When working in the online tool for PDF editing by FormsPal, it is easy to fill in or edit in state form 51923 right here. In order to make our tool better and less complicated to use, we continuously work on new features, with our users' feedback in mind. To get the process started, take these easy steps:

Step 1: Just click the "Get Form Button" in the top section of this page to open our pdf editor. Here you'll find everything that is necessary to work with your document.

Step 2: With this online PDF editor, you can actually accomplish more than merely fill out blank form fields. Edit away and make your docs appear professional with custom text added in, or fine-tune the file's original input to perfection - all that backed up by the capability to incorporate any graphics and sign the file off.

Pay attention when filling out this pdf. Make sure all required blanks are filled out accurately.

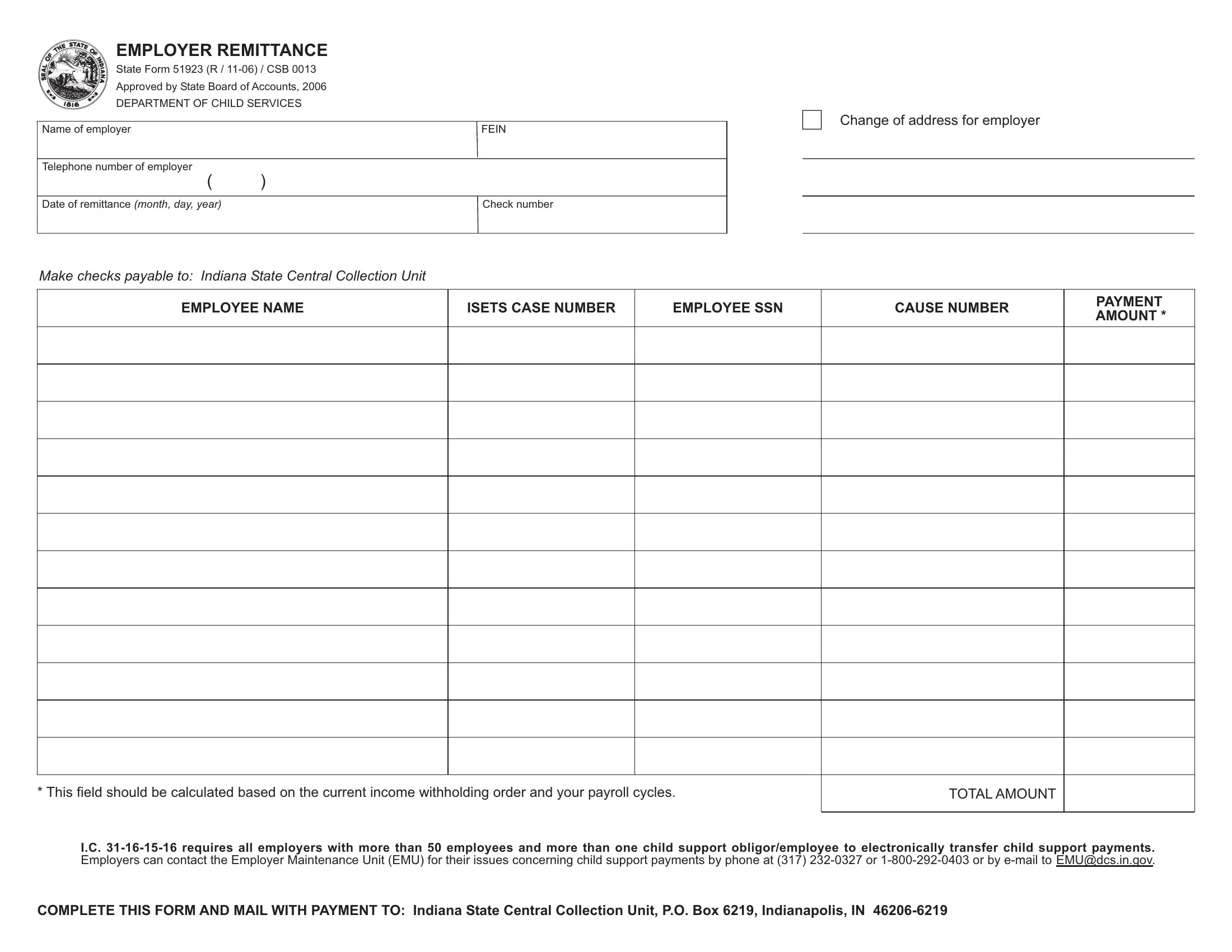

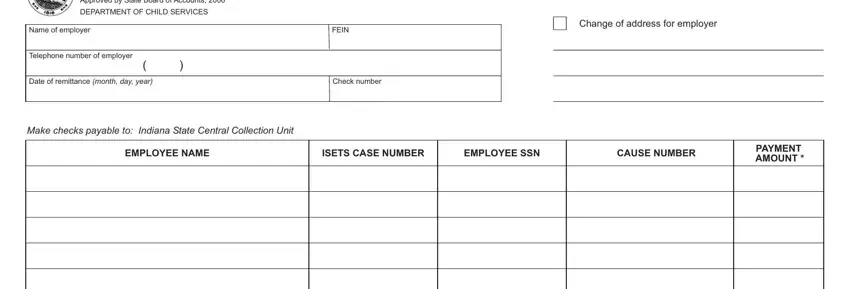

1. Firstly, when filling in the in state form 51923, start out with the page containing following blank fields:

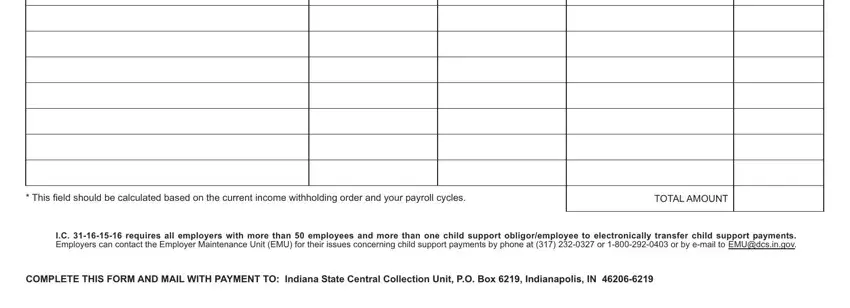

2. Once your current task is complete, take the next step – fill out all of these fields - This field should be calculated, TOTAL AMOUNT, IC requires all employers with, and COMPLETE THIS FORM AND MAIL WITH with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is possible to make an error while filling in your COMPLETE THIS FORM AND MAIL WITH, for that reason make sure you go through it again before you send it in.

Step 3: Check everything you have entered into the blank fields and then click on the "Done" button. Make a free trial plan at FormsPal and gain direct access to in state form 51923 - readily available inside your personal account page. If you use FormsPal, you can fill out forms without being concerned about information breaches or records getting distributed. Our protected software makes sure that your personal details are maintained safely.