Our main web developers worked hard to design the PDF editor we are delighted to present to you. The app permits you to simply create Adobes and will save you valuable time. You only need to stick to this specific guideline.

Step 1: You should choose the orange "Get Form Now" button at the top of the page.

Step 2: Now, you're on the form editing page. You can add information, edit current details, highlight particular words or phrases, place crosses or checks, add images, sign the file, erase unnecessary fields, etc.

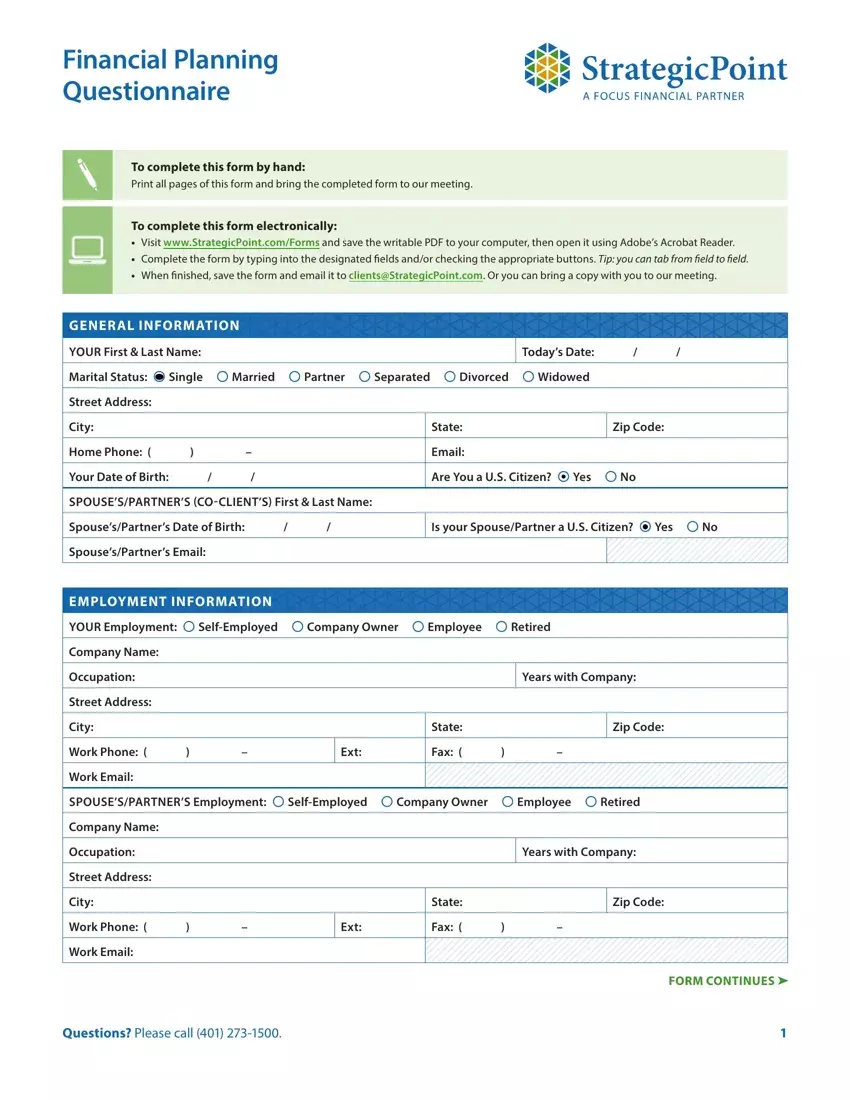

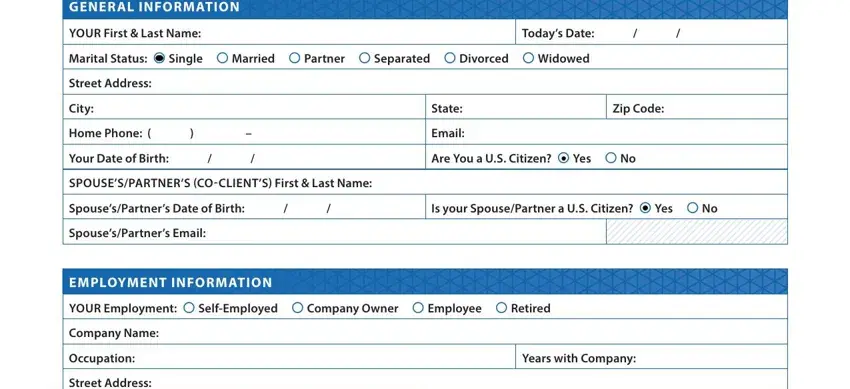

Complete the Adobes PDF by entering the details required for each individual area.

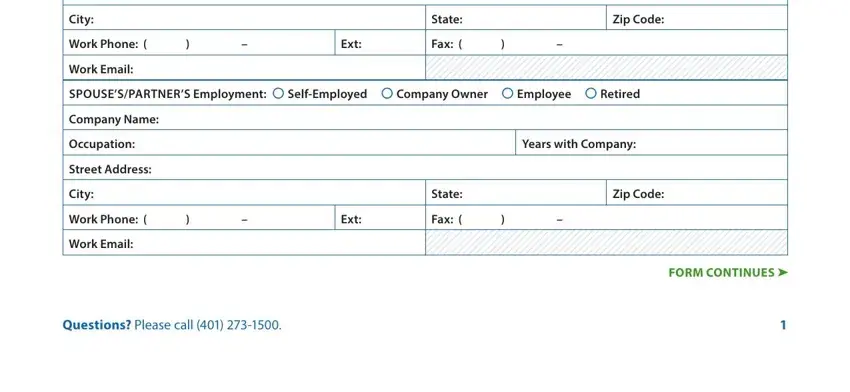

You have to fill in the Street Address, City, State, Zip Code, Work Phone, Ext, Fax, Work Email, SPOUSESPARTNERS Employment, Company Name, Occupation, Street Address, City, Years with Company, and State area with the required data.

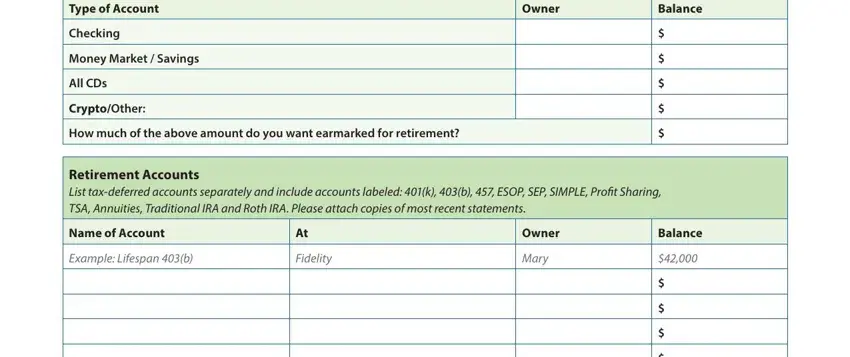

You need to emphasize the required details within the Type of Account, Checking, Money Market Savings, All CDs, CryptoOther, How much of the above amount do, Owner, Balance, Retirement Accounts List, Name of Account, Example Lifespan b, Fidelity, Owner, Mary, and Balance area.

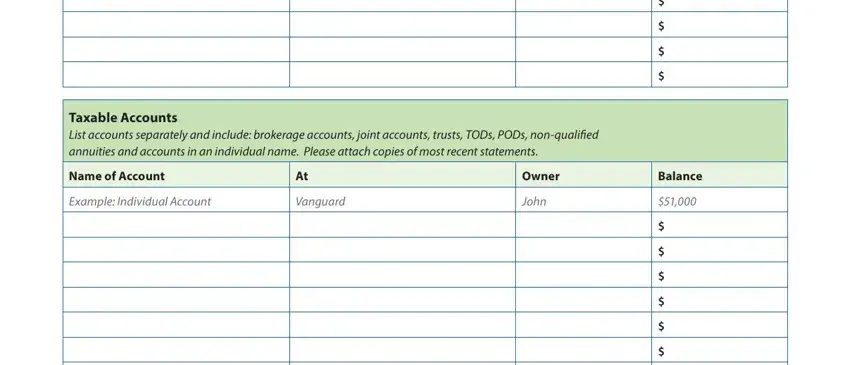

The Taxable Accounts List accounts, Name of Account, Example Individual Account, Vanguard, Owner, John, and Balance area allows you to specify the rights and obligations of each party.

Terminate by looking at the following fields and filling them out as required: FORM CONTINUES, and Questions Please call.

Step 3: When you have clicked the Done button, your file will be ready for transfer to any gadget or email you indicate.

Step 4: Ensure you remain away from possible future problems by preparing around a pair of copies of the file.