Are you familiar with Standard Form 1443? It is a form used by the US government to provide insurance coverage to contractors and other individuals who may be working on behalf of the federal government or have pre-approved contracts in place. This document is an important way for federal entities to make sure their contractor’s liability is properly managed, as well as ensuring that any applicable compensation packages are accurately paid. In this blog post, we will break down what Standard Form 1443 entails, how it affects your business dealings with the federal government, and why it’s necessary for compliance purposes. Read on to explore this vital document!

| Question | Answer |

|---|---|

| Form Name | Standard Form 1443 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | progress payment request form, omb 3090 0105, 20d, 14a |

|

|

|

|

|

|

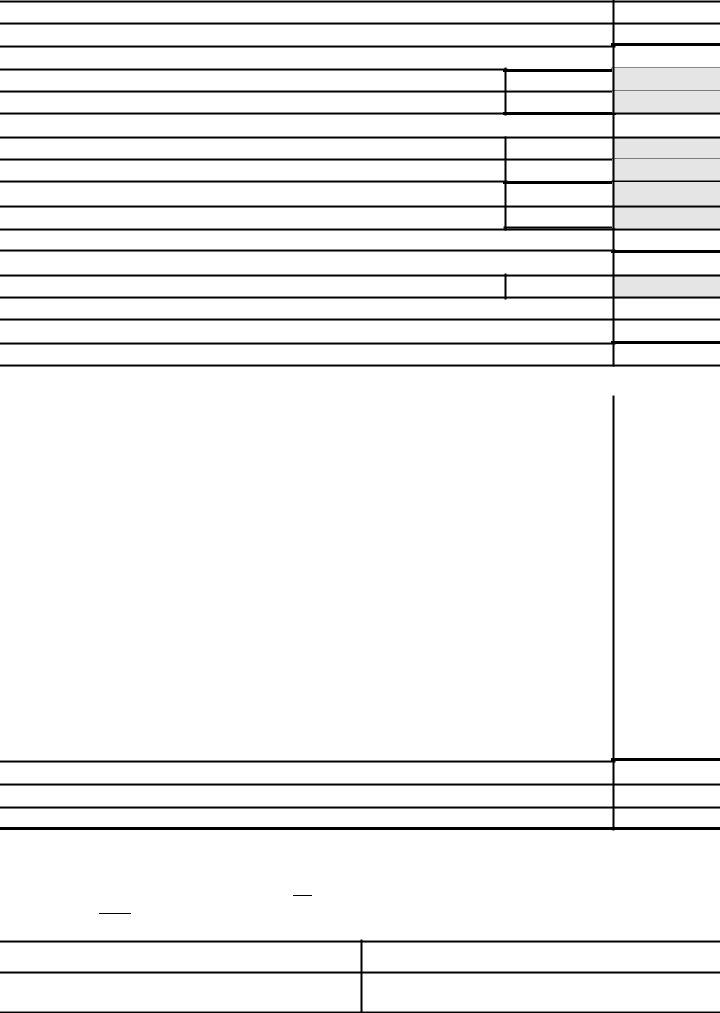

CONTRACTOR’S REQUEST FOR PROGRESS PAYMENT |

|

|

|

Form approved |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OMB No. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT: This form is to be completed in accordance with Instructions on reverse. |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

SECTION I - IDENTIFICATION INFORMATION |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

1. TO: NAME AND ADDRESS OF CONTRACTING OFFICE |

|

|

|

|

1. FROM: NAME AND ADDRESS OF CONTRACTOR (Include ZIP Code) |

|||||||||||||||

|

|

(Include ZIP Code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

PAYING OFFICE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. SMALL BUSINESS |

4. CONTRACT NO. |

|

5. CONTRACT PRICE |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 YES |

9 NO |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

6. |

RATES |

|

|

7. DATE OF INITIAL AWARD |

|

|

8A. PROGRESS PAYMENT REQUEST |

|

8B. DATE OF THIS REQUEST |

|||||||||||

|

A. PROG PYMTS. |

B. LIQUIDATION |

|

A. YEAR |

|

B. MONTH |

|

NO. |

|

|

|

|

|

|

|||||||

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

SECTION II - STATEMENT OF COSTS UNDER THIS CONTRACT THROUGH _______________ |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Date) |

||||

9.PAID COSTS ELIGIBLE UNDER PROGRESS PAYMENT CLAUSE

10.INCURRED COSTS ELIGIBLE UNDER PROGRESS PAYMENT CLAUSE

11.TOTAL COSTS ELIGIBLE FOR PROGRESS PAYMENTS (Item 9 plus 10)

$

12.a. TOTAL COSTS INCURRED TO DATE

$

b. ESTIMATED ADDITIONAL COST TO COMPLETE

13. ITEM 11 MULTIPLIED BY ITEM 6a

14.a. PROGRESS PAYMENTS PAID TO SUBCONTRACTORS

b. LIQUIDATED PROGRESS PAYMENTS TO SUBCONTRACTORS

c. UNLIQUIDATED PROGRESS PAYMENTS TO SUBCONTRACTORS (item 14a less 14b)

d. SUBCONTRACT PROGRESS BILLINGS APPROVED FOR CURRENT PAYMENT

e. ELIGIBLE SUBCONTRACTOR PROGRESS PAYMENTS (Item 14c plus 14d)

15. TOTAL DOLLAR AMOUNT (Item 13 plus 14e)

16. ITEM 5 MULTIPLIED BY ITEM 6b

17.LESSER OF ITEM 15 OR ITEM 16

18.TOTAL AMOUNT OF PREVIOUS PROGRESS PAYMENTS REQUESTED

19 MAXIMUM BALANCE ELIGIBLE FOR PROGRESS PAYMENTS (Item 17 less 18)

SECTION III - COMPUTATION OF LIMITS FOR OUTSTANDING PROGRESS PAYMENTS

*SEE SPECIAL INSTRUCTIONS ON BACK FOR USE UNDER THE FEDERAL ACQUISITION REGULATION

20. COMPUTATION OF PROGRESS PAYMENT CLAUSE (a (3)(i) or a(4)(i)) LIMITATION* |

$ |

|

a.COSTS INCLUDED IN ITEM 11, APPLICABLE TO ITEMS DELIVERED, INVOICED, AND ACCEPTED TO THE |

|

|

DATE IN HEADING OF SECTION II. |

|

|

b. COSTS ELIGIBLE FOR PROGRESS PAYMENTS, APPLICABLE TO UNDELIVERED ITEMS AND TO |

|

|

DELIVERED ITEMS NOT INVOICED AND ACCEPTED (Item 11 less 20a) |

|

|

|

|

|

c. ITEM 20b MULTIPLIED BY ITEM 6a |

$ |

|

|

|

|

d. ELIGIBLE SUBCONTRACTOR PROGRESS PAYMENTS (item 14e) |

|

|

|

|

|

e. LIMITATION a(3)(i) or a(4)(i) (Item 20c plus 20d)* |

|

|

|

|

|

21. COMPUTATION OF PROGRESS PAYMENT CLAUSE (a(3)(ii) or a(4)(ii) LIMITATION* |

|

|

a. CONTRACT PRICE OF ITEMS DELIVERED, ACCEPTED AND INVOICED TO DATE IN HEADING OF |

|

|

SECTION II |

|

|

b. CONTRACT PRICE OF ITEMS NOT DELIVERED, ACCEPTED AND INVOICED (Item 5 less 21a) |

|

|

|

|

|

c. ITEM 21b MULTIPLIED BY ITEM 6b |

|

|

|

|

|

d. UNLIQUIDATED ADVANCE PAYMENTS PLUS ACCRUED INTEREST |

|

|

e. LIMITATION (a(3)(ii) or a (4)(ii)) (Item 21c less 21d)* |

|

|

22. MAXIMUM UNLIQUIDATED PROGRESS PAYMENTS (Lesser of Item 20e or 21e) |

|

|

|

|

|

23. TOTAL AMOUNT APPLIED AND TO BE APPLIED TO REDUCE PROGRESS PAYMENT |

|

|

|

|

|

24.UNLIQUIDATED PROGRESS PAYMENTS (item 18 less 23)

25.MAXIMUM PERMISSIBLE PROGRESS PAYMENTS (Item 22 less 24)

26.AMOUNT OF CURRENT INVOICE FOR PROGRESS PAYMENT (Lesser of Item 25 or 19)

27.AMOUNT APPROVED BY CONTRACTING OFFICER

CERTIFICATION

I certify that the above statement (with attachments) has been prepared from the books and records of the

which would affect or impair the Government’s title, that there has been no materially adverse change in the financial condition of the contractor since submission of the most recent

written information dated by the contractor to the Government in connection with the contract, that to the extent of any contract provision limiting progress payments pending

first article approval, such provision has been complied with, and that after the making of the requested progress payment the unliquidated progress payments will not exceed the maximum unliquidated progress payments permitted by the contract

NAME AND TITLE OF CONTRACTOR REPRESENTATIVE SIGNING THIS FORM

SIGNATURE

NAME AND TITLE OF CONTRACTING OFFICER

SIGNATURE

NSN |

STANDARD FORM 1443 |

|

|

|

Prescribed by GSA (FPR |

|

|

FAR (48 CFR 53.232) |

INSTRUCTIONS

GENERAL - All entries on this form must be typewritten - all dollar amounts must be shown in whole dollars, rounded up to the next whole dollar. All line item numbers not included in the instructions below are

SECTION I — IDENTIFICATION INFORMATION. Complete Items 1 through 8c in accordance with the following instructions:

Item 1. TO — Enter the name and address of the cognizant Contract Administration Office. PAYING OFFICE — Enter the designation of the paying office, as indicated in the contract.

Item 2. FROM - CONTRACTOR’S NAME AND ADDRESS/ZIP CODE — Enter the name and mailing address of the contractor. If applicable, the division of the company performing the contract should be entered immediately following the contractor’s name.

Item 3. Enter an “X” in the appropriate block to indicate whether or not the contractor is a small business concern.

Item 5. Enter the total contract price, as amended. If the contract provides for escalation or price redetermination, enter the initial price until changed and not the ceiling price; if the contract is of the incentive type, enter the target or billing price, as amended until final pricing. For letter contracts, enter the maximum expenditure authorized by the contract, as amended.

Item 6A. PROGRESS PAYMENT RATES — Enter the

Item 6B. LIQUIDATION RATE — Enter the progress payment liquidation rate shown in paragraph (b) of the progress payment clause using three digits - Example: show 80% as 800 - show 72.3% as 723.

Item 7. DATE OF INITIAL AWARD — Enter the last two digits of the calendar year. Use two digits to indicate the month. Example: show January 1982 as 82/01.

Item 8A. PROGRESS PAYMENT REQUEST NO. — Enter the number assigned to this request. All requests under a single contract must be numbered consecutively, beginning with 1. Each subsequent request under the same contract must continue in sequence, using the same series of numbers without omission.

Item 8B. Enter the date of the request.

SECTION II — GENERAL INSTRUCTIONS. DATE. In the space provided in the heading enter the date through which costs have been accumulated from inception for inclusion in this request. This date is applicable to item entries in Sections II and III.

Cost Basis. For all contracts with Small Business concerns, the base for progress payments is total costs incurred. For contracts with concerns other than Small Business, the progress payment base will be the total recorded paid costs, together with the incurred costs per the Computation of Amounts paragraph of the progress payment clause in FPR

Manufacturing and Production Expense, General and Administrative Expense. In connection with the first progress payment request on a contract, attach an explanation of the method, bases and period used in determining the amount of each of these two types of expenses. If the method, bases or periods used for computing these expenses differ in subsequent requests for progress payments under this contract, attach an explanation of such changes to the progress payment request involved.

Incurred Costs Involving Subcontractors for Contracts with Small Business Concerns. If the incurred costs eligible for progress payments under the contract include costs shown in invoices of subcontractors, suppliers and others, that portion of the costs computed on such invoices can only include costs for: (1) completed work to which the prime contractor has acquired title;

(2)materials delivered to which the prime contractor has acquired title; (3) services rendered; and (4) costs billed under cost reimbursement or time and material subcontracts for work to which the prime contractor has acquired title.

SECTION II - SPECIFIC INSTRUCTIONS

Item 9. PAID COSTS ELIGIBLE UNDER PROGRESS PAYMENT CLAUSE — Line 9 will not be used for Small Business Contracts. For large business contracts, costs to be shown in Item 9 shall include only those recorded costs which have resulted at time of request in payment made by cash, check, or other form of actual payment for items or services purchased directly for the contract. This includes items delivered, accepted and paid for, resulting in liquidation of subcontractor progress payments.

Costs to be shown in Item 9 are not to include advance payments, downpayments, or deposits, all of which are not eligible for reimbursement; or progress payments made to subcontractors,

suppliers or others, which are to be included in Item 14. See “Cost Basis” above.

Item 10. INCURRED COSTS ELIGIBLE UNDER PROGRESS PAYMENT CLAUSE — For all Small Business Contracts, Item 10 will show total costs incurred for the contract.

Costs to be shown in Item 10 are not to include advance payments, dow payments, deposits, or progress payments made to subcontractors, suppliers or others.

For large business contracts, costs to be shown in Item 10 shall include all costs incurred (see “Cost Basis” above) for: materials which have been issued from the stores inventory and placed into production process for use on the contract; for direct labor; for other direct

Item 12a. Enter the total contract costs incurred to date; if the actual amount is not known, enter the best possible estimate. If an estimate is used, enter (E) after the amount.

Item 12b. Enter the estimated cost to complete the contract. The estimate may be the last estimate made, adjusted for costs incurred since the last estimate; however, estimates shall be made not less frequently than every six months.

Items 14a through 14e. Include only progress payments on subcontracts which conform to progress payment provisions of the prime contract.

Item 14a. Enter only progress payments actually paid.

Item 14b. Enter total progress payments recouped from subcontractors.

Item 14d. For Small Business prime contracts, include the amount of unpaid subcontract progress payment billings which have been approved by the contractor for the current payment in the ordinary course of business. For other contracts, enter “0" amount.

SECTION III — SPECIFIC INSTRUCTIONS. This Section must be completed only if the contractor has received advance payments against this contract, or if items have been delivered, invoiced and accepted as of the date indicated in the heading of Section II above. EXCEPTION: Item 27 must be filled in the Contracting Officer.

Item 20a. Of the costs reported in Item 11, compute and enter only costs which are properly allocable to items delivered, invoiced and accepted to the applicable date. In order of preference, these costs are to be computed on the basis of one of the following: (a) The actual unit cost of items delivered, giving proper consideration to the deferment of the starting load costs or, (b) projected unit costs (based on experienced costs plus the estimated cost to complete the contract), where the contractor maintains cost data which will clearly establish the reliability of such estimates.

Item 20d. Enter amount from 14e.

Item 21a. Enter the total billing price, as adjusted, of items delivered, accepted and invoiced to the applicable date.

Item 23. Enter total progress payments liquidated and those to be liquidated from billings submitted but not yet paid.

Item 25.

Item 26.

SPECIAL INSTRUCTIONS FOR USE UNDER FEDERAL ACQUISITION REGULATION (FAR).

Items 20 and 20e. Delete the references to a (3)(i) of the progress payment clause.

Items 21 and 21e. Delete the references to a (3)(ii) of the progress payment clause.

STANDARD FORM 1443 BACK