Through the online PDF editor by FormsPal, you can easily fill out or alter unreduced right here and now. In order to make our editor better and less complicated to use, we continuously design new features, with our users' feedback in mind. Should you be seeking to begin, here is what it will require:

Step 1: Hit the "Get Form" button above on this page to get into our PDF tool.

Step 2: The tool provides the capability to change your PDF document in a variety of ways. Improve it with customized text, adjust what's already in the document, and put in a signature - all within a couple of mouse clicks!

It is simple to fill out the pdf using this practical guide! Here is what you must do:

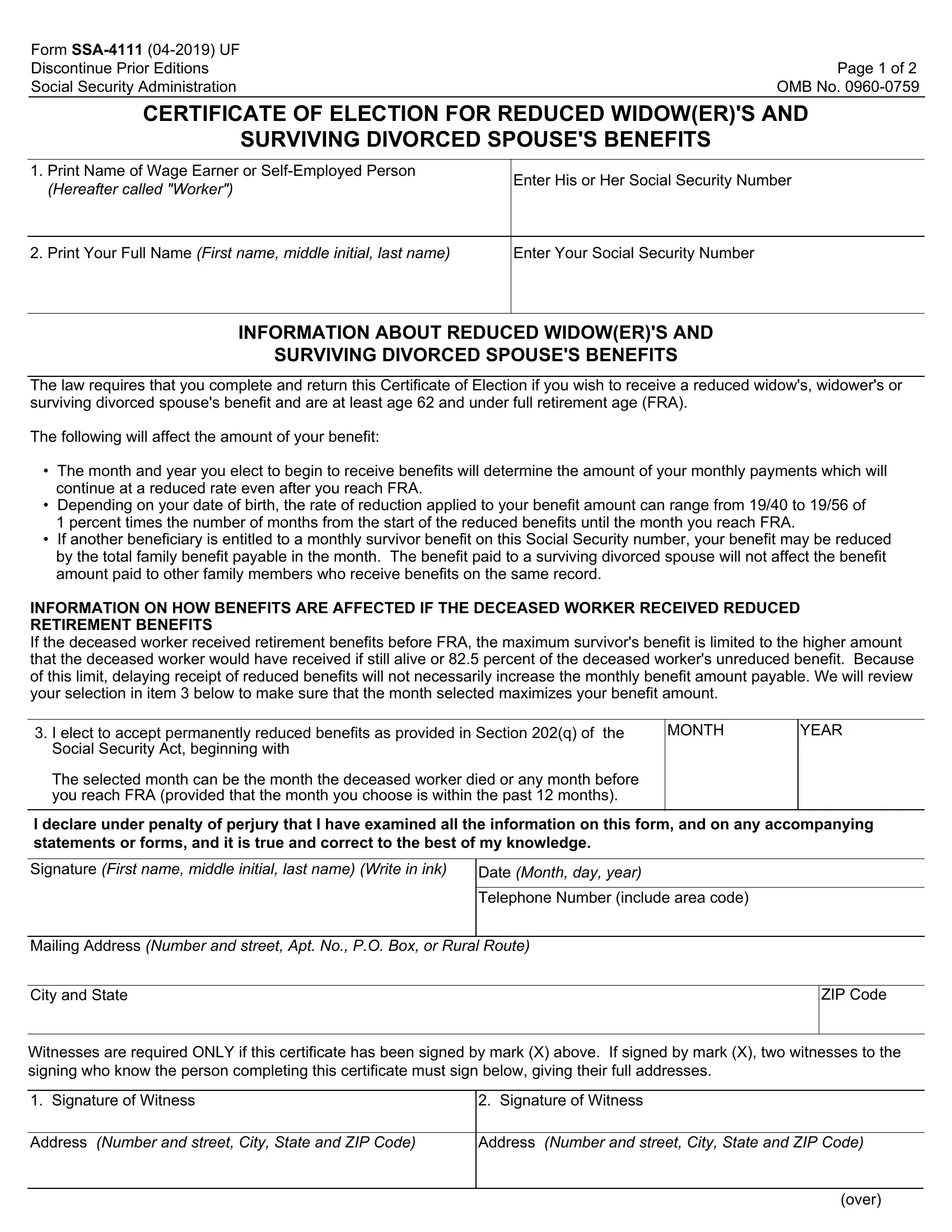

1. When submitting the unreduced, make certain to complete all essential fields within its relevant part. This will help speed up the work, allowing your details to be handled quickly and properly.

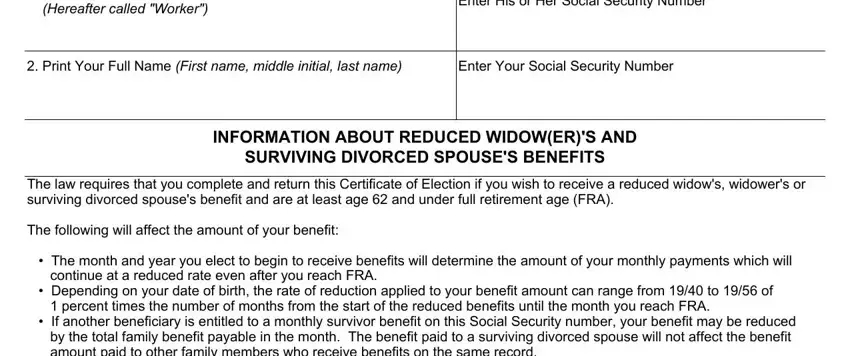

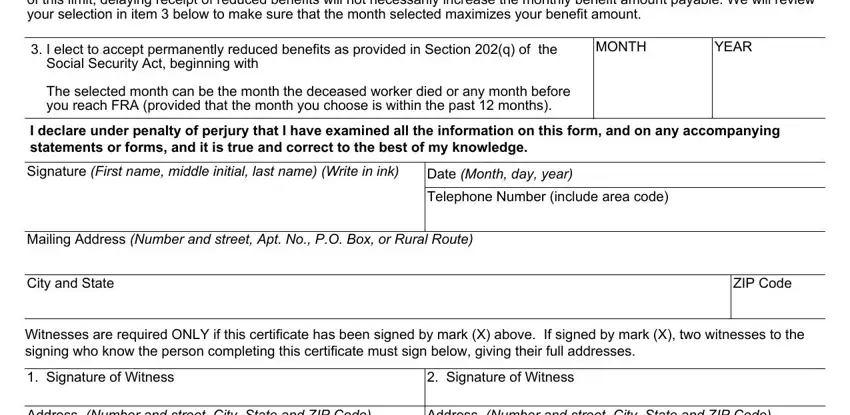

2. Soon after the first selection of blanks is filled out, go on to type in the applicable information in all these - The law requires that you complete, I elect to accept permanently, MONTH, YEAR, I declare under penalty of perjury, Signature First name middle, Date Month day year, Telephone Number include area code, Mailing Address Number and street, City and State, ZIP Code, Witnesses are required ONLY if, Signature of Witness, Signature of Witness, and Address Number and street City.

3. Completing Address Number and street City, Address Number and street City, and over is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

4. The subsequent subsection will require your details in the following parts: Privacy Act Statement, Collection and Use of Personal, and Section of the Social Security. Make sure that you provide all of the requested information to go forward.

It's easy to make errors when filling out your Section of the Social Security, and so you'll want to look again before you send it in.

5. This form has to be concluded by going through this area. Here you can find an extensive listing of fields that require appropriate details for your document submission to be accomplished: .

Step 3: Revise the details you've inserted in the blank fields and then click the "Done" button. Sign up with FormsPal now and instantly get access to unreduced, all set for downloading. All changes you make are saved , helping you to modify the document at a later time if required. We do not share or sell the information you type in when completing documents at FormsPal.