In the evolving landscape of tax compliance, the South Carolina Department of Revenue (SC DOR) mandates the use of specific forms for tax reporting, central to which are Form ST-3 and Form ST-389 for reporting sales and local taxes respectively. These forms are essential tools for businesses in ensuring compliance with state tax obligations. Form ST-3 is designed for the reporting of sales and use tax, reflecting a fundamental compliance requirement for businesses operating within the state. On the other hand, Form ST-389 plays a critical role for businesses that engage in transactions subjected to local taxes, such as the Capital Project Tax, Local Option Tax, School District Tax, Property Offset Tax, and Transportation Tax. The necessity for businesses to navigate through these tax obligations requires a thorough understanding of the conditions under which local taxes apply and how they should be accurately reported. This includes knowledge about specific exemptions from local taxes that can significantly affect the amount of tax owed. Moreover, with regular updates and revisions to tax laws and forms, as seen in the most recent revision of these forms, businesses must stay informed to maintain compliance. Failure to accurately calculate, report, and pay the appropriate taxes by the stipulated deadlines can result in penalties and interests, underscoring the importance of these forms in the broader context of state tax administration.

| Question | Answer |

|---|---|

| Form Name | St 389 Form |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | sc st 389 form, st 389 instructions, sctax, SC |

ESSENTIAL INFORMATION FOR

Please read carefully and keep this booklet in a convenient place for future reference.

INTRODUCTION |

penalties and interest must be calculated and paid, or an |

|||

|

|

assessment will be issued. |

|

|

The South Carolina Department of Revenue is requiring taxpayers to |

|

|

||

report their taxes on Form |

LOCAL SALES TAX: The local taxes are due if the sale was made or |

|||

|

|

|||

Form |

|

products were delivered into a local tax county. The local taxes authorized |

||

|

to be collected by counties include: |

|||

Business Name |

|

|||

|

Capital Projects |

Local Option |

||

Address |

|

|||

|

School District |

Property Offset |

||

Retail License Number or Purchaser's Certificate (Use Tax |

Transportation |

|

||

Registration) |

|

|

|

|

Federal Employer Identification Number |

The local sales or use tax is applicable if the county has approved the tax |

|||

by referendum. The county/jurisdiction codes applicable to these taxes |

||||

Period covered |

|

|||

|

are indicated on the Form |

|||

|

|

|||

Please draw a line through any incorrect information, enter corrections |

within a listed municipality, you must use the municipality code for your |

|||

and check box on your return. If it is necessary to use blank returns, be |

location. |

|

||

sure to indicate the information listed above or other identifying |

|

|

||

information (social security number). |

|

LOCAL TAX FILING NOTICE: If your business is located in a county that |

||

|

|

|||

|

|

is imposing a local tax in addition to the 5% Sales and Use Tax, Form |

||

FILING REQUIREMENTS |

||||

If you have a retail license or use tax registration, you are required to file |

zero must be placed beside the appropriate county/jurisdiction code on |

|||

Form |

|

|||

a tax return even if there is no tax due for the period. See Business Tax |

|

|||

|

|

|||

Telefile instructions for filing zero returns. |

If you are collecting and reporting another county's local taxes, Form |

|||

|

|

|||

Note: To file quarterly, annual, |

or seasonal contact SC DOR for |

|||

tax to a county or jurisdiction. Instructions for completing Form |

||||

approval. |

|

|||

|

located in this booklet. For more detailed information, request SC |

|||

|

|

|||

FORMS TO FILE |

|

Revenue Ruling |

||

|

|

|

||

Form |

EXEMPTIONS FROM LOCAL TAXES |

|||

use tax due in this state. |

|

|||

|

|

The following transactions are exempt from local taxes: |

||

Form |

Sales covered by the maximum tax limitation: aircraft, motor vehicles, |

|||

portion of local tax to a county or municipality based upon sales or |

motorcycles, boats, recreational vehicles, or |

|||

deliveries within the county or municipality. You are required to file a |

construction equipment, |

|

||

Form |

|

Mobile homes (does not apply to contents) |

||

your business is located in a county that imposes a local tax or |

Sales of musical instruments and office equipment sold to religious |

|||

your business delivers to a county with local tax, regardless of |

organizations, |

|

||

whether your business is or is not located in a county that imposes a |

Construction contracts (Must have prior Department approval.) |

|||

local tax. |

|

Sales of certain food which may be lawfully purchased with USDA |

||

|

|

food stamps are exempt from the School District Tax. This exemption |

||

The |

applies to everyone, not just persons using food stamps. |

|||

Capital Project Tax |

Local Option Tax |

|

|

|

School District Tax |

Property Offset Tax |

CHANGE IN OWNERSHIP |

||

Transportation Tax |

|

|||

|

Any change in ownership will |

require a new owner to complete a |

||

|

|

|||

Business Tax Application, Form

WHEN TO FILE

Sales and use tax returns are due on or before the twentieth (20th) day of the month following the close of the period covered. You must file a tax return for every tax reporting period, even if no tax is due for the period. To file your zero gross sales return by phone, call

Monthly Filers:

January reporting period - submit return no later than February 20.

February reporting period - submit return no later than March 20.

March reporting period submit return no later than April 20, etc. December reporting period - submit no later than January 20 (of the next year).

Quarterly Filers:

First Quarter (January, February, March) reporting period - submit no later than April 20

Second Quarter (April, May, June) reporting period - submit no later than July 20

Third Quarter (July, August, September) reporting period - submit no later than October 20

Fourth Quarter (October, November, and December) reporting period - submit no later than January 20 (of the next year)

Annual Filers: (Sales for the entire year)

Submit the December return no later than January 20 (of the next year).

Seasonal Filers: Seasonal filers are required to file returns only for those months scheduled to be reported. Submit seasonal returns no later than the 20th of the next month.

If the return is not filed and/or any taxes due are not paid by the twentieth day of the month due, no taxpayer discount will be allowed, and the return is considered delinquent; applicable

CHANGE OF LOCATION

Any change of location will require written notification to be sent to the Department of Revenue by submitting Form SC8822 (included in this booklet) or visit our website: sctax.org > DORBOS.

CLOSING YOUR BUSINESS

When closing or selling your business you are required by South Carolina law to return your Sales and Use Tax license to the South Carolina Department of Revenue indicating the date of closing. You must file all returns and pay all taxes due. Complete enclosed Form

NO CREDITS: CLAIM A REFUND

For overpayments of tax previously paid to the Department, a taxpayer must file a claim in writing with the Department for a refund. The taxpayer may submit a claim in the form of a letter or a completed Form

the name, address, and telephone number of the taxpayer or contact person;

the appropriate taxpayer identification number or numbers;

the tax period or date for which the tax was paid;

the nature and kind of tax paid;

the amount which the taxpayer claims was erroneously paid;

a statement of facts and documentation supporting the taxpayer's position;

a statement outlining the reasons for the claim, including any law or other authority upon which the taxpayer relies; and

any other relevant information that the department may reasonably require.

If the refund request is timely and in order, a refund will be issued.

6

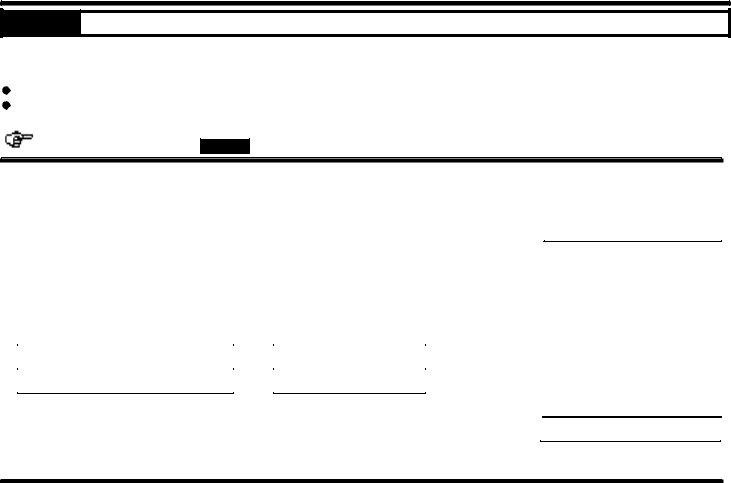

Please read this section before completing your form.

(Rev. 9/5/02)

All entries must be typed or hand printed, clearly and legibly. If using a

If you have a retail license or a use tax registration, you are required to file a tax return even if there is NO TAX DUE for the period. For zero returns, see Business Tax Telefile instructions.

WHEN FILING "NO SALES" RETURNS, please enter zeroes on lines 1 and 3 only on the

COMPLETE THE SALES AND USE TAX WORKSHEET ON THE BACK OF THE

IMPORTANT: If it is determined that no entry is needed on a line (other than lines 1 and 3), PLEASE LEAVE LINES BLANK. Do not write on the lines that do not pertain to you.

STEP 1 COMPLETING THE SALES AND USE TAX WORKSHEET

SAMPLE SALES AND USE TAX WORKSHEET (from the back of

Sales and Use Tax |

|

|

1. |

Gross Proceeds of Sales/Rentals, Withdrawals for Own Use |

1. |

2. |

2. |

|

3. |

Total (Add lines 1 and 2. Enter here and on line 1 on front of return.) |

3. |

4. Sales and Use Tax Allowable Deductions (Itemize by Type of Deduction and Amount of Deduction)

74,000.00

3,000.00

77,000.00

Column A |

|

Column B |

Type of Deduction |

See line 4 |

Amount of Deduction |

|

instructions |

|

Sales Exempt During "Sales Tax Holiday" |

$ |

1,000.00 |

|

|

|

|

|

|

|

Sales for Resale |

$ |

30,000.00 |

|

|

Sales to Federal Government |

$ |

9,000.00 |

|

|

5.Amount of Deductions (Total Column B. Enter here and on line 2 on front of return.)

6.Net Sales and Purchases (Line 3 minus line 5.)

If local tax is applicable, enter this amount on line 1 of the Local Tax Worksheet.

SAMPLE

5. < 40,000.00 >

6. |

37,000.00 |

|

SALES AND USE TAX WORKSHEET INSTRUCTIONS

LINES 1 through 6

Line 1: Gross Proceeds of Sales/Rentals, Withdrawals for Own Use

Enter the total amount of all sales (taxable and nontaxable), leases and/or rentals made by the business for the reporting period. Nontaxable sales are to be deducted on line 5. DO NOT INCLUDE THE AMOUNT OF SALES TAX COLLECTED.

You must also report purchases of tangible personal property (merchandise, equipment, etc.) purchased tax free at wholesale, but used by you and/or your employees. When purchasing merchandise

Line 2:

Enter the total purchases of tangible personal property purchased from an

Line 3: Total

Add lines 1 and 2. Enter total here and on Line 1 on the front of

Line 4: Sales and Use Allowable Deductions

To claim a deduction relating to a sale, the sales transaction must be reported on line 1 or 2 of this worksheet. Enter the type of deduction (see list below) in Column A and the dollar amount of the sale in Column B. South Carolina law provides for a deduction from gross proceeds of sales those items specifically exempt from tax. The list below is used to

14

identify some of the items to be shown as a deduction. Any amount claimed as a deduction on your return must be itemized in Column A and B of this worksheet. You are required to maintain records that will support all deductions claimed on this return. A further explanation of deductions is available by obtaining a copy of the South Carolina

Sales and Use Tax Code of Laws by contacting the Department's Central Office, the Taxpayer Service Centers or visit our website: www.sctax.org

Examples of Allowable Deductions: (Not all inclusive) Sales for resale

Manufacturers Agriculture

Sales to Federal government

Medicine and prosthetic devices (by prescription) Gasoline sales

Installation charges (separately stated on invoice)

Excess over tax cap Mobile Home (Less 35%)

Credit for taxes paid to other states Food purchased with food stamps Sales Tax Holiday exempt sales

1% tax reduction for purchases made by individuals age

85 and older for their own use

NOTE: This 1% tax reduction does not apply to local tax calculation.

Line 5: Total Amount of Deductions (Total Column B. Enter here and line 2 on front of return)

Line 6: Net Sales and Purchases (Line 3 minus line 5)

STEP 2

Calculation of 5% Sales and Use Tax |

SAMPLE SALES AND USE TAX INSTRUCTIONS

SALES AND USE TAX

1.Gross Proceeds of Sales, Rentals, Use Tax and W ithdrawals for Own Use (From line 3 of Sales and Use Tax Worksheet on reverse side)

2.Total Amount of Deductions (From line 5 of Sales and Use Tax Worksheet)

3. Net Taxable Sales (Line 1 minus line 2) |

5% |

|

4.Tax (Line 3 x 5% (.05))

5.Taxpayer's Discount (For timely filed returns only) If your combined tax liability is less than $100.00, the discount rate is 3% (.03) of line 4. If the total is $100.00 or more, the discount is 2% (.02) of line 4.

(Combined Discount cannot exceed $3000.00 per fiscal year, returns for June through May, which are filed July through June.)

6. Sales and Use Tax Net Amount Payable (Line 4 minus line 5)

7.Penalty _________________ , Interest ___________________

(Add Sales and Use Tax penalty and interest. Enter total on line 7 at right.)

OFFICE USE ONLY: ___________________________

8. Total Sales and Use Tax Due (Add lines 6 and 7)

1

2

3

4

5

6

7

8

7 7 0 0 0

4 0 0 0 0

3 7 0 0 0

1 8 5 0

3 7

1 8 1 3

1 8 1 3

.

.

.

.

.

.

.

.

0 0

0 0

0 0

0 0

0 0

0 0

0 0

IMPORTANT: If it is determined that no entry is needed on a line, PLEASE LEAVE LINES BLANK. Do not write on the lines that do not pertain to you.

Line 1 Gross Proceeds of Sales: Enter the gross proceeds of sales, rentals, use tax and withdrawals for own use. Enter the total from line 3 of your worksheet. Do not include sales tax collected in this amount.

Line 2 Total Amount of Deductions: Enter the total amount of deductions from line 5 of your worksheet.

Line 3 Net Taxable Sales: Subtract line 2 from line 1.

Line 4 Tax (Multiply line 3 x 5% (.05).)

Line 5 Taxpayer's Discount: A taxpayer's discount may be claimed when the return is filed and the tax due is paid in full on or before the due date of the return. No discount is allowed if the return or payment is received after the due date. The discount is computed as follows:

If your combined tax liability (line 4,

Note: Discounts are not allowed to exceed $3,000 per taxpayer (for all locations) during any one South Carolina fiscal year, which covers payments made from July 1 through June 30. This includes all returns which become due during this period (returns for June through May). The $3,000 maximum includes the total discounts for sales/use and local taxes. Taxpayers who file and pay electronically are allowed a $3,100 maximum discount. The discount amount is $10,000 for

15

Line 6 Sales and Use Tax Net Amount Payable: Line 4 minus 5.

Line 7 Penalty and Interest: Enter the total of Penalty and Interest, from calculations below or visit our website: www.sctax.org

PENALTY FOR FAILURE TO FILE A RETURN: Five percent (.05) of the amount of tax due (from line 4 on the front of the return) for each month or fraction of a month of delinquency, not to exceed

PENALTY FOR FAILURE TO PAY TAX DUE: The penalty is

INTEREST: Interest is assessed in accordance with 6621 and 6622 of the Internal Revenue Code. Rates are based on the prime rate, subject to change quarterly and are compounded daily.

Line 8 Total Sales and Use Tax: Enter the total of lines 6 and 7.

STEP 3

WOULD LOCAL TAX APPLY?

Only complete this section if one of the following applies:

Your business is located in a county that imposes a local tax, even if the local tax due is zero.

Your business delivers to county with local tax, regardless of whether your business is or is not located in a county that imposes a local tax.

If this does not apply, go to

STEP 6

.

SAMPLE LOCAL TAX WORKSHEET (from the back of form

Local Taxes

1.Net Sales and Purchases (From line 6 of Sales and Use Tax Worksheet.)

2.Local Tax Allowable Deductions

Column A |

Column B |

Type of Deduction |

Amount of Deduction |

Deliveries to counties without Local |

|

17,100.00 |

Tax |

$ |

|

|

$ |

|

1.37,000.00

SAMPLE

$

Total Allowable Deductions (Total Column B)

3.Total Net Taxable Local Sales (Line 1 minus line 2.) Should agree with

Note: W hen your sales, purchases and withdrawals are made or delivered into a locality with more than one local tax, the total on form

2.

3.

17,100.00

19,900.00

LOCAL TAX WORKSHEET INSTRUCTIONS

Complete this section of the return if you sold, purchased or delivered property for use in a county with a local tax. This worksheet is to assist you in determining the proper amount required to be allocated on Form

Line 1 Net Sales and Purchases:

Enter amount from line 6 of sales and use tax worksheet.

16

Line 2 Local Tax Allowable Deductions:

Certain transactions are taxable for the state's 5% Sales and Use Tax, but are exempt from SC local sales and use tax. Some examples are:

Deliveries to counties without local tax

Quarterly and annual filers remitting tax on the first reporting period after the implementation date may use the worksheet to calculate the amounts not subject to the local tax

Taxable portion of all sales which fall under the $300 maximum tax. (i.e. automobiles, mobile homes, etc.)

This is not a complete listing of Local Tax exemptions. You may contact the South Carolina Department of Revenue at

(803)

Line 3 Total Net Taxable Local Sales: (Subtract line 2 from line 1)

Total should agree with Column A, line 1, last page of

Note: If your sales, purchases and withdrawals are used or delivered in a county with more than one local tax, the taxable amount on line 2, last page of

STEP 4 |

|

ST |

CALCULATING LOCAL TAX |

|

|

|

|

||||||||||

1. CAPITAL PROJECT TAX |

(A) |

|

|

|

(B) |

|

(C) |

(D) |

|||||||||

For Office |

|

|

Name of |

Code |

Net Taxable |

|

|

|

Local |

|

Discount |

Net Amount |

|||||

Use Only |

|

|

County or |

|

|

Amount |

|

|

|

Tax |

|

|

|

After Discount |

|||

|

|

|

|

Jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AIKEN |

|

1002 |

|

|

|

x 1% = |

|

|

|

- |

|

= |

|

|

|

|

|

ALLENDALE |

|

1003 |

|

|

|

x 1% = |

|

|

- |

|

= |

|

|

|

|

|

|

NEWBERRY |

|

1036 |

|

3,500.00 |

|

x 1% = |

35.00 |

- |

.70 = |

34.30 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORANGEBURG |

|

1038 |

|

12, 000.00 |

|

x 1% = |

|

120.00 |

- |

2.40 = |

117.60 |

||

|

|

|

|

YORK |

1046 |

|

|

|

x 1% = |

|

|

|

- |

|

= |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS FOR COMPLETING FORM

The Form

If you do not have a preprinted form, please enter the business name and address, retail license or registration number and the period ended as shown on Form

Use instructions below to complete Columns A, B, C, and D for Capital Project and School District Taxes.

Column A Net Taxable Sales or Purchase: Enter net taxable sales or purchases made for each county or jurisdiction. Credits are not allowed to be taken on this form. (See credits section located in this booklet under Essential Information.)

Column B Local Tax: Multiply Column A by 1% (.01) and enter results in Column B for each county or jurisdiction.

Column C Discount: A taxpayer's discount may be claimed when the return is filed and the tax due is paid in full on or before the due date of the return. No discount is allowed if the return or payment is received after the due date. The discount is computed as follows:

Use same discount rate as used for line 5, form

Note: Discounts are not allowed to exceed $3,000 per taxpayer (for all locations) during any one South Carolina fiscal year, which covers payments made from July 1 through June 30. This includes all returns which become due during this period (returns for June through May). The $3,000 maximum includes the total discounts for sales /use and local tax. Taxpayers who file and pay electronically are allowed a $3,100 maximum discount. The discount amount is $10,000 for

Column D Net Amount After Discount: (Column B minus Column C) Enter total in Column D.

17

|

4. LOCAL OPTION TAX |

|

(A) |

(B) |

|

(C) |

(D) |

||||||||

|

For Office |

|

Name of |

|

Code |

Net Taxable |

Local |

|

Discount |

Net Amount |

|||||

|

Use Only |

|

County or |

(See back |

Amount |

Tax |

|

|

|

After Discount |

|||||

|

|

|

Jurisdiction |

of form) |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

NOTE: Sales at your location, if you are in a local option jurisdiction |

|

|

|

|

|

|

|||||||||

|

|

|

FLORENCE |

|

|

1021 |

|

300.00 x 1% = |

3.00 |

- |

.06 = |

2.94 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: Sales delivered to other local option jurisdiction/city/municipality. |

|

|

|

|

|

|

||||||||

|

|

|

BATESBURG |

|

2057 |

|

3,200.00 x 1% = |

32.00 |

- |

.64 = |

31.36 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMTER |

|

|

2880 |

|

900.00 x 1% = |

9.00 |

- |

.18 = |

8.82 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Column A from pages 1, 2 |

19,900.00 |

|

|

|

|

|

||

and all |

1 . |

|

|

|

|

|

|||

|

|

|

|

|

199.00 |

|

|

|

|

2. |

Total Column B from pages 1, 2 and all |

2 |

|

|

|

||||

3. |

Total Column D from pages 1, 2 and all |

|

|

|

|

|

3 |

195.02 |

|

|

|

|

|

||||||

4. |

Penalty ________________ Interest ________________ |

OFFICE USE ONLY: _________________ |

4 |

|

|||||

|

|||||||||

|

|

|

|

|

|||||

|

(Add Local Tax Penalty and Interest) |

|

|

|

|

|

|

|

|

5. |

Total (Add lines 3 and 4) |

Enter amount on line 9, |

5 |

195.02 |

|||||

|

|||||||||

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS FOR COMPLETING FORM

Transportation, Property Offset and Local Option Taxes are reported on page 2.

Local Option taxes are to be reported on page two only of the ST389 and

Name of County or Jurisdiction: This column is used to identify a particular county or municipality where delivery takes place. A list of counties which impose the 1% local option sales and use tax is located on the back of Form

Code: Enter the code for the named county or municipality based upon codes identified on the back of the Form

Column A Net Taxable Amount: Enter net taxable sales or purchases made for each county or municipality. Credits are not allowed to be taken on this form. (See credits section located in this booklet under Essential Information.)

Column B Local Tax: Multiply Column A by 1% (.01) and enter results in Column B for each county or municipality.

Column C Discount: A taxpayer's discount may be claimed when the return is filed and the tax due is paid in full on or before the due date of the return. No discount is allowed if the return or payment is received after the due date. The discount is computed as follows:

Use the same discount rate as used on line 5 of form

Note: Discounts are not allowed to exceed $3,000 per taxpayer (for all locations) during any one South Carolina fiscal year, which covers payments made from July 1 through June 30. This includes all returns which become due during this period (returns for June through May). The $3,000 maximum includes the total discounts for sales /use and local tax. Taxpayers who file and pay electronically are allowed a $3,100 maximum discount. The discount amount is $10,000 for

Column D Net Amount After Discount: (Column B minus Column C) Enter net discount amount in Column D.

Line 1:

Line 2:

Line 3:

Line 4:

PENALTY FOR FAILURE TO FILE A RETURN: Five percent (.05) of the amount of local tax due (on line 3) for each month or fraction of a month of delinquency, not to exceed

18

PENALTY FOR FAILURE TO PAY TAX DUE: The penalty is

The penalty for failure to file and pay must be combined and entered as a total on line 4.

INTEREST: Interest is assessed in accordance with 6621 and 6622 of the Internal Revenue Code. Rates are based on the prime rate, subject to change quarterly and are compounded daily.

Line 5: Add lines 3 and 4. Enter the total of Column D from line 5 on

Make a copy of the completed Form

Reminder: All pages of Form

STEP 5

LOCAL TAX

REMINDER:

If this section does not apply, go to line 10.

9. Total Local Taxes Due (From Column D, line 5, last page of form |

9 |

1 9 5

.

0

2

STEP 6

10. TOTAL AMOUNT DUE (Add lines 8 and 9) |

10 |

2 0 0 8

.

0 2

STEP 7

Sign and date your return on the

DON'T FORGET Returns are past due after the 20th of the month.

If you are not using preprinted forms and it is necessary to use blank forms, be sure to include your social security number or Federal Employer Identification number in the label section.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.

19