Navigating the complexities of local taxation requires a keen understanding of specific forms and regulations, among which the Tax 531 form is particularly significant for residents of Bethlehem, Pennsylvania. This document serves as the final Individual Earned Income Tax Return for those living within the jurisdiction of the City of Bethlehem Tax Bureau. It mandates the inclusion of comprehensive income details, including all W-2 and 1099 earnings, alongside allowable non-reimbursed employee business expenses. Additionally, it accommodates both full-year and partial-year residents by requiring detailed address and employment history. Notably, the form stipulates an April 15 deadline for submission, post which penalties, interest, and late filing fees apply. Taxpayers must accurately calculate their liability, incorporating any quarterly payments made, tax withheld, and applicable credits to determine their refund or remaining tax due. Furthermore, it underscores the necessity of attaching state schedules and W-2 forms to substantiate earnings and tax payments, with a special provision for those with income taxed in Delaware and/or New York. The form's precise instructions aim to ensure taxpayers meet their obligations efficiently, highlighting the importance of accuracy and timeliness in local tax compliance.

| Question | Answer |

|---|---|

| Form Name | Tax Form 531 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | city bethlehem form, west shore tax form 531, pa tax form 531, york county tax form 531 |

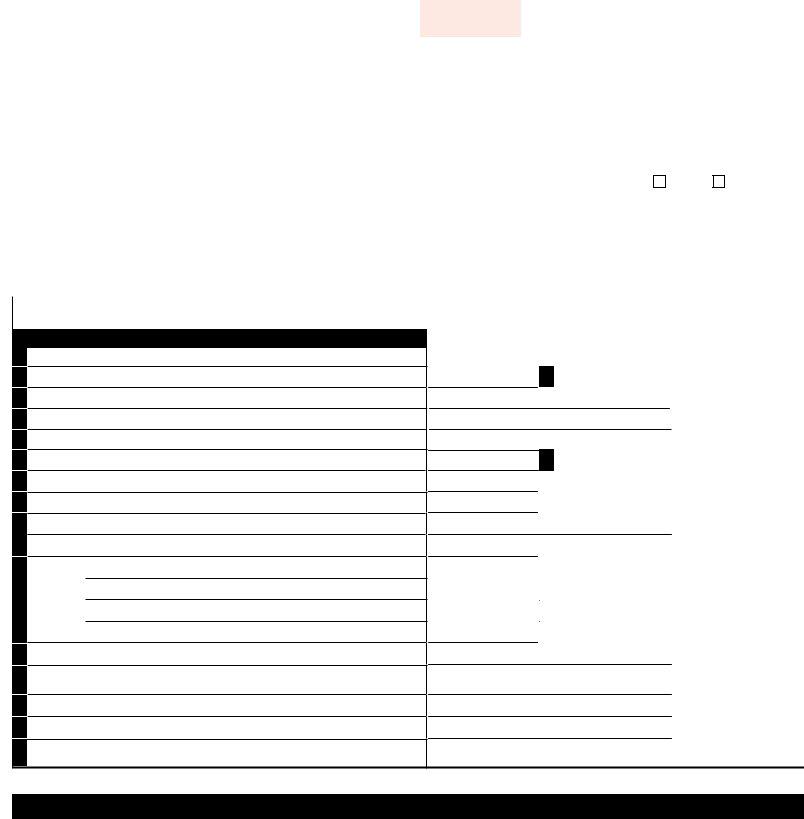

FORM 531 |

|

CITY OF BETHLEHEM TAX BUREAU |

|

|

10 E. CHURCH STREET • BETHLEHEM, PA 18018 |

REFER TO INSTRUCTION SHEET |

MAILING ADDRESS: P.O. BOX 500 • BETHLEHEM, PA |

|

|

|

(610) |

Mail your return in the

FINAL INDIVIDUAL EARNED INCOME TAX RETURN

CALENDAR YEAR

PLEASE FILE THIS RETURN AND INCLUDE ALL NECCESSARY SCHEDULES ON OR BEFORE APRIL 15.

ANY BALANCE OF TAX DUE SHALL BE REMITTED IN FULL WITH THIS RETURN.

SOCIAL SECURITY NO.

MUNICIPALITY

TELEPHONE

FULL YEAR RESIDENT

YES

NO

|

|

PARTIAL YEAR RESIDENT - PLEASE COMPLETE |

||||||||

|

|

ADDRESS INFORMATION BELOW. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

FORMER ADDRESS - INCLUDE STREET OR ROAD, CITY AND STATE |

|

DATES AT FORMER ADDRESS |

|

|

|

|

|||

IF YOU MOVED DURING |

|

|

FROM |

|

|

|

TO |

|

|

|

THE YEAR, COMPLETE |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

CURRENT ADDRESS - INCLUDE STREET OR ROAD, CITY AND STATE |

|

DATES AT CURRENT ADDRESS |

|

|

|

|

||||

THE FOLLOWING |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FROM |

|

|

|

TO |

|

||

|

|

|

|

|

|

|

|

|

|

|

PRINT EMPLOYER’S NAME - ADDRESS (USE WORKSHEET ON BACK IF MORE THAN ONE EMPLOYER) |

LOCAL TAX WITHHELD |

TOTAL |

|

TOTAL 1099 EARNINGS |

||||||

|

|

$ |

|

|

$ |

|

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

A COPY OF FORM

1TOTAL GROSS EARNINGS FROM

2LESS: Allowable

3TAXABLE

4OTHER TAXABLE EARNED INCOME - DO NOT ADD INTEREST, DIVIDENDS OR

5TOTAL TAXABLE EARNED INCOME (Add lines 3 and 4)

6NET LOSS - Include PA Schedule C, F,

7SUBTOTAL (Subtract Line 6 from Line 5) If less than zero, enter zero

8NET PROFIT - Include Schedule C, F,

9TOTAL EARNED INCOME - Subject to this tax (Add lines 7 and 8)

10TAX LIABILITY - Line 9 multiplied by tax rate of 1% (.01)

(a)Quarterly Estimated Payments

11AMOUNT (b) Earned Income Tax Withheld - per

PAID (c) Credit from Last Year (If Credit Due)

(d) Misc. Credit (i.e. Phila Tax or Out of State Tax)

12TOTAL OF LINES 11A + 11B + 11C + 11D REFUND/ CREDIT (Line 12 minus line 10)

13Enter amount and check box ® Credit to Next Year. ® Refund

14TAX DUE (Line 10 minus Line 12)

15INTEREST (6% per year) + PENALTY (1/2% per mo.) + LATE FILING FEE ($10) AFTER APRIL 15

16TOTAL AMOUNT DUE (Line 14 + line 15)

|

|

|

1. |

$ |

|

|

|

|

|

|

2. $ |

2 |

|

|

|

|

|

3 |

$ |

|

|

|

|

|

ATTACH FORM 1099 OR EXPLAIN |

4. |

$ |

||

|

|

|

|

|

|

|

|

5. |

$ |

|

|

|

|

|

|

6. $ |

6. |

|

|

|

|

|

7 |

$ |

|

|

|

|

|

|

8. |

$ |

|

|

|

|

|

9. |

$ |

|

|

|

|

|

|

|

|

10. |

$ |

|

|

|

|

|

PLEASE |

11A. |

$ |

11. |

|

DO NOT |

11B. |

$ |

|

|

ROUND |

|

|

||

11C. |

$ |

12 |

|

|

TAX |

|

|||

|

|

|

|

|

AMOUNTS |

11D. |

$ |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

12. |

$ |

|

|

|

|

|

NO REFUND OR CREDIT IF LESS |

13. |

$ |

||

THAN $1.00 |

|

|

||

|

|

|

|

|

|

|

|

|

|

AMOUNTS LESS THAN $1.00 |

14. |

$ |

||

NEED NOT BE PAID |

|

|

||

|

|

|

|

|

|

|

|

15. |

$ |

|

|

|

16. |

$ |

|

|

|

|

|

|

|

|

|

|

***EXTENSIONS FOR FILING MUST BE RECEIVED BY CITY OF BETHLEHEM TAX BUREAU ON OR BEFORE APRIL 15TH***

ATTACH APPROPRIATE COPIES OF STATE SCHEDULES AND/OR ALL

MAKE CHECKS PAYABLE TO CITY OF BETHLEHEM. A FEE OF $25.00 WILL BE CHARGED FOR RETURN CHECKS.

I declare, under penalties of perjury that I/we have examined this return, and to the best of my knowledge and belief, is a true, correct, and complete return.

|

|

|

|

|

SIGNATURE OF TAXPAYER |

DATE |

|

SIGNATURE OF PREPARER (If other than taxpayer) |

DATE |

|

|

|

|

|

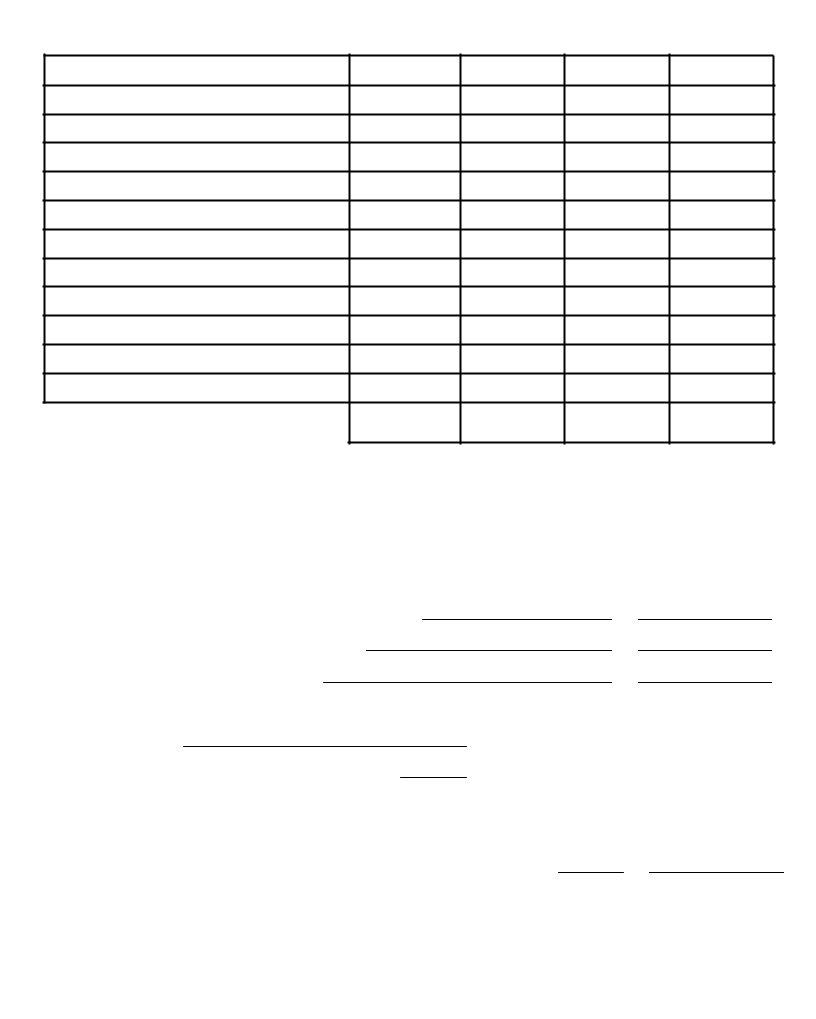

EMPLOYMENT WORKSHEET

Employer’s Name and Address

Dates Employed This Year

From To

Gross

Gross 1099 Earnings

Earned Income Tax

Withheld

TOTALS

WORKSHEET FOR INDIVIDUALS EMPLOYED IN DELAWARE AND/OR NEW YORK

(See Instructions line 12) |

|

EARNED INCOME: Taxed in other state as shown on the state tax return. |

(1) |

Credit will be disallowed if copy of state return is not attached |

X |

Local tax 1% or as specified on the front of this form |

(2) |

Tax Liability to other state |

(3) |

|

|

PA Income Tax (line 1 x PA Income Tax rate for year being reported) |

(4) |

|

|

CREDIT to be used against Local Tax |

|

|

|

(Line 3 minus line 4) On line 11D, enter this amount |

|

|

|

or the amount on the line 2 of worksheet, whichever is less. (If less than zero, enter zero) |

(5) |

||

COPIES OF THE CITY OF BETHLEHEM RULES AND REGULATIONS AND DISCLOSURE STATEMENT

ARE AVAILABLE FROM THE TAX BUREAU. CALL (610)

Rev. 12/07