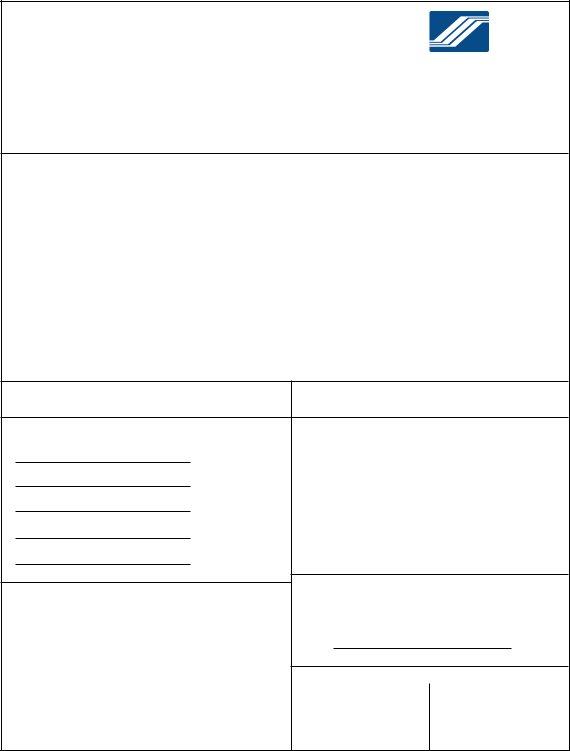

In today's dynamic economic landscape, self-employed individuals bear the significant responsibility of managing their own social security benefits, which necessitates a clear understanding of the Social Security System (SSS) Self-Employed Data Record Form (RS-1). This form, revised in July 1991 and subsequently adapted for internet use in July 2000, serves as the gateway for self-employed persons to register with the SSS, ensuring their eligibility for various benefits. It requires detailed personal information, including the applicant's SS number, name, date and place of birth, address, contact information, civil status, and details regarding their profession or business. The form also solicits information about net earnings, providing options for declaring earnings on both monthly and yearly bases, which plays a crucial role in determining the amount of contributions. Additionally, it includes sections for entering details about the individual's spouse, children, and other beneficiaries, which is essential for the processing of future claims. Supporting documentation is required to substantiate the claims made on the form, ranging from primary documents like birth certificates or passports to secondary documents in cases where primary documents are unavailable. Compliance with these requirements facilitates the timely availment of social security benefits and privileges, emphasizing the form's importance in securing a self-employed individual's financial safety net.

| Question | Answer |

|---|---|

| Form Name | Sss Form For Self Employed |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | how to apply self employed in sss online, how to register sss online self employed, sss requirements for self employed, how to self employed in sss |

|

SS NUMBER |

|

|

|

|

SOCIAL SECURITY SYSTEM |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

FORM |

|

REV. 7/91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SURNAME |

GIVEN NAME |

MIDDLE NAME |

DATE OF BIRTH |

PLACE OF BIRTH |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS

SEX |

|

|

|

|

|

|

|

CIVIL STATUS |

|

|

|

|

|

|

|

|

|

TEL NO. |

|||||||||||||||||||||||

|

|

|

MALE |

|

|

|

FEMALE |

|

|

|

SINGLE |

|

MARRIED |

|

WIDOW/ER |

RESIDENCE: |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

OFFICE: |

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

POSTAL CODE |

|

|

|

|

PROFESSIONAL/ |

|

|

YEAR PROFESSION/ |

DATE OF |

SS NUMBER PREVIOUSLY ASSIGNED |

|||||||||||||||||||||||||||||||

(SSS USE ONLY) |

|

|

|

|

BUSINESS CODE |

|

|

BUSINESS STARTED |

COVERAGE |

IF ANY |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

YEARLY |

|

|

|

|

|

|

MONTHLY |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS |

|

|

|

|

|

NET EARNINGS |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P |

|

|

|

|

|

|

P |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE

CHILDREN

1

2

3

4

5

DATE RECEIVED

BENEFICIARY/IES

AGE |

FATHER |

|

|

|

|

AGE |

||||

AGE |

MOTHER |

|

|

|

|

AGE |

||||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER BENEFICIARIES (If you do not have spouse, children |

||||||||

|

|

|||||||||

|

|

|

|

and parents) |

||||||

|

|

|

NAME |

|

|

|

RELATIONSHIP |

|||

|

|

|

|

|

|

|||||

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I HEREBY CERTIFY THAT THE ABOVE STATEMENTS

ARE TRUE AND CORRECT.

SIGNATURE

THUMB PRINTS

LEFT

RIGHT

Internet Edition (7/2000)

Cut along the dotted line.

Please read instructions on page 2 of this form.

INSTRUCTIONS

1.Submit this form in two copies together with the original/certified true copy and photocopy of the following supporting documents:

PRIMARY DOCUMENTS

-Birth Certificate; or

-Baptismal Certificate; or

-Passport

OTHER REQUIRED DOCUMENTS

For reporting spouse - Marriage Contract

For reporting child -

If legitimate:

Birth or Baptismal Certificate

If illegitimate:

Birth or Baptismal Certificate or in its absence,

Proof of Parentage or Relationship

If legally adopted:

Decree of Adoption

In the absence of any of the primary documents, submit any two of the following where the name and date of birth of the registrant appear:

SECONDARY DOCUMENTS

-Record of Employment/Employer ID

-GSIS Member’s Record

-Certification from National Archives

-Alien Certificate of Registration

-School/Voter ’s Identification Card

-Driver’s License

-Marriage Contract

-Birth Certificate of children

-Joint Affidavit of two disinterested persons attesting to the correct name & date of birth of the applicant

2.If the

REMINDERS

1.An SS number is a lifetime number. No one should have more than one SS number.

2.Notify us in writing in case you would like to change your monthly contribution.

3.A change in monthly contribution may be requested any time but only once in a year.

If the requested change is one step higher or lower from your current monthly sal- ary credit (MSC), no supporting document is required.

If the requested change is more than the next higher or lower step from your cur- rent MSC, submit a copy of your Income Tax Return (ITR) for the prior year duly received by the Bureau of Internal Revenue.