The Standard 269 form, officially titled the Financial Status Report (Long Form), is a crucial document for entities receiving federal funding, playing a pivotal role in ensuring transparency and accountability in the use of federal funds. The form requires detailed financial information, including total outlays, refunds, rebates, program income, and net outlays, thereby providing a comprehensive overview of financial activities related to a specific grant or funding period. Entities must report whether the financial status is based on a cash or accrual basis, indicating the method used to recognize transactions. It delves into specifics, such as the federal agency and organizational element to which the report is submitted, identifiable numbers like the Employer Identification Number (EIN), and various aspects of funding, including the funding/grant period and the period covered by the report. Critical sections of the form account for indirect expenses, allowing for the delineation of rates applied and the total federal share of indirect costs. Importantly, the form serves as a certification by the recipient that all listed outlays and obligations are for purposes outlined in the award documents, underscoring the form's role in enforcing compliance and facilitating oversight. With its detailed instructions for completion and emphasis on accuracy, the Standard 269 form is not just a financial reporting tool but also a testament to the structured and regulated management of federal funds.

| Question | Answer |

|---|---|

| Form Name | Standard Form 269 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | standard form 269 financial status report, 11d, standard form 269a financial status report, OMB |

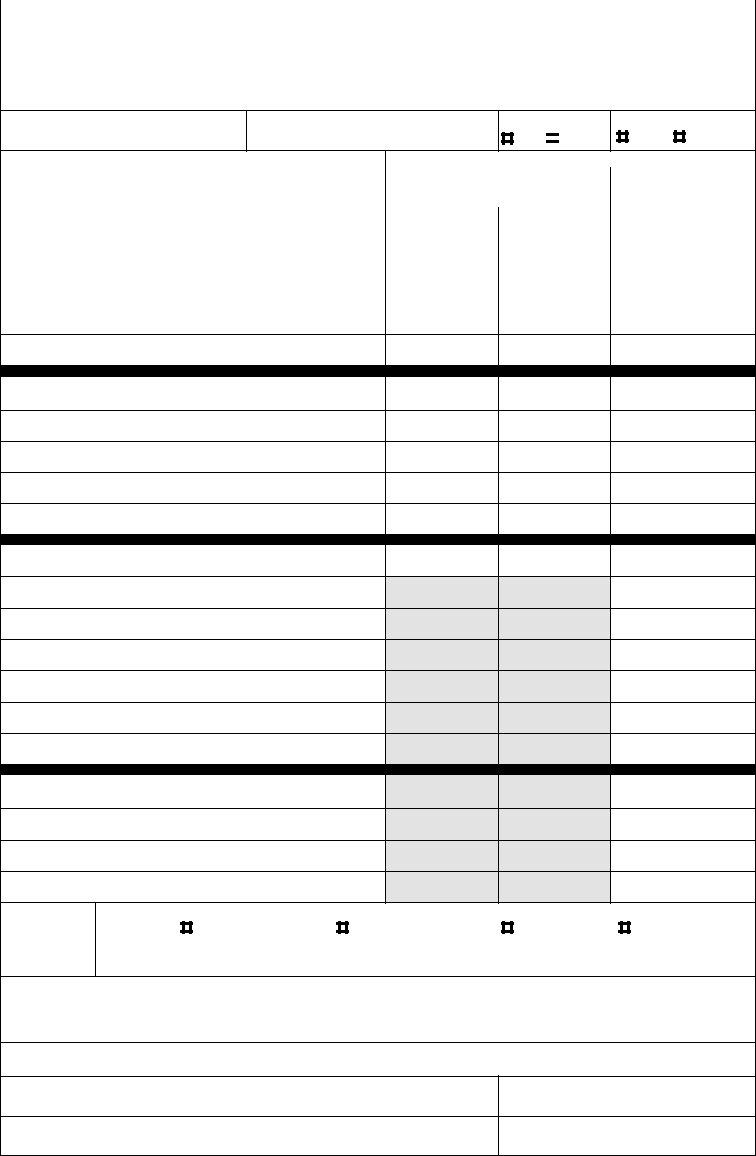

FINANCIAL STATUS REPORT

(Long Form)

(Follow instructions on the back)

1. Federal Agency and Organizational Element |

2. Federal Grant or Other Identifying Number Assigned |

OMB Approval |

Page of |

|

to Which Report is Submitted |

By Federal Agency |

No. |

|

|

|

|

|

pages |

|

|

|

|

|

|

|

|

|

|

|

3. Recipient Organization (Name and complete address, including ZIP code)

4. Employer Identification Number

5. Recipient Account Number or Identifying Number

6. Final Report

YES NO

7. Basis

CASH

ACCRUAL

8. Funding/Grant Period (See instructions) |

|

|

9. Period Covered by this Report |

|

||

From: (Month, Day, Year) |

|

To: (Month, Day, Year) |

From: (Month, Day, Year) |

|

To: (Month, Day, Year) |

|

|

|

|||||

|

|

|

|

|

|

|

10. Transactions: |

|

|

I |

II |

III |

|

|

|

|

|

Previously Reported |

This Period |

Cumulative |

a. |

Total outlays |

|

|

|

|

|

|

|

|

|

|

|

|

b. |

Refunds, rebates, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

c. |

Program income used in accordance with the deduction alternative |

|

|

|

||

d.Net outlays (Line a, less the sum of lines b and c)

Recipient's share of net outlays, consisting of:

e.Third party

f.Other Federal awards authorized to be used to match this award

g.Program income used in accordance with the matching or cost sharing alternative

h.All other recipient outlays not shown on lines e, f or g

i.Total recipient share of net outlays (Sum of lines e, f, g and h)

j.Federal share of net outlays (line d less line i)

k.Total unliquidated obligations

l.Recipient's share of unliquidated obligations

m.Federal share of unliquidated obligations

n.Total Federal share (sum of lines j and m)

o.Total Federal funds authorized for this funding period

p.Unobligated balance of Federal funds (Line o minus line n)

Program income, consisting of:

q.Disbursed program income shown on lines c and/or g above

r.Disbursed program income using the addition alternative

s.Undisbursed program income

t.Total program income realized (Sum of lines q, r and s)

11.Indirect

Expense

a.Type of Rate (Place "X" in appropriate box)

|

PROVISIONAL |

PREDETERMINED |

FINAL |

FIXED |

||

|

|

|

|

|

|

|

b. Rate |

|

c. Base |

|

d. Total Amount |

|

e. Federal Share |

|

|

|

|

|

|

|

12.Remarks: Attach any explanations deemed necessary or information required by Federal sponsoring agency in compliance with governing legislation.

13.Certification: I certify to the best of my knowledge and belief that this report is correct and complete and that all outlays and unliquidated obligations are for the purposes set forth in the award documents.

Typed or Printed Name and Title |

Telephone (Area code, number and extension) |

Signature of Authorized Certifying Official

Date Report Submitted

Previous Edition Usable |

Standard Form 269 (Rev. |

|

NSN |

|

Prescribed by OMB Circulars |

|

|

FINANCIAL STATUS REPORT

(Long Form)

Public reporting burden for this collection of information is estimated to average 30 minutes per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the Office of Management and Budget, Paperwork Reduction Project

PLEASE DO NOT RETURN YOUR COMPLETED FORM TO THE OFFICE OF MANAGEMENT AND BUDGET.

Please type or print legibly. The following general instructions explain how to use the form itself. You may need additional information to complete certain items correctly, or to decide whether a specific item is applicable to this award. Usually, such information will be found in the Federal agency's grant regulations or in the terms and conditions of the award (e.g., how to calculate the Federal share, the permissible uses of program income, the value of

ItemEntry

1, 2 and 3.

4.Enter the Employer Identification Number (EIN) assigned by the U.S. Internal Revenue Service.

5.Space reserved for an account number or other identifying number assigned by the recipient.

6.Check yes only if this is the last report for the period shown in item 8.

7.

8.Unless you have received other instructions from the awarding agency, enter the beginning and ending dates of the current funding period. If this is a

9.

10.The purpose of columns, I, II, and III is to show the effect of this reporting period's transactions on cumulative financial status. The amounts entered in column I will normally be the same as those in column III of the previous report in the same funding period . If this is the first or only report of the funding period, leave columns I and II blank. If you need to adjust amounts entered on previous reports, footnote the column I entry on this report and attach an explanation.

10a. Enter total gross program outlays. Include disbursements of cash realized as program income if that income will also be shown on lines 10c or 10g. Do not include program income that will be shown on lines 10r or 10s.

For reports prepared on a cash basis, outlays are the sum of actual cash disbursements for direct costs for goods and services, the amount of indirect expense charged, the value of

ItemEntry

10b. Enter any receipts related to outlays reported on the form that are being treated as a reduction of expenditure rather than income, and were not already netted out of the amount shown as outlays on line 10a.

10c. Enter the amount of program income that was used in accordance with the deduction alternative.

Note: Program income used in accordance with other alternatives is entered on lines q, r, and s. Recipients reporting on a cash basis should enter the amount of cash income received; on an accrual basis, enter the program income earned. Program income may or may not have been included in an application budget and/or a budget on the award document. If actual income is from a different source or is significantly different in amount, attach an explanation or use the remarks section.

10d, e, f, g, h, i and j.

10k. Enter the total amount of unliquidated obligations, including unliquidated obligations to subgrantees and contractors.

Unliquidated obligations on a cash basis are obligations incurred, but not yet paid. On an accrual basis, they are obligations incurred, but for which an outlay has not yet been recorded.

Do not include any amounts on line 10k that have been included on lines 10a and 10j.

On the final report, line 10k must be zero.

10l.

10m. On the final report, line 10m must also be zero.

10n, o, p, q, r, s and t.

11a.

11b. Enter the indirect cost rate in effect during the reporting period.

11c. Enter the amount of the base against which the rate was applied.

11d. Enter the total amount of indirect costs charged during the report period.

11e. Enter the Federal share of the amount in 11d.

Note: If more than one rate was in effect during the period shown in item 8, attach a schedule showing the bases against which the different rates were applied, the respective rates, the calendar periods they were in effect, amounts of indirect expense charged to the project, and the Federal share of indirect expense charged to the project to date.