Using PDF files online is certainly very easy using our PDF tool. You can fill out self employment report here and use various other functions we offer. To make our editor better and easier to work with, we constantly work on new features, considering suggestions from our users. Getting underway is simple! Everything you need to do is stick to these easy steps below:

Step 1: Click on the "Get Form" button above. It's going to open our pdf editor so you can begin filling in your form.

Step 2: With our online PDF file editor, you could accomplish more than just complete blank form fields. Express yourself and make your docs appear professional with custom textual content added, or fine-tune the file's original input to perfection - all comes along with an ability to incorporate stunning photos and sign the file off.

For you to finalize this PDF form, be sure you enter the information you need in every blank field:

1. It's important to complete the self employment report accurately, thus be careful when filling in the areas comprising these blanks:

2. Once your current task is complete, take the next step – fill out all of these fields - By signing this form you are, SIGNATURE, Date Signed, and Wis Stat m with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is possible to make errors while completing the SIGNATURE, and so make sure to look again before you finalize the form.

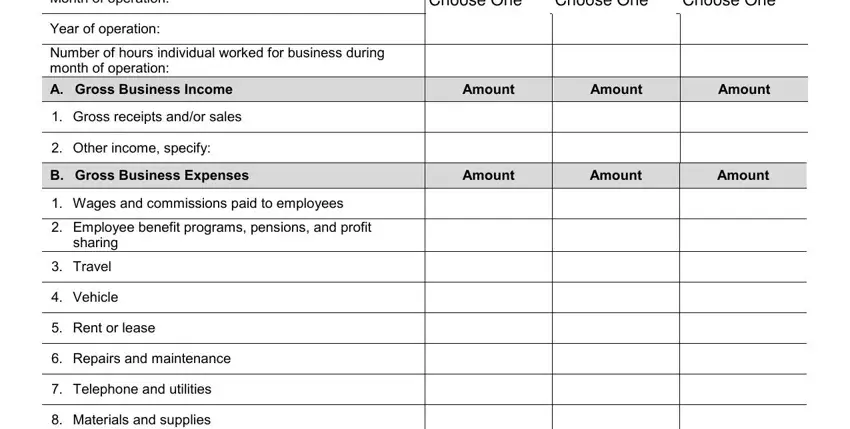

3. Your next stage is hassle-free - fill in all of the form fields in Month of operation, Year of operation, Number of hours individual worked, Choose One, Choose One, Choose One, A Gross Business Income, Amount, Amount, Amount, Gross receipts andor sales, Other income specify, B Gross Business Expenses, Amount, and Wages and commissions paid to to finish the current step.

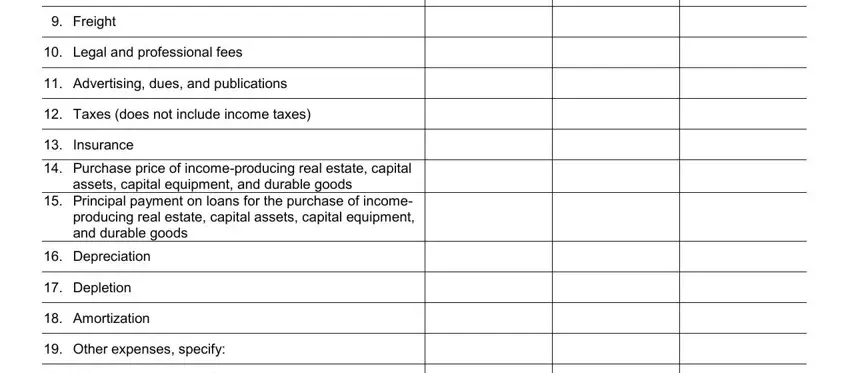

4. This fourth paragraph arrives with all of the following blank fields to type in your specifics in: Freight, Legal and professional fees, Advertising dues and publications, Taxes does not include income, Insurance, Purchase price of incomeproducing, assets capital equipment and, Principal payment on loans for, Depreciation, Depletion, Amortization, and Other expenses specify.

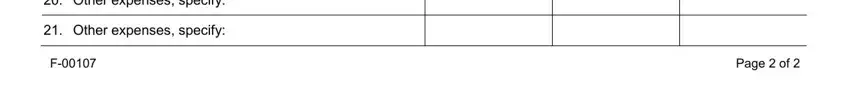

5. Last of all, this last section is precisely what you should wrap up prior to using the document. The blank fields under consideration are the following: Other expenses specify, Other expenses specify, and Page of.

Step 3: Before finishing this file, it's a good idea to ensure that form fields are filled out right. As soon as you’re satisfied with it, click “Done." Find your self employment report after you register here for a free trial. Immediately gain access to the pdf inside your personal account page, with any modifications and changes automatically saved! FormsPal guarantees your information confidentiality by having a secure system that never saves or distributes any sensitive information typed in. Rest assured knowing your docs are kept safe any time you use our services!