In an era where every dollar counts, the process of managing tax obligations presents a puzzle for many, especially for entities entitled to tax-exempt status. The Sales Tax Exemption Claim Guidelines offered by Costco Wholesale Corporation serve as a beacon for those navigating the waters of tax exemption for purchases made on the company's website. The guidelines meticulously outline the procedure for claiming sales tax exemption, beginning with the necessity for the claimant to initially pay the tax at the point of sale, followed by submitting a thoughtful plea for exemption. Required documentation includes a copy of the tax-exempt document, the online purchase confirmation receipt, and a meticulously filled and signed sales tax exemption claim form. However, the path to a successful exemption claim is paved with specific instructions, including the mandate that the claim must align with the exemption regulations of the state where the merchandise is shipped. The process underscores the importance of adhering to state resale or tax exemption laws and highlights Costco's commitment to facilitating this process, albeit post-purchase. Through this structured approach, Costco aims to bridge the gap between operational regulations and the needs of tax-exempt entities, such as educational institutions and nonprofit organizations, thereby reinforcing the intricate dance between taxation policies and the pursuit of operational efficiencies for tax-exempt purchasers.

| Question | Answer |

|---|---|

| Form Name | Tax Exempt Apply To Costco Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | tax exempt costco, costco tax exempt form, tax exempt at costco, costco business membership tax exempt |

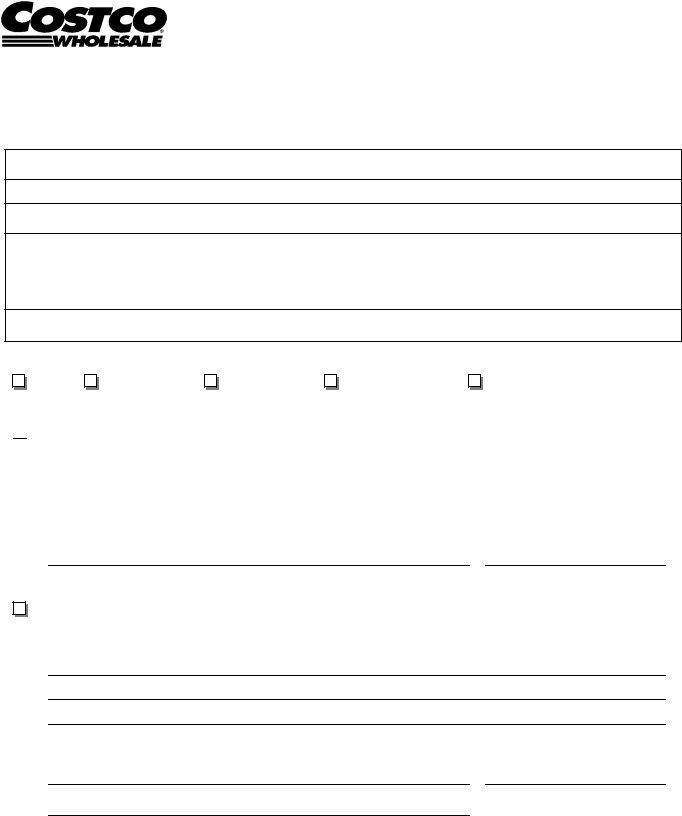

SALES TAX EXEMPTION CLAIM

GUIDELINES

Thank you for

This is in response to your question about using your tax exemption status for purchases on our web site. Currently, Costco.com does not offer sales tax exemption at the point of sale.

Our Tax Department will consider your exemption after you have placed your order. Please send a copy of your resale/tax exempt documentation, a copy of the online

Costco Wholesale

Operations/Buying Tax Department

999 Lake Drive

Issaquah, WA 98027

Only claims meeting the exemption requirements of the state where merchandise is shipped will be considered. Receipt of your claim is not an agreement that tax will be refunded.

For resale, Costco.com requires the appropriate resale certificate from the state where the shipment was delivered. For exempt organizations, such as schools and nonprofit organizations, most states require that purchases must be made with a credit card in the name of the tax exempt business or agency. Payment with personal funds to be reimbursed by the organization may nullify an exemption.

Our ability to provide you a refund of the tax you paid on your purchase will be based on the "ship to" state's resale/tax exemption laws. If your purchase does not meet that state’s guidelines, Costco will not be able to refund the tax.

Please feel free to contact us if you have any more questions/concerns.

Thank you,

Costco Wholesale Corporation

SALES TAX EXEMPTION CLAIM

In order to process your request, please be sure to fill out the form in its entirety. Attach a complete and legible copy of the sales receipt. If you have multiple receipts, please provide a summary of the items you are requesting a refund on. The summary should include (but is not limited to) the date of the transaction, item description and amount. Refund requests lacking the summary may result in a delay in processing the refund.

Legal Business Name:

Doing Business As:

Business Address (include City, State and Zip Code):

Costco Membership #: |

Business Phone #: |

|

|

|

|

Sales Tax Registration #: |

State Registered: |

Total Refund Requested: |

|

|

|

Precise Nature of Business: |

|

|

If you resell merchandise, please list the categories of items typically resold (be specific):

Payment Method for this transaction (Box must be checked):

Cash

Personal Check

Business Check

Personal Credit Card

Business Credit Card

REASONS FOR EXEMPTION

PURCHASED FOR RESALE: To receive a refund of sales tax paid on items for resale, the statement must be signed by a Costco member authorized to purchase merchandise for resale on behalf of your company.

Resale Statement: I certify that I am engaged in the business of selling, leasing or renting tangible personal property of the kind and type listed on the attached receipt(s). I certify that the items listed on the receipt(s) will be resold, leased or rented by me. If the tangible personal property is withdrawn for use other than for resale, I will report the transaction to the appropriate taxing authority and pay the tax based upon the reasonable and fair market value, but not less than the original purchase price. I understand that by extending this form, I am assuming liability for the sales or use tax on transactions between your firm and me.

Signature |

Date |

OTHER EXEMPTION: State the exemption claimed, applicable regulation/statute (if known) and attach completed Exemption Certificate. If the exemption is specific to a product, highlight the product(s) on the receipt and explain why the items should be tax exempt.

Submitted by (Must be signed by an Authorized Signer on Membership):

Signature |

Date |

Print Name

Incomplete exemption claim forms and claims lacking receipts, summary or other requested documents will be returned.

MAIL CLAIM TO: |

Costco Wholesale |

|

|

Operations/Buying Tax Department |

|

|

999 Lake Drive |

Fax #: (425) |

|

Issaquah, WA 98027 |

TaxRequest@costco.com |

|

|

|

For Internal Use Only |

|

|

Form # MB33 04/2006 |

|

Authorized by: _________________ |