Tax season is upon us and with it comes one of the most important annual tasks for all employees: completing their W-4 forms. The form, which establishes how much income tax should be withheld from paychecks, can seem daunting at first glance. Fortunately, there is an alternative option available—the Substitute Form W-4. This form allows taxpayers to adjust the amount of taxes withheld on a paycheck-to-paycheck basis in order to achieve greater take home wages throughout the year. In this blog post, we will explore how substitute forms work and discuss why you may want to consider utilizing them during tax season 2020!

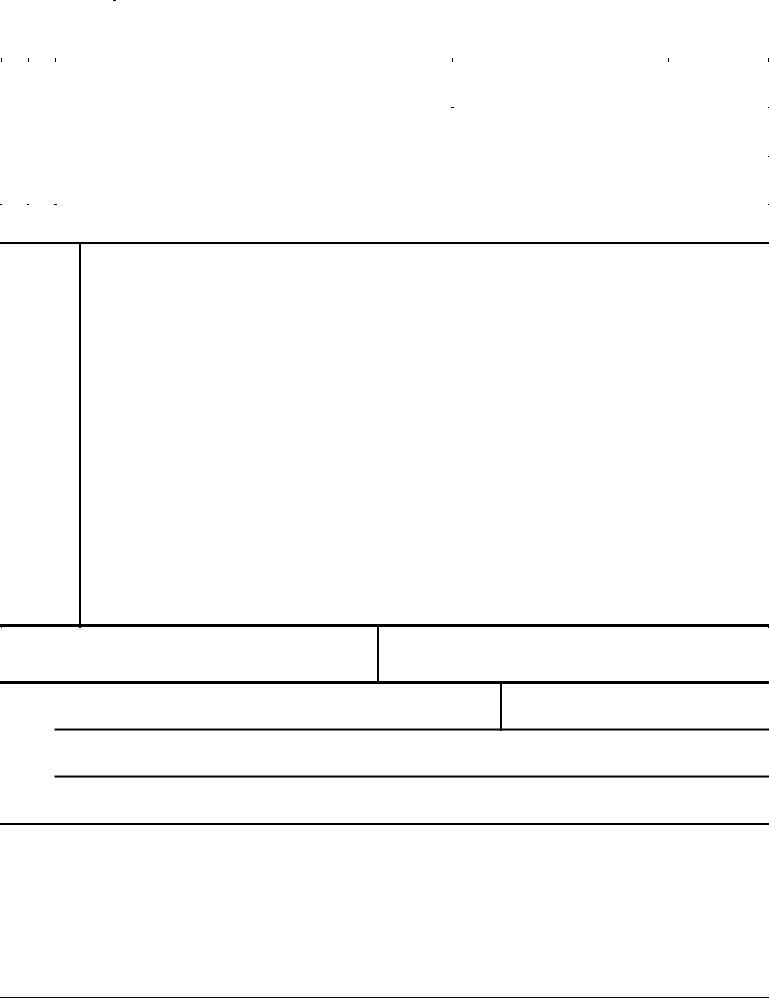

| Question | Answer |

|---|---|

| Form Name | Substitute Form Of W 4 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Washington, SSN, IRC, Texas |

|

Substitute |

Withholding Exemption Certificate / Certificate of Citizenship |

|

|||

|

Form |

►To exempt the employer from withholding tax from payments to an individual not subject. |

2005 |

|||

(Rev. |

|

(Substitute form in lieu of IRS Form |

|

|||

|

|

|

|

|

|

|

|

Type |

Full Name (Last, First, Middle.) |

|

Social Security Number (optional) |

|

|

|

|

|

|

American Citizen, not required by law 42 USC §405(c)(2)(B)(i) |

||

|

|

|

|

|

||

|

|

|

|

|

“Protected Individual”: 8 USC §1342b(a)(3)(A) |

|

|

or |

|

|

|

Unlawful to require: 42 USC §§408(a)(8), 1983; 18 USC §242 |

|

|

Postal Location (number and street, P.O. Box, etc.) |

|

||||

Worker |

|

|

|

|

|

|

Please |

City, State and Zip code |

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

Please

Sign

Here

Worker’s Certification – I certify under the penalties of perjury that I am not subject to or liable for the U.S. income tax; and

1.I am a natural born American inhabitant of the soil, domiciled in one of the states of the Republic of the 50 united States of America; consequently a Citizen of the united States of America.

2.I am not a citizen or resident of the corporate municipal legislative democracy of Washington D.C., or any federal territory or federal enclave within any of the states of this union.

3.I do not have income from any source within the District of Columbia, Puerto Rico, Virgin Islands, Guam, or American Samoa (the “United States” as that term is defined in the Internal Revenue Code), or any other U.S. territory or enclave.

4.This statement establishes my earnings are “excluded” with respect to Federal income taxes imposed under Subtitle A of the Internal Revenue Code, pursuant to 26 CFR

a.I incurred no liability for income tax imposed under subtitle A of the Code for the preceding year.

b.I anticipate I will incur no liability for income tax imposed under subtitle A of the IRC for the current year; and

c.I have a right to a full refund of all amounts taken without my voluntary consent.

d.Pursuant to 26 CFR

5.With respect to IRC §3101, Federal Insurance Contributions Act (known as Social Security), this also establishes my “non- covered worker” status certifying that:

a.I do not derive income which is taxable under 26 USC §3101, and I am therefore classified as a

b.I have never been made liable for any such tax pursuant to 26 USC §6201.

c.Pursuant to 26 USC §6203, I have never been issued any procedurally lawful manual assessment Form 23C or assessment Form 3552 for any tax liability.

d.Pursuant to 26 USC §3402(p)(3), I DO NOT CONSENT for amounts to be taken from my pay for any federal and/or state social insurance (trust) or other government social welfare programs.

6.I am NOT a recipient of government benefits, nor am I a “taxpayer” as that term is defined in the Internal Revenue Code.

I declare to the best of my knowledge, understanding and belief the above facts are true and correct. All rights reserved. UCC

►Signature |

|

Date |

_ |

|

or Type |

Employer’s Name |

Employer |

Employer’s Address |

|

PleasePrint |

Employer ID # |

|

|

|

|

|

|

|

Office Code (optional)

General Information: |

can be income subject to the U.S. income tax: |

Section 63 defines “taxable income” |

||

(Section references are to the Internal |

1. |

Nonresident aliens and foreign |

generally as “gross income” minus deductions. |

|

|

corporations receiving income from within |

Section 61 defines “gross income” generally |

||

Revenue Code unless otherwise noted.) |

|

|||

|

the United States, |

as income “from whatever source derived”. |

||

|

|

|||

Purpose |

2. |

United States citizens receiving foreign |

Sections |

|

|

income, and |

determine the taxable “sources of income”. |

||

This certificate may be used instead of Form |

|

|||

3. |

United States citizens or domestic |

26 CFR |

||

|

corporations receiving a large percentage |

“sources of income” apply only to those |

||

to, or liable for U.S. income tax withholding. |

|

|||

|

of income from within federal |

engaged in international or foreign commerce. |

||

|

|

|||

Individuals Not Subject to Income Tax |

|

possessions. |

Individuals who are not liable for, or subject |

|

|

Section 1 imposes the income tax on |

to the U. S. income tax should not provide a |

||

There are only three situations in which there |

|

|||

“taxable income”. |

(Continued on back.) |

|||

|

||||

Substitute form in lieu of IRS Form

Substitute form in lieu of IRS Form |

|

Page 2 |

||

completed IRS Form |

to any internal revenue tax.(See §7701(a)(14)) |

Request for TIN/ Reporting to the I.R.S. |

||

allowance certificate. |

|

26 CFR |

||

Those United States citizens and individuals |

Withholding Allowance Certificate |

payer, only to request disclosure of one’s Tax |

||

whose income does not originate under any of |

A “withholding allowance certificate” [IRS Form |

Identification Number. When the person |

||

the three situations listed may provide the |

refuses, the law requires you to ask a second |

|||

employer with a withholding exemption |

to certify to the employer that the individual is |

time while stating only the request for |

||

certificate in lieu of Form |

a U.S. citizen liable for U.S. income tax and |

disclosure is required by law. When the |

||

American Citizens may certify that they are |

allows the employer to act as the individual’s |

person refuses a second time, you are |

||

not subject to the U.S. income tax by providing |

withholding agent. |

required to prepare an affidavit (signed by you |

||

a statement of citizenship in lieu of Form |

Note: It is illegal for an employer to withhold |

and individual) stating you have complied with |

||

Neither the U.S. Department of the Treasury |

tax from a payment to an employee if the |

the request, keeping the affidavit as a |

||

nor the Internal Revenue Service provides |

employee does not voluntarily furnish the |

permanent record in the file you maintain on |

||

“officially printed” withholding exemption |

employer with a singed withholding allowance |

the person. |

|

|

certificates or statements of citizenship. It is |

certificate. |

Leave the box for the individual’s SSN or TIN |

||

entirely up to the individual who is not subject |

|

blank when making all necessary reports. |

||

to or liable for the U.S. income tax to provide |

Withholding Exemption Certificate |

Note: This is the correct procedure when the |

||

such documents. |

A “withholding exemption certificate” is a form |

individual does not have or refuses to disclose |

||

|

individuals may voluntarily use to certify to an |

a Social Security Number regardless of which |

||

Definitions: |

employer that the individual is not liable for |

form is being used. |

||

American Citizen |

U.S. income tax and exempts the employer |

Employers are required by law to be in |

||

For purposes of this form, “American Citizen” |

from any U.S. income tax withholding rules. |

accordance with the ruling of EQUAL |

||

(See §3402(f)(2)) |

EMPLOYMENT OPPORTUNITY COMMISION |

|||

and “Citizen of the united States of America” |

||||

The employer is not required to deduct |

v. INFORMATION SYSTEMS CONSULTING, |

|||

means an individual who was born or |

||||

and withhold any tax upon a payment of |

United States District Court for the Northern |

|||

naturalized in any of the 50 States of |

||||

wages to an employee if this form or substitute |

District of Texas Dallas Division |

|||

America. |

||||

is filed in lieu of Form |

T, which states, “the defendant shall be |

|||

Note: You are an individual not subject to |

||||

Note: A withholding exemption certificate |

permanently enjoined from terminating an |

|||

income tax if you are an American Citizen |

||||

should state that (a) the employee incurred no |

employee or refusing to hire an individual for |

|||

residing within the united States of America |

||||

liability for income tax imposed under subtitle |

failure to provide a social security number.” |

|||

(the 50 states). |

||||

A of the Code for his preceding taxable year; |

|

|

||

American Citizens cannot be compelled to |

|

|

||

and (b) the employee anticipates that he will |

Disposition of Statement and Form |

|||

register in and subsequently participate in |

||||

incur no liability for income tax imposed by |

Upon receiving this form send a copy along |

|||

government entitlement programs, as the |

||||

subtitle A for his current taxable year. |

with a letter of transmittal to: Internal Revenue |

|||

authority to require such is a power which |

||||

|

Center, Philadelphia, PA 19255. (See CFR |

|||

“obviously lie(s) outside the orbit of |

|

|||

Statement of Citizenship |

||||

congressional power”. Railroad Retirement |

||||

Board v. Alton Railroad Co. 295 U.S. 330, 55 |

An individual’s written statement that he or she |

to withholding) |

|

|

Ct. 758 (1935). |

is an American Citizen may also be relied |

Transmittal Letter |

||

|

upon by the payer of the income as proof that |

|||

United States |

such individual is a citizen or resident of the |

Your transmittal letter should state that you |

||

For income tax purposes, “United States” |

united States of America and therefore not |

requested the individual’s SSN as instructed |

||

subject to the U.S. income tax. (See CFR |

by §6109(a)(3) and/or 26 CFR |

|||

means District of Columbia, the |

||||

Commonwealth of Puerto Rico, the Virgin |

||||

to withholding) |

§6724(a) or 26 CFR |

|||

Islands, Guam, and American Samoa. (See |

||||

|

waiver of any penalties that may be associated |

|||

§3121(e), §7701(a)(9), and 42 USC §410(i)) |

|

|||

|

with your justifiable failure that is due to |

|||

|

Specific Instructions: |

|||

U.S. citizen |

Worker |

reasonable cause: |

||

1) To withhold tax from payments to the |

||||

For income tax purposes, “U.S. citizen” and |

Full Name: Enter your last name followed by |

|||

individual, and |

|

|||

“United States citizen” means an individual |

|

|||

your first name and then your middle name or |

2) To use a Social Security Number in making |

|||

who is a citizen of District of Columbia, the |

initial. |

|||

reports to the I.R.S. regarding the individual. |

||||

Commonwealth of Puerto Rico, the Virgin |

Postal Location: Enter your address where |

|||

Note: It is reasonable cause if the employee |

||||

Islands, Guam, and American Samoa. |

you receive mail. This can be your street |

|||

does not have, or refuses to disclose a SSN or |

||||

|

address where you live or Post Office Box. |

|||

|

TIN. (See §6724(a)) |

|||

Withholding Agent |

Signature/Date: Affix your signature if the |

|||

|

|

|||

The term "withholding agent" means any |

statements in the Worker’s Certification are |

|

|

|

|

Warning |

|||

person required to deduct and withhold any |

true and date it. |

|

||

tax under the provisions of section 1441, 1442, |

|

This is a legal form required by the Internal |

||

1443, or 1461. |

Employer |

Revenue Service by 26 CFR Sections 1.1441- |

||

Generally, the person responsible for |

Employer’s Name: Enter the name of the |

5 concerning individuals claiming to be a |

||

payment to a nonresident alien individual or |

business here. |

person not subject to withholding and |

||

foreign entity is the withholding agent (see |

Employer’s Address: Enter the full address |

|||

§7701(a)(16) and IRS Pub. 515). |

of the principal office in the country where the |

no income tax liability. Failure to comply with |

||

|

business is located. Also show the current |

the law may lead to criminal prosecution. |

||

Nonresident Alien Individual |

mailing address if it differs from that of the |

|

|

|

For income tax purposes, “nonresident alien |

principal office. |

This document was written after extensive |

||

individual” means an individual who is neither |

Employer ID #: Enter your employer ID |

research into the Internal Revenue Code and |

||

a U.S. citizen nor resident. (See IRS Pub. |

number here. |

other related laws by a Sovereign American |

||

519, U.S. Tax Guide for Aliens) |

Office Code: If you have an office code and |

Citizen for use by those individuals not subject |

||

|

wish to include it on this form you may do so |

to the U.S. income tax. |

||

Taxpayer |

here. |

Please feel free to copy and distribute as |

||

The term “taxpayer” means any person subject |

|

needed. |

(Visit: waldowoc.100free.com) |

|