Using the online PDF tool by FormsPal, it is easy to complete or modify cra t1213 here and now. In order to make our tool better and less complicated to utilize, we continuously come up with new features, with our users' suggestions in mind. To get the ball rolling, consider these easy steps:

Step 1: Firstly, access the editor by pressing the "Get Form Button" above on this page.

Step 2: With this online PDF file editor, you are able to accomplish more than simply fill out blank fields. Try each of the features and make your forms look perfect with customized text put in, or fine-tune the original content to perfection - all that comes along with the capability to incorporate any kind of graphics and sign the document off.

Completing this document needs attentiveness. Make sure that all mandatory blank fields are filled in properly.

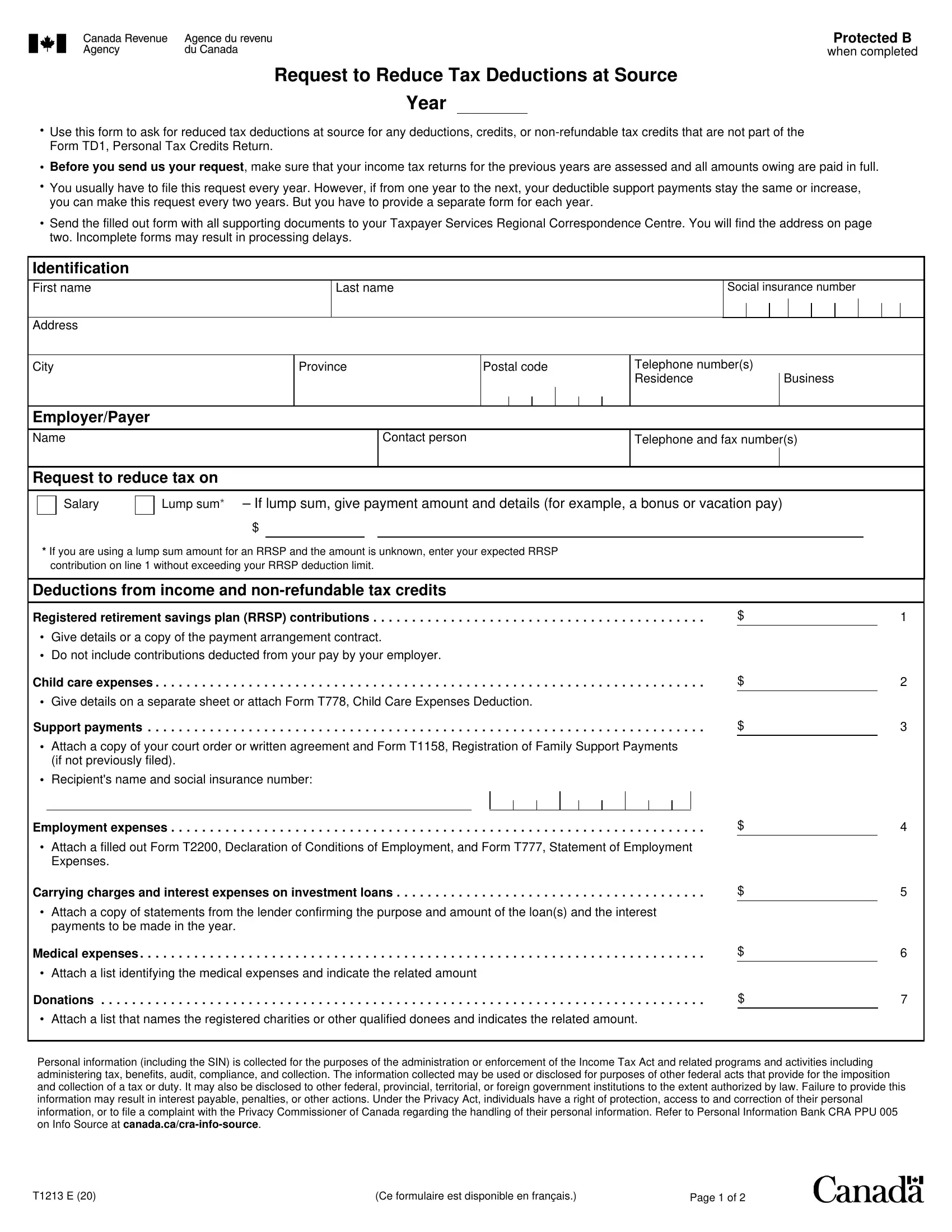

1. Start filling out your cra t1213 with a number of essential fields. Gather all the important information and ensure absolutely nothing is overlooked!

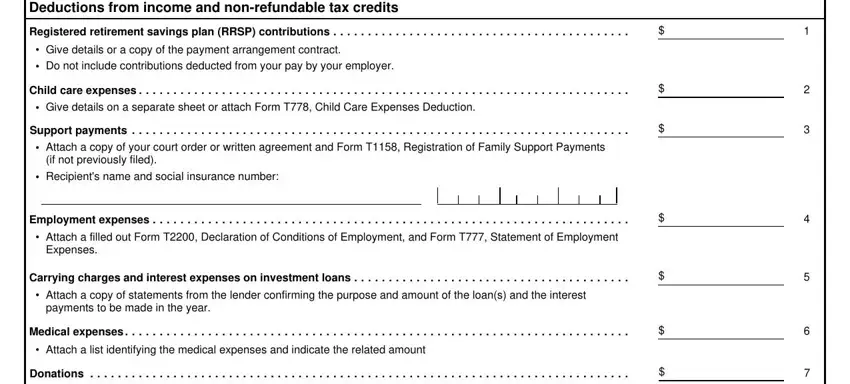

2. The third step is usually to complete the following blanks: Deductions from income and, Registered retirement savings plan, cid Give details or a copy of the, Child care expenses, cid Give details on a separate, Support payments, cid Attach a copy of your court, if not previously filed, cid Recipients name and social, Employment expenses, cid Attach a filled out Form T, Expenses, Carrying charges and interest, cid Attach a copy of statements, and payments to be made in the year.

Concerning if not previously filed and Child care expenses, make sure you get them right in this current part. These two are certainly the most significant ones in the PDF.

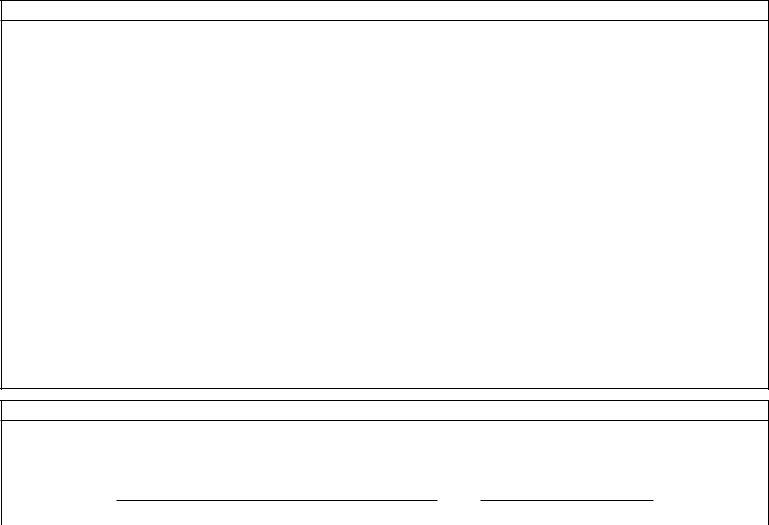

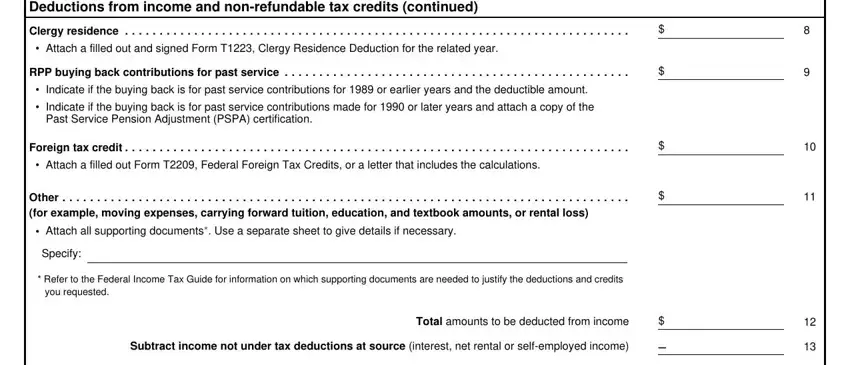

3. The next section is rather easy, Deductions from income and, Clergy residence, cid Attach a filled out and signed, RPP buying back contributions for, cid Indicate if the buying back is, cid Indicate if the buying back is, Past Service Pension Adjustment, Foreign tax credit, cid Attach a filled out Form T, Other, cid Attach all supporting, Specify, Refer to the Federal Income Tax, you requested, and Subtract income not under tax - these form fields will have to be filled in here.

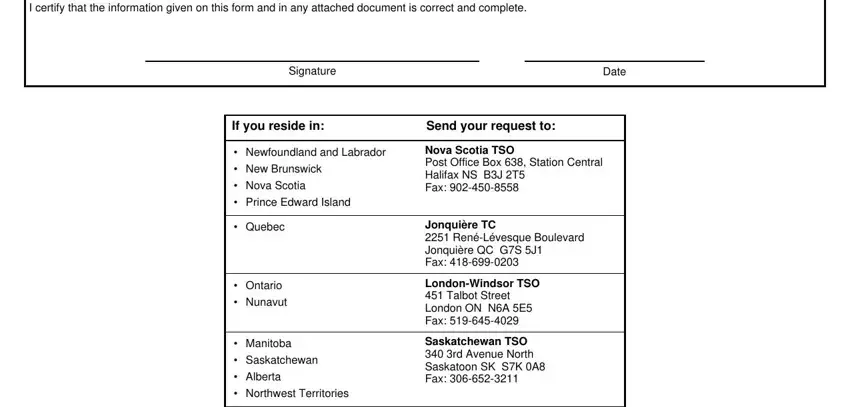

4. Your next subsection needs your involvement in the subsequent parts: I certify that the information, Signature, Date, If you reside in, Send your request to, cid Newfoundland and Labrador, cid New Brunswick, cid Nova Scotia, cid Prince Edward Island, cid Quebec, cid Ontario, cid Nunavut, cid Manitoba, cid Saskatchewan, and cid Alberta. Just remember to fill out all required details to move further.

Step 3: Immediately after double-checking your entries, hit "Done" and you're done and dusted! Right after creating a7-day free trial account at FormsPal, you'll be able to download cra t1213 or email it directly. The form will also be available from your personal account page with all of your adjustments. FormsPal is invested in the confidentiality of all our users; we ensure that all personal data put into our editor remains protected.