sf429c can be filled in without any problem. Just open FormsPal PDF tool to finish the job quickly. FormsPal expert team is continuously endeavoring to expand the tool and make it much faster for people with its multiple features. Uncover an endlessly revolutionary experience today - explore and find out new opportunities along the way! Starting is effortless! Everything you need to do is take these easy steps down below:

Step 1: Hit the "Get Form" button at the top of this webpage to access our editor.

Step 2: This editor grants the capability to modify your PDF in various ways. Change it by adding customized text, adjust what's already in the PDF, and add a signature - all doable in no time!

It will be simple to finish the document using out helpful tutorial! Here is what you must do:

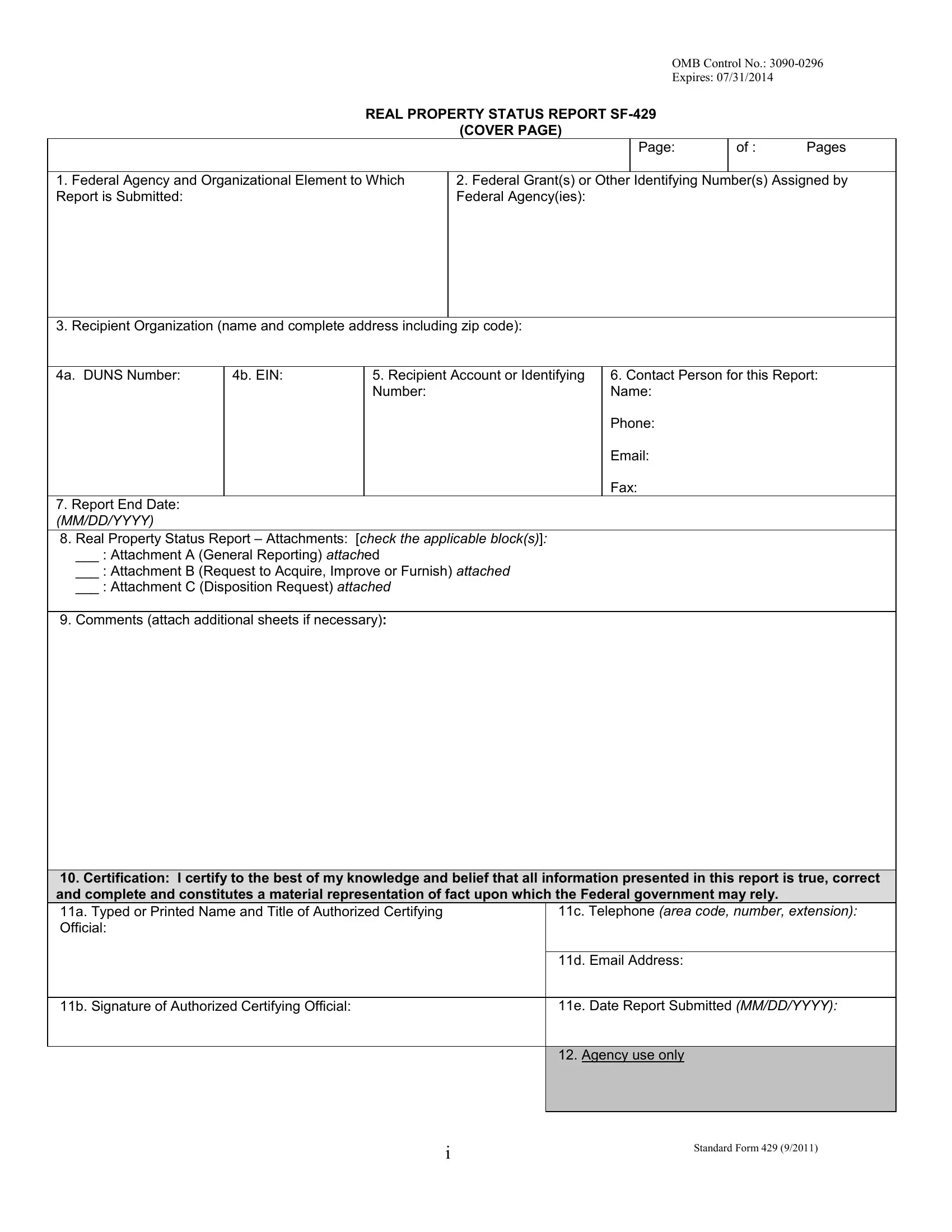

1. Firstly, while completing the sf429c, start in the page that contains the following blanks:

2. Soon after performing the last section, go to the subsequent step and fill out the necessary details in all these blanks - g Are there any Uniform Relocation, A Employs Integrated Design, and Standard Form.

Be really careful while filling in Standard Form and g Are there any Uniform Relocation, as this is where many people make errors.

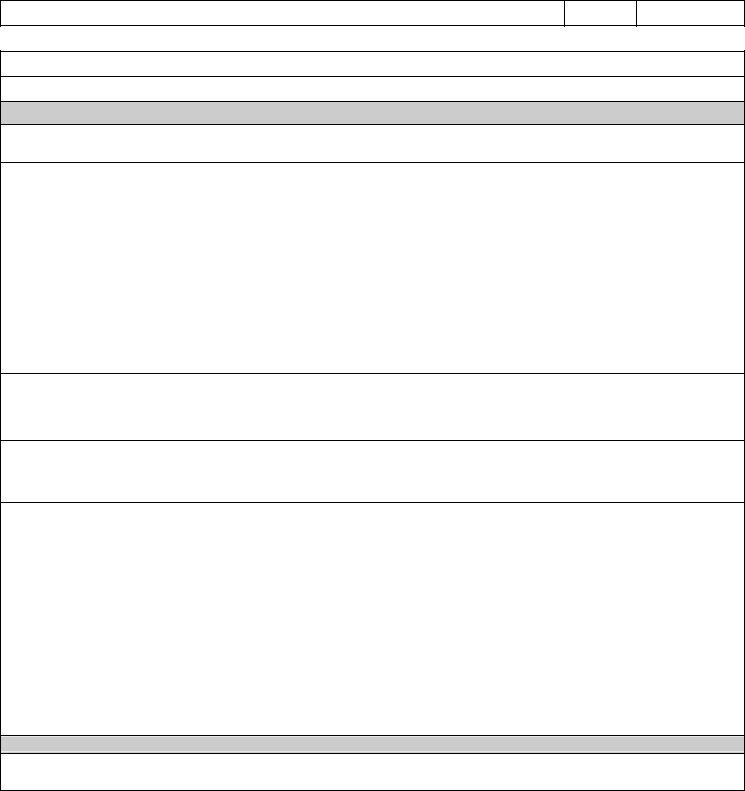

3. The following segment is mostly about OMB Control No Expires, E Optimizes Energy Performance, k What was the cumulative energy, Cumulative Energy Use may be, and l What is the anticipated - fill in all these empty form fields.

Step 3: Make sure your details are accurate and then just click "Done" to conclude the project. Right after creating afree trial account here, you will be able to download sf429c or email it promptly. The PDF file will also be readily accessible via your personal account with all your adjustments. If you use FormsPal, you can certainly fill out forms without worrying about database leaks or entries getting distributed. Our protected system makes sure that your private data is kept safely.