INSTRUCTIONS FOR FORM ST370

General Information

The Special Events Sales Tax Report Schedule is a form used by Special Events Promoters. The Promoter will give this form to the booth operators / vendors to complete and report their sales tax collections. It is to be completed and turned in to the Special Events Promoter at the end of the event.

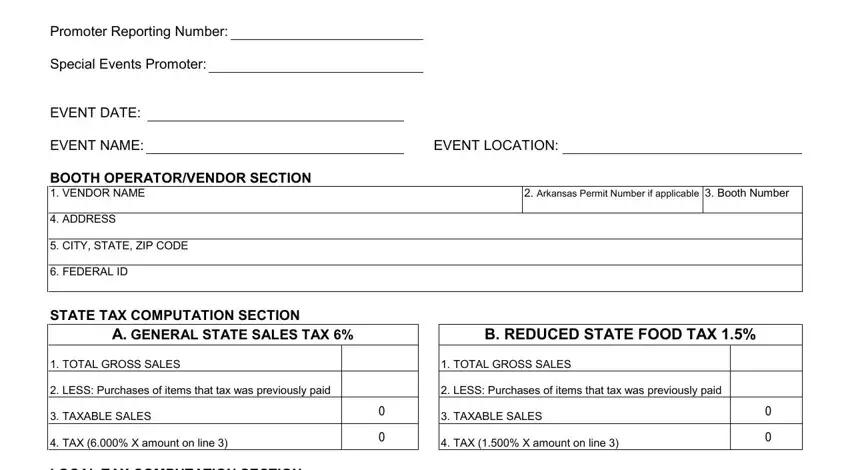

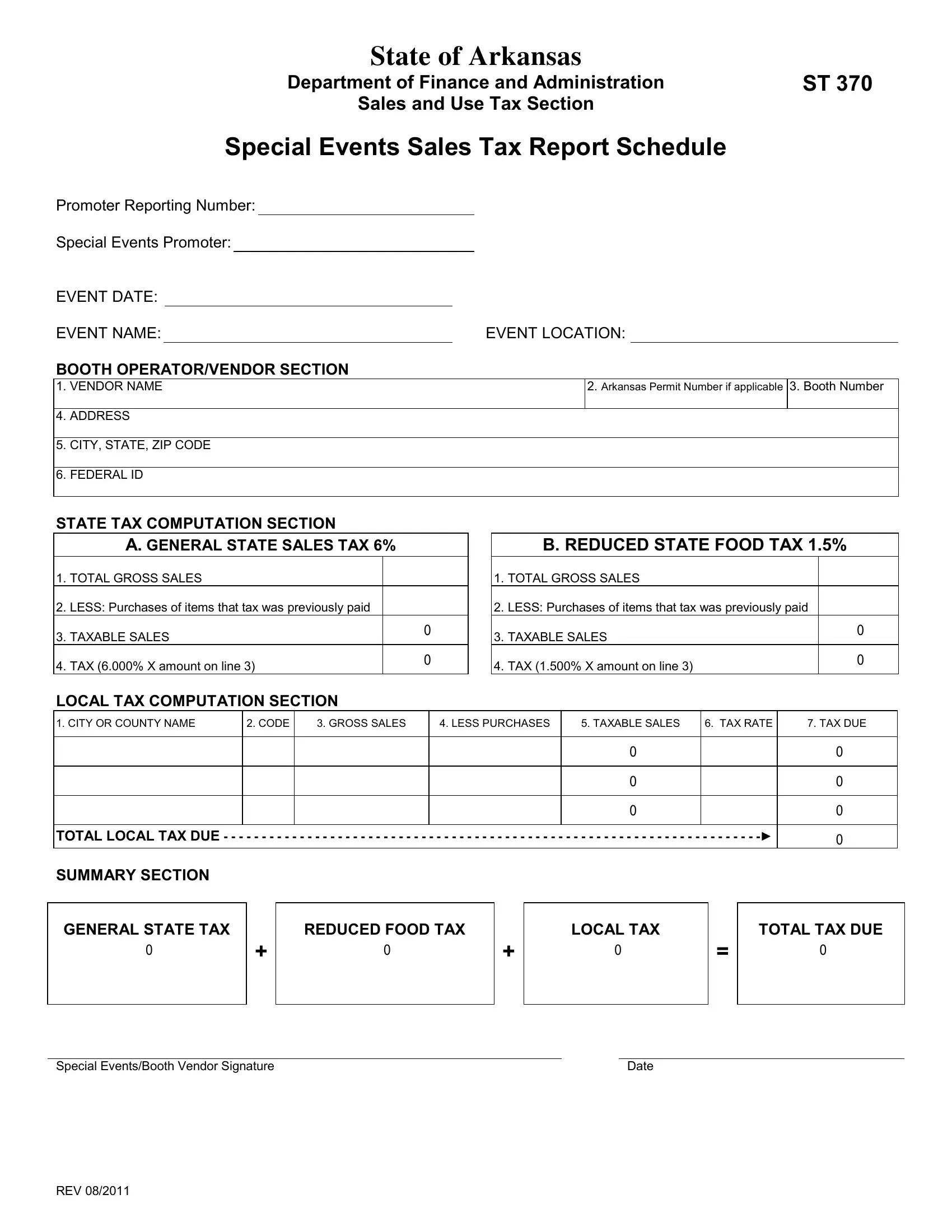

Promoter Section Instructions

01. Reporting Number: The Special Events Promoter inserts his Reporting Number in this blank.

02. Special Events Promoter: Special Events Promoter inserts his name in this blank. NOTE: promoter could use a rubber stamp for the reporting number and name.

03. Event Date: Enter the date of each collection.

04. Event Name: Insert Name of Event. Example is "Big Event Festival"

05. Event Location: Insert City/State where the event is taking place.

Booth Operator/Vendor Section Instructions

06. Block 1. VENDOR NAME Booth operator/vendor name goes in this block.

07. Block 2. PERMIT NUMBER Insert Booth operator/vendor Permit Number if they have one. If the booth operator/ vendor has a permit number, they do not have to report their collections to the Special Events Promoter but, report their sales and tax computations to the department on their ET-1 Excise Tax return form. Also, if the booth vendor has a sales tax permit number, he is required to complete the 'Booth Operator/Vendor' portion of the ST370 and return it to the Special Events Promoter at the end of the event.

08. Block 3. BOOTH NUMBER This field is for use by the Special Events Promoter in order to help keep track of the booth collections.

09. Block 4. ADDRESS Insert the Booth Vendor mailing address.

10.Block 5. CITY, STATE, ZIP CODE Insert your city, state and zip code.

11.Block 6. FEDERAL ID NUMBER Insert the booth operator's Federal Identification Number.

State Tax Computation Section Instructions

12.Line A1: Enter your total gross sales (excluding food items) for the event.

13.Line A2. Enter the cost of goods of sold on which sales tax has been paid.

14.Line A3: Subtract line A2 from line A1 and enter the difference. This is your taxable sales.

15.Line A4: Multiply the amount on line 3 by the state tax rate (6%) and enter that amount as TAX DUE.

16.Line B1: Enter your total gross FOOD sales for the event.

17.Line B2. Enter the cost of FOOD goods sold on which sales tax has been paid.

18.Line B3: Subtract line B2 from line B1 and enter the difference. This is your taxable sales.

19.Line B4: Multiply the amount on line B3 by the reduced state food tax rate (1.5%) and enter that amount as TAX DUE.

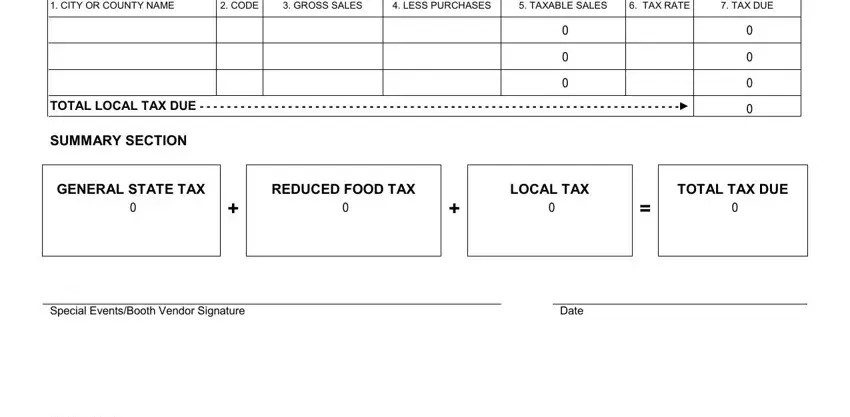

Local Tax Computation Section Instructions

20.Column 1. Enter the city and/or county name where the event is being held. You must collect the local tax for the city and/or county where the event is taking place. You do not collect local taxes for your city and/or county if you are from a different location. The Special Events Promoter should provide the booth operator/vendor with the local taxes that should be collected. If the event is held outside the city limits the city tax does not apply.

21.Column 2. Enter the city and or county local code as defined by the Sales & Use Tax Section of Arkansas. The Special Events Promoter should provide this information.

22.Column 3. The event's gross sales amount is entered here. This amount should be the same as LINE I column A & B in the State Tax Computation Sections.

23.Column 4. Enter the cost of goods sold on which sales tax has been paid.

24.Column 5. Subtract column 4 from column 3 and enter the difference. This is your taxable sales.

25.Column 6. Enter the local tax rate which should be provided by the Special Events Promoter.

26.Column 7. Multiply the amount on column 5 by the local tax rate in column 6 and enter that amount as TAX DUE.

27.TOTAL LOCAL TAX DUE. Add the amounts in column 7 and enter the total on this row.

Summary Section Instructions

28.Enter the amount from line 4 of the appropriate state tax computation section in the STATE TAX block. Enter the amount from the TOTAL LOCAL TAX row in the LOCAL TAX block. Add the STATE TAX block and the LOCAL TAX block and enter the total in the TOTAL TAX block. This is the amount that must be remitted to the Special Events Promoter at the end of the event.