Working with PDF files online is actually super easy with this PDF tool. You can fill out Tax Form 214 here effortlessly. The tool is continually updated by us, receiving new functions and growing to be better. To get the ball rolling, go through these easy steps:

Step 1: Open the PDF file inside our editor by clicking on the "Get Form Button" above on this page.

Step 2: With this online PDF tool, you can actually do more than just fill out blanks. Try each of the functions and make your documents appear perfect with custom text added, or modify the original input to perfection - all accompanied by the capability to insert your personal photos and sign it off.

It will be easy to finish the form using this detailed guide! Here is what you must do:

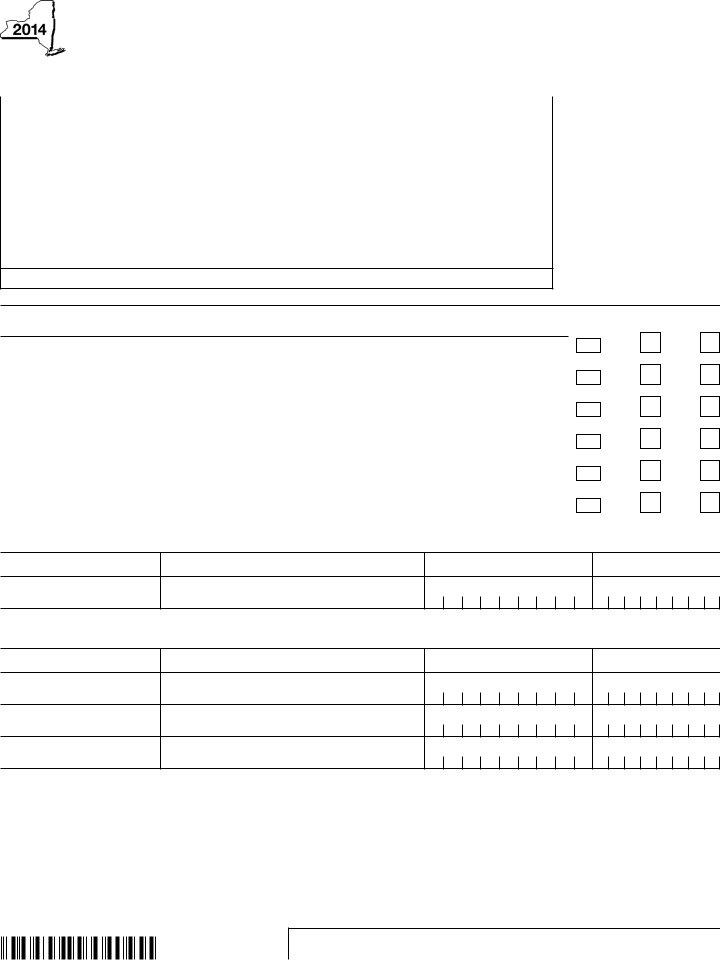

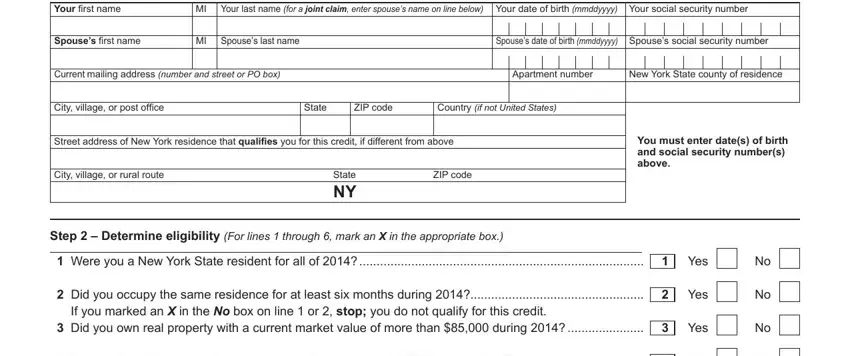

1. To begin with, while completing the Tax Form 214, start with the part containing subsequent fields:

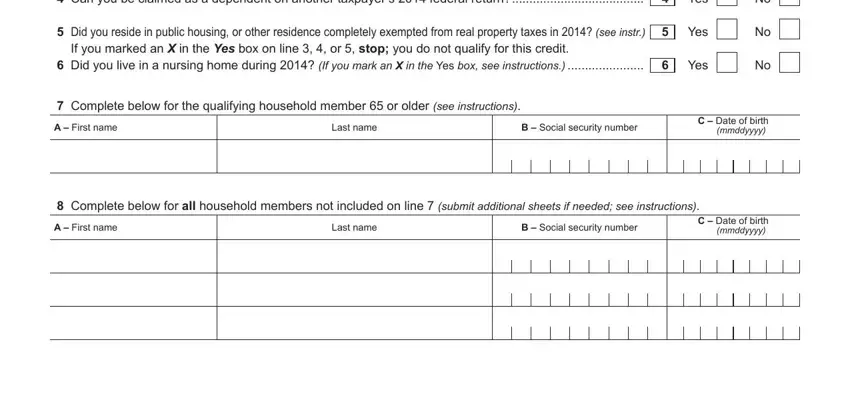

2. After the previous segment is done, you should add the needed details in Can you be claimed as a dependent, Did you reside in public housing, If you marked an X in the Yes box, Did you live in a nursing home, Complete below for the qualifying, A First name, Last name, B Social security number, C Date of birth mmddyyyy, Complete below for all household, A First name, Last name, B Social security number, and C Date of birth mmddyyyy so that you can move forward further.

People often get some points wrong while filling in Did you live in a nursing home in this part. You need to re-examine what you type in right here.

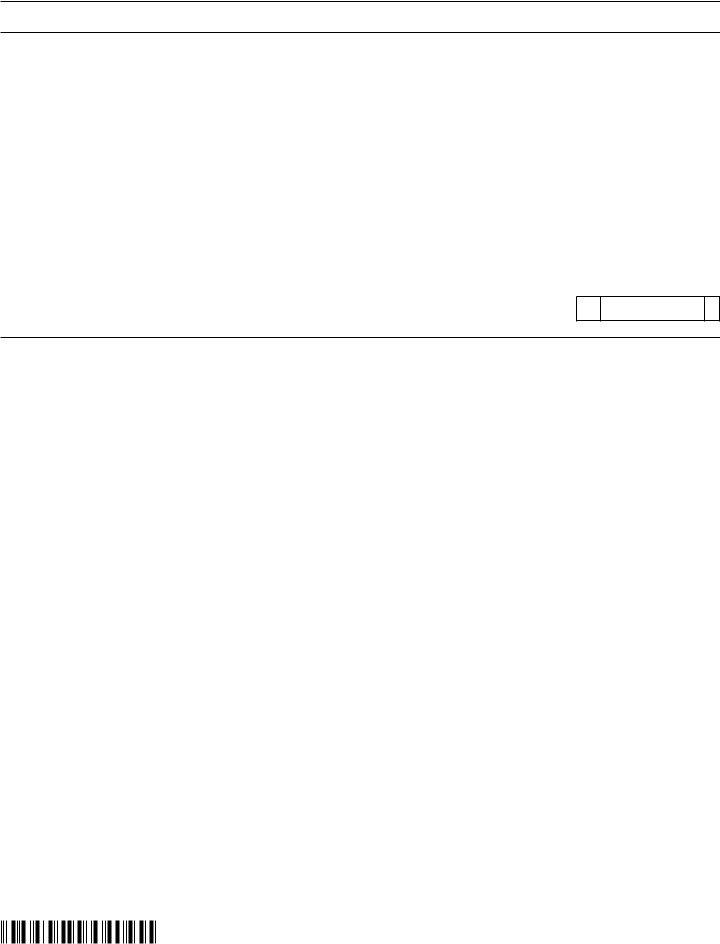

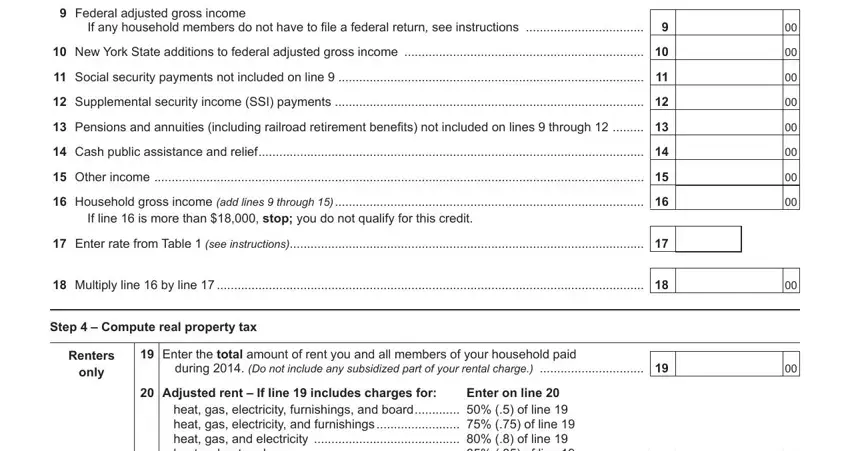

3. Throughout this part, take a look at Federal adjusted gross income, If any household members do not, New York State additions to, Social security payments not, Supplemental security income SSI, Pensions and annuities including, Cash public assistance and relief, Other income, Household gross income add lines, If line is more than stop you do, Enter rate from Table see, Multiply line by line, Step Compute real property tax, Renters, and only. All of these should be taken care of with highest awareness of detail.

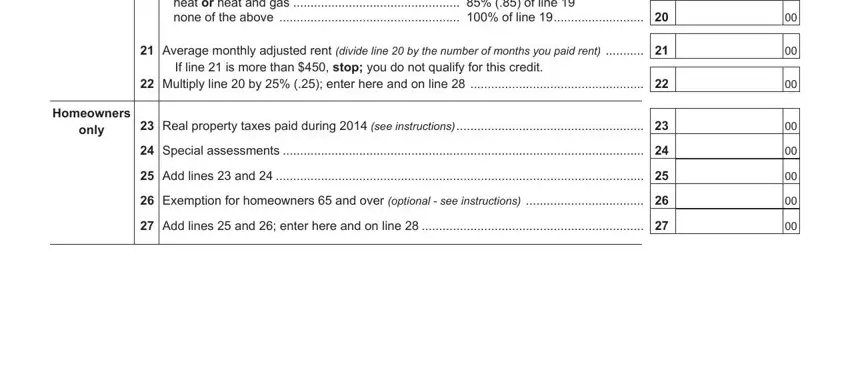

4. This next section requires some additional information. Ensure you complete all the necessary fields - heat gas electricity furnishings, Average monthly adjusted rent, If line is more than stop you do, Multiply line by enter here, Homeowners, only, Real property taxes paid during, Special assessments, Add lines and, Exemption for homeowners and, and Add lines and enter here and on - to proceed further in your process!

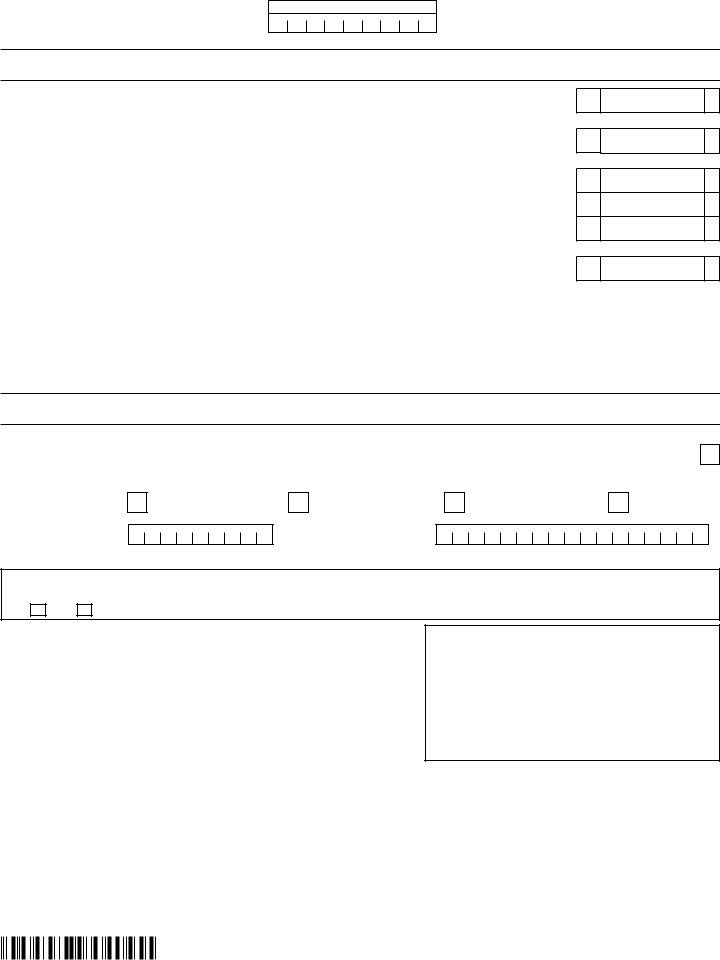

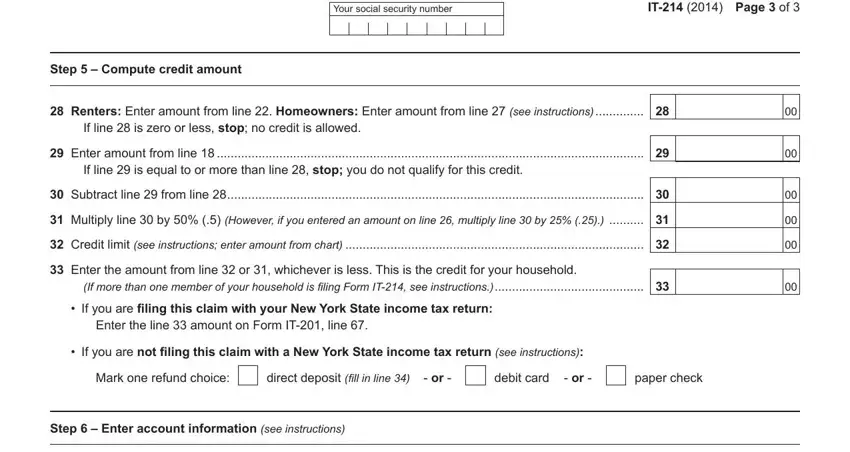

5. While you near the finalization of the form, there are actually a couple more points to undertake. Particularly, Your social security number, IT Page of, Step Compute credit amount, Renters Enter amount from line, If line is zero or less stop no, Enter amount from line, If line is equal to or more than, Subtract line from line, Multiply line by However if, Credit limit see instructions, If more than one member of your, Enter the amount from line or, If you are iling this claim with, Enter the line amount on Form IT, and If you are not iling this claim must all be filled out.

Step 3: Right after taking one more look at the filled out blanks, click "Done" and you are all set! After starting afree trial account at FormsPal, you'll be able to download Tax Form 214 or send it through email immediately. The file will also be at your disposal via your personal cabinet with all your edits. FormsPal is invested in the confidentiality of all our users; we make certain that all information entered into our editor remains secure.