If you are a South Carolina taxpayer, understanding and navigating your state's tax code can be confusing. One key form that all filers must know is Form 1102--the South Carolina Individual Income Tax Return for Part-Year Residents and Nonresidents. This article will discuss the purpose of this crucial form, provide instructions on completing it accurately and efficiently, as well as outline other resources available to help you with your filing needs in order to ensure that you file an accurate return.

| Question | Answer |

|---|---|

| Form Name | South Carolina Form 1102 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | carolina, active, contigent, pdf |

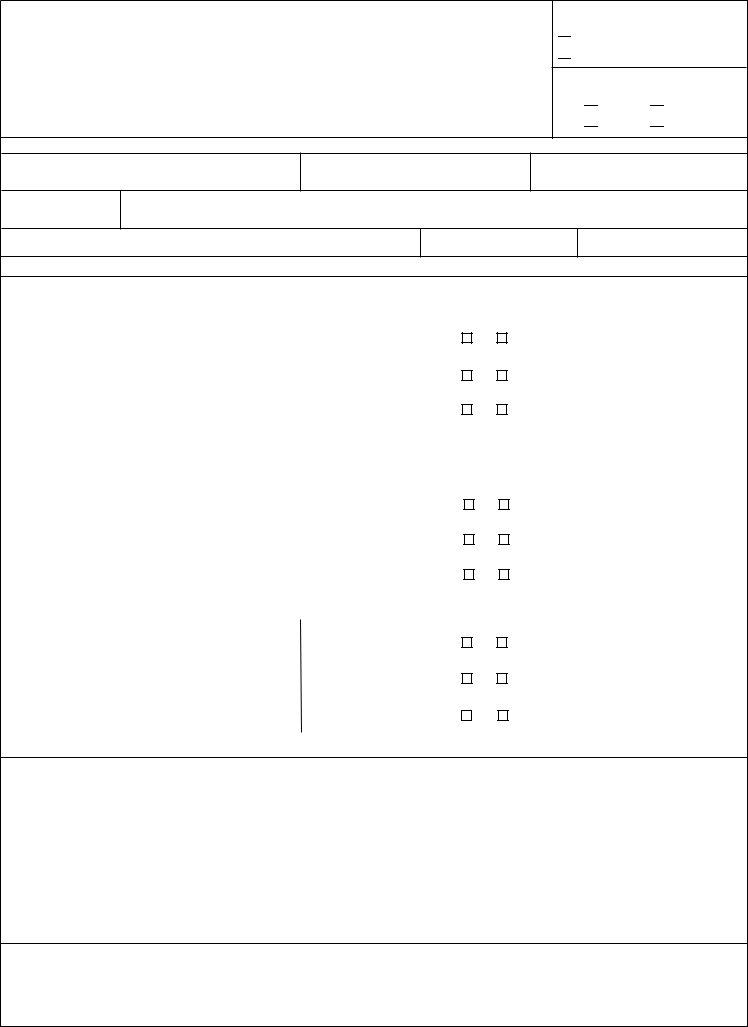

Form 1102

Revised 03/25/2005

Page 1

Print or type in black ink

Please read the instructions on the reverse (page 2) before completing this form.

ACTIVE MEMBER BENEFICIARY FORM

BENEFICIARY DESIGNATION, CONTINGENT BENEFICARY FOR ACTIVE MEMBERS ONLY- RETIREES USE FORM 7201

South Carolina Retirement Systems

State Budget and Control Board

Box 11960, Columbia, SC

Use for designation of active member beneficiaries and contingent beneficiaries. You may wish to consult with an attorney/estate planner before completing this form.

CHECK ONE:

New Enrollee

Change of Beneficiary

Retirement System (check one)

SCRS PORS

GARS JSRS

Section I |

PERSONAL INFORMATION |

1. Last Name & Suffix

2. First/Middle Name

3. Social Security Number

4. Date of Birth

5. Address

6. City

7. State

8. ZIP+4

ALL SECTIONS MUST BE COMPLETED

Section |

BENEFICIARY(IES) FOR REFUND OF CONTRIBUTIONS/SURVIVOR BENEFITS - I designate the following |

|||||||||||||

|

|

|

PRIMARY beneficiary(ies) to receive the Retirement Systems refund of contributions or survivor benefits if eligible. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||||||

|

|

|

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||||||

|

|

|

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||||||

|

|

|

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent Beneficiaries Have No Rights Unless All Primary Beneficiaries Have Died - I designate the following CONTINGENT beneficiary(ies) to receive the

Section

beneficiaries will be revoked and your estate will become your contigent beneficiary.

1. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

|||||

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

|||||

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

|||||

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section III BENEFICIARY(IES) FOR GROUP LIFE INSURANCE (You may not designate contingent beneficiaries for Group Life) I designate the following beneficiary(ies) to receive the Retirement Systems Group Life Insurance:

1. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section IV |

CERTIFICATION AND CONDITIONS |

|

|

|

|

|

||||

IMPORTANT: Please read the Certification and Conditions sections of the instructions on the reverse (page 2) before signing this form. I hereby certify I have read and understand the information on the reverse (page 2), including the certification and conditions, and I agree to the provisions stated.

MEMBER'S SIGNATURE ______________________________________________ WITNESS _____________________________________________

(Do not print)(Required only when signed by mark)

STATE OF ___________________________________________________________ COUNTY OF __________________________________________

Acknowledged before me this date ________________________________ NOTARY NAME _______________________________________________

My Commission Expires ________________________________ NOTARY SIGNATURE __________________________________________________

(Out of state, requires Seal)

THE LANGUAGE USED IN THIS DOCUMENT DOES NOT CREATE ANY CONTRACTUAL RIGHTS OR ENTITLEMENTS AND DOES NOT CREATE A CONTRACT BETWEEN THE MEMBER AND THE SOUTH CAROLINA RETIREMENT SYSTEMS. THE SOUTH CAROLINA RETIREMENT SYSTEMS RESERVES THE RIGHT TO REVISE THE CONTENT OF THIS DOCUMENT.

PAGE ____ OF ____

Form 1102, Page 2 |

INSTRUCTIONS |

USE THIS FORM FOR ACTIVE MEMBER BENEFICIARY DESIGNATIONS WHICH DO NOT REQUIRE A TRUSTEE APPOINTMENT. THIS FORM MUST BE COMPLETED IN ITS ENTIRETY EACH TIME. AN ACKNOWLEDGMENT LETTER WILL BE SENT TO THE MEMBER EACH TIME A FORM IS RECEIVED BY THE SC RETIREMENT SYSTEMS. FOR RETIREE BENEFICIARY DESIGNATION, USE FORM 7201.

Check the appropriate boxes in the upper right corner. If you are a member of more than one system, complete a beneficiary form (FORM 1102) for each system. You should complete a form for each system of which you are a member when making any beneficiary changes (i.e. if you complete a FORM 1102 for your SCRS account, beneficiary changes will be for that system only, your prior designations for your PORS account would still be in effect).

SECTION I |

|

SECTION |

REFUND OF CONTRIBUTIONS/SURVIVOR BENEFITS |

On this form you may designate a person(s) or your estate as beneficiary for your retirement contributions or survivor benefits. Leave the relationship, sex, date of birth, and SSN blank if you are naming your estate as beneficiary. If you are naming your estate as beneficiary, you may not designate a person(s) for this portion of your retirement benefits. If additional space is needed to designate more than 3 beneficiaries, complete and attach a second FORM 1102 and indicate on the form how many pages are being submitted. That information will assist the SC Retirement Systems in determining total number of forms submitted in the event the forms are separated during the processing.

SECTION

In accordance with

SECTION III |

GROUP LIFE INSURANCE |

You may name different beneficiaries for the Group Life Insurance (a benefit equal to your annual salary), paid in a lump sum (if the employer has elected this coverage). The $3,000 State Life Insurance and Optional Life Insurance are administered by the Office of Insurance Services; contact the OIS for information pertaining to those benefits. Contact your employer or SC Retirement Systems for Group Life coverage. If you do not have Group Life Insurance, write "N/A" in Section III on the reverse (page 1) of this form.

SECTION IV |

CERTIFICATION AND CONDITIONS |

1.CERTIFICATION: This form must be signed by the member in the presence of a notary public and be properly notarized. If more than one form is completed, ALL forms must be notarized on the same date. FORMS ALTERED IN THE BENEFICIARY

DESIGNATION OR CERTIFICATION SECTIONS WILL NOT BE ACCEPTED.

2.REVOCATION: All previous beneficiary designations to receive retirement benefits are hereby revoked.

3.AUTHORIZATION: I hereby authorize the SC Retirement Systems to make payment of any refund of my accumulated contributions and/or any other payment due in the event of my death prior to retirement to the beneficiary(ies) designated on the front of this form (page 1) in accordance with the provisions of the SC Retirement Systems , and agree on behalf of myself and my heirs and assigns, that any payment so made shall be a complete discharge of the claim or claims, and shall constitute a release of the Retirement Systems from any further obligations on account of the benefit or benefits. In the event my primary beneficiary(ies) predeceases me and if a contingent beneficiary designation is on file, the SC Retirement Systems would pay any benefits due to the contingent beneficiary(ies). In the event that no primary beneficiary(ies) or contingent beneficiary(ies) are alive at the time of my death, my estate (which is ineligible for survivor benefits), will automatically become my designated beneficiary. I reserve the right to change the designated beneficiary(ies) by a written designation filed with the SC Retirement Systems in accordance with its rules and regulations.

4.PAYMENT: The SC Retirement Systems shall be fully discharged of liability for all amounts paid to the beneficiary(ies), and shall have no other obligation as to the application of such amounts. In any dealing with a beneficiary(ies), including but not limited to any consent, release, or waiver of interest, the SC Retirement Systems shall be fully protected against the claim or claims of every other person.

5.MULTIPLE BENEFICIARIES: Survivor benefits payable to 2 or more beneficiaries shall be calculated based upon the average age of the designated beneficiaries. Payments will be equally divided among surviving beneficiaries at the member's death.

Please call SC Retirement Systems Customer Service with any questions: (800)