Are you looking for a simple and stress-free way to file your regular Dvat registration online form? With the growth of digitalization, filing your DVAT registration online forms has become easy in more ways than ever before. This blog post will provide you with all the information necessary to make sure that you get the most out of submitting an application form without any hassle or difficulty. From navigating through the different steps, understanding what documents are required and how long it takes - this guide is designed to help simplify every step of process ensuring that you have a great experience while going through it!

| Question | Answer |

|---|---|

| Form Name | Surrender Dvat Registration Online Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | how to close tin certificate, tin cancellation, how to close tin number, how to cancel tin number online |

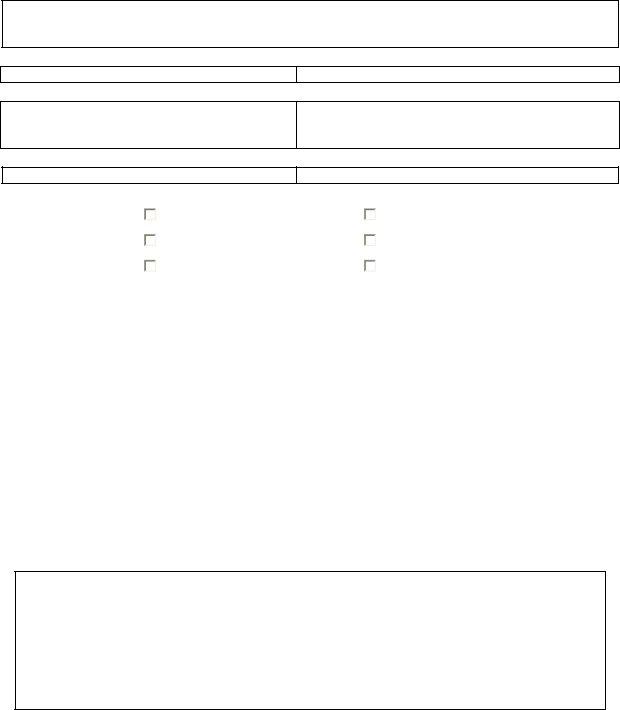

Form DVAT 09

(SEE RULE 16 OF THE DVAT RULES, 2005)

Application for Cancellation of Registration under DVAT Act,

Please attach your tax return for the tax period in which the effective date of cancellation of your registration falls. Please remember that if you are registered under the Central Sales Tax Act, your will have to file a separate application for the purpose of cancellation of that registration.

1. Registration No.

2.Full name of Applicant Dealer (For individuals, provide in order of first name , middle name, surname)

3. Trade Name (If any)

|

4. |

Reason |

for |

Discontinuance of business |

|

|

Closure of incorporated body |

||

|

Cancellation |

(Tick |

|

|

|||||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

||||

|

|

one |

as |

Death of Proprietor |

|

|

Dissolution of firm |

||

|

applicable) |

|

|

|

|

|

|

|

|

|

Has ceased to be liable to pay tax |

|

Other , please Specify |

||||||

|

|

|

|

|

|||||

|

|

|

|

|

|

|

________________________________ |

||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|||||

|

5. Date from which registration under Delhi VAT |

____/ ___ / ______ |

|||||||

|

Act, 2004 is to be cancelled |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

|

6. |

Where |

the dealer has |

Description |

|

(Rs.) |

|||

|

accounted for turnover on the |

|

|

|

|

|

|||

|

(i) Amount not yet received in |

|

|||||||

|

basis of amounts received and |

|

|||||||

|

amounts paid. |

|

respect of sales made. |

|

|

||||

|

|

(ii) Amounts not yet paid in |

|

|

|||||

|

|

|

|

|

|

|

|||

|

|

|

|

|

respect of purchaser made |

|

|

||

|

|

|

|

||||||

|

7. Amount payable in respect of all goods held on the date of |

|

|

||||||

|

cancellation of registration. |

|

|

|

|

|

|||

|

|

Rs. |

|

|

|

|

|

|

|

(Complete annexure to furnish details of stock and calculation of amount payable under section 23 (1) of the Act)

Verification. |

|

I/We ____________ hereby solemnly affirm and declare that the information given hereinabove is |

|

true and correct to the best of my/our knowledge and belief and nothing has been concealed |

|

therefrom. |

|

Signature of Authorised Signatory |

_________________________ |

Full Name (First name, middle, surname) |

_________________________ |

Designation |

_________________________ |

Place : ____________

Date : ____________

RUSHABH INFOSOFT LTD.

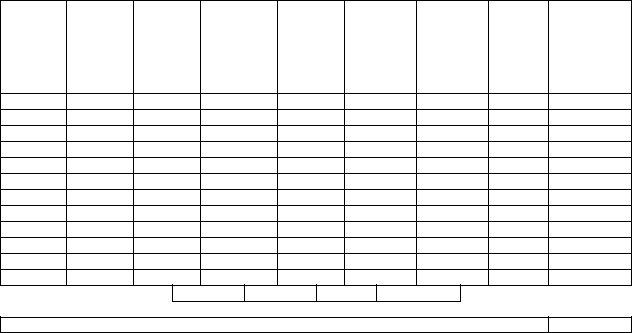

Form DAVT 09 : Annexure

Particulars of stock as on the date of cancellation of registration

Details of stock of all goods held on the date of cancellation of registration.

S. No.

Tax

Invoice

Date

Tax

Invoice

No.

Descriptio

nof Goods

Purchas

ePrice (Rs.)

Fair

market

Value

(Rs.)

(A)

Tax

Credit

previousl

yclaimed (Rs.)

(B)

Rate of tax u/s 4 of the Act

(C)

Output Tax

(Rs.)

(D=AxC)

Total

Higher of total of column B and Column D (carry to field 7 or main form)

Verification. |

|

|

I/We ____________ hereby solemnly affirm and declare that the information given hereinabove is |

||

true and correct to the best of my/our knowledge and belief and nothing has been concealed |

||

therefrom. |

|

|

Signature of Authorised Signatory |

|

_________________________ |

Full Name (First name, middle, surname) |

_________________________ |

|

Designation |

_________________________ |

|

|

|

|

Place : ____________

Date : ____________

RUSHABH INFOSOFT LTD.