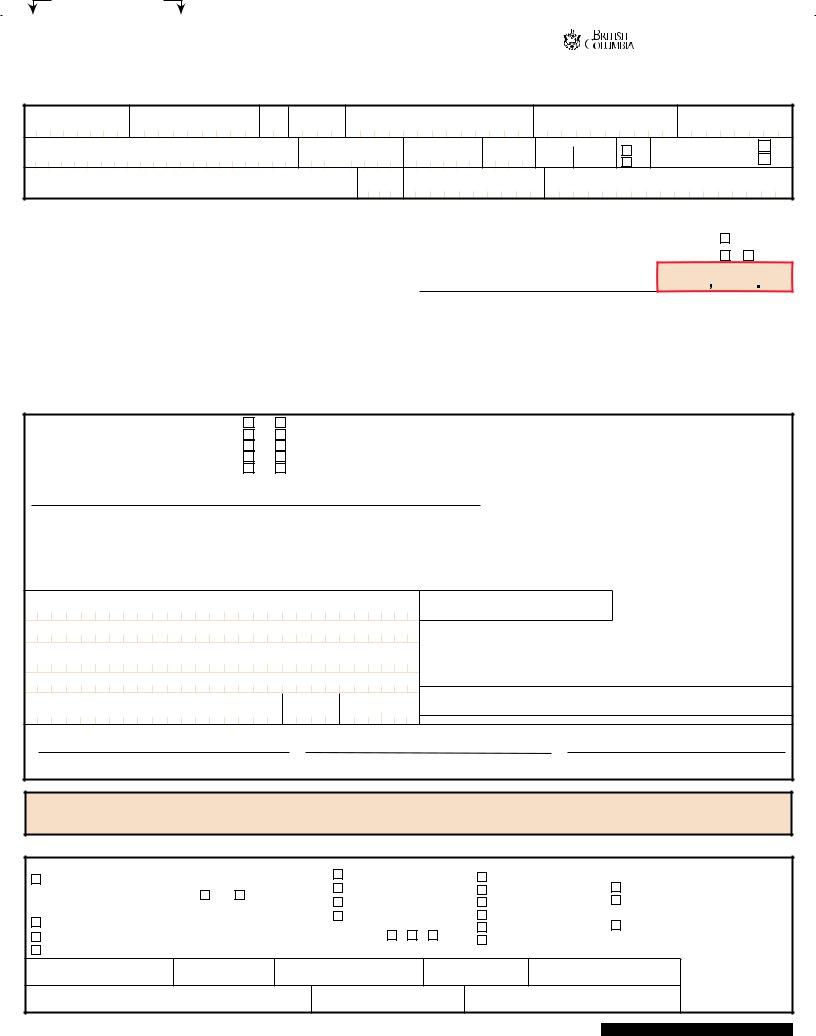

Navigating the nuances of vehicle transactions and tax obligations can often feel like a daunting task, but understanding the APV9T form is your first step towards simplifying this process. This particular form, an integral document issued by the Insurance Corporation of British Columbia (ICBC), plays a pivotal role when it comes to the sale, purchase, or transfer of vehicle ownership in British Columbia. It amalgamates multiple facets of vehicle transfer, including tax declarations, seller and purchaser information, vehicle description, and critical declarations regarding the vehicle's condition and history. Beyond serving as a mere transactional record, this form acts as a legal declaration by both parties about the accuracy of the information provided, ensuring the vehicle's seamless transition under new ownership. The form obligates sellers to disclose comprehensive details regarding the vehicle's past, including any previous damages, alterations, or usage specifics that could influence the vehicle’s valuation or legal standing. Likewise, purchasers are required to acknowledge the transaction details and provide declarations regarding the payment of applicable taxes or claims of exemptions. Notably, the APV9T form also contains sections that address exemptions, tax calculations, and the need for supporting documentation to prevent fraud and ensure transparency. Insight into this form reveals the complex interplay between consumer protection and regulatory compliance, making it a cornerstone document in maintaining integrity in the private sale vehicle market.

| Question | Answer |

|---|---|

| Form Name | Tax Form Apv9T |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | how do i transfer ownership of a trailer in bc, icbc transfer papers, bc transfer papers, vehicle transfer papers bc |

DO NOT WRITE OR STAPLE

IN THIS SPACE

Transfer/ Tax Form |

Insurance Corporation |

|

of British Columbia |

Motor Vehicle Act

Commercial Transport Act

Provincial Sales Tax Act

Excise Tax Act

Motor Vehicle (All Terrain) Act

Motor Dealer Act

Social Service Tax Act

This form must be completed in full and taken to an Autoplan Broker with identification within ten days of the sale. Use blue or black ink only.

VEHICLE DESCRIPTION

REGISTRATION NO.

COLOUR

FUEL YEAR

SEE

REVERSE

MAKE

MODEL

BODY STYLE

VEHICLE IDENTIFICATION NO. (VIN)

SEATING |

NET WEIGHT (kg) |

CAPACITY |

|

|

|

GROSS WEIGHT (kg)

DISP (CC)

VEHICLE STATUS

A - ALTERED

D -

R - REBUILT

S - SALVAGE

FLOOD

No

Yes

VEHICLE HAS CURRENT/ CONDITIONAL AIRCARE PASS

No

Yes

Complete this line only if the vehicle was constructed new by a primary manufacturer and a secondary manufacturer and has 2 vehicle identification numbers (e.g. motor homes, school buses). (see reverse)

YEAR

FRAME / BODY

MAKE |

FRAME / BODY |

SECONDARY VEHICLE IDENTIFICATION NO. (VIN) |

FRAME / BODY |

SELLER INFORMATION AND VEHICLE DECLARATION (Must be completed in full by the seller)

DATE OF SALE (ddmmyyyy) |

PREVIOUS VEHICLE HISTORY |

|

|

|

|

|

|

VEHICLE PREVIOUSLY |

|

CUMULATIVE VEHICLE DAMAGE |

|

|

|

|

|

|

ODOMETER READING |

ODOMETER |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

HAS VEHICLE EVER BEEN USED FOR: |

|

|

|

|

|

|

REGISTERED OUTSIDE BC |

|

New vehicle where |

|

|

No |

Used vehicle |

|

|

No |

|

|

|

|

|

|

|

|

REPLACED/BROKEN |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease |

|

|

Emergency |

|

Taxi |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

damage exceeded 20% |

|

|

|

damage |

|

|

|

|

|

, |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Rental |

|

|

|

|

|

|

|

|

|

No |

|

|

Yes |

|

|

of asking price |

|

|

Yes |

over $2,000 |

|

|

Yes |

|

|

|

|

|

|

km |

mi |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Police |

|

|

of these |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

NAME (SURNAME followed by given names (no initials) or registered company name(s)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

SELLER’S BC DRIVER'S |

|

|

SELLER’S BC DRIVER'S |

|

SELLING PRICE |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIC. NO. |

|

|

LIC. NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/we the seller(s) certify that we are the registered owner(s) of the described vehicle |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and that I/we are entitled to sell it, and that the selling price includes any and all |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

RESIDENTIAL ADDRESS OF SELLER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

consideration received for the vehicle and that the information above is true. |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF SELLER(S) (Print name and title if other than an individual.) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVINCE |

|

POSTAL CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF SELLER(S) (Print name and title if other than an individual.) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

PURCHASER INFORMATION AND TAX DECLARATION

- Exemption from tax being claimed? |

No |

Yes |

- Stated purchase price below market value? |

No |

Yes |

- Stated |

No |

Yes |

- BC seller collected GST only, but no PST? |

No |

Yes |

- Vehicle received as a gift? |

No |

Yes |

Comments: _______________________________________________________________________________________________________

Your Autoplan Broker or the Ministry of Finance may ask you to provide supporting documentation if the purchase price is below current market value, the

A signed Vehicle Registration (APV250) must accompany this document (for licensed dealers an APV250 or APV9 is acceptable)

Tax Calculation

PST/HST/GST R GISTRANTS ONLY |

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||

URCHASE PRICE |

|

|

S LL R’S PST/HST/GST REG. NO. |

|

|

|

|

|||||||||||||||||||||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ESS TRADE (if applicable) |

DEALER REG. NO. OR ICBC APP. NO. |

|

|

|

|

|||||||||||||||||||||||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

NET |

URCHASE PRICE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

CTB |

|

|

|

|

|||||||

|

|

|

|

|

|

|

||||||||||||||||||||||

ST/SST AYABLE (if applicable) |

|

|

|

|

|

AUTHORIZING STAMP |

|

|

|

|

||||||||||||||||||

|

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

$ |

|

|

|

|

|

|

|

|

|

(WHERE REQUIRED) |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||

HST (BC) PAYABLE (if applicable) |

|

|

|

|

|

|

|

|

(ALL COPIES) |

|

|

|

|

|||||||||||||||

$ |

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

NAME (SURNAME followed by given names (no initials) or registered company name(s))

RESIDENTIAL ADDRESS OF PURCHA ER

PURCHASER’S BC DRIVER'S |

PURCHASER’S BC DRIVER'S |

||||||||||||

LIC. NO. |

LIC. NO. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/we the purchaser(s) being 18 Years of age or older or having obtained parents’ consent apply to the Insurance Corporation of British Columbia for vehicle registration or transfer of registered ownership of the vehicle described above and by my/our signature(s), I/we declare that the information included above is true.

PROVINCE

POSTAL CODE

SIGNATURE OF PURCHASER(S) (Print name and title if other than an individual.)

SIGNATURE OF PURCHASER(S) (Print name and title if other than an individual.)

Consent of parent or legal guardian for applicant under 18 years of age

I,

PRINT NAME OF PARENT OR LEGAL GUARDIAN |

PRINT ADDRESS IN FULL |

SIGNATURE OF PARENT OR LEGAL GUARDIAN |

consent to the registration and licencing in the name of the applicant(s), of the vehicle described hereon.

WARNING TO PURCHASER AND SELLER

This form is not valid if the information shown is inconsistent, changed or altered. The Ministry of Finance regularly audits vehicle transactions to verify the information provided. Any false information regarding the selling price or purchase price and

AUTOPLAN AGENT TO COMPLETE For all new registrations, and rebuilt or altered vehicles – Check applicable boxes

Canadian Import

Canadian vehicle - previous jurisdiction _______________________________________

Vehicle purchased from GST/HST registrant? |

Yes |

No |

Foreign Import

P - may not be sold or disposed of in Canada at any time without authorization from Canada Border Services Agency

T - may not be sold on or before______________________________________________

N - not subject to a disposal restriction

|

|

|

Proof of ownership |

Physical Damage |

VIN sighted and confirmed |

NVIS/Certificate of Origin |

(except BC dealer with NVIS) |

||

|

|

|

|

|

IPRE confirmed |

|

|

Vehicle Registration |

Windshield |

|

|

|

|

|

BC Vehicle Inspection Report(s) |

Certificate of Title |

Body location |

||

Vehicle Import Form – Form 1 |

Bill of Sale |

|

||

No. of plates 0 |

|

|

Salvage Invoice |

None visible |

1 |

2 |

|

||

|

|

|||

surrendered |

|

|

Broker Enquiry confirmed ownership |

NOT VALID UNLESS STAMPED BY |

|

|

|

AUTHORIZED ISSUING OFFICE |

|

|

|

|

|

|

TYPE OF IDENTIFICATION

IDENTIFICATION NUMBER

TYPE OF IDENTIFICATION

IDENTIFICATION NUMBER

LEGAL ENTITY NUMBER (other than individual)

Ihave viewed the purchaser’s identification or confirmed legal entity and verified the “Autoplan Agent to complete” information.

NAME OF AGENT (PRINT)

SIGNATURE OF AGENT

APV9T (042014)

SEE REVERSE FOR INSTRUCTIONS

Vehicle Registration