In the picturesque Commonwealth of Massachusetts, the State Tax Form CL-1 stands as a vital tool for owners of forest, agricultural, horticultural, or recreational land seeking favorable tax classification under General Laws Chapter 61, §§ 1 & 2 – Chapter 61A, § 6 – Chapter 61B, § 3. Revised in September 2008, this form requires applicants to provide comprehensive details about their property, including location, size, and current usage, to determine eligibility for reduced tax rates associated with these specific land uses. By checking the appropriate classification, landowners embark on the path of detailing their land's existing condition—be it forested areas managed under a state-approved plan, agricultural lands with designated crop types and income generated, or recreational spaces offering natural preservation and activities. Importantly, this form not only serves as a gateway to potential tax benefits but also as a commitment by the landowner to maintain the property's designated use, supported by a rigorous verification process including income statements and management plans for initial applications. The detailed instructions aim to streamline the application process, ensuring that both the Commonwealth and its land stewards benefit from sustainable land management practices.

| Question | Answer |

|---|---|

| Form Name | State Tax Form Cl 1 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | what is a cl 1, tax form cl, massachusetts state tax form cl 1, mass state tax form cl1 |

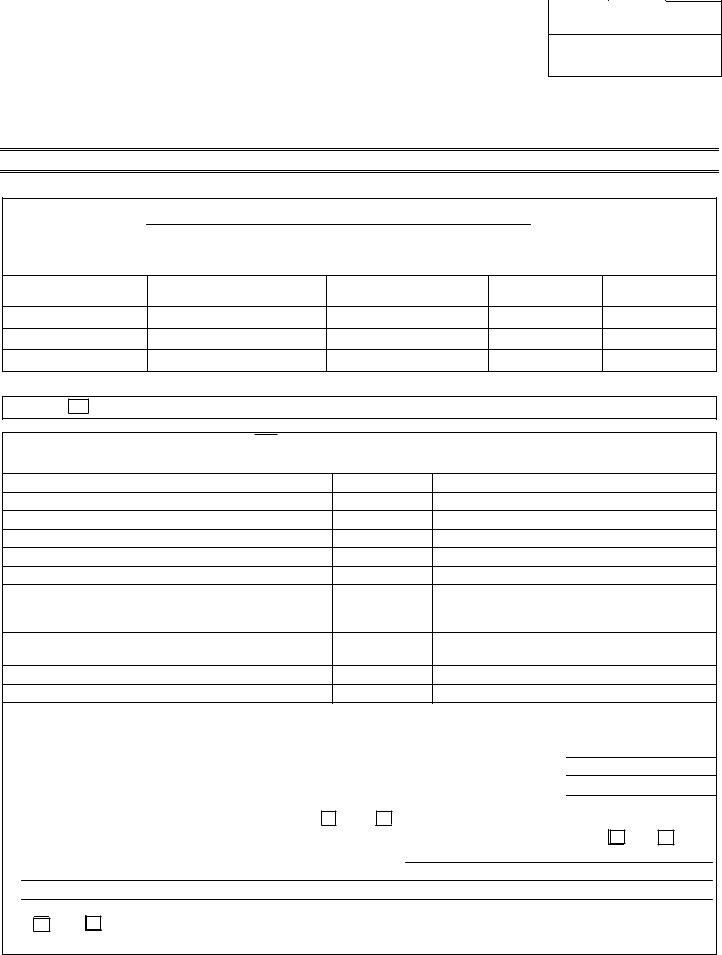

State Tax Form |

The Commonwealth of Massachusetts |

Revised 9/2008 |

|

|

|

|

Name of City or Town |

61 |

61A |

61B |

Assessors’ Use only

Date Received

Application No.

Fiscal Year _______ Application for

General Laws Chapter 61, §§ 1 & 2 – Chapter 61A, § 6 – Chapter 61B, § 3

INSTRUCTIONS: Complete all sections that apply. Please print or type.

A.IDENTIFICATION. Complete this section fully.

Name of Applicant(s):

Mailing Address:

No. Street |

City/Town |

Zip Code |

Property Covered by Application:

Location

Parcel Identification

Deed Reference

(Book & Page/Cert. No.)

Total Acres

Acres to be

Classified

B. TYPE OF CLASSIFICATION. Check the classification you are seeking and provide the required information.

FOREST Attach State Forester’s Certificate and Approved Forest Management Plan.

AGRICULTURAL or HORTICULTURAL

1.Current use of land. List by classes established by the Farmland Valuation Advisory Commission, if applicable.

Land Use by Class

No. of Acres

Specific Use, Crops Grown

a.Vegetables, Tobacco, Sod and Nursery Cropland

b.Dairy, Beef and Hay Cropland

c.Orchards, Vineyards and Blueberries Cropland

d.Cranberries

e.Christmas Trees

f.Productive Woodland (Attach copy of State Forester’s Certificate and Approved Management Plan if initial application, or new/revised plan)

g.Cropland Pasture, Permanent Pasture and Necessary and Related Land

h.Contiguous

i.Other Agricultural or Horticultural (Specify)

2.Statement of income in preceding year. Supporting documentation, including copies of your federal and state tax income returns, may be requested to verify your income.

a. Gross sales from agricultural or horticultural use |

$ |

b. Amount received under MA or US Soil Conservation or Pollution Abatement Program |

$ |

Total (Provide a detailed description of the source of the farm income listed above) |

$ |

3.Previous use of land. Was the land valued, assessed and taxed as classified agricultural or horticultural land

|

under c. 61A for the prior 2 fiscal years? |

Yes |

|

No |

|

|

|

|

|

|

|||

If no, was the use of the land during the prior 2 fiscal years the same as the current use described above? |

Yes |

No |

||||

If no, describe in detail the use of the land during the prior 2 fiscal years |

|

|

||||

If no, was your farm income during either of the prior 2 fiscal years less than the amount reported above? |

|

|

||||

Yes |

No |

|

|

|

|

|

If yes, list the income for the year $ __________________________ Fiscal year _____________

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

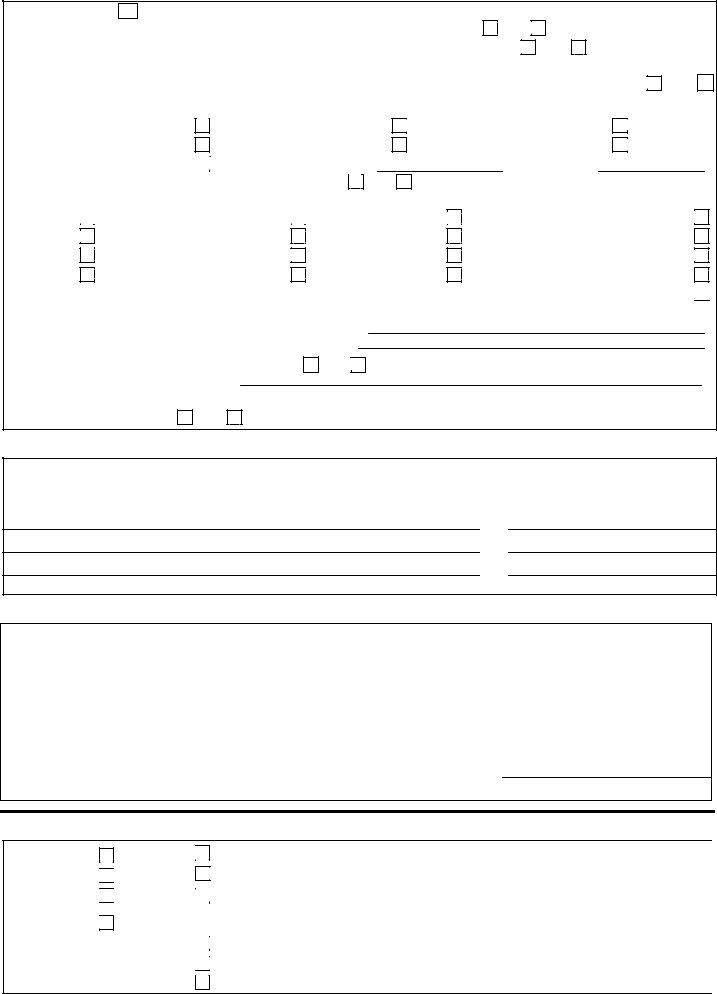

RECREATIONAL |

Land may qualify based on its condition or recreational use. |

|

|

1. Is the land retained in substantially a natural, wild or open condition? Yes |

No |

|

|

Is the land in a landscaped or pasture condition or managed forest condition? |

Yes |

No |

|

If managed forest, attach copy of State Forester’s Certificate and Approved Management Plan if initial application, or new/revised plan.

Does the land allow to a significant extent the preservation of wildlife and other natural resources? Yes |

No |

If yes, indicate which natural resources are preserved: |

|

Ground Water/Surface Water |

|

|

Clean Air |

Rare/Endangered Species |

|

|

Geologic Features |

High Quality Soils |

|

|

Other (specify) |

|

|

||

|

|

|

|

|

|

|

|

2. Is the land used primarily for recreational use? |

Yes |

No |

|||

If yes, indicate for which recreational activity: |

|

|

|||

Archery |

|

Picnicking |

|

|

Camping |

|

|

|

|||

Fishing |

Golfing |

Hang gliding |

Vegetation

Scenic Resources

Other (specify)

Nature Study & Observation

Hiking |

Target Shooting |

Hunting |

Private |

Boating |

Skiing |

Swimming |

Horseback Riding |

Commercial Horseback Riding &

Equine Boarding

How often is the land used for recreational activities?

How many people use the land for those activities?

Is the land open to the general public? Yes |

No |

If no, to whom is its use restricted? |

|

Is the land used for horse racing, dog racing or any sport normally undertaken in a stadium, gymnasium or

similar structure? Yes |

No |

C. LESSEE CERTIFICATION. If any portion of property is leased, the following statement must be signed by each lessee.

I hereby certify that the property I lease is being used as described in this application and that I intend to use the

property in that manner during the period to which the application applies. |

|

Lessee |

Date |

D.SIGNATURE. All owners must sign here to complete the application.

This application has been prepared or examined by me. Under the pains and penalties of perjury, I declare that to the best of my knowledge and belief, it and all accompanying documents and statements are true, correct and complete. I also certify that I have signed and attached a Property Owner’s Acknowledgement of Rights and Obligations under classified forest, agricultural or horticultural or recreational land programs, as part of this application.

Owner |

|

Date |

|

|

|

|

|

|

|

|

|

If signed by agent, attach copy of written authorization to sign on behalf of taxpayer.

DISPOSITION OF APPLICATION (ASSESSORS’ USE ONLY)

Ownership

Min. Acres Use/Condition

Gross Sales

All |

|

|

|

Date Voted/Denied |

|

Part |

|

|

GRANTED |

Date Notice Sent |

|

Deemed |

|

|

|

Board of Assessors |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All |

|

|

|

|

|

Part |

|

|

DENIED |

|

|

|

|

|

|

||

|

|

|

|

||

Deemed |

|

|

|

Date |

|