You are able to complete student finance pff2 form easily with our PDF editor online. FormsPal is dedicated to giving you the ideal experience with our tool by consistently adding new capabilities and upgrades. With these improvements, using our editor becomes better than ever before! This is what you'll need to do to get started:

Step 1: Firstly, open the editor by clicking the "Get Form Button" at the top of this webpage.

Step 2: As you open the editor, you'll see the form all set to be completed. Besides filling in various fields, you may as well do some other things with the file, such as adding any words, editing the original textual content, inserting graphics, signing the form, and more.

It's easy to fill out the document with our helpful guide! Here is what you need to do:

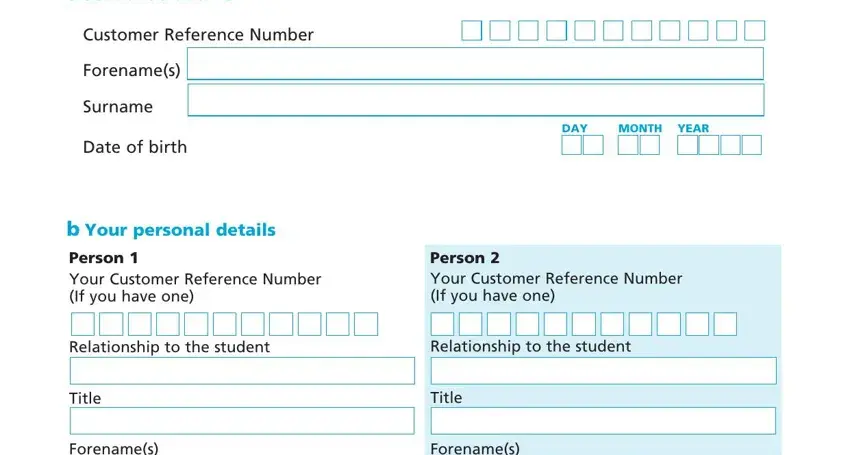

1. It is very important fill out the student finance pff2 form properly, hence be mindful when filling out the parts including these specific blank fields:

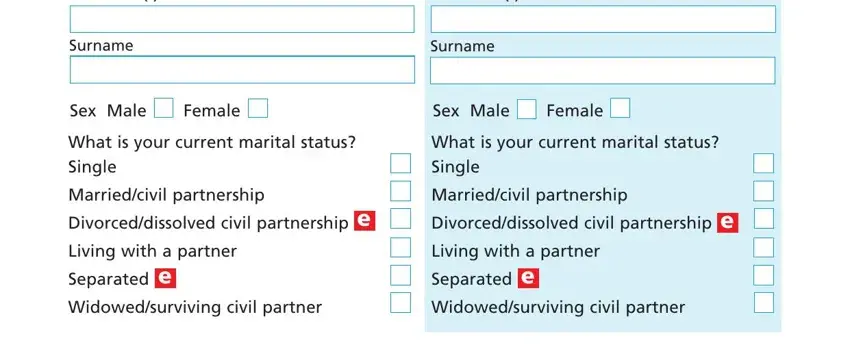

2. After finishing the previous part, go to the next step and fill in the essential particulars in these blank fields - Relationship to the student Title, Relationship to the student Title, Surname, Sex Male Female, Sex Male Female, What is your current marital, Separated Widowedsurviving civil, What is your current marital, and Separated Widowedsurviving civil.

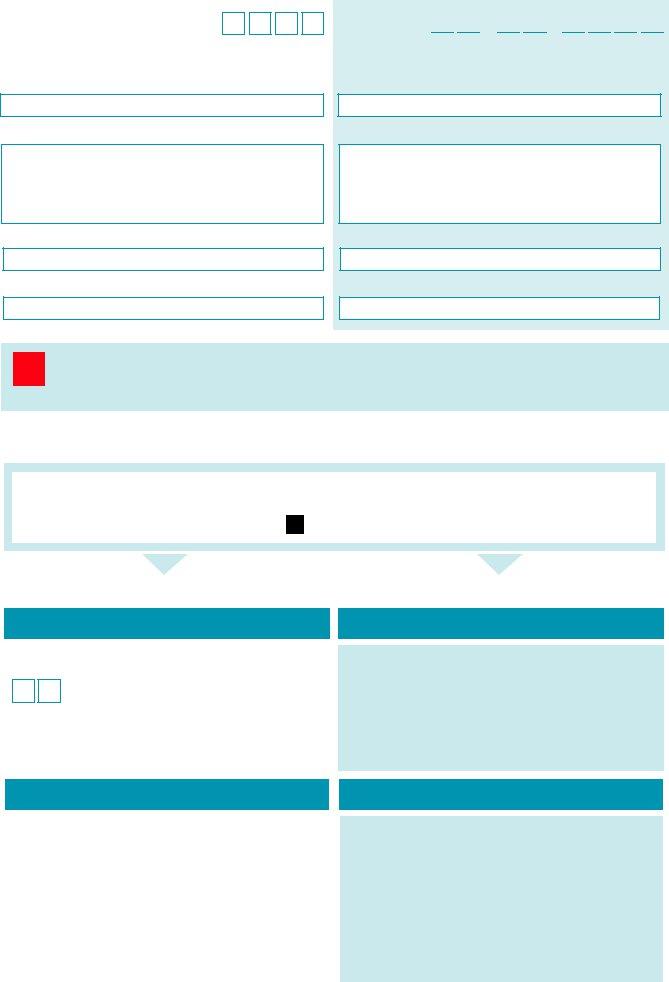

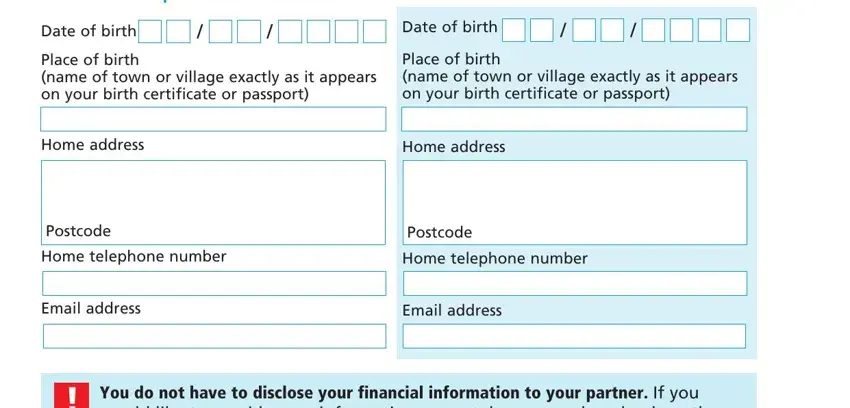

3. This subsequent segment should be relatively straightforward, section personal details, Date of birth, Date of birth, Place of birth name of town or, Place of birth name of town or, Home address, Postcode Home telephone number, Postcode Home telephone number, Email address, Email address, You do not have to disclose your, and would like to provide your - each one of these fields needs to be completed here.

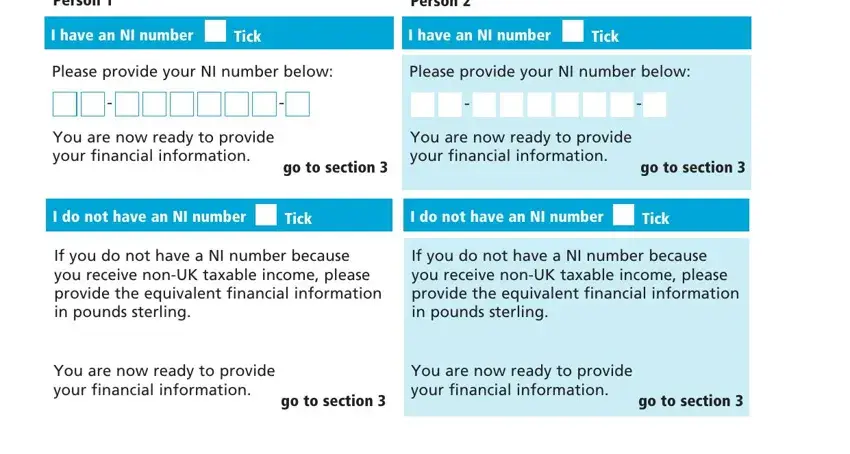

4. The fourth section comes with these empty form fields to complete: Person, Person, I have an NI number, Tick, I have an NI number, Tick, Please provide your NI number below, Please provide your NI number below, You are now ready to provide your, go to section, You are now ready to provide your, go to section, I do not have an NI number, Tick, and I do not have an NI number.

It's very easy to make errors when filling out your You are now ready to provide your, thus make sure to take another look before you decide to finalize the form.

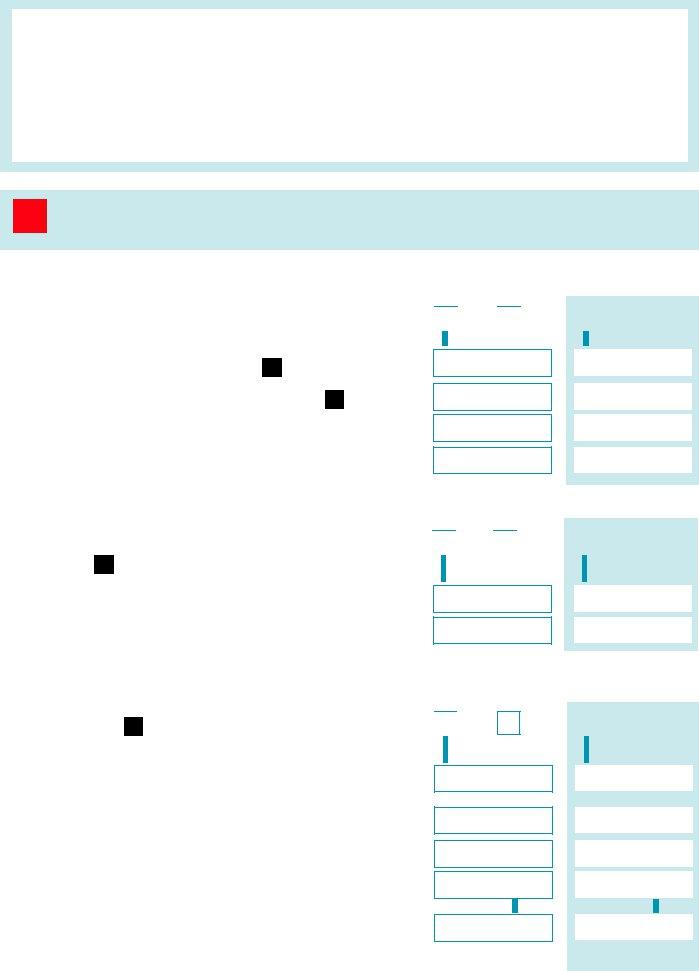

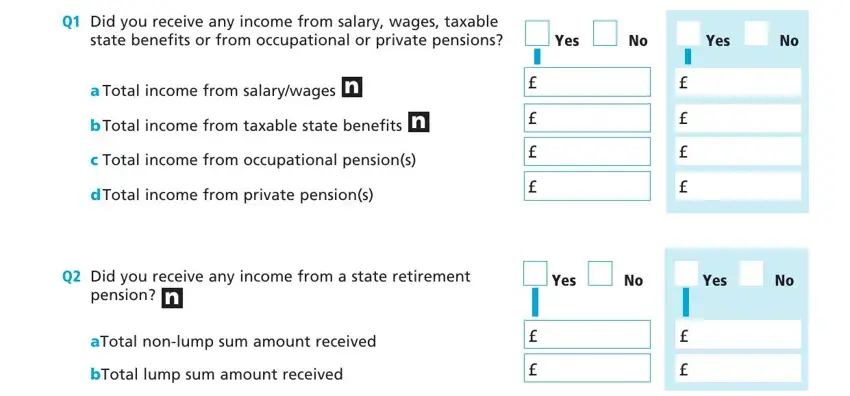

5. The form must be concluded by going through this segment. Further you can find an extensive list of blank fields that need to be filled out with accurate details in order for your document submission to be complete: Person, Q Did you receive any income from, Yes No, Yes No, a Total income from salarywages n, c Total income from occupational, d Total income from private, Q Did you receive any income from, pension n, aTotal nonlump sum amount received, bTotal lump sum amount received, Yes No, and Yes No.

Step 3: Immediately after proofreading your form fields you've filled in, hit "Done" and you're good to go! Go for a free trial account at FormsPal and get immediate access to student finance pff2 form - which you are able to then work with as you wish in your personal account. We do not share the details you type in whenever working with documents at our website.