In today's complex financial landscape, accurate and transparent reporting of taxpayer identification is imperative for individuals and organizations conducting business with entities like the New York State Office of the State Comptroller. A vital tool in this process is the Substitute Form W-9, a document designed to streamline the collection of necessary tax details, specifically the Taxpayer Identification Number (TIN), and to affirm the correctness of this information. Unlike the standard IRS Form W-9, the New York State version mandates completion of the Substitute Form W-9 for all entities wishing to engage in business activities within the state, underscoring its unique requirement. This form encapsulates several key sections including vendor information, the taxpayer's identification number and type, address details for correspondence and orders, primary contact information for the vendor, and imperative certification that protects against backup withholding. The Substitute Form W-9 thus serves not only as a means of tax identification but also as a declaration of compliance with U.S. tax laws, while its strict completion guidelines help prevent potential financial penalties related to backup withholding, making it a crucial document for ensuring seamless financial transactions with the state of New York.

| Question | Answer |

|---|---|

| Form Name | Substitute W 9 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | substitute form, w 9 form ny, nys substitute w 9 form, ny w 9 form |

AC

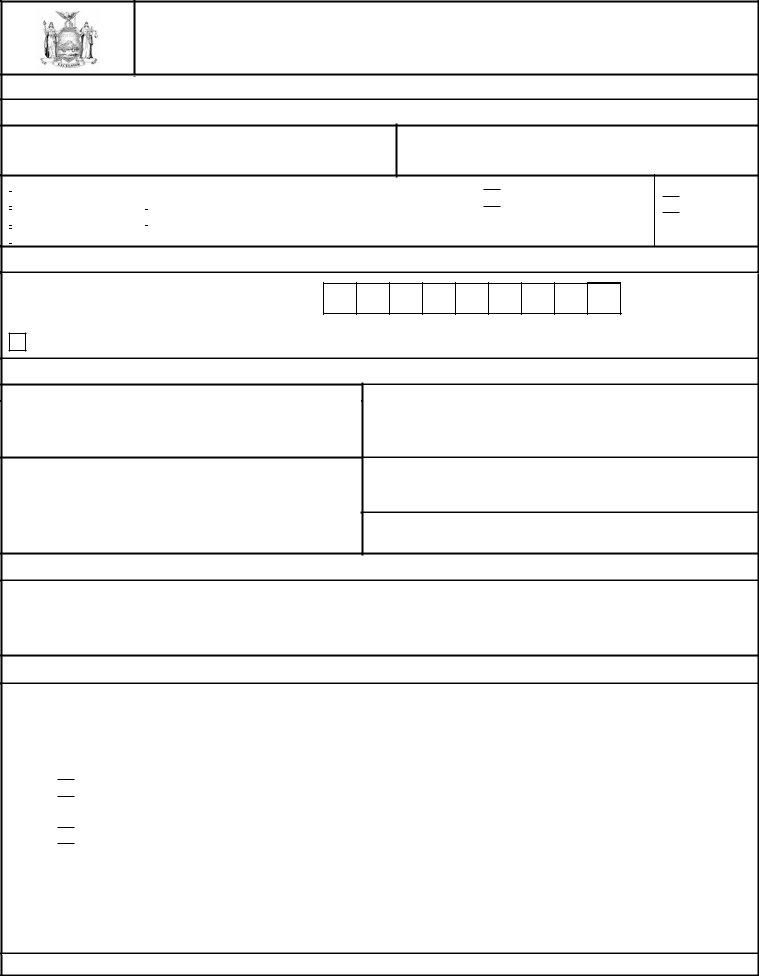

NEW YORK STATE OFFICE OF THE STATE COMPTROLLER

SUBSTITUTE FORM

REQUEST FOR TAXPAYER IDENTIFICATION NUMBER & CERTIFICATION

TYPE OR PRINT INFORMATION NEATLY. PLEASE REFER TO INSTRUCTIONS FOR MORE INFORMATION.

Part I: Vendor Information

1. Legal Business Name:

2.Business name/disregarded entity name, if different from Legal Business Name:

3. Entity Type (Check one only): |

|

|

|

|

|

|

|

|

|||||

|

|

Individual Sole Proprietor |

|

Partnership |

|

Limited Liability Co. |

|

Corporation |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trusts/Estates |

|

Federal, State or Local Government |

|

Public Authority |

|

||||||

|

|

Other _______________________________ |

|

|

|

|

|

|

|||||

Not For Profit Disregarded Entity

Exempt …….Payee

Part II: Taxpayer Identification Number (TIN) & Taxpayer Identification Type

1.Enter your TIN here: (DO NOT USE DASHES)

See instructions.

2.Taxpayer Identification Type (check appropriate box):

Employer ID No. (EIN) |

|

Social Security No. (SSN) |

|

Individual Taxpayer ID No. (ITIN) |

|

N/A |

Part III: Address

1. Remittance Address: |

2. Ordering Address: |

Number, Street, and Apartment or Suite Number |

Number, Street, and Apartment or Suite Number |

City, State, and Nine Digit Zip Code or Country

City, State, and Nine Digit Zip Code or Country

Email Address

Part IV: Vendor Primary Contact Information – Executive Authorized to Represent the Vendor

Primary Contact Name: ________________________________________________ Title:__________________________________________

Email Address: _______________________________________________________ Phone Number: ________________________

Part V: Certification and Exemption from Backup Withholding

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct taxpayer identification number (TIN), and

2.I am a U.S. citizen or other U.S. person, and

3.(Check one only):

I am not subject to backup withholding. I am (a) exempt from back up withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or

(c) the IRS has notified me that I am no longer subject to backup withholding),or

I am subject to backup withholding. I have been notified by the IRS that I am subject to backup withholding as a result of a failure to report all interest or dividends, and I have not been notified by the IRS that I am no longer subject to back withholding.

Sign Here:

___________________________________________________________ |

____________________________ |

____________________ |

|

Signature |

Title |

|

Date |

___________________________________________________________ |

______________________ |

________________________ |

|

Print Preparer's Name |

Phone Number |

|

Email Address |

DO NOT SUBMIT FORM TO IRS – SUBMIT FORM TO NYS ONLY AS DIRECTED

AC

NYS Office of the State Comptroller

Instructions for Completing Substitute Form

New York State (NYS) must obtain your correct Taxpayer Identification Number (TIN) to report income paid to you or your organization. NYS Office of the State Comptroller uses the Substitute Form

Any payee/vendor who wishes to do business with New York State must complete the Substitute Form

Part I: Vendor Information

1.Legal Business Name: For individuals, enter the name of the person who will do business with NYS as it appears on the Social Security card or other required Federal tax documents. An organization should enter the name shown on its charter or other legal documents that created the organization. Do not abbreviate names.

2.Business name/disregarded entity name, if different from Legal Business Name: Enter your DBA name or another name your entity is known by.

3.Entity Type: Check the Entity Type doing business with New York State.

Part II: Taxpayer Identification Number (TIN) and Taxpayer Identification Type

The TIN provided must match the name in the “Legal Business Name” box to avoid backup withholding. For individuals, this is your social security number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, refers to IRS

1.Taxpayer Identification Number: Enter your

2.Taxpayer Identification Type: Check the type of identification number provided.

Part III: Address

1.Remittance Address: Enter the address where payments, 1099s, if applicable, and official correspondence should be mailed. This will become the default address.

2.Ordering Address: Enter the address where purchase orders should be sent. Please note that purchase orders will be sent via email by default.

Part IV: Vendor Primary Contact Information

Please provide the contact information for an executive at your organization. This individual should be the person who makes legal and financial decisions for your organization. Name, phone number and email address are required.

Part V: Certification and Exemption from Backup Withholding

Check the appropriate box indicating your exemption status from backup withholding. Individuals and sole proprietors are not exempt from backup withholding. Corporations are exempt from backup withholding for certain types of payments. Refer to IRS Form

1According to IRS Regulations, OSC must withhold 28% of all payments if a payee/vendor fails to provide OSC its certified TIN. The Substitute Form