When using the online editor for PDFs by FormsPal, you may fill in or change sss downloadable forms r5 right here. To have our editor on the forefront of practicality, we strive to put into practice user-oriented capabilities and enhancements regularly. We are at all times looking for feedback - play a vital role in revampimg PDF editing. To get the process started, go through these easy steps:

Step 1: First, access the pdf tool by pressing the "Get Form Button" at the top of this page.

Step 2: With the help of this handy PDF tool, you could accomplish more than merely fill out blank form fields. Edit away and make your forms seem great with custom text added, or fine-tune the file's original content to excellence - all that accompanied by the capability to incorporate any type of graphics and sign it off.

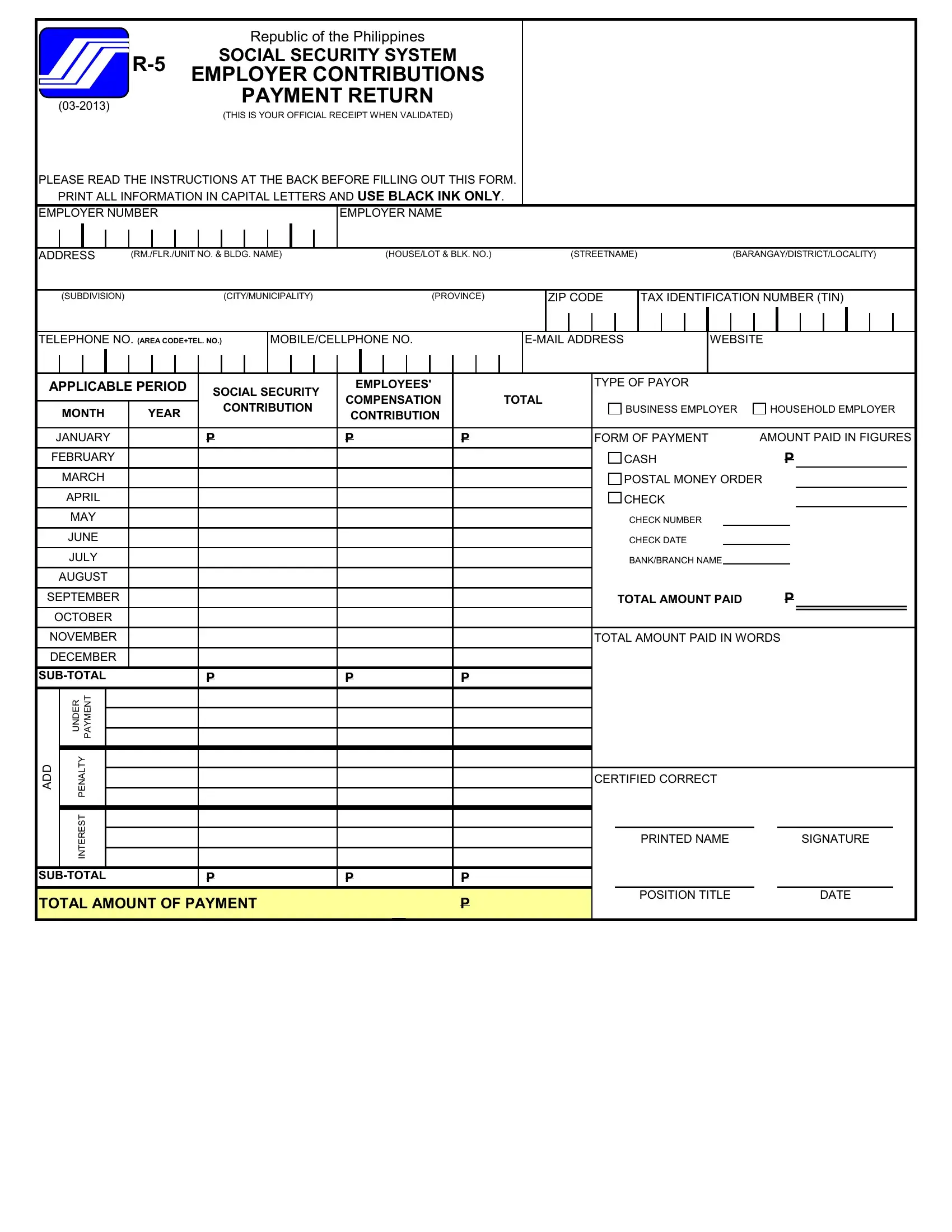

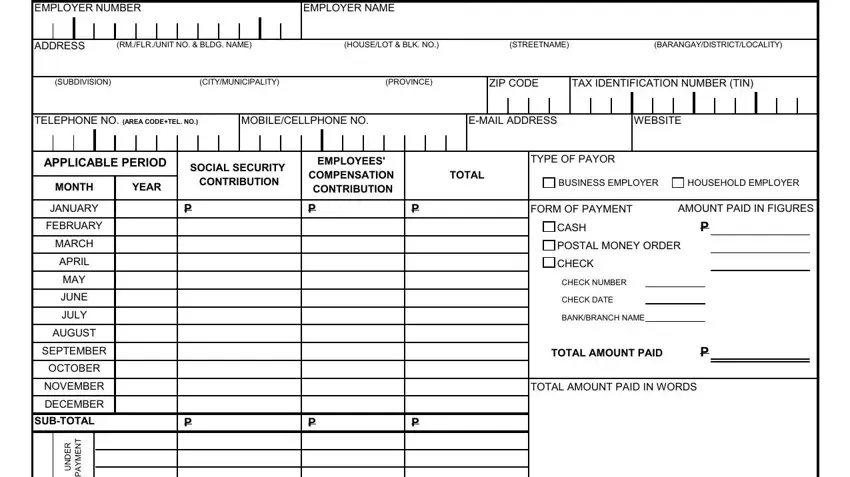

As a way to complete this PDF document, ensure you provide the required information in each blank:

1. The sss downloadable forms r5 necessitates specific information to be inserted. Be sure that the subsequent fields are completed:

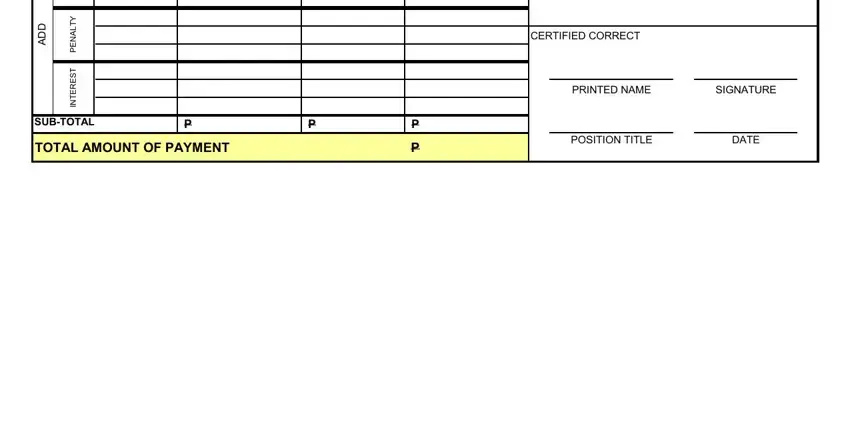

2. Right after finishing the last step, go on to the next part and fill in the necessary details in all these blanks - CERTIFIED CORRECT, PRINTED NAME, SIGNATURE, POSITION TITLE, DATE, D D A, T R N E E D M N Y U A P, Y T L A N E P, T S E R E T N, CON SUBTOTAL, and TOTAL AMOUNT OF PAYMENT.

You can certainly make a mistake while completing the T R N E E D M N Y U A P, consequently be sure you take another look prior to deciding to send it in.

Step 3: Proofread the information you've entered into the blanks and hit the "Done" button. Create a free trial account with us and obtain direct access to sss downloadable forms r5 - available in your personal account page. FormsPal guarantees safe form completion devoid of data recording or sharing. Feel comfortable knowing that your details are secure here!