowledge that the Servicer, owner or guarantor of my mortgage, or their agent(s) may investigate the accuracy of my statements, may require me to provide additional supporting documentation, and that knowingly submitting false information may violate Federal and other applicable law.

3.I understand the Servicer will obtain a current credit report on all borrowers obligated on the Note.

4.I understand that if I have intentionally default on my existing mortgage, engaged in fraud or misrepresented any fact(s) in connection with this request for mortgage relief or if I do not provide all required documentation, the Servicer may cancel any mortgage relief granted and may pursue foreclosure on my home and/or pursue any available legal remedies.

5.I certify that my property has not received a condemnation notice.

6.I certify that I am willing to provide all requested documents and to respond to all Servicer communications in a timely manner. I understand that time is of the essence.

7.I understand that the Servicer will use this information to evaluate my eligibility for available relief options and foreclosure alternatives, but the Servicer is not obligated to offer me assistance based solely on the representations in this document or other documentation submitted in connection with my request.

8.If I am eligible for a trial period plan, repayment plan, or forbearance plan, and I accept and agree to all terms of such plan, I also

agree that the terms of this Acknowledgment and Agreement are incorporated into such plan by reference as if set forth in such pla i full. M fi st ti el pa e t follo i g “e i e ’s dete i atio a d otifi atio of eligi ilit o p e ualification

for a trial period plan, repayment plan, or forbearance plan (when applicable) will serve as acceptance of the terms set forth in the notice sent to me that sets forth the terms and conditions of the trial period plan, repayment plan, or forbearance plan.

9.I agree that when the Servicer accepts and posts a payment during the term of any repayment plan, trial period plan, or forbearance plan it will be without prejudice to, and will not be deemed a waiver of, the acceleration of my loan of foreclosure action and related activities and shall not constitute a cure of my default under my loan unless such payments are sufficient to completely cure my entire default under my loan.

10.I agree that any prior waiver as to my payment of escrow items to the Servicer in connection with my loan has been revoked.

11.If I qualify for and enter into a repayment plan, forbearance plan, and trial period plan, I agree to the establishment of an escrow account and the payment of escrow items if an escrow account never existed on my loan.

12.I understand that the Servicer will collect and record personal information that I submit in this Borrower Response Package and

during the evaluation process, including, but not limited to, my name, address, telephone number, social security number,

credit score, income, payment history, and information about my account balances and activity. I understand and consent to the “e i e ’s dis losu e of pe so al i fo atio a d the te s of a elief o fo e losu e alte ati e that I e ei e to any

investor, insurer, guarantor, or servicer that owns, insures, guarantees, or services my first lien or subordinate lien (if applicable) mortgage loan(s) or to any

13.If I am eligible for foreclosure prevention relief under the federal Making Home Affordable Program, I understand and consent to the disclosure of my personal information and the terms of any Making Home Affordable Agreement by the Servicer to (a) the U.S. Department of the Treasury, (b) Fannie Mae and Freddie Mac in connection with their responsibilities under the Homeowner Affordability and Stability Plan, and (c) companies that perform support services in conjunction with Making Home Affordable.

14.I consent to being contacted concerning this request for mortgage assistance at any cellular or mobile telephone number I have provided to the Lender. This includes text messages, telephone calls and emails to my cellular or mobile telephone.

Selene Loss Mitigation Application |

Page 4 of 13 |

Borrower Signature |

Date |

Date |

Selene Loss Mitigation Application |

Page 5 of 13 |

REAL ESTATE FRAUD CERTIFICATION1

This Certification is being requested by your servicer and is required, for certain additional incentives, by the federal government under, as applicable, the Emergency Economic Stabilization Act of 2008 (12 U.S.C. 5201 et seq.), the

under the Making Home Affordable Program. Therefore, you are required to furnish this Certification if you wish to receive the sixth ea pa fo pe fo a e i e ti e u de the Maki g Ho e Affordable Program.

By signing below, I/we represent that I/we have not been convicted within the last 10 years of any one of the following in connection with a mortgage or real estate transaction:

(a)felony larceny, theft, fraud, or forgery,

(b)money laundering, or

(c)tax evasion.

I/we understand that my/our signature below authorizes the servicer to share this Certification with its agents and the U.S. Department of the Treasury, Fannie Mae, Freddie Mac or their respective agents, each of whom may investigate the accuracy of my statements by obtaining a current consumer report, and performing background checks, including automated searches of federal, state and county databases, to confirm that I/we have not been convicted of such crimes. I/we also understand that knowingly submitting false information may violate Federal law and may result in civil or criminal penalties, as well as loss of benefits or incentives provided under the Making Home Affordable Program and that are posted to my/our mortgage account after the effective date of this Certification. This Certification is effective on the earlier of the date executed as listed below or the date received by your servicer.

I/we also certify under penalty of perjury under the laws of the United States of America that the foregoing is true and correct.

____________________ |

____________________ |

____________ |

_________ |

Borrower Signature |

Social Security Number |

Date of Birth |

Date Executed |

____________________ |

____________________ |

____________ |

_________ |

Social Security Number |

Date of Birth |

Date Executed |

1

This Certification is being requested by your servicer and is required, for certain additional incentives, by the federal government under, as applicable, the Emergency Economic Stabilization Act of 2008 (12 U.S.C. 5201 et seq.), the

felony larceny, theft, fraud, or forgery, (B) money laundering or (C) tax evasion. Providing the requested Certification is v oluntary; however, if you do not provide this Certification, you will not be eligible to receive the sixth year “pay for performance” incentive

under the Making Home Affordable Program. Therefore, you are required to furnish this Certification if you wish to receive the sixth

year “pay for performance” incentive under the Making Home Affordable Program.

Selene Loss Mitigation Application |

Page 6 of 13 |

Borrower Signature |

Date |

Date |

Selene Loss Mitigation Application |

Page 7 of 13 |

******FOR FLORIDA PROPERTIES ONLY******

LOAN NUMBER: _________________________________

FEE AGREEMENT FOR LOAN MODIFICATION SERVICES

FLORIDA LAW REQUIRES THAT WE PROVIDE FLORIDA RESIDENTS WITH THIS AGREEMENT ALTHOUGH WE DO NOT CHARGE YOU A FEE FOR LOAN

MODIFICATION SERVICES.

THIS AGREEMENT FOR LOAN MODIFICATION SERVICES AGREEMENT IS MADE AND ENTERED INTO THIS _______ DAY OF __________________,

20_____, BY AND BETWEEN SELENE FINANCE LP (SELENE) AND ______________________________________________________

(BORROWER/S) FOR THE MORTGAGE LOAN MODIFICATION SERVICES DESCRIBED HEREIN.

SELENE IS A MORTGAGE LOAN SERVICER WHOSE ADDRESS IS: 9990 RICHMOND AVENUE, SUITE 400 S, HOUSTON, TEXAS 77042. SELENE IS OFFERING TO ASSIST YOU IN MODIFYING THE LOAN ON YOUR PROPERTY.

SELENE WILL NOT CHARGE YOU A FEE FOR ASSISTING YOU IN MODIFYING YOUR LOAN BUT WILL REQUIRE THAT YOU PROVIDE FINANCIAL INFORMATION SO WE CAN DETERMINE YOUR ABILITY TO QUALIFY FOR A MODIFICATION.

SELENE WILL REQUEST A CREDIT REPORT TO CONFIRM YOUR DEBTS AND SUBMIT A PACKAGE TO THE NOTE HOLDER FOR REVIEW AND APPROVAL. SELENE CANNOT GUARANTEE THAT THE NOTE HOLDER WILL AGREE TO MODIFY THE LOAN BUT IF THE NOTE HOLDER AGREES, WE WILL CONTACT YOU TO PROVIDE THE TERMS AND FORWARD THE MODIFICATION AGREEMENT TO YOU FOR EXECUTION.

YOU MAY CANCEL THIS AGREEMENT FOR LOAN MODIFICATION SERVICES WITHOUT ANY PENALTY OR OBLIGATION WITHIN THREE (3) BUSINESS DAYS AFTER THE DATE THE AGREEMENT IS SIGNED BY YOU.

THE LAW REQUIRES THAT THE LOAN ORIGINATOR, MORTGAGE BROKER, OR MORTGAGE LENDER IS PROHIBITED FROM ACCEPTING ANY MONEY, PROPERTY, OR OTHER FORM OF PAYMENT FROM YOU UNTIL ALL PROMISED SERVICES HAVE BEEN COMPLETED. IF FOR ANY REASON YOU HAVE PAID THE CONSULTANT BEFORE CANCELLATION, YOUR PAYMENT MUST BE RETURNED TO YOU WITHIN (10) BUSINESS DAYS AFTER THE CONSULTANT RECEIVES YOUR CANCELLATION NOTICE. THIS DOES NOT APPLY IN THIS CASE BECAUSE SELENE DOES NOT CHARGE ANY FEE FOR MODIFICATION SERVICES.

IF YOU WANT TO CANCEL THIS AGREEMENT, PLEASE SEND A SIGNED AND DATED STATEMENT THAT YOU ARE CANCELING THE AGREEMENT TO SELENE AT 9990 RICHMOND AVENUE, SUITE 400 SOUTH, HOUSTON, TEXAS 77042.

IMPORTANT: THE LAW ALSO REQUIRES THAT WE ADVISE YOU THAT IT IS RECOMMENDED THAT YOU CONTACT YOUR MORTGAGE LENDER OR MORTGAGE SERVICER BEFORE SIGNING THIS AGREEMENT. YOUR LENDER OR SERVICER MAY BE WILLING TO NEGOTIATE A PAYMENT PLAN OR A RESTRUCTURING WITH YOU FREE OF CHARGE. IN THIS CASE, SELENE IS YOUR MORTGAGE SERVICER AND WE DO NOT CHARGE YOU A FEE FOR THESE SERVICES.

_________________________________________ ________________________________________

BORROWER SIGNATUREDATE SIGNED

_________________________________________ ________________________________________

DATE SIGNED |

Selene Loss Mitigation Application |

Page 8 of 13 |

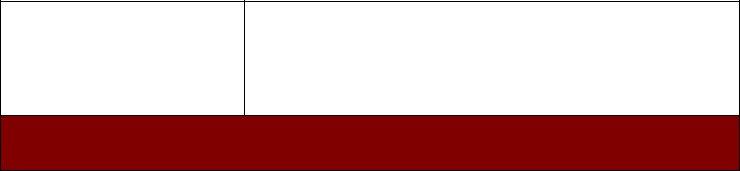

Third Party Authorization

Borrower Information

First Name

Last Name

Last 4 Digits – Social

Security Number

First Name

Last Name

Last 4 Digits – Social

Security Number

|

Property Address |

|

|

Street |

|

|

|

City/State/Zip Code |

|

|

|

|

Loan Information |

|

|

Loan Number |

|

Mortgage Company |

SELENE FINANCE LP |

Name |

|

|

|

I/We am/are the borrower(s) on the above referenced loan.

By signing below, I/we hereby authorize Selene Finance LP to discuss the loan with the following individual/company:

Authorized Individual or

Company

Street

City/State/Zip

Phone Number

This authorization will remain in effect until I send written notice to Selene Finance LP that the authorization is revoked.

Borrower Signature: |

Date Signed |

|

|

Borrower Printed Name: |

|

|

|

Date Signed |

|

|

|

Selene Loss Mitigation Application |

Page 9 of 13 |

Selene Loss Mitigation Application |

Page 10 of 13 |

Selene Loss Mitigation Application |

Page 11 of 13 |

Selene Loss Mitigation Application |

Page 12 of 13 |

Selene Loss Mitigation Application |

Page 13 of 13 |