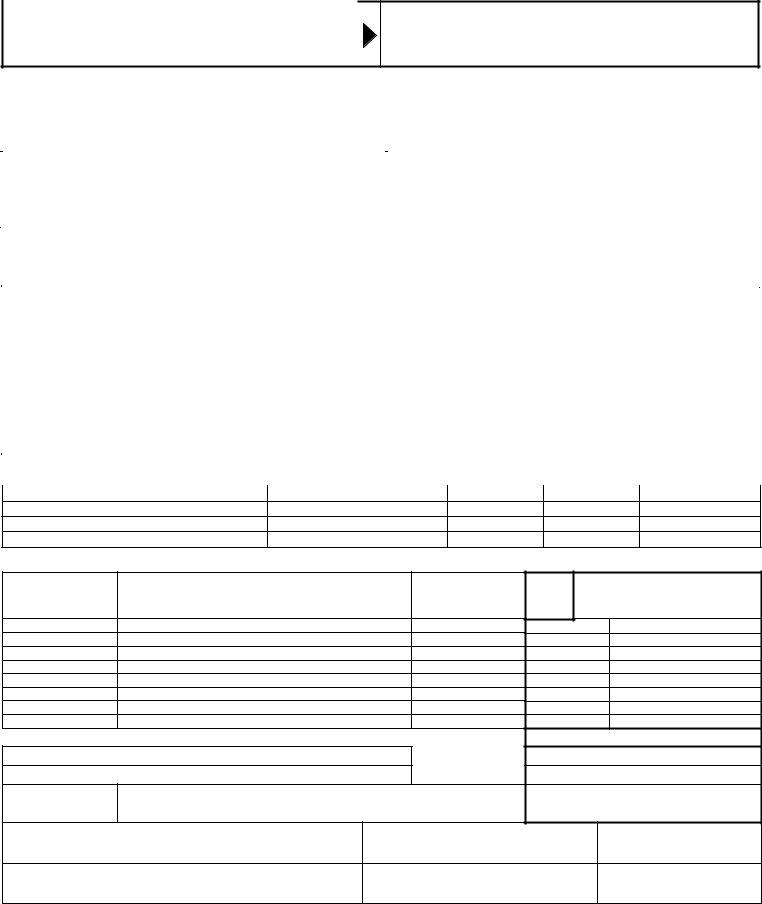

Navigating the complexities of the Statement of Personal Property, a crucial form for businesses in Madison as of January 1, 2021, requires careful attention to detail. This document, integral for the accurate assessment of personal property within the city, mandates thorough completion and adherence to specific instructions for its submission by March 1, 2021. By demanding a comprehensive disclosure of ownership information, including but not limited to the name of the business and its owners, type of ownership, and the exact location of the personal property, the form ensures a detailed inventory of a business's assets. Moreover, it differentiates between various categories of personal property such as leased or loaned items, leasehold improvements, supplies, machinery, tools, patterns, furniture, fixtures, office equipment, and computer equipment & software, clarifying specific exemptions and providing guidance for those items subject to tax or penalty if not reported correctly. With sections dedicated to reporting ownership changes, leased space details, and the year and cost of acquisitions, transfers, or disposals, the Statement of Personal Property form is designed to create a transparent and fair assessment process, overseen by the Office of the City Assessor in Madison, WI. This form not only aids in the accurate levying of personal property taxes but also serves as a critical document for businesses to maintain accurate records of their tangible assets.

| Question | Answer |

|---|---|

| Form Name | Statement Of Personal Property Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | LLC, Leasehold, Copiers, F2 |

Form 2A |

STATEMENT OF PERSONAL PROPERTY |

|

|

SUBJECT TO ASSESSMENT IN THE CITY OF MADISON, JANUARY 1, 2021 |

|

|

PROPER SCHEDULES MUST BE FILLED IN COMPLETELY BEFORE THIS STATEMENT WILL BE ACCEPTED. |

|

|

(If the spaces provided are not adequate to disclose all details, submit the details in separate schedules.) |

|

|

|

|

RETURN BY MARCH 1, 2021

TO THE ASSESSOR

personalproperty@cityofmadison.com

OFFICE OF THE CITY ASSESSOR 210 Martin Luther King Jr. Blvd # 101

Madison, WI |

|

OFFICE #: (608) |

FAX #: (608) |

|

|

|

PERSONAL PROPERTY BELONGING TO: |

|

|

|

|

|

|

OWNERSHIP INFORMATION |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF BUSINESS IF DIFFERENT THAN LABEL: |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DBA (Doing Business as) NAME: |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNERSHIP TYPE: |

Sole Owner |

Partnership |

LLP |

||||||

ADDRESS WHERE PERSONAL PROPERTY IS LOCATED: (When property is at more than one |

Corporation |

LLC Other: |

|

|

|

|

|

||||||||||||||||||||

location, please submit separate statements.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME(S) OF SOLE OWNER OR PARTNERS: |

|

BUSINESS PHONE: |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS DESCRIPTION: |

|

NAICS CODE: |

|||||||

OWNERSHIP CHANGE: (If you no longer own this property, please write the new owner’s name and |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

address and the date the change of ownership was effective in the space provided below and return it |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

to the Office of the City Assessor.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

/ |

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Date Effective |

|

Name of New Owner |

|

|

|

|

|

Mailing Address (Street, City, State, Zip Code) of New Owner |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

IF YOU OWN THE REAL ESTATE THAT YOU OCCUPY, DO NOT COMPLETE ITEMS 1 THROUGH 6 BELOW. |

|

|

|||||||||||||||||||||||||

1) |

Square Foot Area of |

|

2) |

Term: |

|

|

|

|

|

3) Base Rental: |

|

4) Is there a percentage rent clause? |

|||||||||||||||

|

Leased Space? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

From |

|

|

|

|

To |

|

|

|

$ |

|

|

|

per/mo. or per/yr. |

|

|

(% sales) |

Yes No |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

5) |

Option to Renew: |

|

|

6) |

Tenant Pays: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Date |

|

|

|

|

|

|

|

Electric |

Heat |

|

|

Real Estate Taxes |

Other |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE A - Leased or Loaned Property in Your Possession (Attach additional sheets if necessary.)

OWNER’S NAME & ADDRESS |

DESCRIPTION OF ITEMS |

|

LEASE TERM |

ESTIMATED |

|

|

|

|

MARKET VALUE |

|

|

|

|

|

|

|

From: |

To: |

|

|

|

From: |

To: |

|

|

|

From: |

To: |

|

|

|

From: |

To: |

|

SCHEDULE B - Leasehold Improvements (Round to Dollars.)

YEAR |

|

|

ORIGINAL |

|

IMPROVEMENTS |

DESCRIPTION OF LEASEHOLD IMPROVEMENTS |

|||

INSTALLED COST |

||||

WERE MADE |

|

|

||

|

|

|

||

2020 |

|

|

|

|

2019 |

|

|

|

|

2018 |

|

|

|

|

2017 |

|

|

|

|

2016 |

|

|

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

All PRIOR Years |

|

|

|

|

SCHEDULE G - Supplies |

|

|

||

TOTAL SUPPLIES PURCHASED LAST YEAR |

$ |

|

||

JANUARY 1, 2021 SUPPLIES |

............................................ |

$ |

|

|

DATE |

I, the undersigned, declare under penalties of law that I have personally |

|||

|

examined this statement and to the best of my knowledge and belief, it is true, |

|||

|

correct and complete. |

|

||

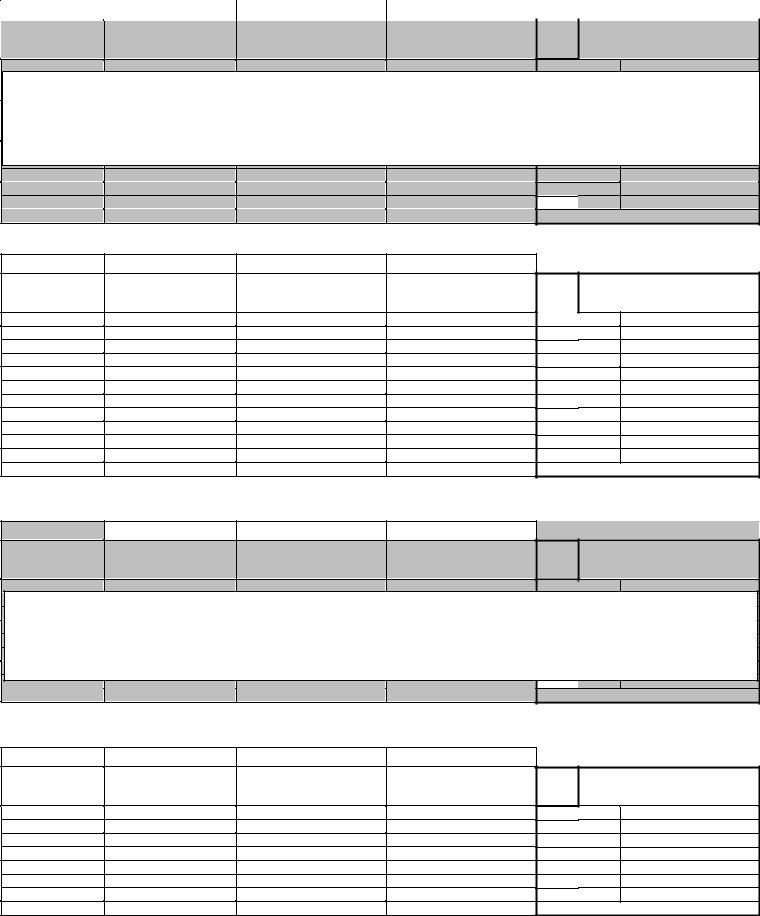

10 |

FOR ASSESSOR’S USE ONLY |

|

2020 .925

2019 .794

2018 .695

2017 .602

2016 .512

2015 .439

2014 .377

PRIOR .143

TOTAL

SUPPLIES

ALL OTHER

Reviewed by: |

Date: |

PREPARER (Please Print) |

Company |

SIGNATURE |

PHONE (with extension) |

Email: |

|

|

|

OWNER/OFFICER (Please Print) |

Title |

SIGNATURE |

PHONE (with extension) |

Email:

Rev. 12/10 F:\progress\aspprop\statemnt.doc

SCHEDULE D - Machinery, Tools & Patterns (Do not include licensed motor vehicles - they are exempt.)

|

Column 1 |

Column 2 |

Column 3 |

|

|

|

|

|

|

|

DISPOSALS & TRANSFERS |

FULL ORIGINAL COST |

|

|

|

|

|

YEAR |

ORIGINAL |

10 |

|

|

|

|||

AT COST |

at Jan. 1, 2021 |

|

|

FOR ASSESSOR’S USE ONLY |

|

|||

ACQUIRED |

INSTALLED COST |

|

|

|

||||

Jan. 1, 2020 to Jan. 1, 2021 |

(Total Column 1 & Column 2) |

|

|

|

|

|||

|

|

|

|

|

|

|

||

2020 |

2019 |

20152016 |

DO NOT REPORT |

2018 |

|

2017 |

|

2014 |

|

2013 |

|

2012 |

|

2011 |

|

All PRIOR Years |

PRIOR |

TOTAL |

TOTAL |

SCHEDULE E - Furniture, Fixtures & Office Equipment (Do not include licensed motor vehicles - they are exempt.)

|

Column 1 |

Column 2 |

Column 3 |

|

YEAR |

ORIGINAL |

DISPOSALS & TRANSFERS |

FULL ORIGINAL COST |

|

AT COST |

at Jan. 1, 2021 |

|||

ACQUIRED |

INSTALLED COST |

|||

Jan. 1, 2020 to Jan. 1, 2021 |

(Total Column 1 & Column 2) |

|||

|

|

|||

2020 |

|

|

|

|

2019 |

|

|

|

|

2018 |

|

|

|

|

2017 |

|

|

|

|

2016 |

|

|

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

2013 |

|

|

|

|

2012 |

|

|

|

|

2011 |

|

|

|

|

All PRIOR Years |

|

|

|

|

TOTAL |

|

|

|

10 |

FOR ASSESSOR’S USE ONLY |

|

|

2020 |

.925 |

2019 |

.794 |

2018 |

.695 |

2017 |

.602 |

2016 |

.512 |

2015 |

.439 |

2014 |

.377 |

2013 |

.324 |

2012 |

.277 |

2011 |

.242 |

PRIOR |

.143 |

TOTAL |

|

SCHEDULE F1 - Computer Equipment & Software, Cash Registers and Single Function Fax Machines

(Exempt per section 70.11(39) WI Stats., if properly reported. Subject to tax or penalty if not reported. See instructions.)

Column 1 |

Column 2 |

Column 3 |

|

|

|

YEAR |

ORIGINAL |

DISPOSALS & TRANSFERS |

FULL ORIGINAL COST |

4 |

|

|

AT COST |

at Jan. 1, 2021 |

FOR ASSESSOR’S USE ONLY |

||||

ACQUIRED |

INSTALLED COST |

|||||

|

|

Jan. 1, 2020 to Jan. 1, 2021 |

(Total Column 1 & Column 2) |

|

|

|

2020 |

|

|

|

|

|

|

2019 |

|

|

|

|

|

20152016 |

DO NOT REPORT |

2018 |

|

2017 |

|

2014 |

|

All PRIOR Years |

PRIOR |

TOTAL |

TOTAL |

SCHEDULE F2 –

|

Column 1 |

Column 2 |

Column 3 |

|

YEAR |

ORIGINAL |

DISPOSALS & TRANSFERS |

FULL ORIGINAL COST |

|

AT COST |

at Jan. 1, 2021 |

|||

ACQUIRED |

INSTALLED COST |

|||

Jan. 1, 2020 to Jan. 1, 2021 |

(Total Column 1 & Column 2) |

|||

|

|

|||

2020 |

|

|

|

|

2019 |

|

|

|

|

2018 |

|

|

|

|

2017 |

|

|

|

|

2016 |

|

|

|

|

2015 |

|

|

|

|

All PRIOR Years |

|

|

|

|

TOTAL |

|

|

|

6FOR ASSESSOR’S USE ONLY

2020 .875

2019 .663

2018 .512

2017 .391

2016 .294

2015 .223 PRIOR .124

TOTAL

Personal Property Account Number:

Rev. 12/10 F:\progress\aspprop\statemnt.doc

Rev. 12/10 F:\progress\aspprop\statemnt.doc