Overvaluation can be completed online very easily. Just try FormsPal PDF editing tool to do the job quickly. FormsPal expert team is ceaselessly endeavoring to enhance the tool and insure that it is even better for people with its extensive functions. Enjoy an ever-improving experience now! To get the process started, go through these simple steps:

Step 1: Open the PDF file in our tool by clicking the "Get Form Button" in the top section of this page.

Step 2: The tool allows you to work with PDF files in a range of ways. Change it with your own text, correct what is originally in the file, and include a signature - all close at hand!

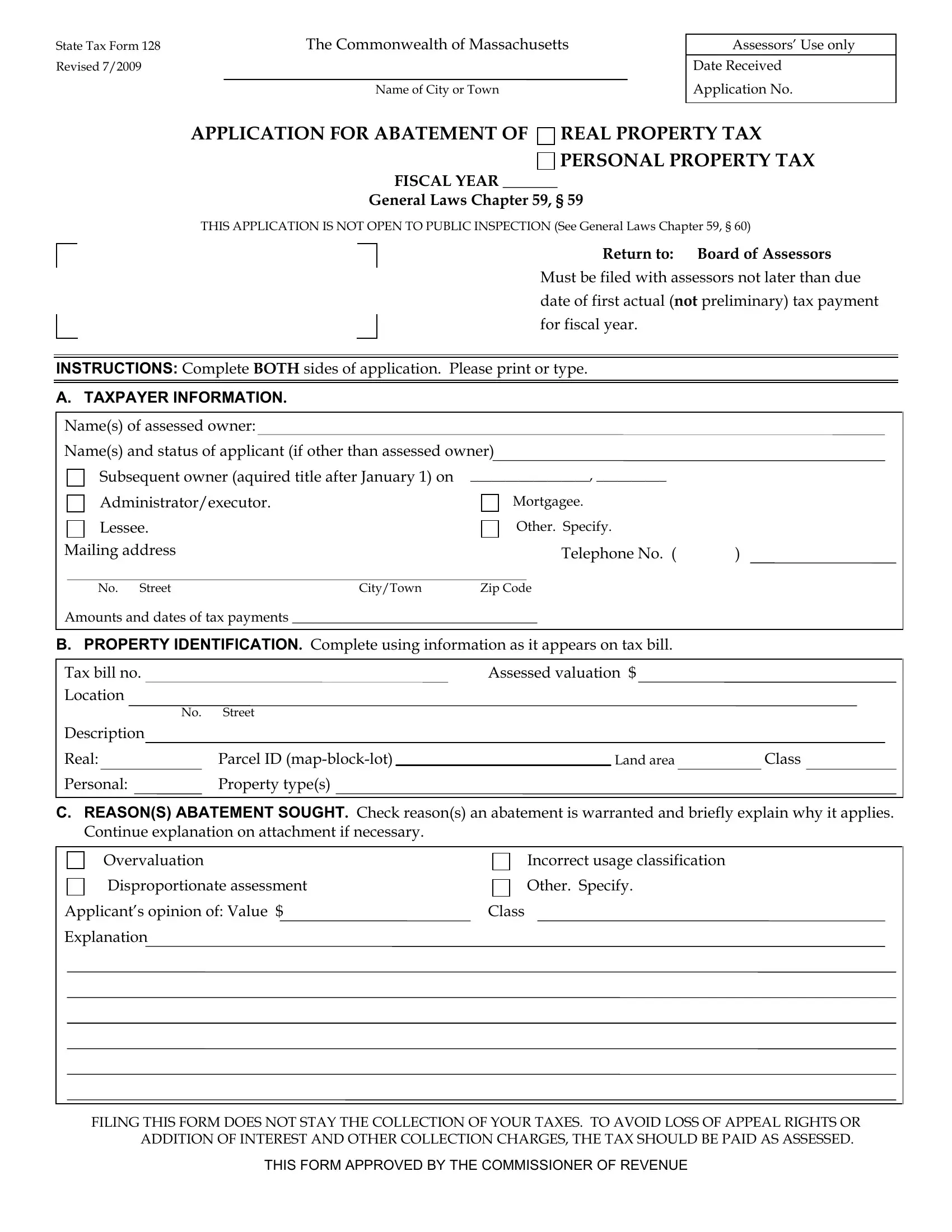

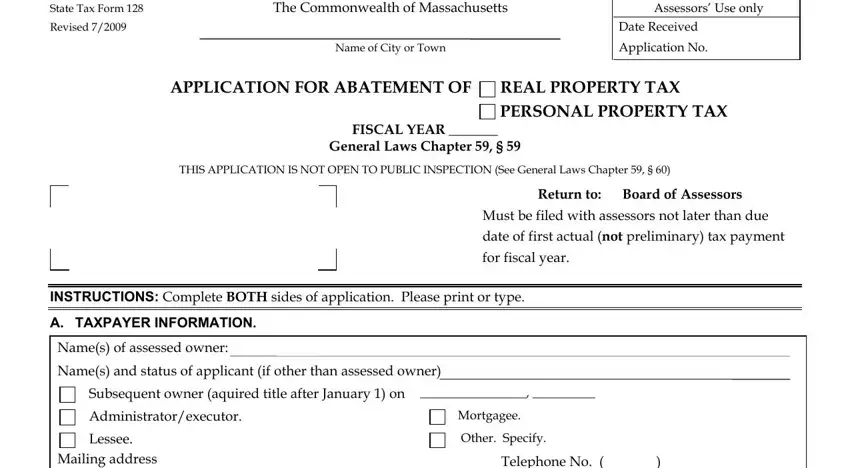

With regards to the blank fields of this particular document, here is what you want to do:

1. It is important to complete the Overvaluation properly, hence be attentive when filling out the sections that contain all these fields:

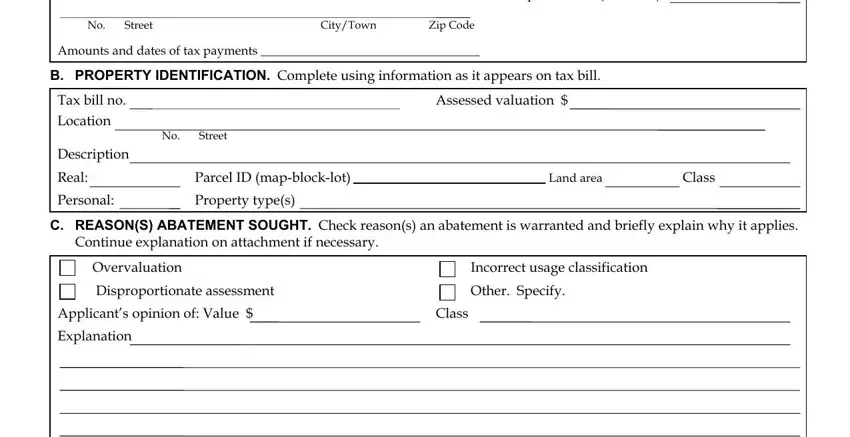

2. Your next step is to complete the following fields: Lessee Mailing address, Telephone No, No Street CityTown Zip Code, Amounts and dates of tax payments, B PROPERTY IDENTIFICATION Complete, Tax bill no Location No Street, Assessed valuation, Real, Personal, Parcel ID mapblocklot, Land area, Class, Property types, C REASONS ABATEMENT SOUGHT Check, and Continue explanation on attachment.

As to Land area and Tax bill no Location No Street, be certain that you take another look in this current part. The two of these are definitely the most significant ones in this file.

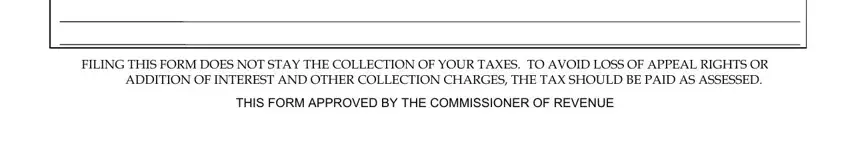

3. This third step is going to be hassle-free - fill in all of the empty fields in FILING THIS FORM DOES NOT STAY THE, and THIS FORM APPROVED BY THE to complete the current step.

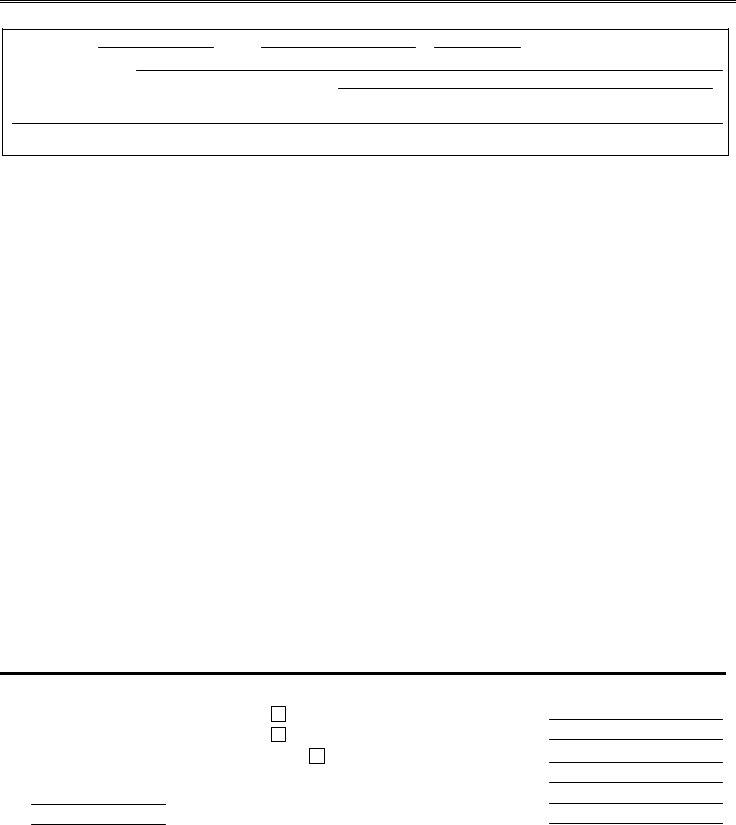

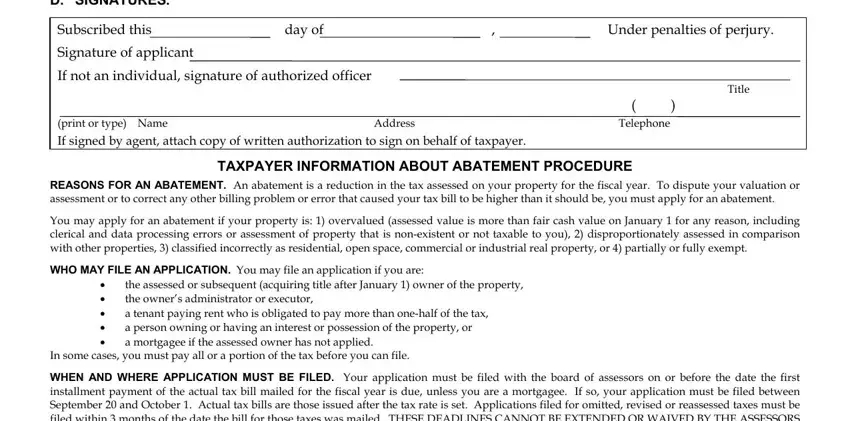

4. Filling out D SIGNATURES, Subscribed this, day of, Under penalties of perjury, Signature of applicant, If not an individual signature of, Title, print or type Name Address, TAXPAYER INFORMATION ABOUT, REASONS FOR AN ABATEMENT An, You may apply for an abatement if, WHO MAY FILE AN APPLICATION You, the assessed or subsequent, In some cases you must pay all or, and WHEN AND WHERE APPLICATION MUST BE is vital in the next part - ensure to don't hurry and take a close look at every single empty field!

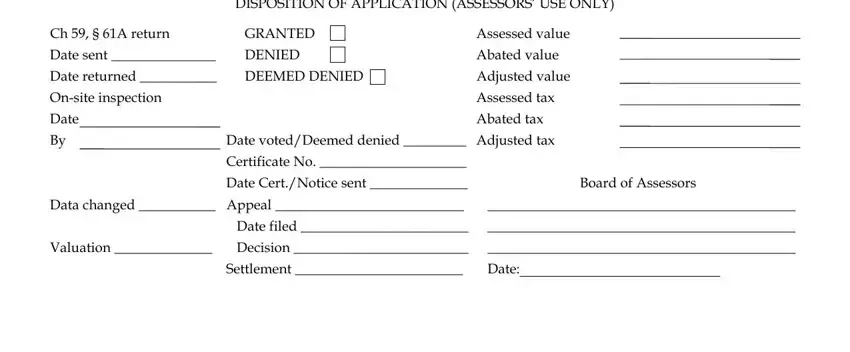

5. The pdf has to be completed by dealing with this section. Further you will notice a detailed set of form fields that need specific details to allow your document submission to be faultless: DISPOSITION OF APPLICATION, Assessed value Abated value, GRANTED DENIED DEEMED DENIED, Ch A return Date sent Date, and Board of Assessors.

Step 3: Before finalizing your document, you should make sure that all blank fields are filled out right. Once you think it is all good, press “Done." After registering a7-day free trial account with us, it will be possible to download Overvaluation or send it through email at once. The PDF file will also be accessible from your personal account page with your each and every change. FormsPal ensures your data privacy via a protected system that in no way saves or distributes any sort of sensitive information used in the file. Be confident knowing your documents are kept safe whenever you work with our editor!