Working with PDF files online is quite easy with our PDF editor. Anyone can fill in t2125 excel template here and use several other functions available. FormsPal team is focused on making sure you have the absolute best experience with our tool by consistently releasing new capabilities and enhancements. With these updates, using our tool gets easier than ever! To get the ball rolling, consider these simple steps:

Step 1: Press the "Get Form" button above. It will open our pdf tool so that you can begin filling in your form.

Step 2: After you access the tool, you'll see the document made ready to be filled out. Apart from filling in various blank fields, you could also do various other things with the PDF, particularly putting on custom text, modifying the original text, adding graphics, placing your signature to the document, and much more.

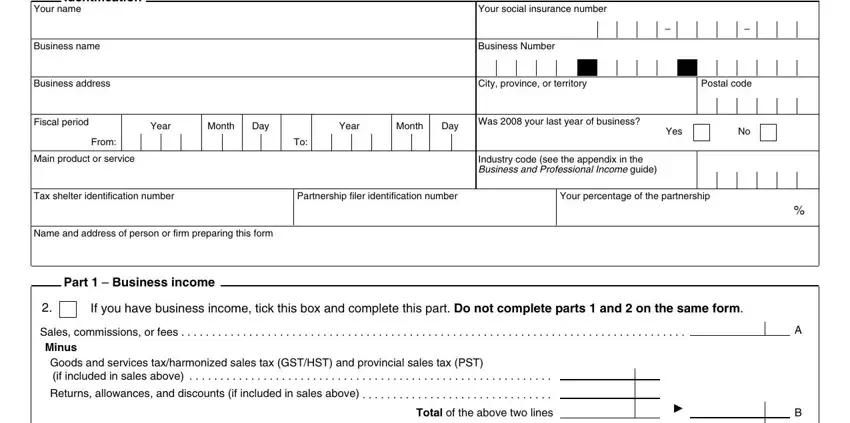

When it comes to blanks of this precise PDF, here is what you want to do:

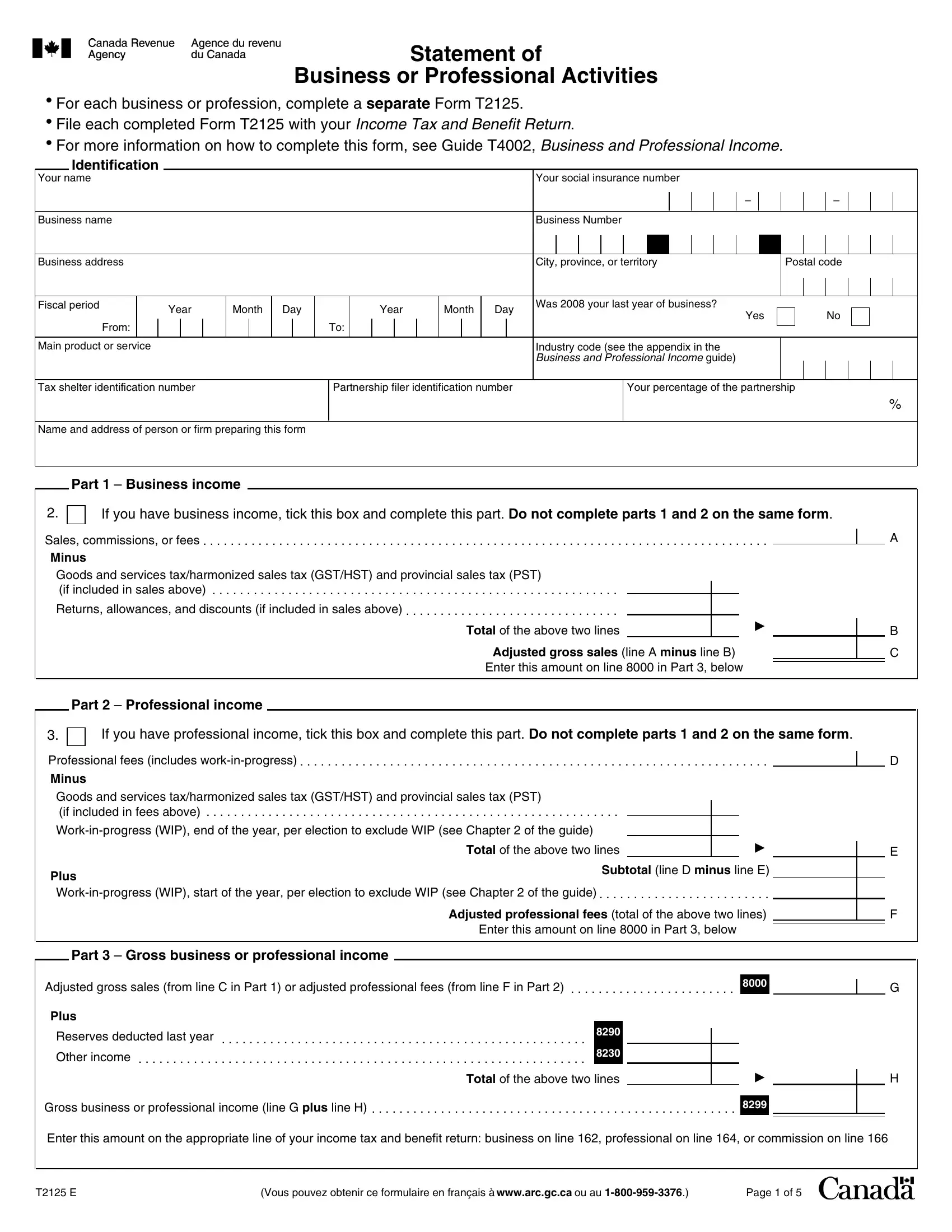

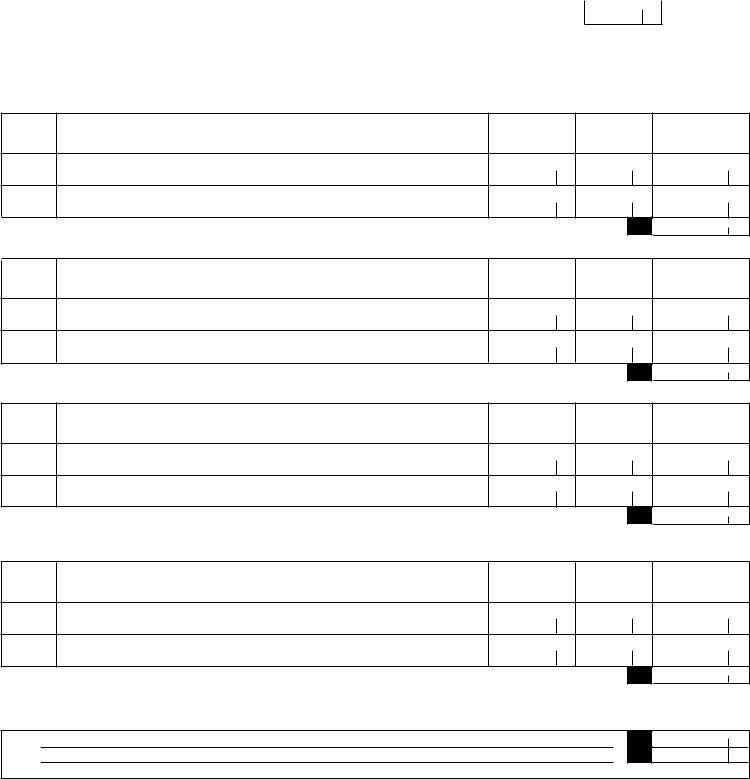

1. To begin with, once filling out the t2125 excel template, start with the form section that includes the following blank fields:

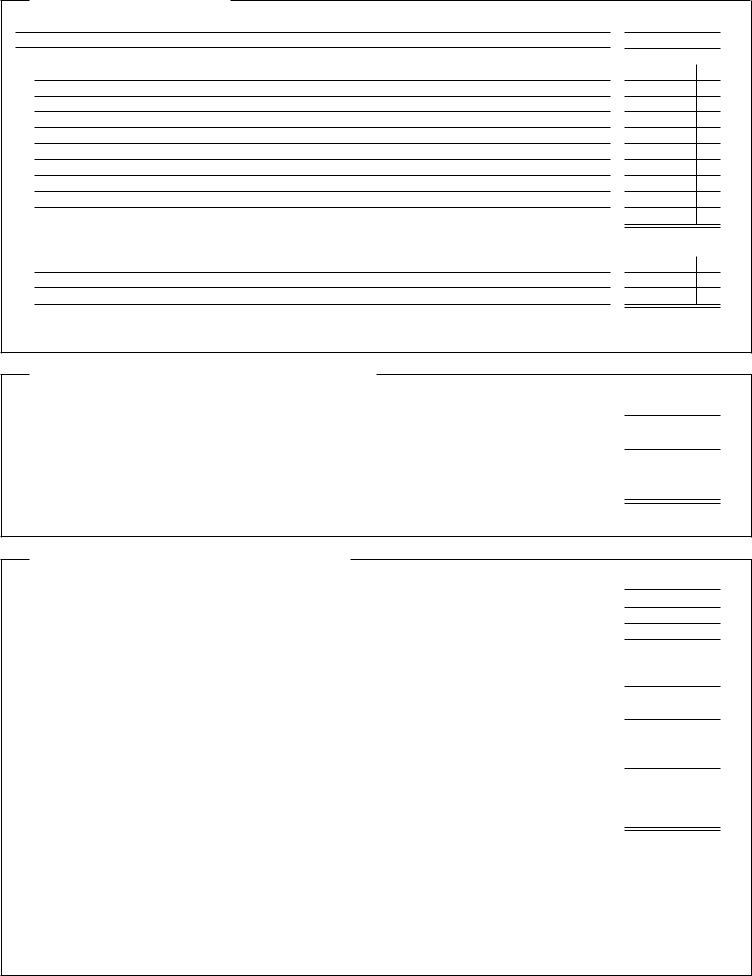

2. Once this selection of fields is done, go on to enter the applicable information in these - Part Professional income, If you have professional income, Professional fees includes, Minus Goods and services, Plus Workinprogress WIP start of, Subtotal line D minus line E, Total of the above two lines, Adjusted professional fees total, Enter this amount on line in Part, Part Gross business or, Adjusted gross sales from line C, Plus, Reserves deducted last year, Other income, and Gross business or professional.

Always be very attentive when completing Subtotal line D minus line E and Professional fees includes, because this is where a lot of people make some mistakes.

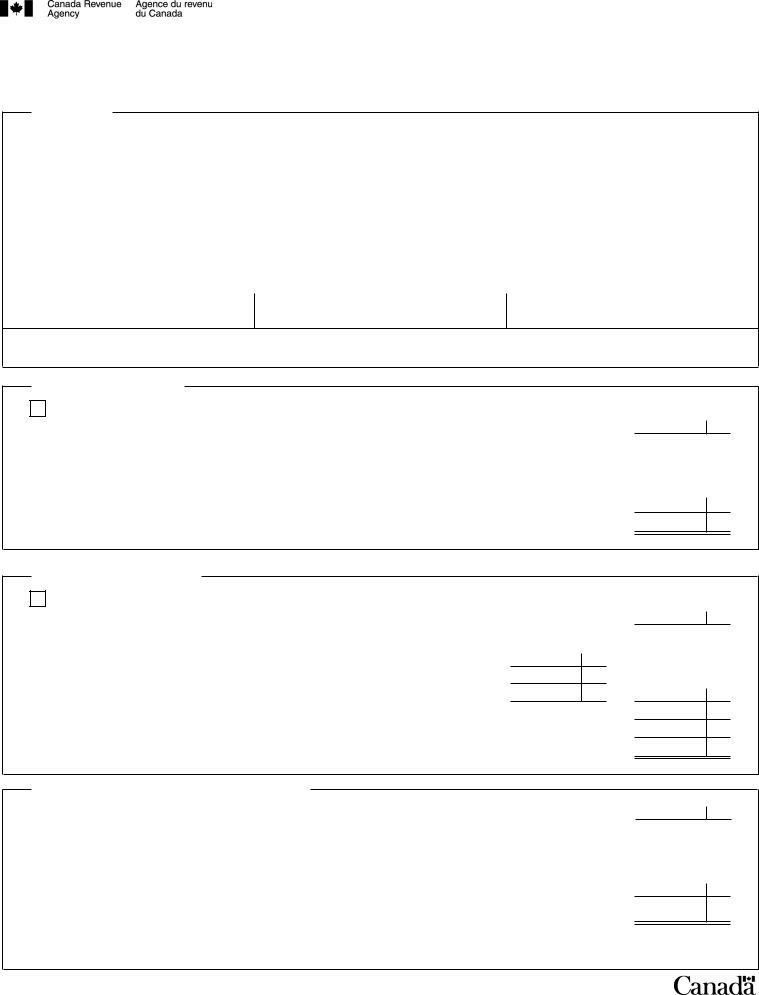

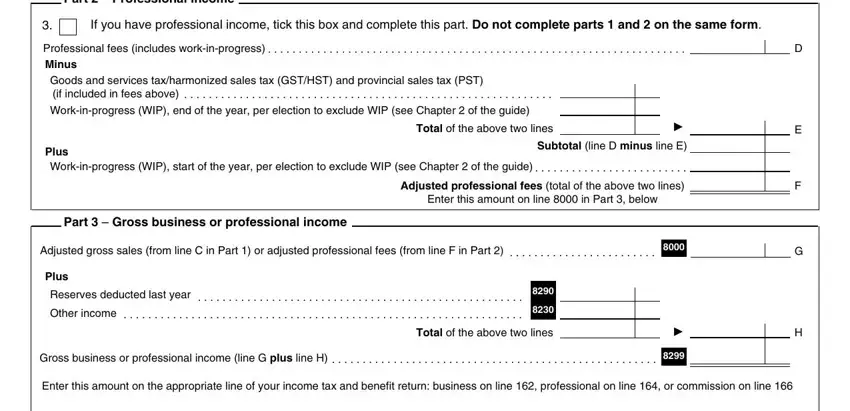

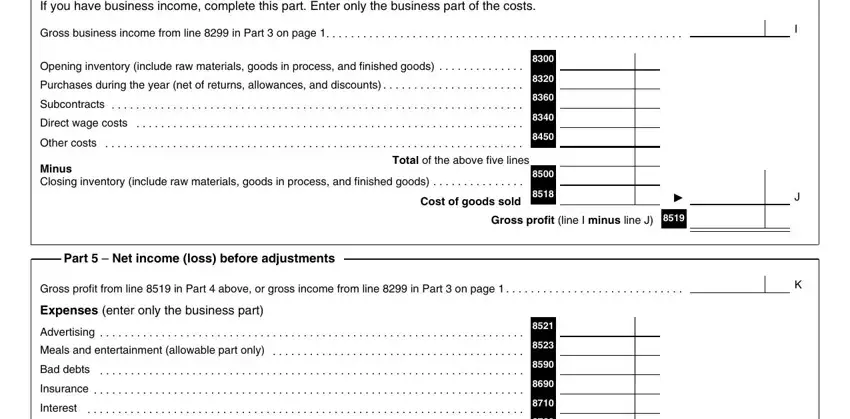

3. Completing If you have business income, Gross business income from line, Opening inventory include raw, Purchases during the year net of, Subcontracts, Direct wage costs, Other costs, Minus Closing inventory include, Total of the above five lines, Cost of goods sold, Gross profit line I minus line J, Part Net income loss before, Gross profit from line in Part, Expenses enter only the business, and Advertising is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

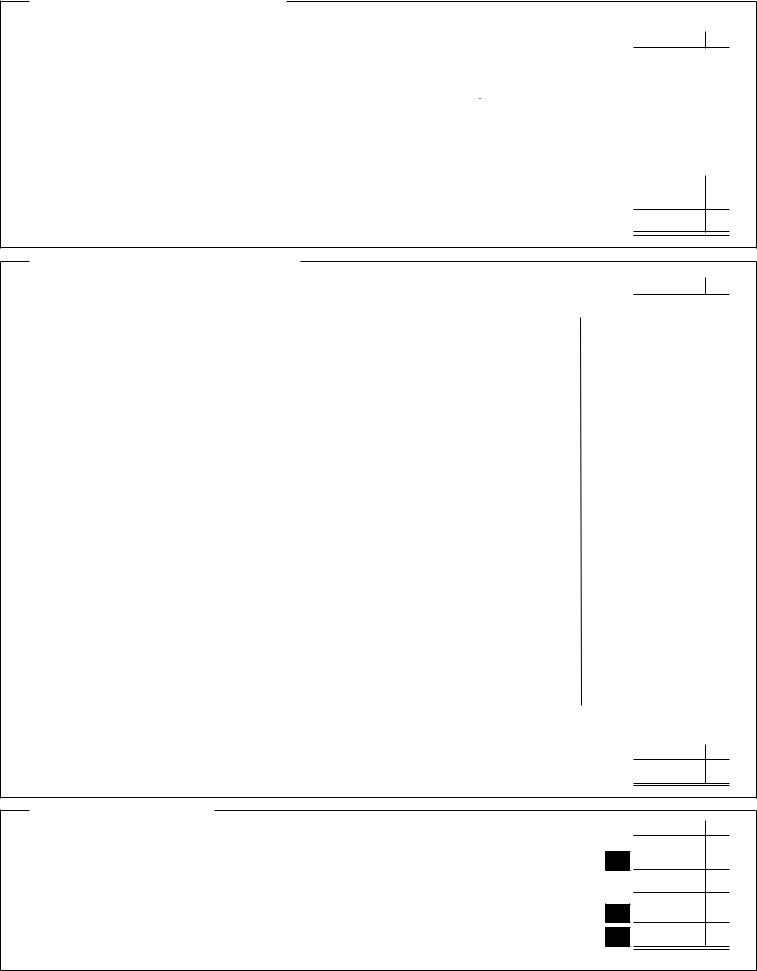

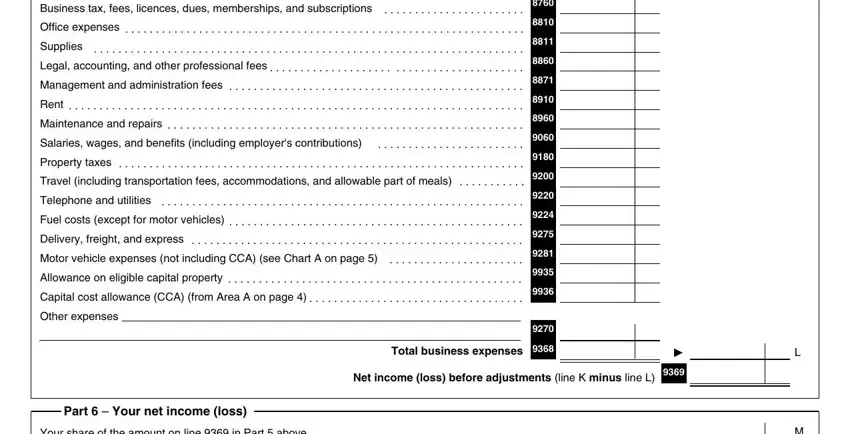

4. This fourth part arrives with these particular blank fields to look at: Business tax fees licences dues, Office expenses, Supplies, Legal accounting and other, Management and administration fees, Rent, Maintenance and repairs, Salaries wages and benefits, Property taxes, Travel including transportation, Telephone and utilities, Motor vehicle expenses not, Allowance on eligible capital, Capital cost allowance CCA from, and Other expenses.

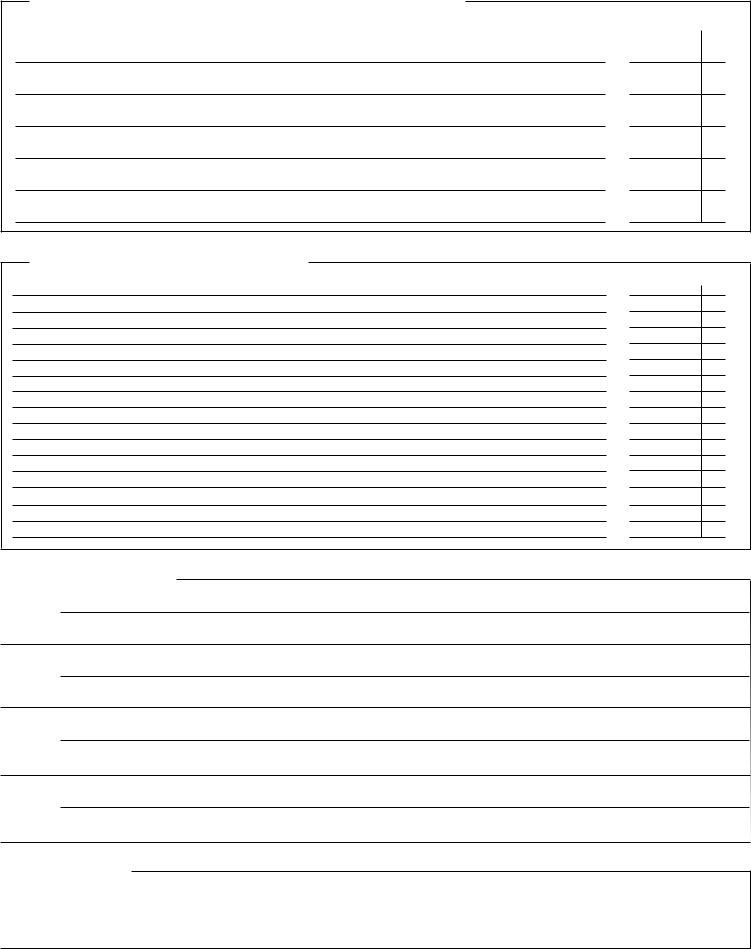

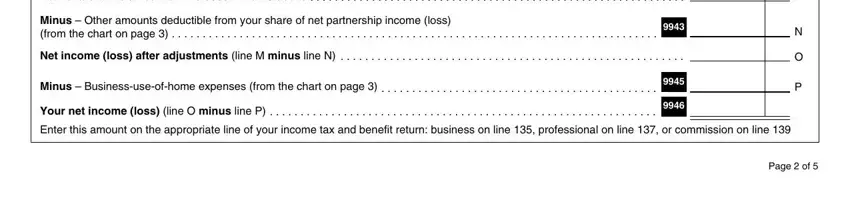

5. This last stage to finalize this document is integral. You must fill in the necessary fields, particularly Your share of the amount on line, Minus Other amounts deductible, Net income loss after adjustments, Minus Businessuseofhome expenses, Your net income loss line O minus, Enter this amount on the, and Page of, prior to finalizing. Otherwise, it may contribute to a flawed and possibly nonvalid document!

Step 3: After you have looked over the details in the fields, click "Done" to finalize your FormsPal process. Create a free trial plan at FormsPal and gain direct access to t2125 excel template - accessible from your personal account page. With FormsPal, it is simple to complete forms without worrying about personal data incidents or data entries getting distributed. Our secure software helps to ensure that your personal details are maintained safely.