Should you would like to fill out CFR, you won't have to download and install any software - simply try using our PDF editor. FormsPal team is aimed at providing you with the ideal experience with our tool by consistently adding new features and improvements. Our editor has become a lot more intuitive thanks to the latest updates! At this point, working with PDF files is a lot easier and faster than before. In case you are looking to get going, here is what it takes:

Step 1: Hit the "Get Form" button above. It will open up our pdf tool so that you can start filling in your form.

Step 2: With the help of this handy PDF file editor, you're able to do more than merely fill out blank form fields. Edit away and make your forms look great with customized textual content added in, or fine-tune the file's original input to perfection - all that comes along with an ability to incorporate any graphics and sign the file off.

It will be an easy task to finish the pdf with this helpful tutorial! Here's what you need to do:

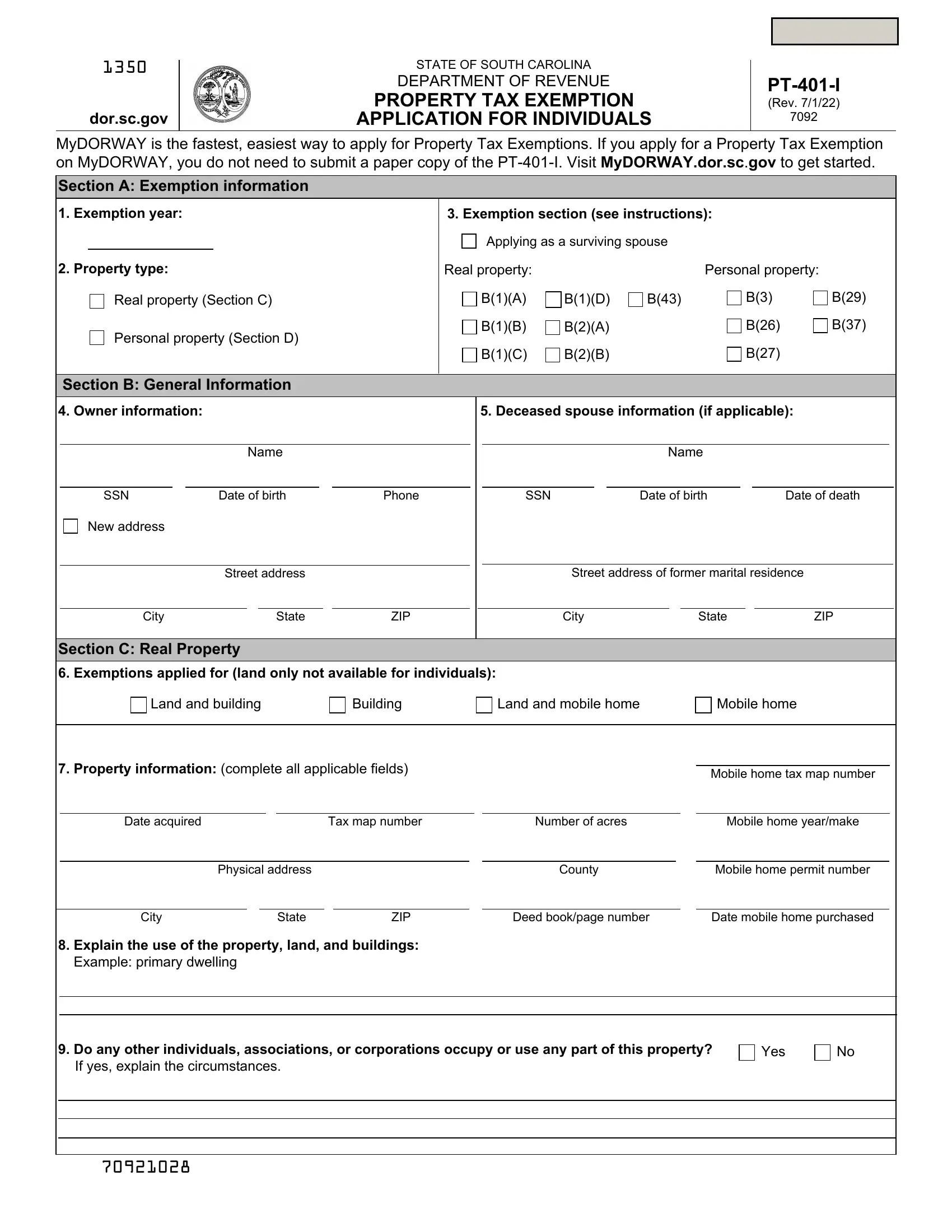

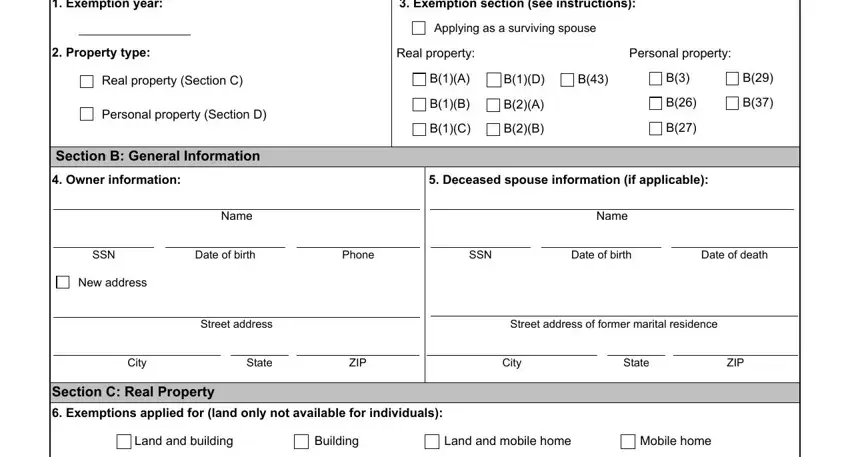

1. To start with, when filling in the CFR, beging with the page that features the next blanks:

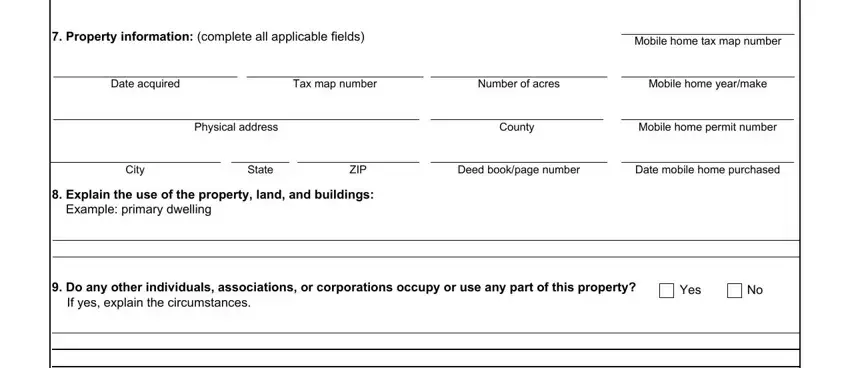

2. Once your current task is complete, take the next step – fill out all of these fields - Property information complete all, Mobile home tax map number, Date acquired, Tax map number, Number of acres, Mobile home yearmake, Physical address, County, Mobile home permit number, City, State, ZIP, Deed bookpage number, Date mobile home purchased, and Explain the use of the property with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

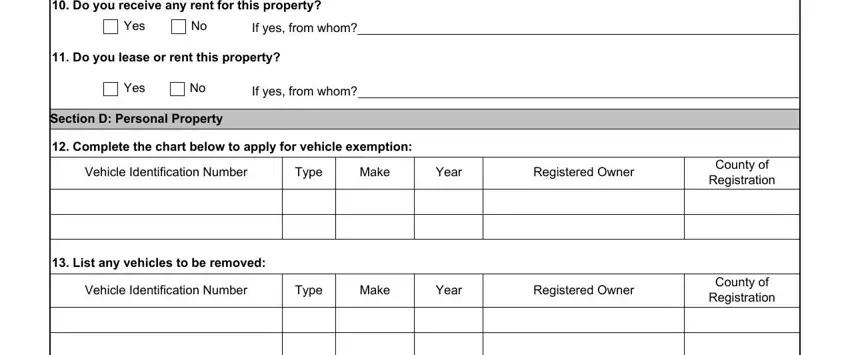

3. The following section will be focused on Do you receive any rent for this, Yes, If yes from whom, Do you lease or rent this property, Yes, If yes from whom, Section D Personal Property, Complete the chart below to apply, Vehicle Identification Number, Type, Make, Year, Registered Owner, List any vehicles to be removed, and Vehicle Identification Number - fill in every one of these blanks.

Be extremely attentive while completing List any vehicles to be removed and Complete the chart below to apply, since this is the section where many people make some mistakes.

4. Completing Signature, Date, Important Reminders, If you leave the Exemption year, record and your effective date of, If you are requesting refunds for, o a change in status or o a change, and Send in your application using one is essential in this fourth form section - be certain to don't rush and fill in every blank area!

Step 3: Before moving forward, ensure that blanks are filled in the right way. The moment you determine that it is fine, click “Done." After starting afree trial account with us, you'll be able to download CFR or email it at once. The file will also be at your disposal from your personal account with your each change. When you work with FormsPal, you're able to complete documents without having to get worried about personal information incidents or entries getting shared. Our protected software helps to ensure that your private data is kept safe.