The TABC L-103 form serves as a comprehensive application for entities outside of Texas seeking authorization to engage in the sale, brewing, or manufacturing of alcoholic beverages within the state. Known as the Application for Nonresident Seller’s Permit, Nonresident Brewer’s Permit, and Nonresident Manufacturer’s License, this document captures a wide array of information critical for the regulatory oversight and operational legality of such entities in Texas. It demands meticulous details including, but not limited to, the type of permit being applied for, business trade name, physical and mailing addresses, and contact information. Additionally, it requires personal details of individuals and key stakeholders involved in the business, highlighting the emphasis on thorough vetting processes. The form also probes into the applicant’s compliance with industry regulations, such as maintaining clear boundaries between manufacture, wholesale, and retail sectors of the industry, and ensures that applicants are the primary source of supply for the brands they wish to sell. Further scrutiny is applied regarding the actual manufacturing locations and the logistical details of transporting the product into Texas, underscoring the state’s stringent stance on tracking and quality control. Lastly, a section for acknowledgment warns about the legal implications of falsifying information on the application, underlining the seriousness with which the Texas Alcoholic Beverage Commission (TABC) takes the permitting process. This multifaceted document, thus, lays the foundation for regulating nonresident entities’ operations in the Texas alcoholic beverage market, ensuring compliance, and safeguarding the interests of the state and its residents.

| Question | Answer |

|---|---|

| Form Name | Tabc Form L 103 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | L 103 tabc application form |

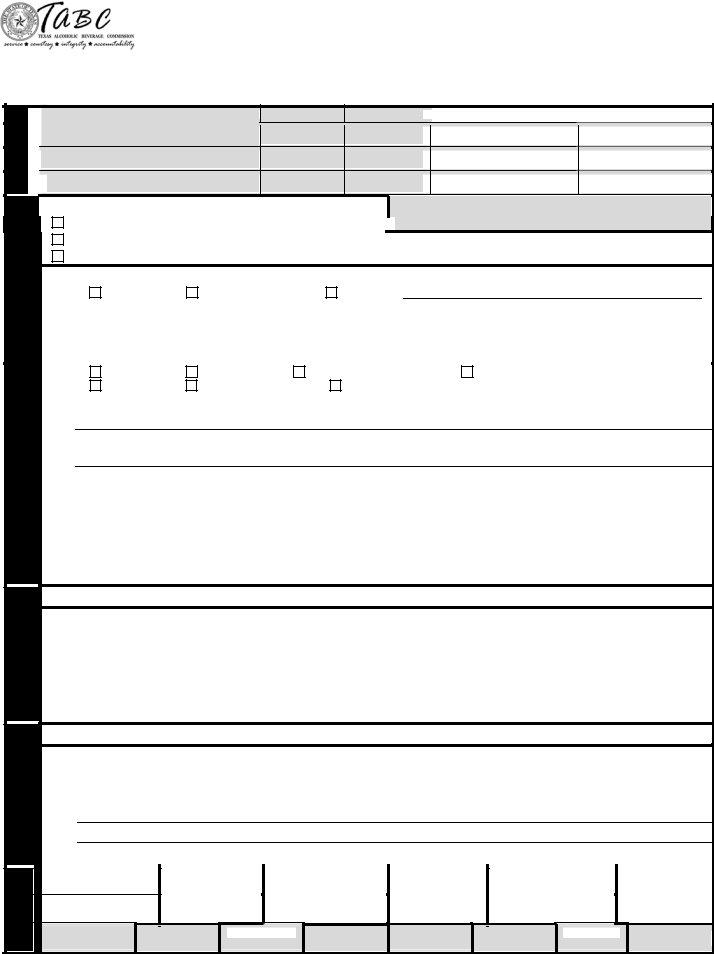

APPLICATION FOR NONRESIDENT SELLER’S PERMIT, NONRESIDENT BREWER’S PERMIT AND NONRESIDENT

MANUFACTURER’S LICENSE

FIRST READ ALL INSTRUCTIONS |

TYPE OR PRINT IN INK |

|

FORM |

TABC USE ONLY

ISSUE DATE

S

U

BS

1A. APPLICATION FILED FOR:

S NONRESIDENT SELLER’S PERMIT U NONRESIDENT BREWER’S PERMIT

BS NONRESIDENT MANUFACTURER’S LICENSE

|

|

|

|

|

|

FEE |

|

SURCHARGE |

|

LATE FEE (RENEWAL ONLY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registry No.

FOR ALL APPLICANTS

FOR INDIVIDUAL |

ONLY

FOR ALL APPLICANTS

TABC USE

B. APPLICATION FILED FOR:

Original |

Renewal Change |

Change of: |

C. If renewal or change, enter license/permit no(s).:

S- |

|

|

U- |

|

|

BS- |

|

|

2. APPLICATION IS FILED BY: |

|

|

|

|

|

|||

|

Individual |

Corporation |

Limited Liability Company |

Other: |

|

|||

|

Partnership |

Limited Partnership |

Limited Liability Partnership |

|||||

3.Trade Name of Business

4.Address or Location

|

City |

|

|

County |

State |

Zip Code (9 digits) |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

5. |

Mailing Address |

|

|

City/Foreign Country State |

Zip Code (9 digits) |

|

|

|

|

|

|

|

- |

|

|

|

|

|

||

6. |

Area Code + Business |

Area Code + Alternate |

|

|||

|

Telephone Number |

Telephone Number |

|

|

||

|

( ) |

- |

( ) |

- |

|

|

FOR INDIVIDUAL

7. Social Security Number |

Issuing State and Driver’s License Number |

Date of Birth (mm/dd/yyyy) |

|||

- |

- |

|

/ |

/ |

|

|

|

|

|

||

|

Full Legal Name (Last, First, Middle) |

|

|

||

|

|

|

|

|

|

|

Residential Address |

City |

State |

Zip Code ( 9 Digits ) |

|

|

|

|

|

|

- |

ALL APPLICANTS

8.Give name, address, and phone number of appointed agent, resident of Texas, certified by applicant to the Secretary of State at Austin, Texas, as the person upon whom notice of a hearing may be served concerning matters, proceedings, hearings and causes involving the refusal, cancellation or suspension of a permit or license issued by this commission. Name shown here must be the same as that shown on Form

Name:

Address:

|

|

|

Phone Number: ( ) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INITIAL APPLICATION |

|

|

|

|

|

|

|

|

ADDITIONAL |

|

|

|

|

|

|

PROCESSOR REVIEW |

|

|

|

|

|

|

|

|

|

|

|

|

YES - NO |

|

|

|

|

|

|

YES - NO |

|

|

|

|

|

/ |

/ |

|

|||||

|

|

|

INCOMPLETE |

|

|

|

|

|

|

CORRESPONDENCE |

|

|

|

|

|

DATE |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

DATE |

|

|

|

YES - NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

# OF PAGES |

|

|

|

|

|

CROSS CHECK DATE |

|

|

|

|

||||||

|

|

CROSS CHECKED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

WRITTEN |

/ |

/ |

END PROCESS |

/ |

/ |

PROCESSOR |

PROCESSOR |

YES |

- |

NO |

|

PROCESS DATE |

DATE |

I.D. |

ERROR |

||||||||

|

|

|

|

|

|

|

Page 1 of 4

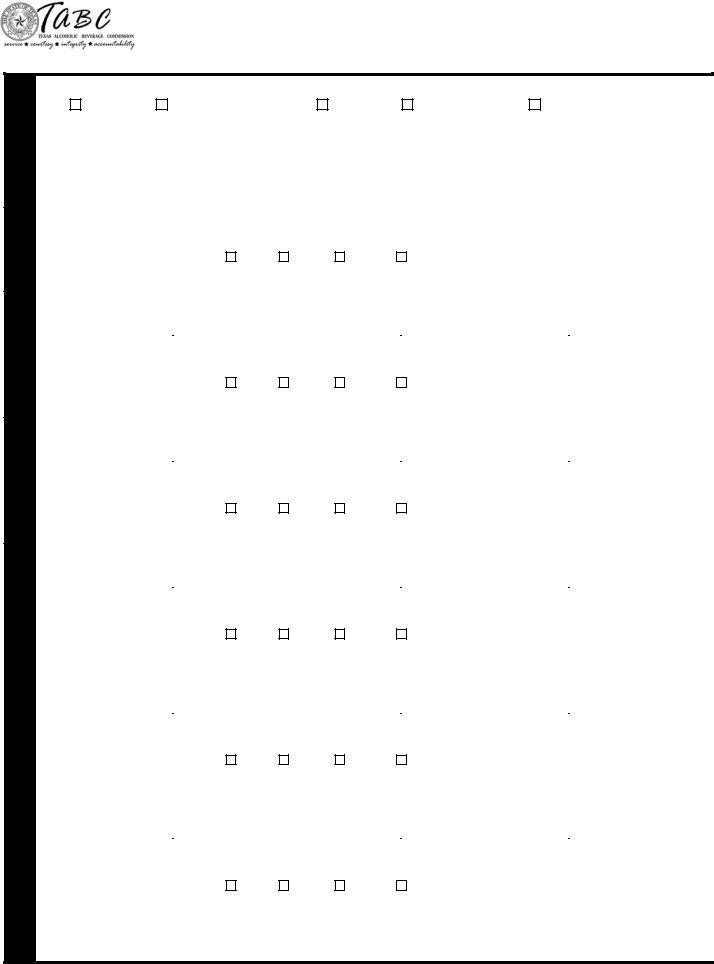

FOR ALL OFFICER(S), PARTNER(S), DIRECTOR(S), MANAGER(S), STOCKHOLDER(S) AND MEMBER(S).

P A R T N E R S H I P S / C O R P O R A T I O N S

TRADE NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM |

|||||||

1A. Indicate type of ownership and complete the information below: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Corporation |

Limited Liability Company |

Partnership |

Limited Partnership |

Limited Liability Partnership |

|||||||||||||||||

B. Federal Employer’s I.D. No.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

C. Entity Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

D. Charter No.: |

|

|

|

|

Date Approved: |

|

/ |

|

/ |

|

|

|

State: |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

E. Number and class of shares, memberships or units issued: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

2. COMPLETE THE FOLLOWING PER INSTRUCTIONS: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Social Security Number |

Issuing State and Driver’s License Number |

|

Date of Birth (mm/dd/yyyy) |

|

|

Class & No. Shares Held |

||||||||||||||||

- |

- |

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

or % Memberships |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or % Interest |

||||

Full Legal Name (Last, First Middle) |

Officer |

Partner |

Director/ |

Stockholder/ |

|

Title |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Manager |

Member |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Residential Address |

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code (9 digits) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

||

|

|

|

|

|

|

|

|

|||||||||||||||

Social Security Number |

Issuing State and Driver’s License Number |

|

Date of Birth (mm/dd/yyyy) |

|

|

Class & No. Shares Held |

||||||||||||||||

- |

- |

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

or % Memberships |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or % Interest |

||||

Full Legal Name (Last, First Middle) |

Officer |

Partner |

Director/ |

Stockholder/ |

|

Title |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Manager |

Member |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Residential Address |

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code (9 digits) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

||

|

|

|

|

|

|

|

|

|||||||||||||||

Social Security Number |

Issuing State and Driver’s License Number |

|

Date of Birth (mm/dd/yyyy) |

|

|

Class & No. Shares Held |

||||||||||||||||

- |

- |

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

or % Memberships |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or % Interest |

||||

Full Legal Name (Last, First Middle) |

Officer |

Partner |

Director/ |

Stockholder/ |

|

Title |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Manager |

Member |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Residential Address |

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code (9 digits) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

||

|

|

|

|

|

|

|

|

|||||||||||||||

Social Security Number |

Issuing State and Driver’s License Number |

|

Date of Birth (mm/dd/yyyy) |

|

|

Class & No. Shares Held |

||||||||||||||||

- |

- |

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

or % Memberships |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or % Interest |

||||

Full Legal Name (Last, First Middle) |

Officer |

Partner |

Director/ |

Stockholder/ |

|

Title |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Manager |

Member |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Residential Address |

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code (9 digits) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

||

|

|

|

|

|

|

|

|

|||||||||||||||

Social Security Number |

Issuing State and Driver’s License Number |

|

Date of Birth (mm/dd/yyyy) |

|

|

Class & No. Shares Held |

||||||||||||||||

- |

- |

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

or % Memberships |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or % Interest |

||||

Full Legal Name (Last, First Middle) |

Officer |

Partner |

Director/ |

Stockholder/ |

|

Title |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Manager |

Member |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Residential Address |

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code (9 digits) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

||

|

|

|

|

|

|

|

|

|||||||||||||||

Social Security Number |

Issuing State and Driver’s License Number |

|

Date of Birth (mm/dd/yyyy) |

|

|

Class & No. Shares Held |

||||||||||||||||

- |

- |

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

or % Memberships |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or % Interest |

||||

Full Legal Name (Last, First Middle) |

Officer |

Partner |

Director/ |

Stockholder/ |

|

Title |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Manager |

Member |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Residential Address |

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code (9 digits) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(IF YOU NEED ADDITIONAL SPACE FOR MORE NAMES, USE ADDITIONAL COPIES OF THIS PAGE)

Page 2 of 4

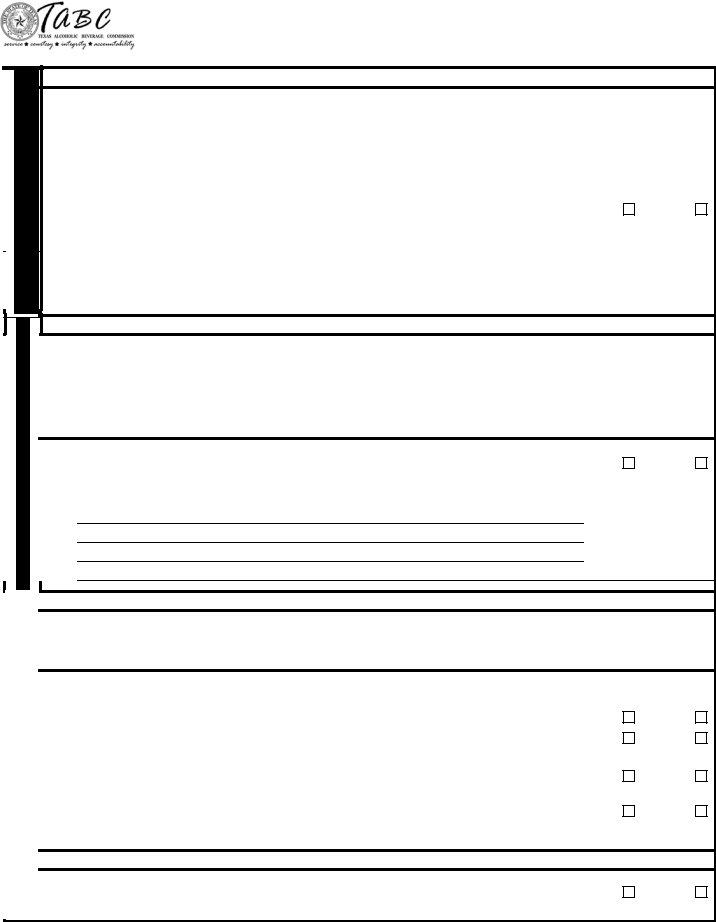

A L L A P P L I C A N T S

FOR ALL APPLICANTS

TRADE NAME: |

FORM |

ALL APPLICANTS

9.The applicant or permit and license holder may have an interest, directly or indirectly in only one level of the alcoholic beverage industry; i.e. manufacture, wholesale or retail. You or your agent, servant or employee may not:

1.be employed in any capacity at different levels,

2.rent or lease property or equipment from or to an entity operating at another level,

3.secure credit or a loan in any form for an entity at another level,

4.control in any fashion the interests of a permittee or licensee at a different level.

A. Are you or anyone indicated in questions 7 on

requirements? |

9A. YES NO |

If “YES,” explain below: (If more space is needed, attach a page.) |

|

|

|

|

|

|

|

|

|

FOR NONRESIDENT SELLER’S PERMIT

FOR NONRESIDENT SELLER’S PERMIT

NOTE: Section 37.10(a) and (b) provides: “ No holder of a nonresident seller’s permit may solicit, accept, or fill an order for distilled spirits or wine from a holder of any type of wholesaler’s permit unless the nonresident seller is the primary source for the brand of distilled spirits or wine that is ordered. In this section, “primary American source of supply” means the distiller, the producer, the owner of the commodity at the time it becomes a marketable product, the bottler, or the exclusive agent of any of those. To be the “primary American source of supply” the nonresident seller must be the first source, that is the manufacturer or the source closest to the manufacturer, in the channel of commerce from whom the product can be secured by American wholesalers.”

10.Is the applicant “the primary American source of supply” for any brands of distilled spirits or

wine within the meaning of Section 37.10(a) and (b) of the Texas Alcoholic Beverage Code? |

10. |

YES NO |

If “YES,” specify the manufacturer and brands of distilled spirits and/or wine. (If more space is needed, attach a page.)

|

|

FOR NONRESIDENT MANUFACTURER’S LICENSE |

|

|

|

||

|

|

|

|

|

|

|

|

|

NONRESIDENT |

BREWER’S PERMIT |

|

|

|

|

|

FOR NONRESIDENT MANUFACTURER’S LICENSE

NOTE: IF APPLYING FOR A NONRESIDENT BREWER’S PERMIT AND/OR NONRESIDENT MANUFACTURER’S LICENSE, EACH LOCATION WHERE PRODUCT IS MANUFACTURED AND SHIPPED INTO THIS STATE MUST APPLY FOR AND OBTAIN A PERMIT OR LICENSE.

11A. Will the applicant actually engage in the business of brewing and packaging beer within a three |

|

|

|

year period covered by its original license and two successive renewals thereof in such |

|

|

|

quantities as will make its operation that of a bona fide brewing manufacturer? |

11A. |

YES |

NO |

B. Is applicant the actual manufacturer of the beer to be imported into the State of Texas? |

B. |

YES |

NO |

C. Is location in question 4 the actual manufacturing location of the product being shipped into |

|

|

|

Texas? |

C. |

YES |

NO |

If answer is “NO,” application cannot be approved. |

|

|

|

D. Will the applicant transport beer into Texas in vehicles owned or leased by applicant? |

D. |

YES |

NO |

If answer is “YES,” refer to #5 of the instructions shown on page 4 for necessary bond |

|

|

|

requirement. |

|

|

|

FOR NONRESIDENT BREWER’S PERMIT |

|

|

|

12.Is location in question 4 the actual manufacturing location of the product being shipped into

Texas? |

12. |

YES NO |

|

|

|

If answer is “NO,” application cannot be approved. |

|

|

Page 3 of 4